Tax-Minded Executives and Corporate Tax Strategies: Evidence from the 2013 Tax Hikes

advertisement

Tax-Minded Executives and

Corporate Tax Strategies: Evidence

from the 2013 Tax Hikes

Gerardo Pérez Cavazos

Andreya M. Silva

Working Paper 16-034

Tax-Minded Executives and Corporate

Tax Strategies: Evidence from the 2013

Tax Hikes

Gerardo Pérez Cavazos

Harvard Business School

Andreya M. Silva

Working Paper 16-034

Copyright © 2014, 2015 by Gerardo Pérez Cavazos and Andreya M. Silva

Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may

not be reproduced without permission of the copyright holder. Copies of working papers are available from the author.

Tax-minded executives and corporate tax strategies:

Evidence from the 2013 tax hikes

Gerardo Pérez Cavazos1

Andreya M. Silva

March 25, 2015

ABSTRACT

Exploiting the increase in personal tax rates due to the American Taxpayer Relief Act and

Healthcare Act, we identify tax-minded executives who exhibit a preference for personal tax

savings. We find that 2,281 top executives strategically realized their built-in capital gains prior

to the tax hikes to save nearly $741 million in personal taxes in 2012. These executives also (1)

make payout policy choices that save their shareholders taxes and (2) make tax strategy choices

that save their firms cash taxes. Their firms altered payout policies in 2012, distributing $8

billion in special and accelerated dividends, to save shareholders nearly $700 million in taxes.

Further, each tax-minded executive reduces a firm’s cash effective tax rate by 0.28%.

Keywords: Executives, capital gains, dividends, effective tax rates, tax avoidance.

JEL classification: G35, H24, H25, K34.

1Please

address all correspondence to Gerardo Perez Cavazos, Department of Accounting, The University of

Chicago Booth School of Business, 5807 South Woodlawn Avenue, Chicago, IL 60637; Phone: 773-870-1023;

Email: gp@chicagobooth.edu. Andreya M. Silva can be reached at 305-753-0492 or

andreya_silva@outlook.com. We thank Jawad Addoum, Phil Berger, Andreas Bodmeier, Jennifer Blouin

(discussant), Vidhi Chhaochharia, George Constantinides, Christopher Cotton, Merle Erickson, Joseph Gerakos,

George Korniotis, Alok Kumar, Doug Skinner, the participants at the 2014 UNC Tax Symposium, and the

workshop participants at the University of Chicago and University of Miami for helpful comments.

1. Introduction

We implement a unique identification strategy that allows us to provide novel insights

on executives’ tax-related corporate policies. We exploit the 2013 increase in personal income

tax as established by The American Taxpayer Relief Act of 2012 (ATRA) and the Healthcare

and Education Reconciliation Act of 2010 (Healthcare Act), to identify executives that

revealed their tax preferences by actively implementing strategies to save personal taxes. We

define these executives as “tax-minded.” By identifying this tax preference we obtain an

understanding of a characteristic that is imbedded in management’s decision making and;

therefore, can empirically examine firm dividend and tax outcomes as a function of executives

and their tax-related policy choices.

Our identification strategy builds on the extensive literature that analyzes year-end

security sales (e.g., Constantinides, 1984; Seyhun and Skinner, 1994; and Poterba and

Weisbenner, 2001). In particular, Dyl (1977), Lakonishok and Smidt (1986), and Badrinath et

al. (1991) find that tax loss selling occurs, a strategy to reduce one’s tax liability at year-end

whereby losers are sold to offset prior capital gains. The setting surrounding ATRA and the

Healthcare Act is distinct from that of these papers, because the optimal tax strategy changes

when there is an anticipated increase in the future tax rate. Built-in capital gains should be

realized in the period before the increase, whereas losses should be held to offset higher taxes

in the future period. We exploit this change to identify tax-minded executives who adopted a

tax-efficient strategy by pre-emptively realizing their built-in capital gains prior to 2013.

We use the Securities and Exchange Commission (SEC) required Form 4 filings to

reconstruct each executive’s insider holdings portfolio and, most importantly, compute the

1

built-in capital gains of their holdings. We subsequently observe each executive’s selling

behavior in 2012 and identify executives who strategically lowered their future tax liability. We

find that 2,281 tax-minded executives reduced their long term built-in gains to save nearly

$741 million in capital gains tax in 2012, an average of $325 thousand per executive.2

In line with the corporate consistency literature (e.g., Malmendier and Tate, 2005;

Cronqvist et al., 2012; Davidson et al., 2013; and Hutton et al., 2013), we expect that

tax-minded executives exhibit their personal tax preference when making corporate decisions.

Thus, their dividend and tax policies should reflect an emphasis on shareholder and corporate

tax savings, respectively. Specifically, our first conjecture is that these executives manage

companies that are more considerate of the tax burden of their shareholders and,

consequently, take actions consistent with this view. To test this prediction we first identify

firms that altered their dividend policy to save their shareholders’ taxes prior to the tax rate

increases legislated by ATRA and the Healthcare Act. Firms that opted to award a special

dividend in 2012 or accelerate a dividend from the first quarter of 2013 to the fourth quarter

of 2012, allowed shareholders to lock-in the lower dividend tax rate before the tax hike. Similar

to Hanlon and Hoopes (2014) we document that there is indeed a subset of firms who alter

their dividend policy; however, our interest lies in examining the simultaneous actions of

executives and firms surrounding the event. Specifically, we examine the link between taxminded executives and the firms that implement strategies to save their shareholders taxes.

Our empirical results support our conjecture. We find that firms managed by

tax-minded executives were more likely to take actions in 2012 that reduced their shareholders’

This estimate is based on comparing the realized tax liability to the “as if” realized in 2013 tax liability.

Considering a discount rate of 5% and an investment horizon of 5 and 10 years, the total savings are reduced to

$581 and $455 million respectively.

2

2

tax liabilities. The 1,010 companies managed by tax-minded executives awarded a total of $3.7

billion in special dividends and accelerated $4.3 billion in regular dividends. These dividend

payouts collectively saved shareholders nearly $700 million in taxes.

Relatedly, both the media and prior research (e.g. Chetty and Saez, 2005 and Brown et

al., 2007) point out that executives also substantially benefit from additional dividend awards

when there is a change in personal tax rates. In particular, the media suggest that the

distributions are mostly self-serving. For example, in November of 2012 The Wall Street

Journal singled out the recently retired CEO of Costco, Jim Sinegal, because the company

borrowed $3.5 billion to finance a special dividend whereby Sinegal would receive a payout of

$14 million and consequently save over $4 million in taxes. While we do not dispute the

benefits to executives, we maintain that the additional dividend payments in 2012 were largely

due to executive tax preferences and are, therefore, an element within a series of actions aimed

at reducing the tax burden of its shareholders. As such, we expect that the dividend payouts

were in line with the executives’ preexisting corporate tax policies which emphasized tax

savings.

Formally stated, our second conjecture is that tax-minded executives manage

companies that prioritize corporate tax savings and, therefore, employ effective tax planning

strategies to lower firm tax liabilities. To test this conjecture, we conduct a panel analysis that

tracks executives through time. We examine the link between tax-minded executives and each

firm’s cash tax payments over time, as measured by their cash effective tax rate (Cash ETR).

As predicted, we find that tax-minded executives manage firms that implement incremental

cash tax savings strategies. On average, the presence of each tax-minded executive lowers a

firm’s Cash ETR by 0.28% per year, which is equivalent to cash tax savings of $2 million per

3

year for the average firm in the sample.3

The results in this paper contribute to the understanding of executives’ corporate

policies by academics and legislators. The first implication of our results is that an executive

who places importance on personal tax savings is more likely to manage a company that

undertakes actions that benefit their shareholders’ tax outcomes. This finding provides

evidence in support of the longstanding theory that managers internalize the effects of

personal shareholder taxes when making corporate decisions (e.g., Miller, 1977; DeAngelo and

Masulis, 1980; Masulis and Trueman, 1988; Green and Hollifield, 2003), as we identify a subset

of executives who display this behavior in their decision-making.

Second, our findings with respect to firm Cash ETRs indicate that an executive that

actively implements strategies to save on personal taxes will also implement strategies to lower

firm taxes. Prior evidence shows that executives impact firm effective tax rates (Dyreng et al.,

2010), but does not disentangle whether the effect is due to executives’ tax policy or other

correlated decisions that impact the outcome (Armstrong et al., 2010). Our results more

specifically demonstrate that executive tax preferences, which are imbedded in firms’ policies,

affect firms’ tax outcomes. As such, we shed light on the open question of why some firms

pay less in taxes than other firms. Moreover, our findings also provide evidence that the special

and accelerated dividend payouts in 2012 were largely in line with the executives’ pre-existing

corporate tax policies that reduced firm cash taxes.

