HALF YEAR REPORT 2008 15684

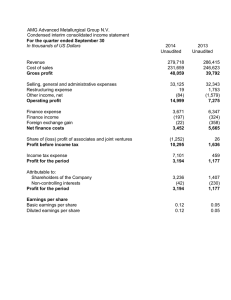

advertisement

15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 1 HALF YEAR REPORT 2008 15684 12/08/2008 Proof 3 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 2 Cautionary Statement This half year report contains forward looking statements which are made in good faith based on the information available to the time of its approval. It is believed that the expectations reflected in these statements are reasonable but they may be affected by a number of risks and uncertainties that are inherent in any forward looking statement which could cause actual results to differ materially from those currently anticipated. Exchange rates used for currencies most important to the Group’s operations are: Basis of Reporting The financial statements for the period are shown on pages 8 to 22 and have been prepared using accounting policies which were used in the preparation of audited accounts for the year ended 31 December 2007 and which will form the basis of the 2008 Annual Report. Further details on the basis of preparation are shown on page 15. Average First Half Euro US dollar Period End 2007 Full Year June June 2008 2007 2008 2007 Average Period 1.30 1.98 1.48 1.97 1.26 1.99 1.49 2.01 1.46 2.00 End 1.36 1.99 Measurement and reporting of performance In this half year report, in addition to statutory measures of profit, we have made reference to profits and earnings excluding the impact of: strategic restructuring and impairment charges, amortisation of non-operating intangible assets arising on business combinations, profits and losses on sale or closures of businesses, and changes in fair value of derivative financial instruments since we believe they show more clearly the underlying trend in business performance. The approximate impact on the annual trading profit of 2007 (including the Group’s share of joint ventures) of a 1% movement in the average rate is euro — £1.6 million, US dollar — £0.7 million. In our internal performance reporting we aggregate our share of sales and trading profits of joint ventures with those of subsidiaries. This is particularly important in assessing sales and profit progress in our Driveline and Other Automotive businesses where significant activity takes place in joint ventures. Reference to these combined figures is made, where appropriate, as “management sales” and “management trading profits”. Trading profit is defined as operating profit before any of the above. Where appropriate, reference is also made to results excluding the impact of 2007 acquisitions as well as the impact of currency translation on the results of overseas operations. 15684 12/08/2008 Proof 3 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 1 1 GKN plc Half Year Report 2008 FINANCIAL PERFORMANCE Business performance – see note below As reported First Half 2008 £m First Half 2007 £m Change £m Sales – including share of joint ventures First Half 2008 £m First Half 2007 £m 2,402 2,056 (132) Less share of joint ventures (125) Change 17% 6% 2,270 1,931 339 2,270 1,931 18% Trading profit – subsidiaries 146 137 9 146 137 7% Operating profit 133 113 20 146 137 7% 12 12 – 12 12 – (27) (24) (3) (27) (24) (13%) 118 101 17 131 125 5% 99 101 (2) 112 122 (8%) 13.8 14.2 (0.4) 15.6 17.2 (9%) Sales – subsidiaries Share of joint ventures (post-tax) Net financing costs Profit before tax Profit after tax Earnings per share – p 18% Tax rate 2008 Interim dividend per share 4.5p – – 2007 Change 4.3p 16% 3% – 5% Note Figures exclude the impact of restructuring and impairment charges, amortisation of non-operating intangible assets arising on business combinations, profits and losses on sale or closures of businesses and changes in fair value of derivative financial instruments. These figures represent underlying performance of continuing businesses. BUSINESS PERFORMANCE HIGHLIGHTS > Sales up 17% and profit before tax up 5% > Aerospace and OffHighway both deliver double digit sales and profit growth > Good sales increase in Driveline with small profit increase Raw material increases hold back profits > Difficult North American markets impact Powder Metallurgy > Substantial new business wins support continued above market growth Driveshafts secures 64% of available volume Aerospace over $1 billion of order wins > EPS 15.6p down from 17.2p due to change in tax rate > Interim dividend increase of 5% to 4.5p 15684 12/08/2008 Proof 3 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 2 2 GKN plc Half Year Report 2008 CHAIRMAN’S AND CHIEF EXECUTIVE’S STATEMENT GKN’s resilience has been demonstrated by our performance and our successes during the first half of 2008. A 17% increase in revenues, a 5% improvement in profit before tax and an excellent increase in operating cash flow clearly show the strength of our global businesses, each of which continues to enjoy market leading positions in their sectors. Our Automotive businesses have shown resilience in tough market conditions and Aerospace and OffHighway have performed strongly. We have also taken a number of actions to protect the performance of our business as automotive markets soften in the second half. We have continued to win substantial new business which has further strengthened order books across Automotive, OffHighway and Aerospace. Discussions with Airbus are close to a conclusion on the acquisition of the Filton site and the sourcing of a major A350 work package — completion of this transaction would be the next major step for Aerospace. Our major businesses are in good shape to prosper in an uncertain economic environment