Integrating The Four Shipping Markets: A New ... By George N. Dikos 2003

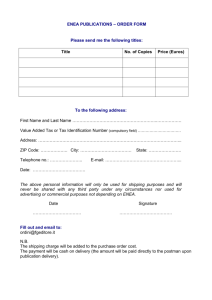

advertisement

Integrating The Four Shipping Markets: A New Approach

By

George N. Dikos

M.Eng. Naval Architecture and Marine Engineering, N.T.U.A., 1999

M.S. Shipping, Trade and Finance, City University Business School, 2001

SUBMITTED TO THE DEPARTMENT OF OCEAN ENGINEERING IN

PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF

MASTER OF SCIENCE IN OCEAN SYSTEMS MANAGEMENT

AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

FEBRUARY 2003

@ 2003 Massachusetts Institute of Technology

All rights reserved

Signature of Author............

............

Department of Ocean Engineering

December 19, 2003

'U

/J

/

-

/

Certified by............

................

Henry Marcus

Professor of Marine Systems

Thesis Supervisor

Accepted by..............................

.i ...... ...............

Arthur Baggeroer

Professor of Ocean Engineering and Electrical Engineering

Chairman, Department Committee on Graduate Studies

MASAoUil

S INSTITUTE

OF TECHNOLOGY

BARKER

JUL 1 5 2003

LIBRARIES

I

........

The Four Shipping Markets: An Integrated

Approach

by

George Dikos

Submitted to the Depratment of Ocean Engineering on December 20, 2002

in Partial Fulfillment of the Requirements for the degree of

Master in Science in Ocean Systems Management

Abstract

Using the approach of modern financial economics, several questions regarding the four shipping markets are addressed. These markets are the

market for new vessels, the second hand market, the scrapping market and

the freight rate market. Using "no arbitrage" arguments, the four markets

are integrated and equilibrium valuation of vessels is derived. Finally, questions of market efficiency and rational expectations are tested empirically,

using modern econometric theory.

Thesis Supervisor: Henry S. Marcus

Title: Professor of Ocean Systems Management

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

ACKNOWLEDGMENTS

First of all I would like to thank the Eugenides Foundation, the A. Onassis Public

Benefit Foundation and the Fulbright Foundation for funding my studies at M.I.T.

My thanks go out especially to the President of the Eugenides Foundation, Mr. L.

Eugenides-Demetriades, for his encouragement and belief in my work and in the old

friendship between our families. I would also like to thank Professor Henry Marcus

for supervising both this thesis and my PhD research. I am also grateful to Professor

Nick Patrikalakis and Professor Jerry Hausman. Thanks also go to my co-authors

Professor Henry Marcus and Nick Papapostolou for allowing me to use parts of our

joint work from the following working papers: 'Market Efficiency in the Shipping

Sector', 'Second Hand Prices, New Buildings and Time Charter Rates' and

'Integrating the Four Shipping Markets: The End of the Puzzle'. Thanks also go to

Vassilis Papakonstantinou and Mr. N. Teleionis.

I dedicate this thesis to my parents, with all my love.

2

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

TABLE OF CONTENTS

1. The Four Shipping Markets: Towards an Integrated Approach................ 4

1.1 Introduction and Motivation......................................................................4

7

2. Empirical Analysis of Second Hand Prices ...............................................

2.1 EBITDA/CAPEX as a leading indicator for depreciation ........................ 7

2.1.1 Testing the Hypotheses......................................................................................................

2.1.2 H ypothesis Testing ................................................................................................................

2.1.3 R esults ...................................................................................................................................

9

10

11

16

2.2 Specification of the Depreciation Curves .............................................

Testing....................................22

Benchmark

and

Testing

of

Sample

2.3 Out

23

2.3.1 R esidual D iagram ..................................................................................................................

25

2.3.2 Structural Analysis of our Empirical Findings ..................................................................

2.4 Econometric Analysis of the Second Hand Price and New Vessel Price Dyanmics ................ 31

THE COST OF RUNNING VESSELS.........................................................................................

H andysize .......................................................................................................................................

Table 2: Summary Statistics Of Price & Profit Series..............................................................

ESTIMATION RESULTS .................................................................................................................

Table 3: Summary Statistics of the Excess Returns in the Four Tanker Carriers......................

Table 4: Predictability of Excess Returns on Shipping Investments ..........................................

COINTEGRATION TESTS...............................................................................................................44

Table 5:Cointegration Test For Prices and Operational Profits.................................................

Table 6: Estimated VECM of Handysize Prices & Profits.............................................................48

Table 7: Estimated VECM of Suezmax Prices & Profits ...............................................................

Table 8: Estimated VECM of VLCC Prices & Profits ...................................................................

C ON C LU SION ..................................................................................................................................

33

34

38

40

42

43

45

49

50

59

3. A Stochastic Model for the Depreciation Curves..................64

3.1Introduction and Motivation....................................................................64

3.2 The Relation between Renewal Value and Market Value of Ships..........66

3.3 Modelling the Evolution of New Building Prices, Second Hand Prices and

Time Charter Rates.................................................................................... 69

3.3.1.1 The Model...............................................................................................................................69

3.3.1.2 Economic Interpretationof the DepreciationCurves........................................................

3.3.1.3 The Form ofDepreciation Curves....................................................................................

72

74

3.4 Empirical Analysis.................................................................................75

3.4.1.1 DataA nalysis..........................................................................................................................

3.4.1.2 EmpiricalReuslts....................................................................................................................76

75

. . 77

Ta b le 2 .....................................................................................................

78

3.5 Summary and Topics for Further Research .........................................

4. Integrating the Four Shipping Markets using the Contingent Claims

. 80

A p pro ach ....................................................................................................

4.1 A Structural Model for the Second Hand Prices.......................................................................80

4.2.1 Risk Factors and Replicating Strategies ................................................................................

81

4.3 A two-factor market model .......................................................................

87

4.3.1 Valuation in an incomplete market.......................................................................................

87

4.4 Generalized formulation of the 'Good Deal' Problem ........................... 90

5. Towards a General Equilibrium...............................................................94

5.1 Partial Equilibrium Pricing......................................................................................................

5.2 Market Microstructure and Open Problems..............................................................................96

3

94

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

1. The Four Shipping Markets:

Approach

Towards

an

Integrated

Historically, the market for new vessels, the market for second hand vessels, the

freight rate dynamics and finally the market for scrap have been considered as

different markets that obey their own laws of supply and demand. The main aim of

this dissertation is to identify the dynamics of second hand prices from a financial

or Real Options approach.

1.1

Introduction and Motivation

After the pioneering work of Zannetos (1966) and others, who set the

foundations of Maritime Economics from a microeconomic or Industrial

Organisation point of view, very little has been done in using financial tools to

identify 'pricing links' between the different markets that constitute the

shipping industry. The dynamics of the freight rates are determined by the

supply and demand for transportation and the same applies for the orderings

of new building vessels and scrapping decisions. However, since the second

hand vessels do not affect the supply and demand patterns, their value

should be determined

by their payoffs and their opportunity or

replacement cost. This observation will be the motivation for this paper and

the link that will allow us to integrate our approach towards the different

shipping markets, by using intuition from finance.

Since the market for second hand vessels doesn't depend on capacity

replacement and speculation and given that ships exist in order to provide

demand capacity, ideally it should not exist. However not only it exists, but

also it is one of the driving forces of shipping economics and shipping

investment. This implies that it functions, on the one hand as a market for

assets and on the other hand (and this is the key idea in this paper) as a

proxy for the market value of a vessel compared to the replacement cost,

given by the prices of new vessels.

The first part of this observation is not new in maritime economics.

Beenstock and Vergottis (1989) came up with a model in order to explain the

prices of second hand values. This model, which was a CAPM type model,

relied on quadratic utility functions for shipping investors and the assumption

4

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

that markets are complete. Since then, few significant research efforts have

been made to understand the financial aspects of the market for second hand

vessels and their role in the shipping industry.

Without the strict assumptions required in a CAPM type approach, we

know that the value of the asset is determined by the value of its expected

payoff, for which time charter rates are a sufficient statistic. Furthermore,

decisions in the second hand market depend on the comparison between

market values (second hand prices) and new building prices (replacement

costs).

If

these

two

factors

are

sufficient

statistics

for

investment/replacement decisions in the second hand market, then they

should also be sufficient statistics for the pricing of second hand ships. This

was the main intuition of the seminal paper (1992) by Marcus et.al.