Third, shareholders are subject to double taxation, tax on corporate earnings and tax

on dividend distributions. Thus, an executive can take two steps to save its shareholders taxes,

3

The range in Cash ETR, 0.28% to 0.65%, depends on different model specifications.

4

the first step is to save corporate taxes and the second step is to make dividend distribution

choices which reduce shareholders’ tax burden. As such, corporate tax policy and dividend

payout policy are related executive choices. Unlike prior papers that examine each of these

policies independently, we show that an executive who is tax-minded is consistent in setting

both policies. Therefore, we establish an important link between setting corporate tax policy

and setting dividend payout policy.

In sum, the key innovation of this paper is that we implement a unique empirical

strategy to identify tax-minded executives. Using this strategy we are able to analyze an

executive’s decision that is analogous in the personal and the corporate spaces: choosing to

take legal tax strategies to lower the tax liability. This is starkly different from tax studies that

focus on executives that misappropriate firm assets to evade taxes, such as Dhaliwal et al.

(2009) and Chyz (2013), because our identification is not dependent on the lack of corporate

governance at the firm level. As a result, we are able to make broader inferences about

executive tax preferences. We provide evidence to support that executives’ personal tax

preference is an important characteristic that directly maps into corporate tax and dividend

policies.

Section 2 provides background on the 2013 tax rate changes. Section 3 describes sample

formation and data. Section 4 discusses our identification strategy and develops our measures

of tax-mindedness. Section 5 explores the impact that tax-minded executives have on

shareholders’ taxes, while Section 6 explores the impact on firm-level taxes. Section 7

concludes the paper.

5

2. Summary of 2013 tax rate changes

The 2013 tax year is marked by legislation that significantly increased tax rates for

high-income taxpayers (Fig. 1). First, set to commence in 2013, the revenue provision for the

Healthcare Act established a 3.8% personal income tax on passive investment income for

taxpayers with an adjusted gross income (AGI) of $250 thousand for married joint filers

(MFJs) and $200 thousand for single filers.4 Consequently, a surtax was imposed on income

from capital gains and dividends.

Moreover, the tax provisions in the Economic Growth and Tax Relief Reconciliation

Act of 2001 (EGTRRA) and Jobs and Growth Tax Relief Reconciliation Act of 2003

(JGTRRA) were set to expire on December 31, 2012. These expirations would eliminate the

favorable ordinary income, qualified dividend, and long-term capital gain tax rates for

individuals in the top income bracket. The highest ordinary income tax bracket was scheduled

to increase by 4.6% to 39.6% and the highest capital gains rate was scheduled to increase by

5% to 20%. Qualified dividends were to lose their preferential tax treatment and increase to

ordinary tax rates, rising from 15% to 39.6%.

On July 24, 2012 the ATRA bill was proposed to address the expiration of EGTRRA

and JGTRRA. The bill called for a one-year temporary extension of both acts. The House

passed the bill on August 1, 2012; however, the Senate put it on hold due to the impending

presidential election and the dichotomous views of the candidates. A tight race existed

between the current president, Barack Obama, who pushed for raising taxes on the wealthiest

Americans and his opponent, Mitt Romney, who championed lower tax rates. On November

4

Passive investment income includes: interest, dividends, capital gains, rental and royalty income, non-qualified

annuities, income from businesses involved in trading of financial instruments or commodities, and businesses

that are passive activities to the taxpayer (within the meaning of IRC section 469).

6

6th, the uncertainty was resolved as the president was re-elected to office.

The bill was revisited and subsequently became a political bargaining chip in the

negotiations aimed at avoiding the fiscal cliff. Numerous scenarios were discussed and

considered over the last two months of 2012, but the federal tax policy remained unresolved

through the end of the year. On January 1st, 2013, the Senate passed the bill after incorporating

changes that raised tax rates. The next day, the president signed ATRA into law. The final

version of ATRA affected taxpayers with an AGI over $450 thousand for MFJs and $400

thousand for single filers by raising the ordinary income rate from 35% to 39.6%, the qualified

dividend rate from 15% to 20%, and the capital gain rate from 15% to 20%. Thus, the

Healthcare Act and ATRA jointly raised the maximum tax rate on capital gains and dividends

to 23.8%, nearly a 60% increase in tax on these types of passive investment income.

3. Sample formation and data

We use several data sources in this study. Our primary data source is Thomson

Reuters’ Insider Data. This database contains corporate insiders’ trades, as reported on SEC

required Form 4 filings of insider transactions. We extract all insider acquisitions and

dispositions of shares from 1986 through 2012. We merge the insider transaction data with

executive data from Execucomp, which covers the five highest compensated officers of each

firm in the S&P 1500. All executives who are not employed through the end of 2012, our

period of identification, are eliminated.

We match each executive’s firm with stock return data from the CRSP monthly stock

files. We also retrieve dividend data from CRSP. Consistent with DeAngelo et al. (2000), we

categorize CRSP distribution codes 1262 and 1272 as special dividends. Regularly paid and

7

taxable U.S. dividends are identified by CRSP distribution codes 1212, 1222, 1232, 1242, and

1252. Lastly, we match each firm to the accounting data on Compustat and create the

corporate tax variable Cash ETR. Table A.1. provides further detail on the definition and data

sources of the variables used in this paper.

4. Identifying tax-minded executives

4.1. Executive reactions to ATRA

The enactment of ATRA was a significant event for high-income taxpayers as it

represented the end of favorable tax rates on ordinary income, capital gains, and qualified

dividends. Prior studies by Bolster et al. (1989) and Seida and Wempe (2000) find that the

unfavorable change in tax rates following the Tax Reform Act of 1986 had a direct impact on

trading behavior. We similarly expect that the 2013 tax hike affected trading behavior;

however, our focus is on the change in behavior leading up to the event. We conjecture that

executives, on average, pre-emptively reacted to the impending 2013 increase in capital gains

tax rates by shifting stock sales to 2012. Due to the timing of the tax legislation, the effect is

likely most prominent during December of 2012. Therefore, we analyze the historical

difference in executive stock sales from December to January.

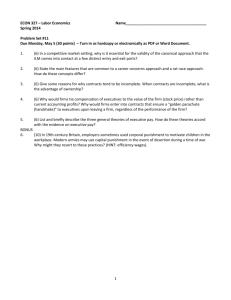

Table 1 presents the December and January differences in all insider stock sales from

2002 to 2012. We find that $1.08 billion additional stock sales occurred in December 2012

compared to January 2013. A t-test confirms that 2012 is the only year in which the difference

is statistically larger than the mean difference of $275 million. Figure 2 shows these results.

8

4.2. Framework

Having established that the impending 2013 tax rate increases spurred executives to

increasingly sell their shares, we direct our attention to identifying which individuals took

action. To do so, we present a simple tax framework.

In a world where taxes are the only friction, the profits of selling a stock at time 𝑡 are

given by the built-in capital gains after tax:

𝛱={

(𝑃𝑟𝑖𝑐𝑒𝑡 − 𝑃𝑟𝑖𝑐𝑒0 ) × (1 − 𝜏𝑡 )

(𝑃𝑟𝑖𝑐𝑒𝑡 − 𝑃𝑟𝑖𝑐𝑒0 )

if (𝑃𝑡 − 𝑃0 ) > 0

,

if (𝑃𝑡 − 𝑃0 ) ≤ 0

(1)

where 𝑃𝑡 is the price at time 𝑡, 𝑃0 is the price at the time of acquisition (i.e. tax basis), and 𝜏𝑡

is the tax rate at time 𝑡.

If an investor has positive built-in gains, i.e. 𝑃𝑡 − 𝑃0 > 0, and the tax rate will change

such that 𝜏𝑡 < 𝜏𝑡+1, there is a tax-saving strategy whereby he sells in 𝑡 and repurchases in 𝑡 +

1 if the following condition holds:

(𝑃𝑡 − 𝑃0 ) × 𝛥𝜏 > 𝑃𝑡+1 − 𝑃𝑡

(2)

If the time interval between 𝑡 and 𝑡 + 1 is sufficiently small (e.g. December 31 at 11:59

and January 1st at 12:00), the prices are likely to remain constant, and thus by construction

there would be an opportunity for tax-savings:

𝛱 𝑠𝑡𝑟𝑎𝑡𝑒𝑔𝑦 = (𝑃𝑡 − 𝑃0 ) × 𝛥𝜏

(3)

Consider a simple example: when an individual purchases 100 thousand shares at $30

per share, he has a stock basis of $3 million. If over a year later the value of the stock is $40

per share, he then has a long-term built-in gain of $10 per share, or $1 million. If he sells any

shares he is required to pay capital gains tax. On December 31st, 2012 the prevailing long-term

capital gains rate of 15% would result in a tax liability of $150 thousand. However, if the sale

9

occurred on January 1, 2013 the new rate would significantly increase the tax liability to

$205,700, i.e. $200 thousand in capital gains tax and $5,700 in net investment tax. The strategy

would result in tax savings of $55,700 or over 25% of the 2013 tax liability.