and the resilience of GKN will support continued development and growth. Group Performance Management sales (subsidiaries and share of joint ventures) £2,402 million (first half 2007 – £2,056 million) Sales of subsidiaries £2,270 million (first half 2007 – £1,931 million) Subsidiaries’ sales for the period were £2,270 million (first half 2007 – £1,931 million). The effect of exchange rates on the translation of the sales of overseas subsidiaries was £139 million positive whilst 2007 acquisitions added £43 million. Underlying sales increased by £157 million (8%) with improvements in all divisions except Other Automotive. Share of sales of joint ventures £132 million (first half 2007 – £125 million) The Group’s share of joint venture sales was £132 million compared with £125 million in the first half of 2007. There were no acquisitions or divestments and the translational impact of exchange rates was £11 million positive. The underlying decrease was £4 million (3%) with further strong growth in Driveline’s Chinese joint ventures offset by reductions at both Emitec and Chassis Systems. Management trading profit (subsidiaries and joint ventures) £161 million (first half 2007 – £153 million) Trading profit of subsidiaries £146 million (first half 2007 – £137 million) Trading profit of continuing subsidiaries rose to £146 million from £137 million in the first half of 2007. The translational impact of exchange rates was £14 million positive, the transactional effect £7 million negative while 2007 acquisitions contributed £6 million. Excluding these items, the decrease was £4 million. Within this figure, Driveline was £6 million lower and Powder Metallurgy reduced by £5 million, largely as a result of higher raw material costs. Other Automotive fell by £2 million. Against these reductions, market conditions remained good for both OffHighway and Aerospace where underlying profit rose strongly by £5 million and £4 million respectively as a consequence of strong sales growth. Share of trading profit of joint ventures £15 million (first half 2007 – £16 million) The Group’s share of the trading profit of joint ventures fell by £1 million from the first half of 2007. Currency translation was £2 million favourable so that 15684 12/08/2008 Proof 3 the underlying reduction was £3 million. Within this, Driveline businesses showed growth in line with the sales increase whilst there were reductions in Chassis Systems and Emitec. Divisional Performance The Group operates mainly in the global automotive, off-highway and aerospace markets. Virtually the whole of Driveline and Other Automotive sales are in the automotive market to manufacturers of passenger cars and light vehicles. Some 80% of Powder Metallurgy sales are also to this market with the balance to other industrial customers. OffHighway sells to producers of agricultural, construction, mining and industrial equipment whilst Aerospace sells to manufacturers of military and civil aircraft, aircraft engines and equipment. The Group’s performance is heavily influenced by conditions in these markets and the current behaviour of both end markets and costs is discussed in the relevant sections of this report. Automotive Markets With the exception of North America, automotive markets in the first half year behaved much as previously anticipated. In North America, production of cars and light vehicles in the period was 12% lower than the same period in 2007 and there was a sharp change in production mix from SUVs to smaller cars and crossover vehicles. Western European production was level with the first half of 2007 with export sales, particularly to Eastern Europe, offsetting weaker Western European demand. In most emerging markets recent growth trends continued with production in both Brazil and China rising by 16%. India, however, showed only a small increase of 1%. Looking forward to the second half of the year we expect production in our major markets to show a slight reduction compared with the same period of 2007. Specifically, North America is anticipated to be down by 12% and Europe slightly lower with continued growth in Eastern Europe more than offset by weakening in the West. Our second half forecasts for emerging markets are for continued growth in Brazil and some slowing of growth in Asia. Costs The major raw material for our Automotive businesses is steel (bar and scrap) either directly or through steel-based products. During the six months to June, prices for scrap steel rose dramatically and the average price for the half was around 70% higher than in the same period of 2007 with the sharpest increases occurring in the second quarter. The impact of these increases on each business is discussed below. GKN Driveline (Subsidiaries’ Trading Profit £71 million; first half 2007 – £71 million) GKN Driveline comprises GKN Driveshafts, which is the global leader in the production of constant velocity jointed (‘CVJ’) products for use in light vehicle drivelines, Torque Technology (‘TTG’), which produces a wide variety of components aimed at actively managing the flow of torque to the driven wheels and Industrial and Distribution Services (‘IDS’) which services mainly the driveline aftermarket. Driveline subsidiary sales in the period were £1,142 million compared with £969 million in the first half of 2007. The impact of currency translation was positive at £97 million. Excluding this, sales increased by £76 million (7%), with increases in Driveshafts in all regions of operation, TTG and IDS. Driveline subsidiaries’ trading profit of £71 million was level with the same period of 2007. The impact of translational