our powerpoint

advertisement

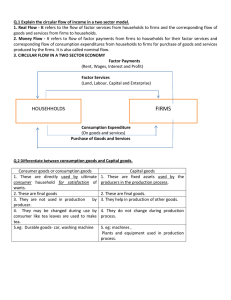

Computational Modeling of Macroeconomics Adam Szatrowski '12 Stephen Sentoff '11 Introduction Goals Lack of literature Humble roots Prototype economy Our Concept Firms and Households Observe the interactions, recording prices and quantities Observe key economic variables Inflation (Δ Price Level) Unemployment Rate Consumption Inventories Perfect competition, with imperfect information Agents Households Use a Cobb-Douglas consumption function for Cookies Choose between savings and consumption Preferences are randomized Employment decisions, 2 ways Firms Use a Cobb-Douglas production function for Cookies Choose between labor and capital Seek to hold zero inventory at the end of each period Simulation Technical Aspects 500 lines of Object Oriented Python Graphing using MatPlotLib Initial State Generate number of households and firms with randomized preferences and production functions respectively Periods At the beginning of each period: Households adjust wage expectations, affects labor supply Firms estimate demand using a PID controller for inventory The round begins, and agents engage in buying and selling Decision Making Households poll 2 random firms, optimize using the lower price Firms determine production based on previous demand Firms poll 10 random workers, optimize production using the average wage demanded Households set wage rate based on previous consumption, inflation, and wages Key Parameters 1. Ratio of Firms to Households 2. Household and Firm endowed funds 3. Household wage indexation vs. consumption indexation 4. Workweek hour limit 5. Mean preference terms 6. Rounds of buying and selling in each period Results Questions