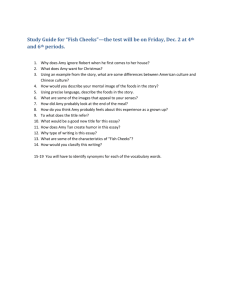

Personal Finance 101

advertisement

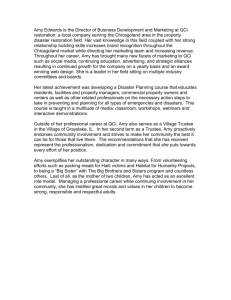

Personal Finance 101 Amy and Bob are single 22-year-old college graduates earning starting salaries of $3,000/month each. Their expenses are identical except for the following: Bob’s sporty car costs $300/month more than Amy’s to finance, maintain and insure. Bob spends $100/month at Starbucks; Amy brews her own coffee. Bob spends $200/month on workday lunches; Amy brown-bags it. Amy puts 10% of her salary (pre-tax) into a tax-deferred retirement plan, and her employer matches this dollar for dollar. Bob plans to set up a retirement plan later on. Amy sets up automatic transfers to an investment account. She starts out investing 10% of her salary in a stock market index fund through a discount broker. Bob doesn’t have a regular saving or investment plan. START: gross salary/month pre-tax retirement savings (10%) taxable income taxes withheld (15%) take-home pay $ $ $ $ $ Amy 3,000.00 (300.00) 2,700.00 (405.00) 2,295.00 $ $ $ $ $ Bob 3,000.00 3,000.00 (450.00) 2,550.00 car Starbucks & workday lunches rent savings/investment cash for other expenses $ $ $ $ $ (200.00) (600.00) (300.00) 1,195.00 $ $ $ $ $ (500.00) (300.00) (600.00) 1,150.00 Five years go by. They get 5% annual salary increases. Amy keeps putting 10% of her salary into her retirement plan, matched by her employer. The plan earns an average 10% return annually. Bob doesn’t get around to setting up his retirement plan. Amy invests half of each year’s raise in the index fund, which also yields an average 10% annual return. Bob’s raises support larger credit-card balances. So after five years their financial situations look like this: 5 YEARS LATER: gross salary/month pre-tax retirement savings (10%) taxable income taxes withheld (15%) take-home pay $ $ $ $ $ Amy 3,646.52 (364.65) 3,281.87 (492.28) 2,789.59 $ $ $ $ $ Bob 3,646.52 3,646.52 (546.98) 3,099.54 car Starbucks & workday lunches rent savings/investment credit card payments cash for other expenses $ $ $ $ $ $ (250.00) (100.00) (650.00) (623.26) (50.00) 1,116.33 $ $ $ $ $ $ (550.00) (400.00) (650.00) (309.21) 1,190.33 retirement savings investment account credit card debt NET WORTH $ $ $ $ 48,129 32,409 (500) 80,038 $ $ $ $ (16,000) (16,000) At age 27, Amy takes $30,000 of her investment account to use as down-payment on a $150,000 house. She gets a home mortgage for $120,000 at 4.5% interest with a 30-year term. Her monthly mortgage payment is $608. Most of this is tax-deductible interest which saves her $65/month in taxes. Home values in her neighborhood increase 5% a year. Bob still rents, and carries a lot of credit card debt. Another five years go by. They get 5% annual salary increases. Amy keeps on putting 10% into her retirement plan, and half of each year’s raise into the index fund. Bob intends to set up his retirement plan soon. So after 10 years their financial situations look like this: 10 YEARS LATER: gross salary/month pre-tax retirement savings (10%) taxable income taxes withheld (15%) take-home pay $ $ $ $ $ Amy 4,653.98 (465.40) 4,188.59 (628.29) 3,560.30 car Starbucks & workday lunches rent home mortgage savings/investment credit card payments net cash tax saving from mortgage interest deduction cash for other expenses $ $ $ $ $ $ $ $ $ retirement savings investment account credit card debt home equity NET WORTH $ $ $ $ $ $ $ $ $ $ Bob 4,653.98 4,653.98 (698.10) 3,955.89 (300.00) (150.00) (608.02) (623.26) (100.00) 1,879.02 65.00 1,944.02 $ $ $ (550.00) (400.00) (700.00) $ $ $ $ $ (483.14) 1,822.75 1,822.75 138,938 69,531 (1,000) 77,787 285,256 $ $ $ $ $ (25,000) (25,000) At age 32, Amy has a net worth near $300,000, and has more spending money each month than Bob. Her net worth is on track to top $1 million before age 40. Bob will still be working for his money while Amy’s money is working for her. (Maybe Bob can marry Amy!) The basic principles: • • • • • Set up your retirement savings plan ASAP, and sock away as much as you can, tax-deferred. If your employer matches your contributions to it, it is crazy to pass up free money. 43% of all working Americans have less than $10,000 in retirement savings, and most of these people will end up subsisting on Social Security or working until they die. The earlier you start saving, the bigger your compounded return. Automate your savings and investments. Set up automatic transfers from payroll or your checking account to a savings or investment account. You’re far less likely to spend it if you never see it. (Automate your bill-paying too, and avoid delinquencies.) When you get a raise, pay yourself first. In other words, ramp up your savings and investments first, before increasing your spending. A moderate amount of frugality now will create your fortune down the road. As soon as you accumulate enough for a 20% down-payment and plan to stay in the area more than 3 years, buy a house. Homeownership builds wealth. The income tax deductions for mortgage interest and property taxes usually make owning cheaper than renting. If you buy a home for 20% down, and its market value increases 3% annually, your equity (its market value minus what you owe the bank) is increasing 15% annually. Use homeownership as a leveraged investment. When your retirement funds are invested in stocks and bonds, homeownership diversifies and reduces your overall financial risk. Use credit wisely to build a solid credit report. A high debt-to-income ratio, high credit card balances and any delinquent payments will hurt your credit scores and make borrowing more expensive. Use a debit card; save the credit card for emergencies. The typical US household pays about 18% interest on $15,000 in credit card debt, and millions of Americans are mired in high-interest debt and facing bankruptcy. Borrow at 4% interest (mortgage), not 20%. And when paying down debt, pay off your highest-interest debt first.