currency was £11 million positive whilst the transactional impact was £5 million negative. Excluding these 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 3 3 GKN plc Half Year Report 2008 factors, profit reduced by £6 million with the benefits of higher volumes more than offset by costs associated with changes in model mix and the impact of higher raw material costs. The gross impact of raw material price increases was £16 million with some £4 million being recovered from customers. In the second quarter we entered into discussion with all our major customers with a view to embedding price adjustment clauses in our sales contracts. These discussions are reaching a conclusion and we anticipate that we will have arrangements in place to recover around 80% of raw material price increases in the second half and beyond. Subsidiaries’ margin in the period was 6.2% compared with 7.3% in the first half of 2007. Looking forward to the second half, margins are anticipated to improve as a consequence of the increased level of cost price recovery. On a management basis (i.e. including the Group’s share of joint ventures) total divisional sales showed £83 million (7%) underlying growth to £1,218 million. On the same basis, trading profit of £81 million compared with £79 million in 2007 and the margin of 6.7% compared with 7.7% a year earlier. Driveline joint ventures, the principal one being Shanghai GKN Drive Shaft Company Ltd, again saw good growth in both sales and profit. During the period, Driveshafts was again successful in obtaining a significant level of new and replacement business and won some 64% (first half 2007 – 68%) of all available sideshaft business, equating to approximately 48% of the total market. Production of Countertrack™ joints commenced in the period and additional programmes will come on stream during the second half of the year. GKN Driveline’s high performance Torque Vectoring technology made its debut on the new BMW X6 ‘sports activity coupe’. This new technology is a key element of BMW’s Dynamic Performance Control system, which is being pioneered on the new, highly acclaimed, vehicle. There is growing interest from major manufacturers in torque vectoring and other axle control technologies and, in July, we were awarded Nissan’s global innovation award for our contribution to the Nissan GT-R. IDS continued its steady improvement and plans are in place to further extend its operations through the opening of new service centres. Other Automotive (Subsidiaries’ Trading Loss £(2)m; first half 2007 – £nil) The Other Automotive businesses manufacture structural chassis components for the passenger car, SUV and light vehicle markets in Western Europe and engine cylinder liners for the North American and, increasingly, Chinese truck markets. Emitec, in which we have a 50% stake, produces metallic substrates for catalytic converters in Germany, the US, China and India. Sales in the period of £48 million were £9 million lower than the first half of 2007. £13 million of the reduction was the result of the closure of Sheepbridge Stokes in 2007 so that in ongoing businesses there was an increase of £4 million largely as a result of improvements in the Chinese business. The Chinese operations made a small profit in the period against break-even in the first half of 2007 but this was offset by losses in the UK AutoStructures businesses, largely as a result of reorganisation costs incurred in the period. Within joint ventures, sales at Chassis Systems Ltd were somewhat lower than in the first half of 2007 and profit reduced as a result both of lower volumes and the absence of one-off credits which had benefited the first half of last year. £104 million in the first half of 2007 and trading profit fell to £3 million from £8 million. Powder Metallurgy (Trading Profit £11 million; first half 2007 – £15 million) Powder Metallurgy produces metal powder (Hoeganaes) and sintered products (Sinter Metals). Approximately 80% of sales are into the automotive market with the balance to a variety of other industrial manufacturers. Powder Metallurgy sales in the period were £333 million compared with £309 million in the same period in 2007. Excluding the favourable impact of currency on translation of £20 million, there was an increase of £4 million (1%). Within Sinter Metals, the European business achieved sales growth of 5% and Asia Pacific sales increased by 8%. Sinter Metals North American business experienced a sales reduction of 11%, primarily due to very weak sales to General Motors. However, new programme launches partially mitigated the negative impact. Hoeganaes increased overall sales volumes by 3% due to new business wins, market share gains in North America and increased exports to Asia Pacific and Europe, all of which more than offset the impact of market weakness on sales in North America. First half trading profit fell to £11 million from £15 million. In Sinter Metals there were increased profits in Europe related to the benefits of restructuring completed in 2007 and volume growth. North America reported a loss in line with sharply lower sales and the impact of rapidly increasing material costs not yet recovered from customers. The strike at American Axle affected a number of GKN plants, including the closure of two facilities for a number of weeks. In Hoeganaes, underlying profits were level with the first half of 2007 supported by good growth in sales to both Europe and Asia Pacific. For Powder Metallurgy as a whole, the gross impact of raw material cost increases was approximately £12 million, of which some £6 million was recovered