Essays on the Financial Behavior of Corporations and... Scott J. Weisbenner

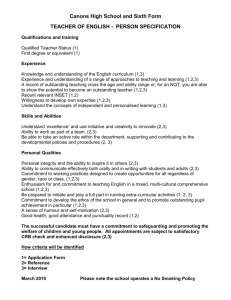

advertisement