A second strategy exists whereby the investor permanently defers the realization of

capital gains. However, this alternative is unlikely for at least two reasons. First, there are

benefits to diversification that cannot be attained if an investor’s portfolio is not rebalanced.

Second, an investor’s investment horizon may be different from that of the firm.

Thus, in the absence of non-tax costs, individuals with built-in capital gains should

realize their gains to save on taxes. However, empirically we observe that only 16% of

executives realized more than 80% of their long term built-in capital gains in 2012. This

indicates that there must be additional factors that affect each investor 𝑖 , such that their

expected profits from exercising the strategy are better described by:

𝐸𝑖 [𝛱 𝑟𝑒𝑎𝑙 𝑤𝑜𝑟𝑙𝑑 ] = [(𝑃𝑡 − 𝑃0 ) × 𝛥𝜏] × 𝑃𝑟𝑜𝑏𝑖 (𝛥𝜏) − 𝐶𝑜𝑠𝑡𝑠𝑖

𝑠. 𝑡. 𝐼𝑛𝑠𝑖𝑑𝑒𝑟 𝑡𝑟𝑎𝑑𝑖𝑛𝑔 𝑙𝑎𝑤𝑠 𝑎𝑛𝑑 𝐵𝑜𝑎𝑟𝑑 𝑟𝑒𝑠𝑡𝑟𝑖𝑐𝑡𝑖𝑜𝑛𝑠

(4)

These additional factors can include a variety of unobservable costs such as the

political or image costs of being perceived as a greedy or unpatriotic executive (Graham et al.,

2013), or market frictions such as transaction costs or the costs associated with hiring an expert

to gather tax knowledge. These costs need not be the same for all executives, as they depend

on each executive’s tax preferences. For example, managers’ political preferences affect

corporate policies (Hutton et al., 2013), family owners are more concerned with the reputation

costs of being tax aggressive (Chen et al., 2010), and CEOs with military experience tend to

avoid less tax (Law and Mills, 2013). Furthermore, executives are also subject to insider trading

laws and other restrictions set by the Board of Directors that may prevent them from selling

10

and immediately repurchasing shares. For example, executives are not allowed to trade in

opposite directions within a six-month period. This constraint becomes more costly in cases

where the executive has insider information that indicates a positive abnormal return in the

next six months.

Therefore, analyzing the variation in executives’ reactions to the 2013 tax hikes

provides an insight into their personal cost and benefit functions related to tax strategy. We

develop measures of tax-mindedness that are based on executives’ revealed tax preferences

and intend to capture the idiosyncratic costs they face. Note that we exclusively focus on

executives with built-in capital gains. Executives with zero gains or built-in losses throughout

2012, which make up less than 5% of the sample, would not have the opportunity to lower

their tax liability by selling prior to 2013. As such, their tax preferences are unobservable and

these executives must be excluded from the analysis.

4.3. Personal Tax-Minded Measures

We define tax-mindedness as a preference for tax savings that is revealed through

strategic actions to improve tax outcomes. In our setting, executive tax-mindedness can be

observed via the reduction of built-in gains before the increase in personal tax rates in 2013.

This identification strategy requires that we quantify each executive’s long-term

built-in capital gains as of December 31, 2011 and throughout 2012. To do so, we reconstruct

each executive's insider holdings portfolio starting with his first insider transaction.

Specifically, for every acquisition that an executive makes, we create a batch that records the

number of shares and their corresponding purchase price. This is referred to as tax basis. Note

that all 2012 acquisitions are excluded because a minimum holding period of one year must

11

be met for gains on stock sales to qualify for long-term capital gains treatment. When an

executive sells shares we adjust the number of shares in each batch using the First-In FirstOut (FIFO) method, in accordance with the Internal Revenue Code (IRC). 5

At each period of interest we observe the number of shares that remain in the

executive’s portfolio and record the current price per share. We then subtract the tax basis

from the current value of the shares to obtain the long-term built-in capital gains of each

portfolio. Thus, at each point in time the built-in capital gains for a particular executive are

given by:

𝑡

𝑡

𝐵𝑢𝑖𝑙𝑡-𝑖𝑛 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 𝑔𝑎𝑖𝑛𝑠𝑡 = ∑𝑁

𝑖=1(𝑃 − 𝑃𝑖 ) × 𝑥𝑖

(5)

where 𝑃𝑡 is the price at time 𝑡, 𝑃𝑖 is the price at which shares in batch 𝑖 were acquired, 𝑥𝑖𝑡 is

the number of shares in batch 𝑖 at time 𝑡, and 𝑁 is the total number of batches.

We then observe which executives decreased their built-in capital gains prior to the tax

hike and create three tax-mindedness variables. Tax_Minded_2012 identifies executives who

reduced their built-in capital gains throughout 2012. It is calculated as the difference between

the initial built-in capital gain during 2012 and the built-in capital gain at January 1, 2013.6 The

following two variables capture executives who more aggressively reacted to the tax change.

Tax_Minded_Dec identifies executives whose built-in gains increased through December 1,

2012 and who subsequently realized their built-in gains during the month of December.

Tax_Minded_80 identifies executives who reduced more than 80% of their built-in gains by

For the purpose of calculating capital gains, the IRC calls for the FIFO method or exact identification of the

shares to be sold. We use the FIFO method because we cannot observe whether exact shares were identified for

every sale of stock. Nonetheless, we consider the FIFO method to be a reasonable assumption as it is the default

method used at brokerage houses and, per the IRC, to change from FIFO the client is required to identify the

exact shares at each moment they trade and no later.

6 Executives with positive built-in capital gains at the start of the year are assigned the capital-gain value at January

1, 2012. All other executives are assigned the value from their first positive month of capital gains.

5

12

the 2012 year-end.7 The definitions of these variables are summarized as follows:

Tax Variable

Definition

𝐶𝐺12 − 𝐶𝐺𝑗𝑎𝑛13 > 0

Tax_Minded_2012

Tax_Minded_Dec

𝐶𝐺12 − 𝐶𝐺𝑑𝑒𝑐12 < 0 & 𝐶𝐺12 − 𝐶𝐺𝑗𝑎𝑛13 > 0

Tax_Minded_80

𝐶𝐺𝑗𝑎𝑛13 ≤ 0.2 × 𝐶𝐺12

4.4. Descriptive Statistics

Table 2 provides summary statistics of our sample. Panel A reports our tax-minded

variables as well as other executive characteristics. The sample is comprised of 4,435 executives

that manage 1,485 firms. Of these executives, 557 are CEOs and 867 are CFOs. On average,

each executive holds a portfolio with $766 thousand in long term built-in capital gains. Slightly

more than half of the sample is defined as Tax_Minded_2012, while only 4% and 16% are

categorized as Tax_Minded_Dec and Tax_Minded_80, respectively.

Panel B provides descriptive data on the characteristics of the 1,485 firms managed by

the executives in Panel A. Overall, the firms in our sample are large and profitable. Each

company has on average 1.54, 0.13, and 0.47 executives classified as Tax_Minded_2012,

Tax_Minded_Dec, and Tax_Minded_80, respectively. Of the 1,050 firms that regularly award

dividends, 12% accelerated their payouts in 2012. On average, 2% of firms paid special

dividends in 2012.

4.5. Validation of the measures

The larger the executive’s built-in gain during 2012, the greater the incentive to sell

before January 1st, 2013. In other words, as the incentives increase executives are more likely

80% is a natural breakpoint in the distribution of built-in capital gains changes. The main results are robust to

changing that threshold in the 60% to 90% range.

7

13

to derive enough tax benefits to offset the potential costs associated with realizing their capital

gains. Therefore, to validate our measures we test whether there is an increase in the likelihood

that an executive 𝑗 is tax-minded as his built-in capital gains increase. We use a logistic

regression model with the following specification:

Pr(𝑇𝑎𝑥_𝑀𝑖𝑛𝑑𝑒𝑑𝑗 ) = 𝛼 + 𝛽 log(𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐺𝑎𝑖𝑛𝑠𝑗 ) + 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠𝑗

(6)

The dependent variable, Tax_Minded, takes the value of one for those executives who

reduced their capital gains as defined by Tax_Minded_2012 and Tax_Minded_Dec. The main

explanatory variable is the logarithm of each executive’s initial built-in capital gains value. This

variable captures the tax savings, or benefits, associated with exercising the optimal tax

strategy. Unlike the tax benefits, the costs are not observable. Therefore, we include several

executive and firm characteristics as proxies for possible costs.