from customers through the surcharge mechanism in Hoeganaes and surcharge/customer price actions in Sinter Metals. In light of the unprecedented volatility in the scrap market, the Hoeganaes surcharge was moved to a monthly basis to provide better alignment between volumes shipped and surcharging. The division’s trading margins in the first half fell to 3.3% from 4.9% in the same period of 2007. The positive impact of prior year restructuring activity was clearly seen in the results of the European Sinter business but the benefits in North America were offset by the weak automotive trading environment. Work continues to implement material surcharging at Sinter Metals customers to reduce risk given the current high levels of raw material volatility. Actions have also been implemented to align the North American cost structure to the developing market conditions and the workforce will be reduced by around 400 by September. Approximately £50 million of new business was won in the period which will continue to support the anticipated growth in all regions of 6%–8% in the medium term. Underlying sales of Emitec were lower as German retrofit demand fell sharply and profits consequently reduced from the first half of 2007. OffHighway (Trading Profit £25 million; first half 2007 – £19 million) OffHighway designs and manufactures steel wheels, gearboxes, axles and driveline systems for the global agricultural, construction, mining and industrial machinery sectors. On a management basis (i.e. including the Group’s share of joint ventures) divisional sales of continuing businesses were £102 million compared with European agricultural markets (50% of divisional sales) performed strongly in the first half with demand up significantly by comparison to the first half of 15684 12/08/2008 Proof 3 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 4 4 GKN plc Half Year Report 2008 CHAIRMAN’S AND CHIEF EXECUTIVE’S STATEMENT CONTINUED 2007. This has been fuelled by both an increase in farm incomes in 2007 and higher commodity prices. Demand for US agricultural machinery (14% of divisional sales) was also sharply higher as farm incomes rose on the back of higher commodity prices. Generally, the harvesting market is forecast to be strong globally for the remainder of 2008 and into 2009. In the construction equipment market (22% of divisional sales) the picture has been mixed. The lower level of housing starts in the US has led to a decline in demand for light construction equipment but demand has remained strong in mining markets. Whilst local demand in the US has been weak there has been an increasing level of exports by our customers and this trend is expected to continue for the remainder of the year. European volumes have continued to be strong. However, we are seeing a slowing of demand for light construction equipment, particularly in the UK and Spain (though this sector accounts for only around £25 million of annual sales across the division). The Asian market still continues to grow, but at slower pace than last year. Our Chinese plants have seen strong demand in the first 6 months partly driven by higher local demand but also by additional demand from Europe. The major input cost for the division remains steel, and overall material prices in the first half of 2008 have increased significantly as a result of strong global demand. These price increases are carefully monitored and we have been successful in mitigating much of the increase in the period. Against this background, subsidiary sales in the first half were £280 million compared with £219 million in the same period of last year. The impact of currency on translation was £20 million positive so that the underlying increase was £41 million (17%) with good progress in all product areas and regions. Trading profit also improved significantly to £25 million from £19 million. The impact of movements in exchange rates on the translation of results was £2 million favourable whilst transactional effects were £1 million negative. Excluding these factors the increase was £5 million, in line with the improvement in sales. Margin improved to 8.9% (first half 2007 – 8.7%). The overall performance of GKN OffHighway has been strong so far in 2008 and, with order books at record levels, we anticipate this will continue for the second half of the year consistent with normal seasonal trends. The breadth of our product portfolio and geographical coverage provides a strong basis for further growth. GKN Aerospace (Trading Profit £47 million; first half 2007 – £38 million) GKN Aerospace is a global first tier supplier of airframe and engine structures, components, assemblies and engineering services to aircraft prime contractors. The aerospace market conditions of 2007 continued into the first half of 2008 with strength in both civil and military sectors. During the period January to June Airbus and Boeing delivered 486 aircraft, an increase of 8% over the first half of 2007, and the order backlog increased to 7,324. At the same time, increased oil prices and general economic conditions are likely to result in fewer passenger miles being flown and increased financial pressure on some airlines. Both Airbus and Boeing expect a reduction of order intake but are maintaining current production plans as a result of the strong order book. There is, however, a growing expectation that some of these will be subject to delay or cancellation. The regional and business sector has also seen growth, with turbo props securing new orders as a result of operating cost benefits compared with 15684 12/08/2008 Proof 3 regional jets, and