Furthermore, the intuition behind the relationship of second hand prices and

new vessels has close connections to Tobin's q-theory. This approached will

provide the theoretical background for our empirical analysis in Chapter 2.

From an empirical point of view, 10 years later after the 'Buy Low - Sell

High'

approach,

Haralambides

et.al

(2002)

conducted

an

excellent

econometric analysis for the determination of the factors that affect second

hand prices. Once these factors are identified empirically, one has good

estimates about the sources of risk involved in pricing the uncertain payoffs.

Then by assuming that we are able to trade continuously in a portfolio that

spans the payoffs of the second hand ship (which is the case under

complete markets) we may use 'arbitrage' arguments to derive the value of

the second hand ship, contingent on the factors of risk. In Chapter 2 we derive

empirically these risk factors by running an econometric analysis on the prices

of the second hand values. In Chapter 3 and Chapter 4 we use the

assumption of continuous trading and elements of the Real Options literature

to derive closed form formulas for the prices of second hand vessels as a

function of the underlying risk factors. In Chapter 5 we abandon the

assumption of continuous trading and describe a dynamic model for the

shipping industry, using elements from Dynamic Optimization and extensions

of the Devanney (1971) model.

The introduction of continuous time methods and contingent claim

valuation methods in shipping is not new: Goncalves (1992) used future

5

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

contracts as an underlying instrument and Dixit and Pindyck (1994) derived

threshold ratios that trigger investment in the tanker industry. As we shall

observe from our empirical analysis in Chapter 2, the functional relationship

between second hand values is highly non-linear. This non-linearity provides

significant evidence for a hidden 'real option' value in the second hand market

asset play. The introduction of contingent claim methods and the justification

for these methods is the main idea in Chapters 3 and 4; the integrated

dynamic model is finally presented in Chapter 5.

By pricing second hand

vessels in terms of their replacement cost (the price of a new vessel) and their

market value (in terms of the expected revenue generated by the time charter

rates) and using the scrap value as a terminal condition we manage to

establish a link between the 'four shipping markets', or what economists

would identify as the market for services and the market for capital

replacement. From this point of view we hope this will provide an integrated

approach for comparative valuation of equilibrium prices in the second hand

market.

6

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

2. Empirical Analysis of Second Hand Prices

2.1 EBITDA/CAPEX as a leading indicator for depreciation

Our empirical analysis relies heavily on the previous work by Marcus

et. al. (1992) In this paper it was identified that efficient buy-low sell strategies

can be conducted using Time Charter Rates and prices of New Vessels as

sufficient statistics for prices of Second Hand Vessels. We shall conduct our

empirical analysis by identifying the relationship between second hand prices

of 5, 10 and 15 year old ships, the prevailing time charter rates and prices of

new vessels. Before proceeding with our analysis let us define two important

variables that will appear in our empirical analysis: EBITDA/CAPEX will

denote the ratio of the revenue earned by the one year time charter rate

minus operating expenses divided by the expenses incurred by investing in a

new vessel:

Formally we define:

EBITDACAPEX= (TC/ Day-OPEXI Da)* DaysEmplagdand

CAPEX

CAPEX stands for the capital expenses associated with investing in a new

vessel. Furthermore, depreciation or Depr will stand for:

Depr(t) =

CAPEX(t) - PriceSH(t)

,

CAPEX

where PriceSH(t) is the price of a

second hand vessel at time t.

In

the

heart

of

our

analysis

lies

the

observation

that

the

EBITDA/CAPEX ratio is a leading indicator of (real incurred) depreciation.

Behind this empirical observation underlies the following economic intuition:

EBITDA/CAPEX is a proxy to the Return on Equity or to the economic returns

that the cash-flow generating asset-ship yields; it is a 'measure' of its true

value, whereas

depreciation is a measure

(EBITDA/CAPEX)/Depreciation

of its replacement

cost.

is a proxy for the long-term return on the

investment compared to its replacement cost and it can be considered as a Qratio equivalent. According to Tobin's Q-Theory when the true value of an

7

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

asset exceeds its replacement cost, one should invest and the reverse.

According to the intuition in our model, an increase of the economic rent (or

EBITDA/CAPEX ratio) which corresponds to an increase in the true value and

the Q-ratio should result in an increased demand and investment activity;

thus, depreciation should decrease. Therefore, EBITDA/CAPEX should be

negatively correlated with depreciation, which would imply that an increase in

the expected cash flow would result in the appreciation of the ship price (or

lower levels of depreciation). For a more rigorous analysis of the relationship

between Q-Theory and Industrial Organisation see Ross (1981) and Tobin

(1969).

However,

a

negative correlation

between

EBITDA/CAPEX

and

Depreciation, which is in line with Economic Theory, would also imply some

other important relations: It implies that EBITDA adjusts more slowly than

replacement costs and depreciation. This is supportive to the evidence of

sticky prices in investment theory and provides us with partial explanations to

the fact that time charter rates adjust far more quickly than ship market prices

(replacement costs).

The

shipping

industry

possesses a

unique characteristic:

The

replacement cost of the underlying asset is tradable in a relatively liquid

market and the true value of the asset can be estimated fairly accurately given

the long-term time charters. Therefore, the Depreciation ratio provides us with

consistent estimates of the Q-ratio.

In our economy prices serve to equilibrate supply and demand and in

an equilibrium they reflect all information available. The Q-ratio is a measure

of how far the economy is from equilibrium and can be considered as a

measure of economic efficiency. However, economic efficiency does not

necessarily imply asset market efficiency, as pointed out in Waldman and

Dow (1997). This is the case in the Banking System and this will be the case

in the Shipping Industry. Although asset players can exploit profitable

strategies (old versus new, small versus large) similar to strategies of

investors in capital markets, and is therefore not market efficient it is

economically efficient. And this will be verified by proving the EBIDTA/CAPEX

/Depreciation relationship or Q-Theory equivalent.

8

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

Since this market is found to be market-inefficient, strategies that lead to

excess profits can be exploited. According to Investment Theory the Q-ratio or

EBITDA/CAPEX/Depreciation can be considered as a leading indicator for the

demand for the asset. If the second-hand market verifies this relationship, we

will be able to infer that it is economically efficient. Having verified this

coefficient we will have an industrial example in line with Waldman and Dow,

where market efficiency is not a necessity for economic-investment efficiency.

Being able to test the relationship between the order book and the Qratio would suggest a test for the economic efficiency of the Newbuilding

market, which is questioned by numerous studies.

Due to the above economic intuition we shall not follow the trivial

procedure in empirical analysis and regress second hand prices on prices of

new vessels and time charter rates directly, including age and ship type as

dummies in our model. Based on our previous discussion we shall use the

equivalent q-type formulation approach and test the empirical relation with

dimensionless parameters. Therefore, we shall regress Depreciation rates for

the age of 5, 10 and 15 years with EBITDA/CAPEX rates, including dummies

for ship type.

Imposing this additional structure, we are testing two

hypotheses. On the one hand we are testing for the effect of new building

prices and time charter rates on second hand prices and on the other hand

we are testing for a negative correlation between Depreciation ratios and

economic rents (measured with the EBITDA/CAPEX

proxy). A negative

relation will be a strong indicator of economic efficiency in this market.

Furthermore if our intuition is correct, we are gaining in statistical efficiency by

using economic information in our statistical tests.

2.1.1 Testing the Hypotheses

In order to test these hypotheses we conduct the following statistical

tests:

1) We run the incurred depreciation on the EBITDA/CAPEX ratio, including

dummies for the age of each ship. We perform this regression separately

for each type and then for a generalised data set including dummies for

category. In this way we see if there is a significant relationship between

9

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

EBITDA/CAPEX and Depreciation for each category separately and how

significance changes with category.

2) From Economic Theory a decrease in economic rents (or a decrease in

the ratio EBITDA/CAPEX) should result with an increase of depreciation.

Since the potential profits are less than expected, investors are willing to

sell this asset. In order to check our economic intuition we run the first

difference of the EBITDA/CAPEX ratio on depreciation and on the first

difference of depreciation.

In this way we can check for spurious

regression and fixed effects. If the supportive statistics remain high after

taking first differences, this makes our case even stronger. Finally, we run

EBITDA/CAPEX ratio on passed ratios and depreciation in order to verify

our hypothesis of the elastic behaviour of long term rates (EBITDA) to

market price fluctuations.

