Q.1 Explain the circular flow of income in a two sector model. 1. Real

advertisement

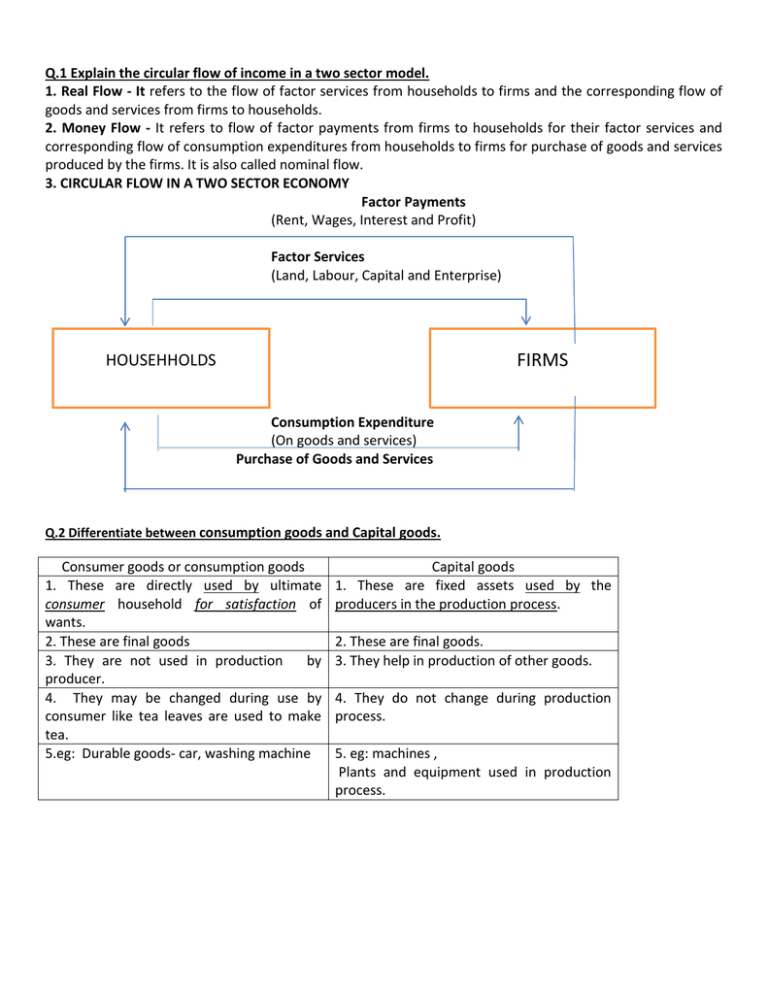

Q.1 Explain the circular flow of income in a two sector model. 1. Real Flow - It refers to the flow of factor services from households to firms and the corresponding flow of goods and services from firms to households. 2. Money Flow - It refers to flow of factor payments from firms to households for their factor services and corresponding flow of consumption expenditures from households to firms for purchase of goods and services produced by the firms. It is also called nominal flow. 3. CIRCULAR FLOW IN A TWO SECTOR ECONOMY Factor Payments (Rent, Wages, Interest and Profit) Factor Services (Land, Labour, Capital and Enterprise) FIRMS HOUSEHHOLDS Consumption Expenditure (On goods and services) Purchase of Goods and Services Q.2 Differentiate between consumption goods and Capital goods. Consumer goods or consumption goods 1. These are directly used by ultimate consumer household for satisfaction of wants. 2. These are final goods 3. They are not used in production by producer. 4. They may be changed during use by consumer like tea leaves are used to make tea. 5.eg: Durable goods- car, washing machine Capital goods 1. These are fixed assets used by the producers in the production process. 2. These are final goods. 3. They help in production of other goods. 4. They do not change during production process. 5. eg: machines , Plants and equipment used in production process. Q.3 What is the difference between Final goods and Intermediate Goods? Final goods 1. These are ready for final use by consumer for consumption or By producer for investment. Intermediate goods 1. These are not ready for use; they are for resale or used for further production. 2.These are:(a)Consumer goods used for satisfaction of wants. They may change during use. (b) Capital goods which help in production process. Thy do not transform during use,; 2. These are purchased by one firm from another for following purpose:(a) Resale during the year (b) Use as raw material in production process. So they may change during production process 3. Once sold these pass out of production 3. These are inside the production boundary. boundary. 4. These are included in national income 4. These are not included in national income. Q.4 Differentiate between Stocks and Flows variables . Stocks 1. Stock variables are measured at a particular point in time. 2. They do not have a time dimension, 3. Eg: Capital stock, inventory, wealth on a particular day. 4. Stock is static concept Flows 1. Flow variables are measured over a period of time, 2. They have a time dimension, 3. Eg: Capital formation during a year, change in stock, national income during a year. 4. Flow is dynamic concept. Q.5 Differentiate between Factor income and Transfer Income. Factor income or Factor payment Transfer Income or Transfer payment 1. It is the income received in return for It is the income received without any rendering factor services by the factors of corresponding services. production. 2. These are included in national income. These are not included in national income 3. Example: Rent, wages, interest, and profit. Retirement pension. Example: old age pension, scholarship of students, unemployment allowance, charity ,gifts, expenditure on birthday / Marriage, pocket money, remittances from abroad, financial help to earthquake victims, beggars, meals to beggars, compensation given to accident victims etc.