there have been a number of new product launches in both sectors. Military demand, which is largely driven by US defence spending, is likely to remain solid in the medium term. The Joint Strike Fighter programme continues its development phase and has moved into its initial production schedule and preparation for higher rate manufacturing. Sales in the first half of £467 million were £90 million (24%) higher than the same period of 2007. The impact of currency translation was £2 million positive while Teleflex, acquired at the end of June 2007, added £43 million. The underlying increase of £45 million represented a 12% improvement and was the result of the ramp-up of production on a number of programmes. The annual delays in the Boeing 787 programme will reduce our expected 2008 revenues by about £40 million and has led to lay-offs in one of our US plants. Trading profit increased by £9 million to £47 million. The impact from currency on translation of results was nil while the transactional impact was £1 million negative. The 2007 acquisition of Teleflex and synergies arising from its integration added £6 million. Excluding these factors, the increase was £4 million. The margin was steady at 10.1%. During the period orders won included the HTF 7000 third Nacelle application and an additional C130J Nacelle Multi Year from the US Department of Defense. We also entered a joint venture with Rolls-Royce for the development of composite fan blades, initially focused on future 150 seat aircraft applications. As a result of increasing fuel costs the pressure to improve operating costs is driving demand for retrofit winglet programmes and we have increased rate deliveries on the B737 Winglet and delivered the first B767 Winglet to American Airlines. Across the portfolio the division has maintained its balanced position in civil and defence programmes and has continued to secure its market position with a range of customers and programmes that maintains its diversity. A large proportion of these programmes are now entering the initial phase of production schedule ramp-up and are projected to reach volume rates over the period 2010 to 2014. If, as we expect, we finalise a deal with Airbus for the acquisition of the Filton wing assembly plant and associated A350 wing package it will add in the region of £400 million to our annual revenues and significantly increase our order book. Corporate costs (£6 million; first half 2007 – £6 million) Corporate costs, which comprise the costs of stewardship of the Group, remained at the same level as the first half of 2007. Restructuring and impairment charges (£4 million; first half 2007 – £13 million) The first half charges of £4 million (first half 2007 – £13 million) related primarily to the final phase of the strategic restructuring programme, first announced in March 2004, with the major element representing the final costs associated with Driveline operations in North America and Europe. There are no further restructuring costs to be charged in respect of this programme. Amortisation of non-operating intangibles arising on business combinations (£5 million; first half 2007 – £3 million) The charge of £5 million in the period was £2 million higher than in the same period of 2007. The increase was in respect of intangible assets (e.g. customer contracts and relationships, technological know-how and intellectual property rights) of the Teleflex acquisition. 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 5 5 GKN plc Half Year Report 2008 Profits and losses on sale or closures of businesses (£nil; first half 2007 – £7 million) There were no businesses sold or closed during the period. The prior year charge of £7 million related to the results of the Group’s UK cylinder liner business, GKN Sheepbridge Stokes, which ceased trading in the second half of 2007. The ‘cash tax’ charge for the period (which excludes deferred taxes, movements in provisions for uncertain tax positions and tax relating to restructuring, impairment charges and sale of businesses) was 17% and we continue to expect ‘cash tax’ to average 20% or less for the near term as we continue to make use of prior years’ tax losses, incentives and deductions in the various countries in which we operate. Changes in fair value of derivative financial instruments (£4 million charge; first half 2007 – £1 million charge) The Group enters into foreign exchange contracts to hedge much of its transactional exposure. Hedge accounting continues to be applied to a small proportion of these transactions. Where hedge accounting has not been applied, the change in fair value between 1 January 2008 and 30 June 2008, or the date of maturity if earlier, is reflected in the income statement as a component of operating profit and has resulted in a charge of £5 million (first half 2007 – £1 million charge). In addition, during the first half year, there were changes in the value of Powder Metallurgy commodity contracts of £1 million credit (2007 – £1 million credit). There were no changes in the value of embedded derivatives in the period (2007 – £1 million charge). For the 2008 full year the tax rate is likely to be broadly in line with the half year rate. For 2009 and beyond, the overall reported tax rate on underlying profits of subsidiaries may continue to be volatile, being influenced by the possible further recognition of currently unrecognised deferred tax assets and the settlement of prior year tax disputes. Operating profit (£133 million, first half 2007 – £113 million) Operating profit of £133 million compared with £113 million in the first half of 2007, reflecting