2.1.2 Hypothesis Testing

The

first hypothesis we

test

is the

causality

between

the

ratio and depreciation. We run a linear regression and

EBITDA/CAPEX

perform all the tests for heteroscedasticity and autocorrelation. We finally

check for the statistical significance of the beta's, that would imply a strong

causal relation.

a +

p

EBIDA

BD

CAPEX,

+IFt =A CA PEXt-

Hypothesis 1

The second hypotheses we check is the one that underlies our

economic intuition. Namely:

EBIDA

PA CAPEX,

9

+EK = a + ACAPEX,,,_,

Hypothesis2

and

Finally we check the EBITDA/CAPEX ratio for autocorrelation of

10

5th

order:

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

P

S1=

J15

AJ(EBIDA )+,

CAPEX

=a+ACAPEX

Hypothesis3

2.1.3 Results

The AFRAMAX Case

A) We performed our tests using the LimDep Econometric Analysis Package

of William Greene:

In order to test the first hypothesis we run OLS (Ordinary Least Squares) for

AFRAMAX on the model:

P

2

agel0 + f3agel 5 +

P

EBIDA / CAPEX

4

+

Depr = fage5 +

and we obtained the following results:

Ordinary Least Squares Regression - Weighting Variable = none

Dep.var.= DEPR

Mean=.4777638889E-01

S.D.=.1373611057E-01

Model size: Observations = 108

Parameters = 4

Deg.Fr.= 104

Residuals Sum of squares= .1602804337E-01

Std.Dev.= .01241

Fit R-squared= .206094

Adjusted R-equared .18319

Autocorrel: Durbin-Watson Statistic =

.21900

Rho

.89050

Coefficient

Standard Error

t-ratio

P[ITI>t]

Mean of X

.7283863620E-01

.54038009E-02

13.479

.0000

.33333333

AGE2

.7463808064E-01

.54038009E-02

13.812

.0000

.33333333

AGE3

.7299502509E-01

.54038009E-02

13.508

.0000

.33333333

-2486298001

48267514E-01

-5.151

.0000

10342361

Variable

AGE1

EC

The reported statistics are significant and a strong causal relationship

between EBITDA/CAPEX versus Depreciation cannot be challenged.

Even though R square is found to be low this doesn't imply anything about the

relationship we want to examine. The only statistic that leads us to accept

our reject causality is the t-statistic, which is highly above the critical

value of 1.96. We performed OLS using robust matrices to correct for

heteroscedasticity and the statistical significance remained high. An important

11

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

observation is that age is a significant factor in determining depreciation. The

most sensitive category is the 10-year-old ships and the less sensitive is the

five-year-old ships. This observation is counterintuitive indeed and shall be

furthered examined.

In order to perform an elementary test for autocorrelation and to check our

economic intuition we run OLS for the first differences of our data:

First Differences

Ordinary Least Squares Regression - Weighting Variable = none

Dep. Var. = DEPR

Mean= -.3403738318E-03

S.D.= .6364871838E-02

Model size: Observations = 107

Parameters = 4

Deg.Fr= 103

Residuals: Sum of squares= .3453686171E-02

Std.Dev.=.00579

Fit: R-squared= .195738,

Adjusted R-squared =.17231

Model test: F[3, 103] = 8.36

Prob value

Diagnostic: Log-L = 401.4247

Restricted (b=0) Log-L = 389.7708

LogAmemiyaPrCrt.= -10.266,

Akaike Info. Crt.= -7.428

Autocorrel: Durbin-Watson Statistic = 1.21498

Variable

Rho =

=

.00005

.39251

Coefficient

Standard Error

t-ratio

P[TI>t

Mean of X

AGE1

-. 1252421124E-02

.97909397E-03

-1.279

.2037

.32710280

AGE2

.3649028066E-03

.96509837E-03

.378

.7061

.33644860

AGE3

-.4593052670E-04

.96509837E-03

-.048

.9621

.33644860

-.1861053410

.38529597E-01

-4.830

.0000

.20429907E-03

EC

What we observe is that the strong relation between Depreciation and

EBITDA/CAPEX remains statistically significant and the t-statistic remains in

the same levels. Therefore, the regression cannot be considered as spurious.

What we observe is that although size is a factor when forecasting, it doesn't

really explain the percentage variations of the two factors. This implies that

incorporating age can yield a better explanation of Depreciation; however, it is

not a causal force to its variations. As we can observe, the Durbin-Watson

statistic is now inconclusive for autocorrelation; however, in the first panel it

indicated that autocorrelation might be present. Since the finite differences

indicate no autocorrelation, the presence of a common trend is strong.

We then regress the Depreciation change in the period t, t+2 with the change

in EBITDA/CAPEX that we observe at time t and we still derive high tstatistics, which implies that EBITDA/CAPEX

is indeed a leading

indicator and can be used to forecast incurred depreciation.

12

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

We now want to check how 'sticky' is the EBITDA/CAPEX ratio and we

therefore run OLS on its history:

What we documented is a very strong positive relationship between the

today's EBITDA/CAPEX ratio and the ratio six observations before. We

therefore run the Depreciation ratio with EBITDA/CAPEX and the history of

EBITDA/CAPEX to specify if the history can improve our forecast. We still

observe that the observation two years ago can improve our forecast for

depreciation. Whether this is due to seasonality or due to 'stickyness' is a fact

that has to be further examined. Before proceeding to checking these

hypotheses for other types, we run OLS with correction for autocorrelation on

the Data in the first Panel:

From the following results it is evident that the tested relationship survives

easily all the tests:

Ordinary Least Squares Regression - Weighting Variable = none

Dep. Var. = DEPR

Model size: Observations = 108

Residuals: Sum of squares=.1602804337E-01

Fit: R-squared=.206094

Model test: F[ 3, 104] = 9.00

Diagnostic: Log-L = 322.7942

LogAmemiyaPrCrt.= -8.741

Autocorrel: Durbin-Watson Statistic = .21900

Autocorrelation consistent covariance matrix for

Variable

AGE1

AGE2

AGE3

EC

Coefficient

.7283863620E-01

.7463808064E-01

.7299502509E-01

-.2486298001

Mean= .4777638889E-01

Parameters = 4

Std.Dev.= 01241

Adjusted R-squared = .18319

Prob value = .00002

Restricted(b=0) Log-L = 310.3315

Akaike Info. Crt.= -5.904

Rho = .89050

lags of6 periods

Standard Error

.94738787E-02

.91076161E-02

.79729283E-02

.77457980E-01

t-ratio

7.688

8.195

9.155

-3.210

S.D.=1373611057E-01

Deg.Fr.=104

P[ITI>t]

.0000

.0000

.0000

.0018

Mean of X

.33333333

.33333333

.33333333

.10342361

Challenging Tasks for further Analysis:

Provided that the above relations are verified for the other types of ship, we

can argue that the second hand market is economicly efficient (the Q-ratio is

an indicator of economic activity). In some sense the asset play market is

efficient too and therefore the imbalance in supply could be attributed to the

newbuilding market. A Dynamic Analysis with time series method could reveal

more information about the interaction between the Q-ratio and the industry

dynamics.

13

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

The VLCC Case

Following

the

same

steps we

now

run

the

Depreciation

on

the

EBITDA/CAPEX ratio for the VLCC, accounting for size:

Ordinary

least squares regression

Dep. var. = DEPR

Model size: Observations = 108

Residuals: Sum of squares= .3903941156E-

Weighting variable = none

Mean= .5963129630E-01

Parameters = 4

Std.Dev.= .01937

S.D.= .1362702442E-01

Deg.Fr.= 104

01

Fit: R-squared= -. 964796

Diagnostic: Log-L = 274.7216

LogAmemiyaPrCrt.= -7.851

Autocorrel: Durbin-Watson Statistic = .38163

Adjusted R-squared = -1.02147

Restricted (b=0) Log-L = 311.1926

Akaike Info. Crt.= -5.013

Rho = .80918

Results Corrected for heteroskedasticity

Breusch - Pagan chi-squared = 162.7924 with

Variable

AGE1

AGE2

AGE3

EC

3 degrees of freedom

Coefficient

Standard Error

t-ratio

P[ITI>t

Mean of X

.6997216916E-01

.6727099467E-01

.6678394635E-01

.80811075E-02

.72206230E-02

.46288619E-02

8.659

9.317

14.428

.0000

.0000

.0000

.33333333

.37037037

.33333333

-.1704179991

.57061315E-01

-2.987

.0035

.81344444E-01

The relationship remains statistically significant, however it is less sensitive

to EBITDA/CAPEX and more sensitive to age, especially for the 15 year

old ship. Possibly this puzzle could be explained if we took into account the

fact that old VLCC's were traded for a premium, due to the extra steel that

was placed in them before the introduction of more high-tensile steel and

thinner scantlings.

