DEFENSE ACQUISITIONS Assessments of Selected Weapon

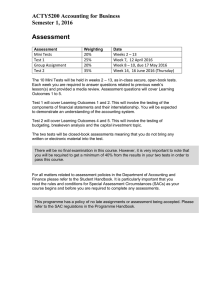

advertisement