the movements discussed above. Post-tax earnings of joint ventures (£12 million; first half 2007 – £12 million) The post-tax earnings of joint ventures in the period were £12 million, the same figure as the comparable period in 2007. As noted above, there was a net £1 million reduction in trading profit but a corresponding decrease in the tax charge. Net financing costs (£27 million; first half 2007 – £24 million) Net financing costs totalled £27 million (first half 2007 – £24 million) and included financing costs of post-employment benefits of £1 million (first half 2007 – £1 million). The net of interest payable and interest receivable was £26 million (first half 2007 – £23 million). The £3 million increase largely resulted from the impact of 2007 acquisitions and higher investments in emerging markets. Profit before tax (£118 million; first half 2007 – £101 million) Profit before tax on a statutory basis was £118 million compared with £101 million in the first half of 2007. Excluding the impact of restructuring and impairment charges, amortisation of non-operating intangible assets arising on business combinations, profits and losses on the sale or closures of businesses and changes in fair value of derivative financial instruments, the figure was £131 million (first half 2007 – £125 million), an increase of 5%. Taxation (£19 million charge; first half 2007 – £nil) The tax charge for subsidiaries for the period, including deferred taxation, was £19 million (first half 2007 – £nil). The tax charge as a percentage of subsidiaries’ profit before tax, before restructuring and impairment charges, amortisation of non-operating assets arising on business combinations, profits and losses on sale or closures of businesses and changes in fair value of derivative financial instruments, is 16.0% compared with 2.7% in the first half of 2007. The increase in the effective rate from 2007 is partly attributable to the benefit arising from the utilisation and recognition of previously unrecognised deferred tax assets being smaller than the equivalent benefit recognised in the first half of 2007; and partly attributable to a charge arising from the reversal, via use, of previously recognised deferred tax assets. The recognition of previously unrecognised deferred tax assets has been based upon management projections which indicate an improvement in future taxable profits in the relevant territories. 15684 12/08/2008 Proof 3 Minority Interests (£2 million; first half 2007 – £1 million) The movement of £1 million in the profit attributable to minority interests was largely the result of improved profitability in the Chinese cylinder liner Company and in Driveshaft’s Asian businesses. Earnings per share Earnings per share were 13.8p (first half 2007 – 14.2p). Before restructuring and impairment charges, amortisation of non-operating intangible assets arising on business combinations, profits and losses on the sale or closures of businesses and changes in the fair value of derivative financial instruments, the figure was 15.6p (first half 2007 – 17.2p). The reductions are mainly due to the increased tax charge discussed above. Dividend The Board has decided to pay an interim dividend of 4.5p per share, representing an increase of 4.7% over the 2007 interim dividend. The cost of the dividend will be £32 million (first half 2007 – £30 million). The interim dividend will be paid on 30 September 2008 to shareholders on the register at 15 August 2008. Shareholders may choose to use the Dividend Reinvestment Plan (DRIP) to reinvest the interim dividend. The closing date for receipt of new DRIP mandates is 16 September 2008. Cash Flow Operating cash flow, which we define as cash generated from operations of £159 million (first half 2007 – £98 million) adjusted for capital expenditure of £101 million (first half 2007 – £89 million) and proceeds from the disposal of fixed assets of £2 million (first half 2007 – £7 million), was an inflow of £60 million compared with an inflow of £16 million in the first half of 2007. Within operating cash flow there was an outflow on working capital and provisions of £63 million (first half 2007 – £87 million) reflecting both the higher level of sales and usual seasonality. Capital expenditure on both tangible and intangible assets totalled £101 million (first half 2007 – £89 million). Of this, £95 million (first half 2007 – £80 million) was on tangible fixed assets and was 1.2 times (first half 2007 – 1.1 times) the depreciation charge. The ratio for the full year is expected to trend down closer to 1.1 times. Expenditure on intangible assets, mainly initial non-recurring costs on Aerospace programmes, totalled £6 million (first half 2007 – £9 million). Net interest paid totalled £30 million compared with £25 million in the same period last year, mainly reflecting the higher level of debt following the acquisition of Teleflex at the end of the first half of 2007. Tax paid in the period was £14 million (first half 2007 – £14 million). The cash cost of the 2007 final dividend was £65 million (first half 2007 – £61 million) and acquisition expenditures, net of cash acquired, was £2 million (first half 2007 – £70 million). 