However we still have to adjust for autocorrelation and we include the passed

six lags:

Ordinary Least Squares Regression - Weighting Variable = none

Dep. var. = DEPR

Model size: Observations = 108

Residuals: Sum of squares= .3903941156E-01

Fit: R-squared= -. 964796

Diagnostic: Log-L = 274.7216

Mean= .5963129630E-01

Parameters = 4

Std.Dev.= .01937

Adjusted R-squared = -1.02147

Restricted (b=0) Log-L = 311.1926

LogAmemiyaPrCrt.= -7.851

Akaike Info. Crt.= -5.013

Autocorrel: Durbin-Watson Statistic = .38163

Rho = .80918

S.D.= .1362702442E-01

Deg.Fr.= 104

Autocorrelation consistent covariance matrix for lags of 6 periods

Variable

Coefficient

Standard Error

t-ratio

P[ITI>t

Mean of X

AGE1

.6997216916E-01

.14813474E-01

4.724

.0000

.33333333

AGE2

AGE3

.6727099467E-01

.6678394635E-01

.10572965E-01

.62887299E-02

6.363

10.620

.0000

.0000

.37037037

.33333333

EC

-.1704179991

.76954789E-01

-2.215

.0290

.81344444E-01

14

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

The relationship remains statistically strong having corrected for six period's

lags.

15

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

2.2 Specification of the Depreciation Curves

2.2.1 Testing for non-linearity

At this point there are two main assumptions on which our analysis relies:

We have assumed that there is no trend in our data and have treated them as

Panel Data using no time series techniques. It has been verified that beyond

the high correlation and the strong causality there is also a significant

underlying economic intuition. However, we have not tested for any timeseries effects or common trends. Finding a common trend could on the one

hand justify further the strong causality and on the other hand it could improve

our forecastability significant. If for example there is a common force that

drives this causality, then this could be exploited further and used as an

additional factor in our forecasting procedure. However, this is a task that

requires additional data and analysis and at the end of the day it can only

result in advanced forecasting techniques and by no means reverses the

results we have found until now.

A second important assumption is the one of linear conditional expectation.

When

regressing

Depreciation

on

the

EBIDTA/CAPEX

the

standard

underlying econometric assumption is namely the following one: The

conditional expectation (or the best prediction) of the Depreciation based on

the EC observation is namely a linear function of EC. We are now going to

test if this is a correct specification. At this point we have to bear in mind that

adding terms in a model always results in a higher fit. We shall therefore

examine if the incremental fit gained is worth the extra parameters.

We now test the relation between the observations of the Depreciation on the

stochastic regressors of age and EC. At this point the treat age as an input

and not as a dummy.

This has the following consequence: We shall determine joint coefficients for

age, EC and their functions for both VLCC and AFRAMAX- the only term that

will remain variable will be the constant. This will keep the number of variables

16

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

needed for prediction as low as possible and will allow our model to be easily

updated.

Specifying a complex functional form for a model is a significant drawback: On

the one hand the economic intuition and rationale becomes questionable

(which leads people to test the hypotheses) and on the other hand updating

the model requires an update in the functional form. Therefore, keeping the

number of dependent variables as low as possible is a true 'asset'.

VLCC and AFRAMAX joint results

We run OLS on the joint data for VLCC and AFRAMAX with age and EC and

the 'goodness of fit' or R2 turned out to be 42%. All the t-statistics remained

statistically significant, indeed.

At that point we decided to 'weighting' the EBITDA/CAPEX ratio with respect

to age. The intuition is that older ships will be more efficiently priced than

younger ships and less volatile to large market movements. Furthermore,

based on the Q-renewal theory the replacement cost of an old asset should

be much closer to its true value, since much less uncertainty is associated to

his future.

The result from this cross-product term, turned out to be beyond expectations.

The t-statistic of this cross term is close to 15 (indicates cointegration) and

the R2 has reached 58%. We now include the square of the age and the EC

ratio as independent terms and we present our results. At this point we have

to bear in mind that adding the data from the other sectors and including other

types of ships can only increase the forecasting power of our model.

17

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

Joint AFRAMAX and VLCC Results - Specification

Ordinary least squares regression - Weighting variable = none

S.D.=.148867641 1E-01

Deg.Fr.= 209

Mean=.5370384259E-01

Parameters = 7

Std.Dev.= .00889

Adjusted R-squared =.64328

Prob value =.00000

Restricted(b=0) Log-L =602.7835

Akaike Info. Crt.= -6.576

Rho =.84712

Dep. var. = DEPR

Model size: Observations = 216

Residuals: Sum of squares=.1652254741E-01

Fit: IR-squared= .69323

Model test: F[6, 209] = 65.62

Diagnostic: Log-L = 717.1665

LogAmemiyaPrCrt.= -9.413,

Autocorrel: Durbin-Watson Statistic =.30577

Variable

Coefficient

Standard Error

t-ratio

P[ITI>t

Mean of X

AGE

VLCC

AFRA

EC

EA

AA

EE

-.2319671183E-02

.1253398320

.1202226475

-.8855295396

.4478081079E-01

-.1171356135E-03

.8564916386

.11188717E-02

.74237274E-02

.77673709E-02

.10003614

.45390247E-02

.51333956E-04

.42653632

-2.073

16.884

15.478

-8.852

9.866

-2.282

2.008

.0394

.0000

.0000

.0000

.0000

.0235

.0459

10.000000

.50000000

.50000000

.92384028E-01

.92384773

116.66667

.96011111E-02

Predicted Values

(* => observation was not in estimating sample.)

Predicted Y

Observation Observed Y

.53132E-01

.82130E-01

1

.50228E-01

2

.81280E-01

.47253E-01

3

.80500E-01

.45531E-01

.78410E-01

4

.43548E-01

.68360E-01

5

.43135E-01

.61330E-01

6

.41381E-01

7

.58610E-01

.38479E-01

8

.56290E-01

.60432E-01

9

.59060E-01

.56894E-01

10

.62980E-01

.56732E-01

.63980E-01

11

.55916E-01

.56930E-01

12

.54892E-01

.43510E-01

13

.53923E-01

.35080E-01

14

.53526E-01

.35080E-01

15

.51201E-01

.30980E-01

16

.47843E-01

17

.22780E-01

.47670E-01

.25000E-01

18

.45208E-01

19

.24830E-01

.45830E-01

20

.26970E-01

.42796E-01

.20400E-01

21

.44441E-01

.23900E-01

22

.47615E-01

.45870E-01

23

.52875E-01

24

.64060E-01

.52436E-01

25

.68740E-01

.60538E-01

.66810E-01

26

.66143E-01

27

.66810E-01

.67725E-01

28

.59920E-01

.54457E-01

29

.52940E-01

.41362E-01

.43670E-01

30

.32845E-01

31

.31720E-01

.19435E-01

.16220E-01

32

.15735E-01

33

.13720E-01

.22403E-01

34

.16040E-01

.34628E-01

35

.17610E-01

.42192E-01

36

.33960E-01

.52883E-01

37

.69680E-01

.51268E-01

38

.68620E-01

.49648E-01

39

.66460E-01

.48722E-01

.63310E-01

40

.47669E-01

.59410E-01

41

.47451E-01

.55670E-01

42

.46534E-01

.54800E-01

43

.45041E-01

.52480E-01

44

.57037E-01

.51130E-01

45

.55003E-01

46

.50580E-01

.54911E-01

.50640E-01

47

.54447E-01

48

.49700E-01

18

Residual

.0290

.0311

.0332

.0329

.0248

.0182

.0172

.0178

-. 0014

.0061

.0072

.0010

-.

-.

-.

-.

-.

-.

-.

-.

-.

-.

-.

0114

0188

0184

0202

0251

0227

0204

0189

0224

0205

0017

.0112

.0163

.0063

.0007

-.

0078

-. 0015

.0023

-. 0011

-.

-.

-.

-.

-.

0032

0020

0064

0170

0082

.0168

.0174

.0168

.0146

.0117

.0082

.0083

.0074

-.

-.

-.