The controls include executive characteristics such as age, tenure at the firm, and

whether the executive serves as Chief Financial Officer (CFO), Chief Executive Officer

(CEO), or dualy as CEO and Chairman of the Board. These variables can impact

tax-mindedness. For example, the Board can subject CEOs and CFOs to additional

restrictions on insider selling because of the visibility of their actions. A CFO may have more

tax knowledge or tax awareness compared to that of a vice president in an operational area of

the firm. Moreover, older or more experienced executives may have previously faced tax

changes which impact their perception of the relevance of taxes and the cost of becoming

informed. An older executive is also more likely to have a shorter investment horizon, which

reduces the foregone investment returns associated with making an early tax payment on

capital gains. We include firm controls for size and the firm’s six-month post period return.

Firm size controls for potential costs associated with the visibility of the company. Lastly, the

14

company’s stock return during the first six months of 2013 controls for the cost of realizing

capital gains when an executive has positive private information.

Note that Tax_Minded_80 is excluded from this analysis because by construction it

captures two opposing effects, costs and benefits. The greater the built-in capital gains the

greater the incentive to sell and the greater the cost of realizing 80% of those gains. Therefore,

there would be no clear interpretation for the coefficients of our main explanatory variable

when using Tax_Minded_80 as the dependent variable.

There is a positive and statistically significant relationship between the tax-mindedness

measures and the level of built-in capital gains (Table 3). These results validate that our

measures of tax-mindedness capture the economic tradeoff that exists in our theoretical

construct. Notably, the area under the curve (AUC) is relatively low across models, 56% to

62%, and the control variables do not provide large incremental explanatory power to the

regressions. This indicates that our tax-mindedness measures capture a significant element of

tax preferences that is not captured by readily observable characteristics of the executives and

the firms.

4.6. Economic significance of executive tax savings

To assess the economic magnitude of the effect, we quantify the tax savings of the

executives identified as Tax_Minded_2012. We find that these executives reduced their

long-term built-in gains in excess of $8.4 billion or 47%. The reduction of these gains in 2012

effectively reduced their tax liability by nearly $741 million, which is equivalent to an average

savings of $325 thousand per executive.

15

5. Tax-minded executives and shareholders’ taxes

The main thesis of the paper is that tax-minded executives have a preference for tax

savings which affects their corporate decisions. Specifically, our first conjecture is that these

executives manage companies that are more considerate of the tax burden of their

shareholders and, consequently, take actions consistent with this view. To test this hypothesis

we examine firm dividend payout policy in 2012.

The period before the 2013 tax change is an optimal setting to test this hypothesis

because the impending increase in dividend tax rates created an opportunity for companies to

lessen their shareholders’ dividend tax burden. Any additional dividend awards in 2012 would

allow shareholders to lock-in the lower dividend tax rate. Specifically, firms could choose to

award a special dividend in 2012 or accelerate a dividend from the first quarter of 2013 to the

fourth quarter of 2012.

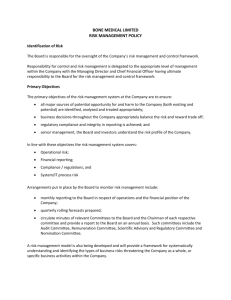

Figure 3 shows evidence consistent with firms taking both of these actions. The

historical total value of both ordinary and special dividends awarded increased substantially in

2012, the effect being most pronounced during the fourth quarter. Additionally, the number

of special dividend awards reached a historical high of 383 in 2012, surpassing the 342

observed in 2010 when JGTRAA and EGTRRA were initially set to expire. We therefore

examine whether tax-minded executives were more likely to manage the companies that

distributed special dividends or accelerated the payment of their regular dividends in

anticipation of their shareholders’ tax increases.

16

5.1. Special Dividend Awards in 2012

We test whether there is an increase in the probability that company 𝑖 awards a special

dividend when there are more tax-minded executives in the firm. We use the following logistic

model:

𝑃𝑟(𝑆𝑝𝑒𝑐𝑖𝑎𝑙𝑖 ) = 𝛼 + 𝛽(𝑁𝑜. 𝑇𝑎𝑥 𝑀𝑖𝑛𝑑𝑒𝑑 𝐸𝑥𝑒𝑐𝑠𝑖 ) + 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠𝑖 + 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝐹𝐸

(7)

The dependent variable takes the value of one for those firms that awarded a special

dividend, and zero otherwise. The main explanatory variable, Tax_Minded_Execs, is the

number of tax-minded executives present in each company. We control for several firm

characteristics such as firm size, market-to-book-ratio (MTB), cash on hand, financial leverage,

return on assets, cash from operations, and institutional stock holdings. We also include

industry fixed effects.

We expect that companies with more cash holdings (Jensen, 1986) and stronger past

performance (Fama and Babiak, 1968) are more likely to make special payouts. Moreover, we

predict that companies with low leverage will use dividends as a means to rebalance their

capital structure. We include institutional investors as a control, because they have different

tax implications than that of individual investors (Allen et al., 2000; Grinstein and Michaely,

2005). MTB controls for growth opportunities. Lastly, industry fixed effects control for

possible industry-wide shocks that could have triggered the distribution of special dividends

in 2012.

We find strong evidence that the presence of each tax-minded executive significantly

increases the likelihood of a company awarding a special dividend throughout 2012 (Table 4).

The odds ratio is between 1.06 and 2.36 across the different models. The coefficients on the

17

control variables are not always significant; however, we find that their signs are consistent

with our economic predictions. For instance, the coefficient on the institutional holdings

variable is negative, which is consistent with the dividend catering theory (Baker and Wurgler,

2004a and 2004b). In this setting institutional investors do not demand an increase in special

dividends because they do not obtain a significant tax benefit. Lastly, the AUC is between 78%

and 82% for the models that include controls and industry fixed effects. This indicates that

our models are useful to predict which companies are more likely to award a special dividend.

5.2. Acceleration of regular dividends to the fourth quarter of 2012

We use a logistic regression model to examine whether the probability of a company

accelerating the payment of its regular dividends increases with the presence of tax-minded

executives. To define a company as a dividend accelerator, all three of the following conditions

must be met: (1) the company paid a dividend during the first quarter of 2011 and 2012, (2)

the company decreased or did not pay a dividend in the first quarter of 2013, and (3) the

company increased a payment in the last quarter of 2012. We include the same set of controls

that appear in the special dividends regression; however, we do not expect that any of the nontax variables will play a critical role in the decision to accelerate a dividend by less than one

quarter. Therefore, in contrast to the analysis of special dividends, we expect the coefficients

of the control variables to be statistically insignificant across models. The general specification

is as follows:

𝑃𝑟(𝐴𝑐𝑐𝑒𝑙𝑒𝑟𝑎𝑡𝑖𝑜𝑛𝑖 )

= 𝛼 + 𝛽(𝑁𝑜. 𝑇𝑎𝑥 𝑀𝑖𝑛𝑑𝑒𝑑 𝐸𝑥𝑒𝑐𝑠𝑖 ) + 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠𝑖 + 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝐹𝐸

(8)

There is a positive and significant relation between the number of tax-minded

executives in a firm and the likelihood that a company will accelerate dividends (Table 5). The

18

odds ratio that a regular dividend paying company will accelerate the payment of dividends

increases by 1.2 to 1.5 with the presence of each tax-minded executive. As predicted, the

coefficients associated with the control variables are insignificant. This is explained by the low

cost of accelerating a dividend, which is equivalent to the cost of borrowing funds for a period

shorter than 3 months.

5.3. Economic significance of tax savings from special dividends and dividend

accelerations

The tax-minded executives in our sample manage 1,010 companies. These companies

awarded a total of $3.7 billion in special dividends and accelerated $4.3 billion in regular

dividends in 2012. Due to the lower dividend tax rate, the dividend payouts collectively saved

shareholders nearly $700 million in taxes.8

We perform additional analyses on the 194 Tax_Minded_Dec executives to quantify

their impact. We find that these executives saved roughly $78 million in taxes by realizing

capital gains during December 2012. They manage 144 companies. Of these companies, 100

award dividends regularly. Of the regular dividend issuers, 28 awarded special dividends or

accelerated dividends in 2012. Of the 44 non-regular dividend issuers, five granted a special

dividend.

8

This estimate is based on the assumption that all shareholders were individuals subject to the 23.8% tax on

dividends. Also note that these awards were granted when the dividend rate was scheduled to increase to a

maximum of 43.4%; therefore, there may have been an expectation of much larger tax savings for shareholders.