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 6 6 GKN plc Half Year Report 2008 CHAIRMAN’S AND CHIEF EXECUTIVE’S STATEMENT CONTINUED Post-employment costs Post-employment costs comprise both pensions and post-employment medical benefits. Details of the amounts included in the Balance Sheet and the assumptions used in their computation are shown in Note 9 on page 20. Outlook In uncertain economic conditions, GKN expects that its global positioning, diversity of end markets and strong order books will support continued above market growth. Cost recovery measures and increased operational flexibility are anticipated to deliver improved performance in Driveline and Powder Metallurgy when compared with the first half, against a background of softening markets. Aerospace and OffHighway are expected to perform strongly. Income Statement For the six month period, the current service cost included in operating profit was £15 million compared with £17 million in the first half of 2007. Changes to retiree medical arrangements in the US in 2007 were the major reason for the reduction. In detail, Automotive markets are likely to soften further, with the Americas continuing their first half trend, Europe set to weaken and a potential slowdown in growth in Asia. We now expect second half light vehicle production in our major markets to show a small reduction against last year, leaving the year as a whole slightly ahead. Financing charges in respect of post-employment obligations totalled £1 million (first half 2007 – £1 million) and comprised expected returns on pension scheme assets for the period of £81 million (first half 2007 – £74 million) which were more than offset by the £82 million (first half 2007 – £75 million) of notional interest on pension scheme liabilities. Global OffHighway markets for agricultural and mining and heavy construction equipment remain strong. Period end borrowings totalled £529 million compared with £574 million at 30 June 2007 and £506 million at the end of December 2007, leaving the balance sheet in a strong position. Balance Sheet and funding The gross deficit of all schemes at 30 June 2008 was £450 million, a £119 million increase over December 2007, which is shown on the balance sheet as a non-current liability. The increase in the deficit was largely due to asset returns that were £227 million lower than expected, partially offset by a £108 million reduction in liabilities from higher discount rate increases from end 2007 levels in the UK, the Americas and Europe. Company contributions for the six months across the Group totalled £21 million (first half 2007 – £21 million). UK post-employment obligations The gross deficit of £122 million was £106 million higher than the December 2007 year end figure of £16 million. The increase was mainly due to asset returns that were £203 million lower than expected, partially offset by lower liabilities from a 60 basis point increase in the discount rate. In Aerospace, the US defence market continues to support a healthy procurement programme. Civil aerospace growth looks set to soften, although this is unlikely to have much impact in the second half. Raw material costs, particularly steel, remain high and volatile. However, the Group has undertaken initiatives in the first half that will improve the level of cost recovery from our customers. Exchange rates at current levels would continue to provide a translational benefit to earnings, although this will be partially offset by adverse transactional impacts. Conclusion of the negotiations for the acquisition of the Airbus Filton wing aerostructures site is imminent with completion expected before the end of the year. In summary, we anticipate that second half performance will benefit from actions taken in the first half and that progress for the year as a whole will be in line with expectations. Mortality assumptions were adjusted at 2007 year end, in part to reflect specific scheme longevity. It is normal policy to review mortality assumptions in the second half following the annual publication of scheme specific mortality experience. Principal risks and uncertainties The principal risks and uncertainties to which the Group is exposed are set out on pages 37–39 of the 2007 Annual Report. There have been no changes in the nature of the risks identified but the weaknesses emerging in some of the world’s major economies and the significant rise in oil prices which have occurred during the first half year have increased uncertainties concerning: ● ● the overall levels of global car and light vehicle production in the near term and the mix of types of vehicles likely to be produced, and the number of passenger miles flown and airline profitability, both of which could affect demand for new aircraft. Roy Brown Chairman Sir Kevin Smith Chief Executive 5 August 2008 As noted in the Annual Report, in 2007 56% of the Group’s sales were for automotive vehicle manufacturers and 20% for original equipment on aircraft or aircraft components and the Group’s performance is dependent on levels of demand in these areas. In addition, these macro economic trends, together with liquidity issues arising from the ‘credit crunch’, have increased pressure on some of our customers and suppliers. We continue to monitor the situation closely with a view to minimising any adverse consequences. 