0059

0044

0043

-. 0047

95% Forecast Interval

.0708

.0354

.0679

.0325

.0296

.0650

.0278

.0632

.0613

.0258

.0609

.0254

.0237

.0591

.0207

.0562

.0782

.0427

.0392

.0746

.0744

.0390

.0736

.0382

.0726

.0372

.0716

.0362

.0712

.0358

.0689

.0335

.0655

.0301

.0654

.0300

.0629

.0275

.0635

.0281

.0605

.0251

.0622

.0267

.0653

.0299

.0706

.0352

.0347

.0428

.0483

.0499

.0368

.0236

.0701

.0150

.0010

-. 0030

.0507

.0042

.0168

.0245

.0352

.0336

.0320

.0310

.0300

.0298

.0288

.0273

.0393

.0373

.0372

.0367

.0783

.0839

.0856

.0722

.0591

.0378

.0345

.0406

.0524

.0599

.0706

.0690

.0673

.0664

.0654

.0651

.0642

.0627

.0748

.0727

.0726

.0722

CA

v/

(U

S0

H H 0

W0 V

LA

MM M

w.

(N

'

W'W

O

en

10

0 L M N M H H

Mn (N

0 e N V M r

LA L N 0 C V

(n H V 0 V

LA 0 1

'0 '0 '0 '0 '0'0 N N N N N '0 '0 LA LA LA'

(N

In N rN

-n

LA

w o N LA o m cN H

h

M

OD 0) OD

-iHHHr

00 C0 000C 000000000000

e

l

l1i

(N

M)

WO

W

L M L

0 r W a) N (3 L (N r -) O %D r 0N ) W V W v m m Lo wN v Lm Lo '0 m A '0

M M M en ene LA LA 14,

e en en v en C (M) M CV

Me)

M M -W

V Ln

0

'0

00 'OCOC

GC '0'0'0

''0

'

'00

0'

'0'

'0'

'0 '0'

KO '00'' 00''' 00 000000

'0 '0 '0 '0 '0

LA

W V

i

I

I

LA O

i

I

I

LA

I

3)

I

q,

aO

0

h

N

a N

H LA N

LA

a)

LO

N

M MN

h

li

I

I

W W 0) H 0 a) (N N N) M

en W0 LA M 0 H

lI

-

1

1

11

N

w m

w

a

00

w

m r-i

o

a) a) '0

H

H

e n en N

m LA 0 en ONew en v N- H H- H

r-

\v0

)a

( V

)

a)

e H 0 en

o

'

LA

en

(

N

CD'%

NNNN

LA

1

000

w

M (N N

0

0 0N

LA

e (N

LA 0 LA H OD W

000 H

w LA a N-

Lr- nw

1 1

o

00000000 H

a (N N

u

H h%

LA

L

v c(N a) c(N LA LA v 0 a) Hi LA n M

a) a) ODMN en a)

o0)Ni LA (N (N IN LA N- a) (N 00 N- a) a) 00 en a) 0

r,~~HaNLaaN)0)ANna''LN0L~nNH0o)LLL~ee(aoN0a

OV OD

V VCn

en N a) H H v (N LA v'w M'w H en 0 LA 0 LA LA en LA w0 H- aO )

Lnw r-m m H NM -4 m wtl- m 0H N v mw r-w m HNM * m Hr-HwmH0H NH .H40HwH- H H HINHMVHMH rH H HH HNMHVH WHr H0H) H HNHv)HV H) H r H O H0H0 H H H H

%d-

a) w

v

en

0 o) m -o I N v00o LA w m cen v H In LA 0 0 N r- -w N

00 0HH HH LA - en0 HW V VM eCOH (NW V LA -4 M' n 0 ( HW -

1

M 0 M V 00 LA m cN a)0w H - M (N M N a) O H M O 0'0 W 0 m

hI

0L LA V (N M N H 0 H H H HN

LA

I

0000000000000000000000

Oa w r N cN w o

H 0 N 0) a) C OD N

u

N

H H H H H H H H 0000000000000000000000000000000

(N (N

0n H LA H 0 %D OD H (N

-

'

a) a) en M

oo~~~~~~~~~~~~

mO

a c:)H INM -tl

m

(v e, n LA 00o H 0 (N4 (N H 0 co (N LA 0h H- LA LA v Ch ND C 04 (N

r- N - N N 0 00 en en H N- N- H

H en) (N 0) CN' W - H 0 oo v''w

LA m00 LA Hi v LA v en H 0D ) LA enN (N H 00o LA LA) v en (N4 H- o LA LAn m

00 OD CO

OD D CD D a) 0 ) 0 H H M CD 00 aD 0) OD N aD 00 N LA W N N OD V e a N LA H 0 N en 0 N e (N V LA W

en H

LA v (N (N 0 H 0 0 N L v a) N m LA co v 0OD W) LA 0 N O O O0 0 0 O 0 00 0

LA

en en e e e e en M

M n (N (N H H H (N (N (N (N (N (N (N (N (N (N M N N N N (N N (N (N N (N N (N N (N (N (N (N en M M N (N N N (N N (N (N W k ' W W VD L LA LA LA M M M M M M e W e

M M M en

oo

-

-

0 0

o

r-

H H a) 0

N

0 0

-

N r-1

(N

H 0

-

a 0'

0000

0

(N

LA M) N OD I

N 0 o

N

r

0 LA (w0m)m)ILA H LAS)

rHH Hlr H H- H- Hl H H H H H H H H H H H H H H HH H H H H H H H H H H H H H H H H H H H H H H H H H H H HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

C0 C0 00

C00

00000

0 0C00CC0

00

000

0 0 0000

00C0 0 000

0000000000

0000000000000000000000000C

~wI24-oM

CA

+

Cn

r/

Ln C

f

r

'

LA

V0

" q.

L

N 0 H LA o . (N

N,

0

(N

N

N N- 0

LA LA

LA LA LA N

I

r-

H

LH

LH

H

0 ' '

LA W.

H

H

i i

HN

H

LNLNNLNLN

r

LN

(N N4 -o m

Le

.0

Ho o oo

N

H

o

H H0 0

I I

0 0 0

0

H

.0

e

N N

LA

M

1w

0 H 0

"

LA

H

N

M

H en H e

L H0LA

m

In

N

LA

N

0 LA 00

N0 N- ( N

0en

II

0 0'

0 N

LA

0H

0

M 0) LA 0 N

0)

0 0

M

e

M

N

M

LA

00

N

H

o

H

N

-

M M M M ' LA

en ee M m M (In

M M

M M

0 H N (N 0

000000000O

III IIII II

H e H (N0

LA N LA

N H

en en en en en

(N N

0 (N0 H M H 0) D N

OH 0 0

0 o 0

00000%\66000@00

0m

'0 N

LA W W

M M

LA

0 0)0 H

%0\0

M

0

l il

0 0 0 00 0

LA LA

0

I

en M

N

00000 000

1 0

N H

0' H LA

H

0

HH

000 N ) ')

eM M M

[ li i i i l ti ii

0 0 0 0 0

0 0 LA

H0 0 H H H 00 0 0 LA Nen H (N

00 LA

0\ '0 00 H M H H

N v N (N M N M N 000

00

WN (N en ' en e en M

II

0 00 N N

0 N H N H '

0L0 000 0 00 0 0 0 0 0H 0 0 000

M M M M M M M VN

0MOM

'.

