Assessments

advertisement

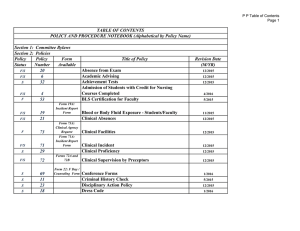

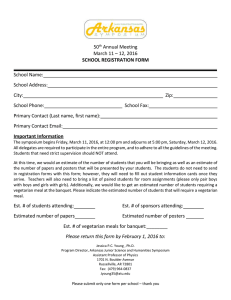

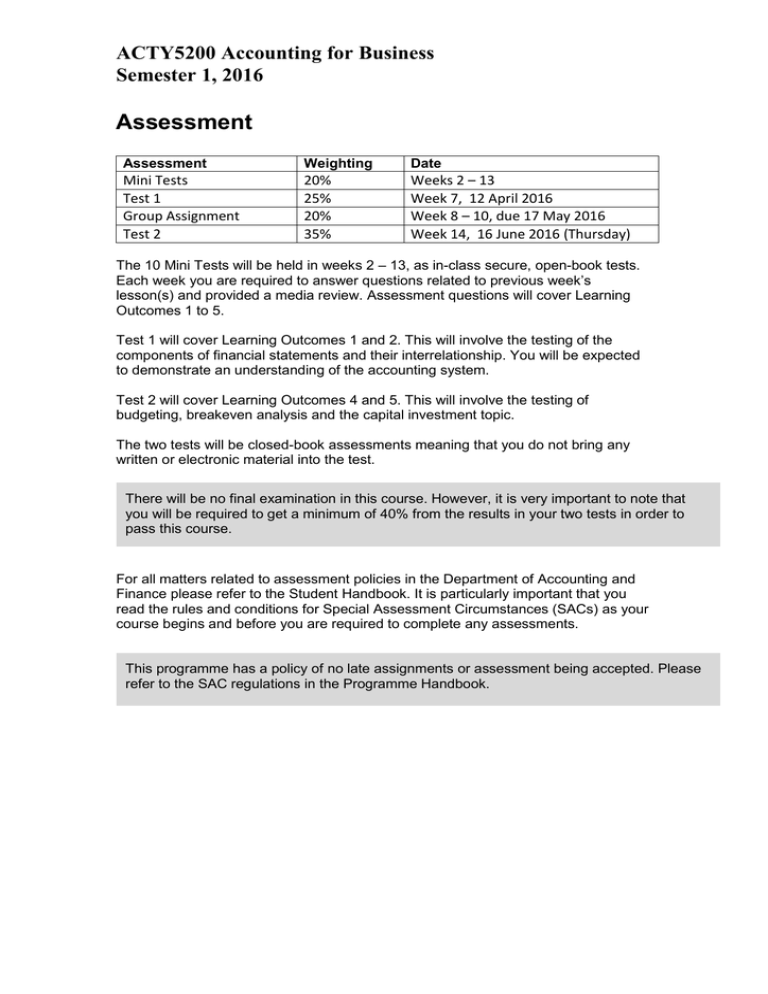

ACTY5200 Accounting for Business Semester 1, 2016 Assessment Assessment Weighting Date Mini Tests Test 1 Group Assignment Test 2 20% 25% 20% 35% Weeks 2 – 13 Week 7, 12 April 2016 Week 8 – 10, due 17 May 2016 Week 14, 16 June 2016 (Thursday) The 10 Mini Tests will be held in weeks 2 – 13, as in-class secure, open-book tests. Each week you are required to answer questions related to previous week’s lesson(s) and provided a media review. Assessment questions will cover Learning Outcomes 1 to 5. Test 1 will cover Learning Outcomes 1 and 2. This will involve the testing of the components of financial statements and their interrelationship. You will be expected to demonstrate an understanding of the accounting system. Test 2 will cover Learning Outcomes 4 and 5. This will involve the testing of budgeting, breakeven analysis and the capital investment topic. The two tests will be closed-book assessments meaning that you do not bring any written or electronic material into the test. There will be no final examination in this course. However, it is very important to note that you will be required to get a minimum of 40% from the results in your two tests in order to pass this course. For all matters related to assessment policies in the Department of Accounting and Finance please refer to the Student Handbook. It is particularly important that you read the rules and conditions for Special Assessment Circumstances (SACs) as your course begins and before you are required to complete any assessments. This programme has a policy of no late assignments or assessment being accepted. Please refer to the SAC regulations in the Programme Handbook.