19

5.4. Historical analysis of specials and accelerations

Finally, to verify that our results with respect to special and accelerated dividends are

driven by a tax choice and not due to other unique characteristics of tax-minded executives,

we perform a falsification test. We examine whether the presence of tax-minded executives

explains the distribution of special dividends or acceleration of regular dividends in prior years.

While we expect that our tax-mindedness variables are able to explain payouts in 2012 and

potentially in 2010, we do not expect to find a relation between these variables in other years.9

Table 6 reports the results of a logit regression where the dependent variable takes the

value of one if the company paid a special or accelerated a dividend during the year. The choice

of controls is the same as in Tables 4 and 5. Evidence from Table 6 is consistent with our

prediction. There is a positive and significant relation between the number of tax-minded

executives and the likelihood of a company distributing a special dividend or accelerated

dividend in 2012 and 2010, but not in other years.

5.5. Robustness checks

In this section we perform additional tests to analyze the robustness of our results.

5.5.1. Tax-mindedness or price decline?

A potential concern is that our identification strategy can possibly misidentify executives

as tax-minded if the stock price of their company had a sharp decline during 2012, thus

reducing their built-in capital gains. Even though this reduction in built-in capital gains is

consistent with an optimal tax strategy, it can be argued that these executives need not take

In 2010 there was a strong belief that the favorable tax rates were going to expire; however an extension was

signed into legislation on December 16th 2010.

9

20

any action and therefore should not be categorized as tax-minded. To address this concern,

we repeat the analyses from Sections 6.1. and 6.2., excluding all companies whose stock price

decreased during 2012.

An issue with this type of test is that it reduces the sample size; however, only 28% of

the firms in our sample are excluded since the S&P 500 rose over 11% in 2012. Models (1)

and (3) in Table 8 show the results for specials and accelerations respectively. In both models

the coefficient associated with the number of executives is positive, although it is only

significant for accelerations.

5.5.2. Tax-mindedness or restricted stock holdings?

A second potential concern is that an executive’s portfolio is likely to have restricted

stock. This could impact our identification if the restricted stock holdings hinder some

executives from strategically selling in 2012. To mitigate this concern, we conduct additional

analyses that do not include the value of restricted stock in the calculation of built-in capital

gains.

A couple of caveats are in order. First, Execucomp only shows the restricted stock

holdings on an annual basis; therefore, only Tax_Minded_2012 and Tax_Minded_80 can be

adjusted. Second, we assume that the tax basis of the restricted stock is equal to zero, as it is

common that restricted stock is awarded at no cost or very little cost. Table 8 shows that our

results are robust to the exclusion of restricted stock.

21

6. Tax-minded executives and corporate taxes

The spike in dividend awards in 2012 provokes the question of whether executives

were primarily acting in their own interest when granting payouts prior to the tax change. For

example, an article by Forbes highlights that Oracle’s CEO, Lawrence Ellison, would largely

benefit from its three-quarter dividend acceleration as he would receive $198.9 million from

the payout, resulting in a $17.5 million tax break. A similar article by the New York Times

reported that Steve Wynn, founder and CEO of Wynn Resorts, received nearly a $20 million

tax break in 2012 due to the special dividend award by his company.

While the magnitude of these tax benefits undeniably provides executives with

incentives to act, it is important to note that the fundamental driver behind these decisions is

the executives’ preference for tax savings. It stands to reason that this preference is also

present when making other managerial choices. Therefore, we maintain that the additional

dividend payments in 2012 were not an opportunistic one-shot action, but rather an element

within a series of actions aimed at reducing the tax burden of its shareholders. As such, we

expect that the dividend payouts were in line with the executives’ preexisting corporate tax

policies which emphasize tax savings.

Formally stated, our second conjecture is that tax-minded executives manage

companies that prioritize tax savings and, therefore, employ incremental tax planning

strategies to lower firm tax liabilities. We test this prediction using a panel regression that

tracks executives through time. The panel includes all firm years that have at least two

executives whose tax preferences have been identified from their actions in 2012. This

restriction mitigates the issue of attributing a tax outcome in a previous year to a single

22

identified executive.10 For the same reason we use a one-year measure of cash taxes paid, as

opposed to a longer measure, as the outcome variable.

Table 8 provides the summary statistics for the panel. It consists of 6,744 firm years.

On average, each firm year has 1.6 Tax_Minded_2012, 0.14 Tax_Minded_Dec, and 0.46

Tax_Minded_80 executives. The mean Cash ETR is 24%, which is equivalent to $168.5 million

cash taxes paid for the average firm in the sample.

Using a linear model, we analyze the impact of tax-minded executives on the cash taxes

paid by their firm in each year 𝑡:

𝐶𝑎𝑠ℎ 𝐸𝑇𝑅𝑖,𝑡 = 𝛼 + 𝛽(𝑁𝑜. 𝑇𝑎𝑥 𝑀𝑖𝑛𝑑𝑒𝑑 𝐸𝑥𝑒𝑐𝑠𝑖,𝑡 ) + 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠𝑖,𝑡 + 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝐹𝐸

(9)

+ 𝑌𝑒𝑎𝑟 𝐹𝐸

Cash ETR measures the cash taxes paid by the firm. The main explanatory variable is

the number of tax-minded executives who are present at each company. We control for firm

characteristics that are associated with tax avoidance (e.g., Gupta and Newberry, 1997; Mills

et al., 1998). These controls include firm size, leverage, multinational operations, R&D

intensity, intangibles, and advertising expense. We also include industry and year fixed effects.

Consistent with our conjecture, we find that there is a negative and statistically

significant relation between Cash ETR and Tax_Minded_2012 and Tax_Minded_80. The

presence of each tax-minded executive reduces the cash effective tax rate by 0.28% to 0.65%

per year, which is equivalent to cash tax savings of $2 million to $4.5 million for the average

firm in the sample. This result suggests that executives’ tax preferences are stable over time

10

The other executives likely contribute to the tax outcome; however, due to their inexistence in our 2012 sample

we are unable to determine their tax preference.

23

and is consistent with tax-minded executives implementing long-term corporate tax policies

that are aimed at reducing cash taxes for the firm. This finding also demonstrates that

executives were not simply acting in self-interest by awarding additional dividends in 2012. On

the contrary, these tax-minded executives maintain an overall corporate policy of tax

minimization, saving taxes for both their firms and its shareholders.

7. Conclusion

This paper examines executive tax preferences, a previously unexplored characteristic

of executives that maps into firm dividend and tax policies. We implement a unique empirical

approach to identify tax-minded executives who demonstrate a preference for tax savings.

Specifically, we exploit the setting in 2012, the year prior to large tax rate increases legislated

by ATRA and the Healthcare Act, to identify executives who lowered their tax liability by

realizing their built-in capital gains prior to year-end. We then examine the link between taxminded executives and the firms who awarded additional dividends in 2012 with the intention

of reducing the tax burden of their shareholders. Lastly, we analyze the link between taxminded executives and the firms who pay less cash taxes than their industry peers.

We find that tax-minded executives saved nearly $741 million in personal taxes by

reducing their built-in capital gains prior to 2013. They are also between 1.19 and 1.34 times

more likely to manage firms that take incremental steps to lessen shareholder taxes. This is

evidenced by their firms awarding two types of dividend payouts, $3.7 billion in special

dividends and $4.3 billion in accelerated dividends, prior to the 2013 tax hikes. These payouts

collectively saved shareholders nearly $700 million in taxes. Additionally, tax-minded

24

executives manage firms that actively strategize to reduce their tax liability. The presence of

each tax-minded executive reduces a firm’s Cash ETR by 0.28% to 0.65%. This is equivalent

to a $2 million to $4.5 million cash tax savings per tax-minded executive per year.

In sum, we present evidence that tax-minded executives save on personal taxes and

make strategic decisions at the firm level that save their shareholders taxes and firm cash taxes.

As such, we identify a contributing factor that sheds light on the open question of why some

firms pay less in taxes than other firms. Our findings also support the longstanding assumption

that managers internalize the effects of personal shareholder taxes when making corporate

decisions. In future work, it would be useful to examine other aspects of firms managed by

tax-minded executives, such as capital structure and performance. We leave these subjects for

future research.

25

Appendix

Table A.1.