0

0 LA

0 0W

0 '. LA

e en e n

0

e H H N

I

H

LH

H H H H

a) m r%D

kD

Ho

LH

HH

H H H H H HO HO H0 HH H H H H

H H H H

H H H H H

0

HH

V M

H

0M

H H

L

N N N N m N N to o wO m ro L L L L Lf) L Ln L L L L

0440

H HH HHHH

N

r- w H m w r- r- r- w Ln wO wO wO w w m m v m m N N N o ct o m

LI Ln wO w Ln Lf l L L Lf) L u)v Ln Lf) Ln u)1 L In u)

LD Ln

N (N

H H

Lo L

e NN

mm

L

m

LA

M

I)

ene M

M

n

M mm

m M mn M M M M

M

M

M

en M

0 v e HN

u Ln q Ln Lir Ln Lf) Ln Ln u L

'

m N -LOo4" N04MM"r-UMin

oM v N M0N0

-)r,)N q.

m r-000000000000000000O

0

0m

Ch

%v C40-W L0M r)wvM N H

rI - Ln Ln 0 M40 w N wO Ln M W0 N M H 0 0 Lr) W M N H H M Ch r- WO -0 w N M MH 0 N

Ln r- H 0) 0

41o r Ln r- o N w0 w0 c c4 M M 4V 0) I) r- 0) 0 r- N 0 0) W0 r- LO H M C N Lf) H -I C1 M V V IN "N -; 0 M N M

H

LH

m-rH a%

D

A L0 L LA

LA LALA

0 0 to .NO A'.0L

H ( ALA

N LH {L' ALALALACLALALALALALALALALALAL\

( e en r

N LA 00 "n ALALALALA

0

(N

ONL NL L LN LAmL mL

0 0 L(N

H H HO H H H H H HH

00 r-

LNLALLALLALALALALALALALAW

m ma v N N H H m r- wO oo

wO r- \-r

-r -r -r

w o

m

000000000000000000000000000000000000000000000000000000000000000

i i i i i i i

H H

N

LA LA LA LA LA LA LA LA LA LA ' -

Me

LA

N LA 00 0 N 0 e N

W0

M. 0 0 00 0 -

L H M LA H LA M v H N N 0 N 0 N N H M M LA M 0 - 0 0

LA (N M MW 0 LA L 03 LA N 0 HH (N 0) N

0 (N 06 m me H H H N (N (N 00 o0 LA m N 0 0 N LA H H N N M M N H

H O M 0 N LA

L m

LA

L LA

vm N

000000000000000000000000000000000 00000000000000000000000000tD\O

H

N V

H (N

'

M t N N 0r m M Mn 00

0N

LA LA

H00

H

en H N LA N C H CC0 0 N N 0 LA C) C 0 0e 0

0 LA 0 H N

0000 H H0

H N e n en

O

0000000

H

00 NO 00

H Ln H m N vN mmmH

Y M Nj M m

Ln v

,-

H000000000000000000000000000000000000000000000000000000000000000

N M0m ,m m H w w Nr

w -m mw

m M w0 Hm mM

mm

r- q4 qq M 0 m H N N M MN N m m03 HN wO r- m% r- w

-N t) M rr- M N " O H O N -0LO N r- W r M11 0) OD1 H v

tnm

HH

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

We have included the following variables:

-

Age

-

Type

-

EBIDTA/CAPEX

-

The product of EC with Age

-

Age 2

-

EC 2

And this 'simple' second order quadratic conditional expectation yields an

R2=69%, with all coefficients statistically significant at 95%. We have

now a powerful prediction benchmark in our hands, which can easily be

extended to all types of ships. This still remains a static model and large

improvements can be expected when we account for Time Series

Analysis and Dynamic Effects.

Finally, since our economic intuition is that EBITDA/CAPEX is a leading

indicator for Depreciation and our practical target is to be able to make

inference about future Depreciation based on today's EBITDA/CAPEX we run

OLS of the observation at time t on the result at time t+1.

We obtain statistically supportive results; however, the problem with leading

indicators (as addressed by Hendry) is whether the elasticity remains constant

over time. This issue could be addressed in a dynamic analysis and we could

test the model for structural changes over time.

21

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

2.3 Out of Sample Testing and Benchmark Testing

In this section we perform an out of the sample testing of our above

specification and compare our depreciation curves to other forms of

depreciation curves, such as the Lin Cai Depreciation curves (LC hereafter)

and compare the results.

The LC model outperforms our model for the first 25% of our

observations. This is obvious since it was designed on a fitting-sorting

algorithm. However, as time goes by the forecast error becomes huge relative

to our simple 5-factor model. The Forecast error is actually ten times higher

than our variance, whereas our forecast accuracy is 90% for the last 30% of

the observations with minimal error. For the last observations that are

relatively explosive (due to the bullish shipping market) the LC error formula

explodes.

From the diagram that compares the two errors the supremacy of the

specification in 2.1.2 is obvious.

Note: The Lin -Cai formula we used in our analysis for the depreciation

curves is the following:

=1F((C$28*($R$95*C$118*25/$G$16*C$118*25/$G$16+$R$97*C$118*25/$G

$16)+$R$96*C$118*25/$G$16*C$118*25/$G$16+$R$98*C$118*25/$G$16+$

R$99)*$V$95+ C$118*25/$G$16*$V$96+$V$97>0,

C$28*($R$95*C$118*25/$G$16*C$118*25/$G$16+$R$97*C$118*25/$G$16)

+$R$96*C$118*25/$G$16*C$118*25/$G$16+$R$98*C$118*25/$G$16+$R$9

9,

C$28*($T$95*(C$i I8*25I$G$1 6-25)*(C$11I8*25I$G$1 625)+$T$97*(C$118*25/$G$16

25))+$T$96*(C$118*25/$G$16-

25)*(C$118*25/$G$16 25)+$T$98*(C$118*25/$G$16-25)+$T$99)

The first part of the formula is a sorting condition that decides the fit:

The second part can be simplified if we assume a Life of 25 years for our ship:

Then it simply collapses to the following:

C28*(R95+R97*C 18)+R96+R98*C118+R99 or equivalently:

22

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

(D(EBITDA/CAPEX (a + 0 * age) + y +

*age)

+

DeprLnKai=

Where the Greek Letters correspond to the estimated residual parameters

s2,s21,sl,sl 1,sQ and are adapted based on the sorting condition. The sorting

condition results in different formulas for each observation set and requires

many parameters. It gives a very good fit when passed data occur and is

strongly outperformed by our formula. Another reason that leads to its

outperformance is the omission of the non-linear terms and the model

misspecification.

2.3.1 Residual Diagram

The Lin Cai formula outperforms the MITSIM05 model only on the first

25% of the observations.

AFRAMAXVLCC Observations

o 14

0.12

0.1

0 0.08

0 D8

'I.

CL

a)

0.04

0.02

0

-0.02

Observations

23

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

VLCC

2

y = 0.8565x -

0.12

0.2137x + 0.0642

0.1

0.08+ MIT-5

0 MIT-10

.0

0.06

4

."..~.4-4MIT-15

----

-(

0.04-

0.02

0

0.02

0.04

0.06

0.08

0.12

0.1

0.14

0.16

EBITDA-CAPEX

Fitted Curves for VLCC vessels with age 5, 10 and 15 years

24

0.18

0.2

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

2.3.2 Structural Analysis of our Empirical Findings

In our previous analysis we concluded that the following factors appear

to determine the prices of second hand vessels:

1. A constant that differs for each industry (Random Effect)

2. A beta factor for Age.

3. A beta factor for EBITDA/CAPEX.

4. A beta factor for the AGEA2 and EBITDA/CAPEXA2

5. A beta factor for weighted EBITDA/CAPEX*Age

Thus our intuition about the parameters has turned out to be correct. There is

however significant evidence that there are important non-linearities in these

relationships. In the Paragraphs 3 and 4 we shall construct some dynamic

models that will justify these non-linearities.

25

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

Appendix

Joint Formula for the AFRAMAX-VLCC SUEZMAX

Following our previous analysis we derive the formulas for the joint

AFRAMAX-VLCC and SUEZMAX and we compare the coefficients derived

with the AFRA-VLCC coefficients derived on page 20. We stack our data in

Panel Data form and use a total of 323 observations. Running LIMDEP and

correcting for multicollinearity we obtain the following results:

Ordinary Least Squares Regression - Weighting Variable = none

Dep. var. = DEPR

Model size: Observations = 323

Residuals: Sum of squares= .2237366571E-01

Fit: R-squared= .721246

Model test: F[ 7, 315] = 116.43

Diagnostic: Log-L = 1088.4528

LogAmemiyaPrCrt.= -9.528

Autocorrel: Durbin-Watson Statistic = .35024

Variable

AGE

SUEZ

VLCC

AFRA

EC

EA

AA

S.D.= .1578811278E-01

Deg.Fr.= 315

Std.Dev.= .00843

Adjusted R-squared = .71505

Prob value =.00000

Restricted (b=0) Log-L = 882.1485

Akaike Info. Crt.= -6.690

Rho = .82488

coefficient

Standard Error

t-ratio

P[ITI>t]

Mean of X

-.3431757693E-02

.1366533138

.1405608564

-1.086932388

.4536886420E-01

1.579992417

.85803367E-03

.55342457E-02

.54618293E-02

.57097227E-02

.66560000E-01

.32199621E-02

.25874240

-4.000

24.692

25.735

24.045

-16.330

14.090

6.106

.0001

.0000

.0000

.0000

.0000

.0000

.0000

9.9845201

.33126935

.33436533

.33436533

.93676594E-01

.93524467

.10048235E-01

-. 6489909736E-04

.39760161E-04

-1.632

.1036

116.33127

.1372882790

EE

Mean= .5284492260E-01

Parameters = 8

We now compare the 2-industry case coefficients with the3- industry case:

Coefficients

2by2

-0.0023

3by3

-0.00343

Suez

VLCC

AFRA

E/C

0.1253

0.1202

-0.8855

0.1366

0.1405

0.1372

-1.0869

AGE*E/C

0.04478

0.04536

Age

ECA2

AGEA2

0.856

1.5799

-0.0002

-0.00006

The industry constants that display the higher statistics do not change

significantly and neither does the EBITDA/CAPEX coefficient that becomes

even higher implying that SUEZMAX is the most sensitive industry to E/C

variations. Dynamic Effects of age become less important (age is not a non-

26

Massachusetts Institute of Technology

The Four Shipping Markets: An Integrated Approach

squared becomes even higher

linear effect); however, EBITDA/CAPEX

implying that SUEZMAX is very sensitive to its changes especially in a good

market.

(The coefficient of the squared term is the coefficient of the Taylor expansion

and the second derivative- a positive second derivative implies that the E/C

coefficient rises in a booming market and is less sensitive to a bad market.)

This is in line with the empirical observation that in a bad market ships cannot

depreciate more than their 'natural' depreciation rate; therefore, depreciation

becomes independent of E/C at rock-bottom prices. The positive coefficient of

the squared E/C term is in line with Maritime Economic Theory and empirical

observations.

Tanker Industry Prediction Model

Predicted Values

(* => observation was not in estimating sample.)

Observation

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

Observed Y

.82130E-01

.81280E-01

.80500E-01

.78410E-01

.68360E-01

.61330E-01

.58610E-01

.56290E-01

.59060E-01

.62980E-01

.63980E-01

.56930E-01

.43510E-01

.35080E-01

.35080E-01

.30980E-01

.22780E-01

.25000E-01

.24830E-01

.26970E-01

.20400E-01

.23900E-01

.45870E-01

.64060E-01

.68740E-01

.66810E-01

.66810E-01

.59920E-01

.52940E-01

.43670E-01

.31720E-01

.16220E-01

.13720E-01

.16040E-01

.17610E-01

.33960E-01

.69680E-01

.68620E-01

.66460E-01

.63310E-01

.59410E-01

.55670E-01

.54800E-01

.52480E-01

.51130E-01

.50580E-01

.50640E-01

.49700E-01

Residual

.0282

.0306

.0331

.0329

.0251

.0185

.0176

Predicted Y

.53951E-01

.50671E-01

.47363E-01

.45470E-01

.43307E-01

.42859E-01

.40970E-01

.37883E-01

.62353E-01

.0184

-. 0033

.0047

.58248E-01

.58061E-01

.0059

-.

-.

.57127E-01

.55954E-01

.54848E-01

-.

.54393E-01

.51762E-01

-.

.48017E-01

-.

.47825E-01

.45114E-01

.45792E-01

.42492E-01

.44276E-01

.47764E-01

.53655E-01

.53159E-01

-.

-.

-.

-.

-.

-.

-.

0002

0124

0198

0193

0208

0252

0228

0203

0188

0221

0204

0019

.0104

.0156

.0043

0023

-. 0110

-. 0025

.62478E-01

.69082E-01

.70966E-01

.55453E-01

.40951E-01

.32057E-01

.19240E-01

.16039E-01

-.

.0027

-.

0003

-. 0030

0023

.21931E-01

-.

-.

.33876E-01

-. 0163

.41842E-01

-.

.52323E-01

.50349E-01

.48414E-01

.47327E-01

0059

0079

.0174

.0183

.0180

.0160

.0133

.0098

.46107E-01

.45856E-01

.44815E-01

.43156E-01

.57539E-01

.54957E-01

.54841E-01

.54264E-01

.0100

-.

-.

-.

-.

27

.0093

0064

0044

0042

0046

95% Forecast

.0370

.0337

.0304

.0285

.0264

.0259

.0240

.0209

.0454

.0413

.0411

.0402

.0390

.0379

.0375

.0348

.0311

.0309

.0282

.0288

.0255

.0273

.0308

.0367

.0362

.0455

.0521

.0540

.0385

.0240

.0150

.0020

-.0013

.0048

.0169

.0249

.0356

.0336

.0317

.0306

.0294

.0291

.0281

.0264

.0408

.0382

.0381

.0375

Interval

.0709

.0676

.0643

.0624

.0603

.0598

.0579

.0549

.0793

.0752

.0750

.0741

.0729

.0718

.0713

.0687

.0650

.0648.0621

.0627

.0594

.0612

.0647

.0706

.0701

.0794

.0860

.0879

.0724

.0579

.0491

.0364

.0334

.0391

.0509

.0588

.0691

.0671

.0652

.0641

.0628

.0626

.0616

.0599

.0743

.0717

.0716

.0710

(LHLLLLHHHH(LHLmLH

2

CA

m

0O

Lb

0

H

0

o

omr HONN

0

V

0b

o~o

o

e

oo

d

e

m

d

oo

w

Ho

d

o

w

ooo

mm

W

o

o

oooooor~wowo

~

m

o

d

o

0000

H

o

H

OO

m

dm

m

mr oriooon Wv~D

~

0

. . .

0

.

I

N

0

0

0

1111111

v

0

0

H

b0HL

bL

Lbb

Lbb00

bNH0Nm0L

ONW M

MV

H H m H H

NHm~L

H

0) - V

H

*

0

C

0

*

O OO

*** ***

OO

CN W

O

* **

O

"*

0

-0

0

LA m 0

0 0

H

H

H

0

0

o

wb vj 0

m o m

r- v H

H

c; r- n

H

**

H

OOnO

* *'

O

H H H

H

V C) U) H H -0 W Wr- r- n

OO

H

H H H H H H- HD H) H H HN H H n H H( - H D H AH

H- H H H H ((MN

H H H H H H H H H H H H H H H H H H H H H H H H H H H H H H H H

oOnvLwO)CoocrOoo oOWv

o

o

H

H -

(N

OD 0

H

M

H

M 0

H

H

H

LA (N (N

LAu LA LA 4 mv 0) H- 00

I Id

.

m H m L N N 0

A~(

o

bLbNLbbLAbLb

0LH

wb v LA Lb N r- (Ni H

H

m

Lb 0 o

i

L N 0

000 c)

..

0

I

0

H

0

00..00

0

0

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

I

I

111111

( N Lb H Lb N

(N 0 LA m (N4 0 H

N0H(

uA m Hi (N Lnvwo

L

-wNdommrHvm

AL

LAANH

OD OD V (N4 H

AHL

0

NN N N N m m m H L m L N m 00 oN L N 00 N Lb

H H (N (Ni m LA LA ml 0 H (N (N LAO H 0- (N Lb4 w

.

w~

o Lo

o

m

m

o

m

e

m

m

m

m

m

w

H H

LLMMmmMMb

H H, H H H H H H H

H HH HH H(N O(N((N ((N(NN(Nmmmm

OH

0

... ..T . ... .... ... ... ... ... .... .... ... ... ... ...0

0

00

0 0 Lb Lb) Lb Lb Lb Lb (N H H Hi H H 0 0 Lb Lb Lb Lb Lb Lb Lb 00 (N

HeM WMMNHMNHHWWMN rloo

a)

00o0

LbL o LA b N Lb b Lb 0 H LA b Lb m m H Lb (N H H Lb Lb m (N N 0 0 b N NN...owmemo

(N LA 0 H b (N HN

HLbHbmLb(HH

Lb OD V Lb L) 0 H Lb H 0 (N rN (N W M 04 CN (N (N (N H Wb LA LA v v v m 0m m (j (N CN (N ml IW M -0

0

O

H H H 0 N N Nr- 0 Lb Lb H 0 oN b mLb w4 L H 0 Lb

N H- Lb w L v v

0 LA N 0 m , 0 H1 0 mn (N H LA H Lb Lb Lb N- Lb Lb Lb LA 0 H H 0 0 (N (N

00

0

0

0

0

0

0

0

0

0

0

0

00

0

0

0

0.0.0.0.0.

.0.0.0. .0..

. .0. .0..

.0..