Definition and data source of variables

Variable

Acceleration

Description

One if the company accelerated the payment of

a regular dividend from the first quarter of year

t+1 to the last quarter of year t, and zero

otherwise

Source

The Center for Research in

Securities Prices (CRSP)

Advertising

Advertisement expense as a percentage of sales

Compustat

Age

Executive age

Execucomp

Capital gains

Logarithm of each executive’s initial built-in

capital gains value

Created from Thomson

Reuters Insiders Data

Cash

Total cash divided by total assets

Compustat

Cash_ETR

Cash taxes paid divided by pre-tax book income

less special items

Compustat

CEO

One if the executive is a CEO, and zero

otherwise

Thomson Reuters Insiders

Data

CFO

One if the executive is a CFO, and zero

otherwise

Thomson Reuters Insiders

Data

Duality

One if the executive is both the CEO and the

chairman of the board, and zero otherwise

Thomson Reuters Insiders

Data

Institutional Investors

Percentage of institutional ownership in the

firm

Thomson Reuters

Institutional Holdings Data

Intangibles

Intangible assets divided by total assets

Compustat

Leverage

Long term debt divided by total assets

Compustat

MTB

Market value divided by shareholders’ equity

Compustat

Multinational

One if the company has positive pre-tax

income generated outside the US, and zero

otherwise

Compustat

Operating Cash Flow

Cash flow from operations divided by total

assets

Compustat

Post Period Return

Stock return from January 2013 to June 30th

2013

The Center for Research in

Securities Prices (CRSP)

R&D

Research and development expense divided by

sales

Compustat

26

ROA

Net income divided by average total assets

Compustat

Size

Logarithm of the company’s average assets

Compustat

Special

One if the company paid a special dividend

during the year, and zero otherwise

CRSP

Tax_Minded_80

One if the executive reduced his built-in capital

gains by more than 80% throughout 2012, and

zero otherwise

Created from Thomson

Reuters Insiders Data

Tax_Minded_2012

One if the executive reduced his built-in capital

gains throughout 2012, and zero otherwise

Created from Thomson

Reuters Insiders Data

Tax_Minded_Dec

One if the executive continued to increase his

built-in capital gains through December 1, 2012

and subsequently reduced his built-in gains in

the month of December, and zero otherwise

Created from Thomson

Reuters Insiders Data

TM_80

Number of Tax_Minded _80 executives present

in the company

Created from Tax_Minded_80

TM_2012

Number of Tax_Minded _2012 executives

present in the company

Created from

Tax_Minded_2012

TM_Dec

Number of Tax_Minded _Dec executives present

in the company

Created from

Tax_Minded_Dec

Tenure

Number of years of an executive’s employment

at the firm

Execucomp and Thomson

Reuters Insiders Data

27

References

Allen, F., Bernardo, A. E., & Welch, I., 2000. A theory of dividends based on tax clienteles.

The Journal of Finance 55, 2499-2536.

Armstrong, C. S., Blouin, J. L., & Larcker, D. F., 2012. The incentives for tax planning. Journal

of Accounting and Economics 53, 391-411.

Badrinath, S. G., & Lewellen, W. G., 1991. Evidence on tax‐motivated securities trading

behavior. The Journal of Finance 46, 369-382.

Baker, M., & Wurgler, J., 2004a. A catering theory of dividends. The Journal of Finance 59,

1125-1165.

Baker, M., & Wurgler, J., 2004b. Appearing and disappearing dividends: The link to catering

incentives. Journal of Financial Economics 73, 271-288.

Bolster, P. J., Lindsey, L. B., & Mitrusi, A., 1989. Tax‐induced trading: the effect of the 1986

Tax Reform Act on stock market activity. The Journal of Finance 44, 327-344.

Brown, J. R., Liang, N., & Weisbenner, S., 2007. Executive financial incentives and payout

policy: firm responses to the 2003 dividend tax cut. The Journal of Finance 62, 19351965.

Chen, S., Chen, X., Cheng, Q., & Shevlin, T., 2010. Are family firms more tax aggressive than

non-family firms? Journal of Financial Economics 95, 41-61.

Chetty, R., & Saez, E., 2005. Dividend taxes and corporate behavior: evidence from the 2003

dividend tax cut. The Quarterly Journal of Economics 120, 791-833.

Chyz, J. A., 2013. Personally tax aggressive executives and corporate tax sheltering. Journal of

Accounting and Economics 56, 311-328.

Constantinides, G. M., 1984. Optimal stock trading with personal taxes: implications for prices

and the abnormal January returns. Journal of Financial Economics 13, 65-89.

Cronqvist, H., Makhija, A. K., & Yonker, S. E., 2012. Behavioral consistency in corporate

finance: CEO personal and corporate leverage. Journal of Financial Economics 103, 20-40.

Davidson, R., Dey, A., & Smith, A., 2013. Executives'“off-the-job” behavior, corporate

culture, and financial reporting risk. Forthcoming in Journal of Financial Economics.

DeAngelo, H., DeAngelo, L., & Skinner, D. J., 2000. Special dividends and the evolution of

dividend signaling. Journal of Financial Economics 57, 309-354.

28

DeAngelo, H., DeAngelo, L., & Stulz, R. M., 2006. Dividend policy and the

earned/contributed capital mix: a test of the life-cycle theory. Journal of Financial

Economics 81, 227-254.

DeAngelo, H., & Masulis, R. W., 1980. Optimal capital structure under corporate and personal

taxation. Journal of Financial Economics 8, 3-29.

Dhaliwal, D., Erickson, M., & Heitzman, S., 2009. Taxes and the backdating of stock option

exercise dates. Journal of Accounting and Economics 47, 27-49.

Dyl, E. A., 1977. Capital gains taxation and year‐end stock market behavior. The Journal of

Finance 32, 165-175.

Dyreng, S. D., Hanlon, M., & Maydew, E. L., 2010. The effects of executives on corporate tax

avoidance. The Accounting Review 85, 1163-1189.

Fama, E. F., & Babiak, H., 1968. Dividend policy: an empirical analysis. Journal of the

American Statistical Association 63, 1132-1161.

Fama, E. F., & French, K. R., 2001. Disappearing dividends: changing firm characteristics or

lower propensity to pay? Journal of Financial Economics 60, 3-43.

Graham, J., Hanlon, M., Shevlin, T., & Shroff, N., 2013. Incentives for tax planning and

avoidance: evidence from the field. The Accounting Review 89, 991-1023.

Green, R. C., & Hollifield, B., 2003. The personal-tax advantages of equity. Journal of Financial

Economics 67, 175-216.

Grinstein, Y., & Michaely, R., 2005. Institutional holdings and payout policy. The Journal of

Finance 60, 1389-1426.

Gupta, S., & Newberry, K., 1997. Determinants of the variability in corporate effective tax

rates: evidence from longitudinal data. Journal of Accounting and Public Policy 16, 1-34.

Hanlon, M., & Heitzman, S., 2010. A review of tax research. Journal of Accounting and

Economics 50, 127-178.

Hanlon, M., & Hoopes, J. 2013. What do firms do when dividend tax rates change? An

examination of alternative payout responses. Journal of Accounting and Economics, 114,

105-124.

Hutton, I., Jiang, D., & Kumar, A., 2013. Corporate policies of Republican managers.

Forthcoming in Journal of Financial and Quantitative Analysis.

Internal Revenue Bulletin: 2010-47. Basis reporting by securities brokers and basis

determination for stock. November, 2010. Washington, D.C.: Internal Revenue Service.

29

Jacob, M., Michaely, R., & Alstadsæter, A., 2014. Taxation and dividend policy: The muting

effect of diverse ownership structure. Working paper. WHU – Otto Beishem School of

Management.

Jensen, M. C., 1986. Agency costs of free cash flow, corporate finance, and takeovers. The

American Economic Review 76, 323-329.

Lakonishok, J., & Smidt, S., 1988. Are seasonal anomalies real? A ninety-year perspective.

Review of Financial Studies 1, 403-425.

Law, K., & Mills, L. F., 2013. Following the rules? Corporate tax reporting by CEOs with

military experience. Working paper. Tilburg University.

Malmendier, U., & Tate, G., 2005. CEO overconfidence and corporate investment. The

Journal of Finance 60, 2661-2700.

Masulis, R. W., & Trueman, B., 1988. Corporate investment and dividend decisions under

differential personal taxation. Journal of Financial and Quantitative Analysis 23, 369-385.

Miller, M. H., 1977. Debt and taxes. The Journal of Finance 32, 261-275.

Mills, L., Erickson, M., & Maydew, E., 1998. Investments in tax planning. Journal of the

American Taxation Association 20, 1-20.

Popper, N., & Schwartz N., 2012. Investors rush to beat threat of higher taxes. The New York

Times, 18 November.

Poterba, J. M., & Weisbenner, S. J., 2001. Capital gains tax rules, tax‐loss trading, and turn‐of‐

the‐year returns. The Journal of Finance 56, 353-368.

Review & Outlook, 2012. Costco’s dividend tax epiphany. The Wall Street Journal, 30

November.

Schaefer, S., 2012. Larry Ellison, Oracle investors latest to skirt higher taxes with quicker

dividend. Forbes Magazine, 3 December.

Scholes, M., Wolfson, M., Erickson, M., Maydew, E., Shevlin, T., 2005. Taxes and business

strategy. Prentice-Hall, Englewood Cliffs, NJ.

Seida, J. A., & Wempe, W. F., 2000. Do capital gain tax rate increases affect individual

investors’ trading decisions? Journal of Accounting and Economics 30, 33-57.

Seyhun, H. N., & Skinner, D. J., 1994. How do taxes affect investors' stock market realizations?

Evidence from tax-return panel data. Journal of Business, 231-262.

30

U.S. Government, 2013. Bill Summary and Status: American Taxpayer Relief Act of 2012. The

Library of Congress. Web site, <http://thomas.loc.gov/cgi-bin/bdquery/z?d112:HR

00008:@@@S>

Wilson, R. J., 2009. An examination of corporate tax shelter participants. The Accounting

Review 84, 969-999.

31

Fig. 1. Timeline of relevant changes in tax legislation from 2001 to 2013.

This figure presents the dates of the introduction and enactment of legislation that impacted ordinary income, qualified dividend, and long-term capital gain tax rates for

high-income tax payers from 2001 to 2013. The lower half shows the tax implications of each act and the boxes span the time period when they were in effect. EGTRRA

stands for the Economic Growth and Tax Relief Reconciliation Act of 2001. JGTRRA stands for the Jobs and Growth Tax Relief Reconciliation Act of 2003. The short

title of the Healthcare Act is the Healthcare and Education Reconciliation Act of 2010. The short title of the Tax Relief Act is the Tax Relief, Unemployment Insurance

Reauthorization, and Job Creation Act of 2010. ATRA stands for the American Taxpayer Relief Act of 2012.

2012

Introduction of ATRA

July 24: introduced

Aug 1: passed in the House

Presidential election results

Healthcare Act enactment

2013

ATRA enactment

2001

2002

2003

2004

2005

2006

Jan 2: signed into law

Tax Relief Act enactment

JGTRRA enactment

EGTRRA enactment

2007

2008

2009

2010

2011

2012

Jan 1: passed in Senate with changes

2013

Extends EGTRRA and JGTRRA

Schedule to gradually reduce taxes

Additional 3.8% tax on net investment income

Accelerated the EGTRRA reduction in ordinary income tax

Highest ordinary income rate increased by 4.6%

Lowered the qualified dividend tax rate to 15%

Highest long-term capital gains rate increased by 5%

Qualified dividend rate increased by 5%

Lowered the long-term capital gain tax rate to 15%

32

Fig. 2. Executive stock sales, December and January differences, 2002 - 2012.

This figure presents the difference of December and January executive stock sales, in millions of dollars, for the

2002-2012 period. The dotted line represents the average difference for the 2002-2012 period.

Value of executive sales (millions)

$1,200

$1,000

$800

$600

$400

$200

$0

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

-$200

-$400

December - January

33

Average

2012

Fig. 3. Value of ordinary and special dividend payments, January 2001 - March 2013.

This figure shows the dollar amount, in billions of dollars, of regular and special dividends paid quarterly from

the first quarter of 2000 to the first quarter of 2013.

180

Dividend payments (in billions)

160

140

120

100

80

60

40

20

0

Ordinary

34

Special

Table 1. Executive stock sales, December and January differences, 2002 - 2012.

This table presents the historical level of executive stock sales in December and January, in millions of dollars, for the 2002-2012 period. The table shows the difference

of December and January values and reports a test of the statistic being different from the 2002-2012 average.

Year

December t

January t+1

Diff. Dec - Jan

T-stat (different from the mean)

2002

223.7

193.6

30.0

2003

828.5

673.3

155.2

2004

1436.0

914.3

521.7

2005

1280.8

1581.7

(300.9)

2006

793.5

797.0

(3.5)

2007

1264.7

860.0

404.7

2008

276.7

186.0

90.6

2009

822.7

282.0

540.7

2010

778.8

469.8

309.0

2011

799.8

600.0

199.8

2012

1744.9

667.2

1077.7

(0.67)

(0.33)

0.68

(1.59)

(0.77)

0.36

(0.51)

0.73

0.09

(0.21)

2.21

35

2002 - 2012

Mean St. Dev.

931.8

464.9

656.8

399.7

275.0

362.9

Table 2. Summary Statistics, 2012.

This table presents the summary statistics for the sample. Panel A presents executive characteristics. Panel B

presents firm-level characteristics. The sample consists of 4,435 executives and the 1,485 unique firms they

manage. Variable definitions are provided in Appendix Table A.1.

Panel A. Executive characteristics, 2012

Variable

Mean

Std. Dev.

Q1

Median

Q3

Tax_minded_2012

0.51

0.50

0.00

1.00

1.00

Tax_minded_Dec

0.04

0.20

0.00

0.00

0.00

Tax_minded_80

0.16

0.36

0.00

0.00

0.00

(0.27)

2.17

(1.39)

(0.04)

1.12

Tenure

8.25

4.81

5.00

7.00

11.00

Age

48.84

6.64

44.00

49.00

53.00

CEO

0.13

0.33

0.00

0.00

0.00

CFO

0.20

0.40

0.00

0.00

0.00

Duality

0.02

0.15

0.00

0.00

0.00

Capital Gains

Panel B. Firm characteristics, 2012

Variable

Mean

Std. Dev.

Q1

Median

Q3

Special

0.02

0.14

0.00

0.00

0.00

Acceleration

0.12

0.32

0.00

0.00

0.00

No. TM_2012

1.54

1.47

0.00

1.00

3.00

No. TM_Dec

0.13

0.46

0.00

0.00

0.00

No. TM_80

0.47

0.83

0.00

0.00

1.00

Institutional Investors

0.77

0.16

0.68

0.80

0.89

Cash

0.14

0.15

0.03

0.09

0.20

Leverage

0.20

0.19

0.04

0.17

0.31

ROA

0.05

0.10

0.01

0.04

0.08

Size

8.07

1.73

6.83

7.98

9.14

MTB

2.81

3.66

1.25

1.91

3.12

Operating Cash Flow

0.09

0.09

0.05

0.09

0.14

Post Period Return

0.02

0.24

(0.10)

0.00

0.12

36

Table 3. Likelihood of an executive being tax-minded, logistic regression 2012.

This table reports the estimation results from logit regressions of the following form:

Pr(𝑇𝑎𝑥_𝑀𝑖𝑛𝑑𝑒𝑑𝑗 ) = 𝛼 + 𝛽 log(𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐺𝑎𝑖𝑛𝑠𝑗 ) + 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠𝑗 .

In this model the dependent variable is an indicator for executive tax-mindedness. The dependent variable in

columns 1 and 2 is Tax_Minded_2012, while in columns 3 and 4 is Tax_Minded_Dec. Variable definitions are

provided in Appendix Table A.1. Standard errors are adjusted for heteroskedasticity and autocorrelation. P-values

are reported below the coefficient estimates. *, **, *** indicate significance at the two-tailed 10%, 5% and 1%

levels, respectively. The Odds-Ratio factor for an increase of 1% in the initial built-in capital gains is presented.

It is calculated as the exponential of the coefficient and is provided for interpretation purposes.

Dependent Variable:

Model:

Intercept

Capital Gains

Tax_Aware_2012

Tax_Aware_Dec

(1)

0.081***

(2)

0.707**

(3)

-3.077***

(4)

-3.242***

0.0075

0.025

<.0001

<.0001

0.09***

0.075***

0.085**

0.049

<.0001

<.0001

0.0348

0.3267

Tenure

Age

0.014

0.052***

0.1429

0.0066

-0.005

0.008

0.3491

0.5243

CEO

0.120

-0.290

0.3028

0.3358

CFO

-0.185**

-0.067

0.0447

0.7791

-0.108

0.942**

Duality

Size

Post Period Return

0.6503

0.0269

-0.062***

-0.076

0.0036

0.166

-0.029

-0.144

0.8393

0.6106

AUC

N. Obs.

0.56

4,435

0.56

3,276

0.56

4,435

0.59

3,276

Odds Ratio: Capital Gains

1.09**

1.07**

1.08**

1.04*

37

Table 4. Likelihood of a company awarding special dividends, logistic regression 2012.

This table reports the estimation results from logit regressions of the following form:

𝑃𝑟(𝑆𝑝𝑒𝑐𝑖𝑎𝑙𝑖 ) = 𝛼 + 𝛽(𝑁𝑜. 𝑇𝑎𝑥 𝑀𝑖𝑛𝑑𝑒𝑑 𝐸𝑥𝑒𝑐𝑠𝑖 ) + 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠𝑖 + 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝐹𝐸.