. . . . . . . . . . . . . . . .

I

0 0

o. b N < < mLb omw

Lb m

mI' r0.1MoNqlLI) ( %V (N M LA)

o

LA q, (N4 Hi 00 Lb L H) LA LA 0 LA Lb Lb Lb m Lb N,

m N LA

Lb Mb r-

0

Lb Lb

....

(N

m H m 0 N o m L H Ln

N, 00

Lb 0 Lb% Lb 0) N)

0H0

0

. ....

0

o

oWODOooo

u

....................................................

m

IO

e

o

O

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . **

oo)

mo

ob~~b

o

mN

~ o e m ~ o

e

~o oo N me mo mm md oo

S0

A b b b A H L L L L

ocNHbbNLnbbMbM

bL(m0MMMLM

H H H H H H bAM

H- H m(NH00LNM

H H H H H

~ ~~LALALALAH LoLA

H H H, Hy HI Hn H -000

C

ALALALAb

LbbNoN

obbN obo

NN NN Nb oob ooooooooobO~b~bb~bb OOOObObb

o< | 1 i

~ C/)MMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMMM

..

I g I I I) I I I I I g ILg I IIIa) a)

i i wNwii

I

~

~

u

O

to U,

UI

Ul

N) CD w -]

WMMmA

W 0D

M

MAnA

-.

,

PFW4

II4g

Jk.~~~W"

I

II

I

Ot)

gb.I

n~~u

P

n-

i&

JJl

~~-L

1C

~~~~~~~

CIaII

0C10

.CC~C~C01 CC1.1.1..1 C1CC11.1.

O

Ul

M 00 0 %.D 0) 4

Ul

%D OD H 0D H N) U, w.

00N-.HOOOOOOOOooOOOOOOOOOOOOOOOOOOOOOOOOOoOOOOOOOOOoooOOOOOOOOOoOOOOOOOOoOOOOOOO

H ti r 0) 0)

Ul,

HH HHH N

H 00 0)0 0 OoO 00 U , C D C D C DC D C D C D C D CDo~JOJo

O

t

-

CN

m

N) NJ

M

wW

P H

oOi

H 0

lnonW

" W 0 U) N)W

OD

O

M

W

"

H

UJ

.

.

nL

U,

C)

)

0

0

0 0 0

W

n

0

C 0CDa

0

)0

-.-

w

)MU

0

%,

0

OD

OD1

4

0

0

~

W

3

0 0 0. 0 00l " lIe

U,(3- 0 m . ch

m D - a% a%

0)

imWk

n 4-3-3MmU

j 4t tm

3U9 lN)P- D-3. C)t) 0jW

jwL

. jU0 NWWU

DW003

, .-L)-JF DLl44PP0L

W-JwPk

n-lP )"MWnN

tJ kD 0

00 )

$

0 0 0 0 0

550 0 5

Pl P 0 0 0 P W - W W 0 P P l 0 P 0 0 0 0 0

-3-]

nO

w~~

PtxWN

0

m0 0)

0 0 0 0 0 05 0 0 0

4 -. . W W W P HU0 W l

nW0WO

a

N WKb 0 t, t, p

HoU, k.30

O

j5

0-b

tQ U)

. -

0 0 0 0 0 0 0 05 U Ul 0 0l 0 0 0

W & WN & 64 W W kt 14 0 M 0 M W

CD U,-

j-

-

.OO

O

0 D 0 0D CD

nL~

W0

D M

-

0

0

0 D;

M

P

) D

-. 3 W P -

)

M M

U, -3

oooP

$

:

oD

L

olPa

W

7

W

CD

**

m ) 0D U,

ayooMmoMmMe

W Ch - U Un -3 ]

U,

J

0

H

W

M M

Ul

W

W

Ul n t)

CD 0 OD OD OCD

0 Lp Li

o --

-4 N) Un

CD

P o

P

-.

p. IN w

oe 4UlA WW

H3 -

W

WN M W 3

CDN

W

CD CD1 U, U, U, U, -

J 0) ko 0) P K) P

U, 3

P

000000000000000000oe

43 Ln W N) P 0 0 0 P PJ W 0

DU

00000

)-3DC

00 00 00 4l -3 0 Ln 1, L

(nU

M

"

W UJ kP -, -i cr o D oD P M C: N) p P a) P N) o j 4 t0\ uj P c1 o u OOM m Ul Ul -j Ln

.4

J J J :, :.

kL

0 0

:,

P o o wL.o Lr-. - m4 4oFtp w& a)

00

oD o

MOD,

W 4

D

-N W n 0 OD OD Ln 0

D

H

U, CD 5

-- j

ML

)4w

n, wwp

%- o"F,--womt .i )wL

LjwwmwwP

W

CD 0 .

JJ~DU

D

O M OD P U) L P 0 00 0 0 O 03 P ) U P -1 %. k. t. k. k. 0 0 P Eluj 4 l (n m OI' 0 0 C 0 W 0 P P O 14 - CD -J P O K) W -, b W P

4 " . N) t, P -j U0 M 01 Ch 00 j w 0 o n -. W DL.-0t)-3W W 0 t, 0 y

, W CD -J t, OD a% o) a

P W - H LA N) NW -,

000

:4 I

o -4 0

W

NWVH)WrvHO

Im

O

)v03r N1Nn-ri%

-narNC0r0M

r 1--H

0

o

+

c

)~

r

CA

~o

nenenen

Een

M

LA

HC")N

NH

N

Nv

LC

00 00000000OOOO OO O OC OCO

0

H

r-

v N-

v w

e H A LA LA a) I ) H LA o co

N e H L c") v H

0 a

N v

om" 0 ,

N LA L C 0 L

L

enN L L

e en en en en e .1) v

'N NNn M M M M MMN H H H H

) eN

oC'

O Co C 0 00 00

LA LALAnLA

LH

enenT

LA

c, v Ln w

MT

[o )oric

e ne nM

n

wr

OD

a)

a)

OD

AN

m

H H

N LA L

N enN

w r- c

LA

h

LA

0

v

N

-44

N e

HHHHHH

'

OD

HH

eN

H

H

0

V

L L

N L

w a) C a Ca

0

D (n 03

r- C

a)

N mO

w

mom00000000000000000000000

-1 4 In w n w -

LALALALAOLA LALALA LA LA LALA

In 0 H c4 In v Ln

MnC')eneeLA

NNNNNNNNNaNaNaaNNNaaNNNNaNNNNaNNNNNNMMMMMMoooooooM

v Ln w r, 00 0) 0 H N M " Ln W r- OD (A 0

nNN f[N [NLALALALA 4LLALA

W r- OD In 0 H 04

HH HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH

NNM

00 MO HO CO

o

e m LA H

LA

N o mn w L -, N H -w Nn

H m H N 14

L H N H ) C" HI

H 0 C' N H e N r a) a) a) m H H LA LA LA H N LA IN ) a LA m m

Nv

00

0a a) m m N w w H a) LA 0 LA LA m w 00 L H LAO

LA 0 H H ) N LA 0 CN N m en m m m IN C' a) 0 M H CN H an em m N CN 0 H CN H OH H 0 H 0000 HH v W H C) 0 e - 0 LA N H 0 en L a) 00 0 0

H 0

H H C' eN m N H 0 H H H IN N m 0

0 0 H m M n 0 w M

H m v M n V Wm - m m I W0 N - M 0 I I r M M I V M 0 H O M M M M r M V M M r M C W

H

V H H 00 M M IN r0 H 0 H H 00 00 0 0 0 H 0 r0 000000000000

0

00

00 o0

0 o 00 o o 0 0CNw- r mo o q wc VHOVr 0WMV- 4 0mwv OI 0 n 0 OLn O00o 00 wo0 w00o0 0 0 o o wmvmo vwHw(%I

I I

N

N

0 H WA m) v H . N m a) N r N L m w H W N w LA N N LA LA e m m H H N m

LA 0 H LA N H N N # a)a) q) C' H o m en H 0 LA

M a LA N W N 0 -IV M 00 O 0 r

LV

a 0I L

N M '0 0 CN

e CD M M C N w m LA H N LA m

H o L T H a) N n a ) LA ) a N LA

a ' C C e 0 C a L LA LA LA L LA a) N LA LA v C H H

LA en " H4 0m c H en N L) 0 a) L LH 6a H w m

N LA en C" 0 D

LA n 'n H 0

o p ) N N L A LA LA I me N N H H H