In this model the dependent variable is an indicator for special dividends paid during 2012. The independent

variable is the number of tax-minded executives present at each firm. The independent variable in columns 1 and

2 is TM_2012, in columns 3 and 4 is TM_Dec, while in columns 5 and 6 is TM_80. Variable definitions are

provided in Appendix Table A.1. Standard errors are adjusted for heteroskedasticity and autocorrelation. P-values

are reported below the coefficients. *, **, *** indicate significance at the two-tailed 10%, 5% and 1% levels,

respectively. The Odds-Ratio factor for an increase of 1 tax-minded executive is presented. It is calculated as the

exponential of the coefficient and is provided for interpretation purposes.

Dependent variable: Special

Tax-mindedness variable:

Model:

Intercept

No. Tax-Minded Execs.

TM_2012

TM_Dec

TM_80

(1)

-3.931***

(2)

-0.277

(3)

-4.051***

(4)

-0.359

(5)

-4.062***

(6)

-0.306

<.0001

0.7881

<.0001

0.7382

<.0001

0.7707

0.069

0.183

0.837***

0.864***

0.384***

0.359**

0.5442

0.1388

<.0001

0.0005

0.0097

-0.302***

0.008

0.0155

0.012

MTB

-0.001

-0.001

-0.001

0.56

0.5594

0.5842

Cash

0.109

0.051

0.066

0.9286

0.9685

0.9571

0.028

0.035

-0.018

Leverage

-0.301**

0.0215

Size

-0.306**

0.9818

0.9782

0.9881

ROA

7.663***

7.514***

7.145***

0.0004

0.0006

0.0011

Operating Cash Flow

-4.995**

-5.008**

-4.525**

0.0127

0.013

0.0237

Institutional Investors

-1.873*

-1.805*

-1.687*

0.0567

0.0848

0.0953

Industry FE

AUC

N. Obs.

No

0.53

1,485

Yes

0.78

1,435

No

0.57

1,485

Yes

0.82

1,435

No

0.59

1,485

Yes

0.78

1,435

Odds - Ratio: No. Tax-Minded Execs.

1.06

1.2

2.29***

2.36***

1.46***

1.42**

38

Table 5. Likelihood of a company accelerating a dividend, logistic regression 2012.

This table reports the estimation results from logit regressions of the following form:

𝑃𝑟(𝐴𝑐𝑐𝑒𝑙𝑒𝑟𝑎𝑡𝑖𝑜𝑛𝑖 ) = 𝛼 + 𝛽(𝑁𝑜. 𝑇𝑎𝑥 𝑀𝑖𝑛𝑑𝑒𝑑 𝐸𝑥𝑒𝑐𝑠𝑖 ) + 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠𝑖 + 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝐹𝐸.

In this model the dependent variable is an indicator for accelerated dividend payment from the first quarter of

2013 to the last quarter of 2012. The independent variable is the number of tax-minded executives present at

each firm. The independent variable in columns 1 and 2 is TM_2012, in columns 3 and 4 is TM_Dec, while in

columns 5 and 6 is TM_80. Variable definitions are provided in Appendix Table A.1. Standard errors are adjusted

for heteroskedasticity and autocorrelation. P-values are reported below the coefficients. *, **, *** indicate

significance at the two-tailed 10%, 5% and 1% levels, respectively. The Odds-Ratio factor for an increase of 1

tax-minded executive is presented. It is calculated as the exponential of the coefficient and is provided for

interpretation purposes.

Dependent variable: Acceleration

Tax mindedness variable:

TM_2012

(3)

-2.116***

(4)

-0.913

TM_80

Model:

Intercept

(1)

-2.362***

<.0001

0.1738

<.0001

0.2149

<.0001

0.2043

No. Tax-Minded Execs.

0.189***

0.177**

0.388***

0.33**

0.307***

0.245**

0.0141

0.006

0.0293

0.0007

0.0037

(2)

-0.991

TM_Dec

(5)

-2.22***

0.01

Size

-0.044

0.4723

0.6542

0.513

MTB

-0.003

-0.003

-0.003

0.1572

0.1355

0.1466

0.493

0.343

0.278

0.6275

0.7445

0.7878

-1.147

-1.294

-1.264

0.2118

0.1576

0.1676

ROA

2.962

2.495

2.565

0.1142

0.1981

0.166

Operating Cash Flow

-1.812

-1.127

-1.191

0.3866

0.5893

0.5631

Institutional Investors

-0.742

-0.745

-0.668

0.2219

0.2188

0.2652

Cash

Leverage

-0.026

(6)

-0.925

-0.040

Industry FE

AUC

N. Obs.

No

0.58

1,050

Yes

0.65

998

No

0.54

1,050

Yes

0.64

998

No

0.58

1,050

Yes

0.65

998

Odds - Ratio: No. Tax-Minded Execs.

1.2***

1.19**

1.46***

1.39**

1.35***

1.27**

39

Table 6. Specials and accelerated dividend awards over time, 2008-2012.

This table reports the estimation results from logit regressions of the following form:

𝑃𝑟(𝑆𝑝𝑒𝑐𝑖𝑎𝑙 or 𝐴𝑐𝑐𝑒𝑙𝑒𝑟𝑎𝑡𝑖𝑜𝑛𝑖 ) = 𝛼 + 𝛽(𝑁𝑜. 𝑇𝑎𝑥 𝑀𝑖𝑛𝑑𝑒𝑑 𝐸𝑥𝑒𝑐𝑠𝑖 ) + 𝛾𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑠 + 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝐹𝐸.

In this model the dependent variable is an indicator for special dividend paid in 2012 or accelerated dividend payment from the first quarter of 2013 to the last quarter

of 2012. The independent variable is the number of tax-minded executives present at each firm. The independent variable in columns 1, 3, 5, 7, and 9 is TM_2012, while

in columns 2, 4, 6, 8, and 10 is TM_80. Variable definitions are provided in Appendix Table A.1. Standard errors are adjusted for heteroskedasticity and autocorrelation.

P-values are reported below the coefficients. *, **, *** indicate significance at the two-tailed 10%, 5% and 1% levels, respectively.

Dependent variable: Special or acceleration

Year:

2012

Tax-mindedness variable:

TM_2012

TM_80

Model:

Intercept

No. Tax-Minded Execs.

2011

2010

2009

2008

TM_2012

TM_80

TM_2012

TM_80

TM_2012

TM_80

TM_2012

TM_80

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

-1.804**

-1.761**

-2.992

-2.908

-1.643

-1.711

-6.274***

-6.124**

-0.803

-0.701

0.012

0.0152

0.1724

0.227

0.2208

0.2212

0.0026

0.0148

0.516

0.5822

0.178***

0.297***

-0.010

-1.150

-0.013

0.377*

-0.047

-0.808

0.042

-0.217

0.0097

0.0039

0.9655

0.2566

0.9447

0.0966

0.7971

0.1199

0.7948

0.6293

Size

0.061

0.065

0.129

0.159

-0.147

-0.166

0.471***

0.487***

-0.202

-0.202

0.3625

0.3332

0.5615

0.478

0.3698

0.2903

0.0043

0.004

0.1496

0.151

MTB

-0.002

-0.002

0.045

0.048*

0.000

0.000

-0.002

-0.002

-0.009

-0.009

0.103

0.1173

0.134

0.0765

0.876

0.9772

0.3255

0.2571

0.1792

0.2313

Cash

-0.090

-0.162

1.917

1.583

2.755**

2.738**

2.572

2.371

-1.272

-1.278

0.917

0.8531

0.2725

0.4308

0.0367

0.0431

0.1209

0.1467

0.6011

0.6096

Leverage

-1.024

-1.105

-4.230

-5.150

-0.907

-0.688

-2.363

-2.735

-0.295

-0.323

0.2853

0.2501

0.23

0.2092

0.4185

0.5551

0.4169

0.3416

0.8615

0.8494

1.664

1.561

-2.120

-3.141**

8.979**

9.28**

-6.063**

-6.274**

0.841

0.939

0.1126

0.1356

0.1437

0.0284

0.0126

0.0184

0.0256

0.02

0.6918

0.6565

-1.788

ROA

Operating Cash Flow

Institutional Investors

Industry FE

AUC

N. Obs.

0.122

0.427

-0.223

-0.779

-3.161

-3.491

8.271**

8.295**

-1.895

0.9376

0.7851

0.9582

0.8816

0.3213

0.3038

0.0363

0.0314

0.4738

0.4964

-1.218*

-1.148*

-3.593**

-3.298**

-1.411

-1.503

-2.755*

-2.723*

-0.697

-0.676

0.05

0.063

0.042

0.0286

0.2218

0.1987

0.0889

0.0974

0.3945

0.3994

Yes

0.66

1,132

Yes

0.68

1,132

Yes

0.90

1,121

Yes

0.91

1,121

Yes

0.82

1,092