15684 12/08/2008 Proof 3 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 7 7 GKN plc Half Year Report 2008 STATEMENT OF DIRECTORS’ RESPONSIBILITIES The half yearly financial report is the responsibility of the Directors who confirm that to the best of their knowledge: ● the condensed set of financial statements has been prepared in accordance with IAS 34 Interim Financial Reporting as endorsed and adopted by the EU; ● the interim management report includes a fair review of the information required by: (a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an indication of important events that have occurred during the first six months of the financial year and their impact on the condensed set of financial statements; and a description of the principal risks and uncertainties for the remaining six months of the year; and (b) DTR 4.2.8R of the Disclosure of Transparency Rules, being related party transactions that have taken place in the first six months of the current financial year and that have materially affected the financial position or performance of the entity during that period; and any changes in the related party transactions described in the 2007 Annual Report. The Directors of GKN plc are listed in the GKN Annual Report for 31 December 2007, with the exception of the following change in the period: Richard Parry-Jones CBE was appointed a non-executive Director with effect from 1 March 2008. By order of the Board of GKN plc. Roy Brown Chairman Sir Kevin Smith Chief Executive Bill Seeger Finance Director 4 August 2008 15684 12/08/2008 Proof 3 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 8 8 GKN plc Half Year Report 2008 CONSOLIDATED INCOME STATEMENT FOR THE HALF YEAR ENDED 30 JUNE 2008 Unaudited Continuing operations Sales Notes First half 2008 £m First half 2007 £m Full year 2007 £m 1 2,270 1,931 3,869 146 (4) (5) – (4) 137 (13) (3) (7) (1) 277 (31) (8) (7) (10) 133 12 113 12 221 24 (33) 7 (1) (30) 7 (1) (62) 19 (3) (27) (24) (46) 118 (19) 101 – 199 (1) Profit after taxation for the period 99 101 198 Profit attributable to minority interests Profit attributable to equity shareholders 2 97 1 100 2 196 99 101 198 13.8 13.7 14.2 14.2 27.9 27.8 4.5 – 4.3 – 4.3 9.2 Trading profit Restructuring and impairment charges Amortisation of non-operating intangible assets arising on business combinations Profits and losses on sale or closures of businesses Changes in fair value of derivative financial instruments Operating profit Share of post-tax earnings of joint ventures Interest payable Interest receivable Other net financing charges 1, 3 1, 4 5 Net financing costs Profit before taxation Taxation 6 Earnings per share – p Basic Diluted 7 Dividends per share – p Interim dividend per share Final dividend per share 8 15684 12/08/2008 Proof 3 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 9 9 GKN plc Half Year Report 2008 CONSOLIDATED STATEMENT OF RECOGNISED INCOME AND EXPENSE FOR THE HALF YEAR ENDED 30 JUNE 2008 Unaudited First half 2008 £m Currency variations Derivative financial instruments: Transactional hedging Translational hedging Actuarial gains and losses on post-employment obligations including tax: Subsidiaries Joint ventures Deferred tax on other items First half 2007 £m Full year 2007 £m 58 (12) 66 – (32) – 11 – (28) (95) – – 128 – – 140 1 (8) (69) 127 171 Profit for the period 99 101 198 Total recognised income for the period 30 228 369 Total recognised income for the period attributable to: Equity shareholders Minority interests 28 2 226 2 365 4 30 228 369 Net (losses)/profits not recognised in the Income Statement 15684 12/08/2008 Proof 3 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 10 10 GKN plc Half Year Report 2008 CONSOLIDATED BALANCE SHEET AT 30 JUNE 2008 Unaudited Notes 30 June 2008 31 December 2007 £m 30 June 2007 Restated £m 285 134 1,519 96 24 69 271 133 1,354 93 17 60 280 136 1,462 100 22 56 2,127 1,928 2,056 597 706 1 24 246 513 647 – 46 206 552 571 2 25 282 1,574 1,412 1,432 – 4 – 3,701 3,344 3,488 2 Assets Non-current assets Intangible assets – goodwill – other Property, plant and equipment Investments in joint ventures Other receivables and investments including loans to joint ventures Deferred tax assets 11 Current assets Inventories Trade and other receivables Current tax assets Derivative financial instruments Cash and cash equivalents Assets held for sale Total assets Liabilities Current liabilities Borrowings Derivative financial instruments Trade and other payables Current tax liabilities Provisions £m (80) (59) (943) (110) (37) (54) (12) (811) (94) (53) (92) (30) (837) (104) (45) (1,229) (1,024) (1,108) (695) (81) (32) (50) (726) (72) (31) (56) (696) (75) (31) (51) (450) (355) (331) (1,308) (1,240) (1,184) (2,537) (2,264) (2,292) 1,164 1,080 1,196 Shareholders’ equity Ordinary share capital Share premium account Retained earnings 372 29 774 372 27 758 372 29 834 Other reserves (33) (95) (58) Non-current liabilities Borrowings Deferred tax liabilities Trade and other payables Provisions 9 Post-employment obligations Total liabilities Net assets Total shareholders’ equity Minority interests — equity 10 Total equity 15684 12/08/2008 Proof 3 1,142 1,062 1,177 22 18 19 1,164 1,080 1,196 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 11 11 GKN plc Half Year Report 2008 CONSOLIDATED CASH FLOW STATEMENT FOR THE HALF YEAR ENDED 30 JUNE 2008 Unaudited First half 2008 £m Cash flows from operating activities Cash generated from operations (note a) Interest received Interest paid Tax paid Dividends received from joint ventures Cash flows from investing activities Purchase of property, plant and equipment and intangible assets Proceeds from sale of property, plant and equipment Acquisitions of subsidiaries (net of cash acquired) Investment loans and capital contributions Cash flows from financing activities Net proceeds from issue of ordinary share capital Net proceeds from borrowings Finance lease payments Repayment of borrowings Dividends paid to shareholders Dividends paid to minority interests Currency variations on cash and cash equivalents First half 2007 £m Full year 2007 £m 159 3 (33) (14) 20 98 4 (29) (14) 3 299 16 (60) (28) 13 135 62 240 (101) 2 (2) 1 (89) 7 (70) 2 (192) 21 (71) 7 (100) (150) (235) – 3 5 10 – (6) (65) – 2 (1) (1) (61) – 13 (1) (17) (91) (1) (61) (58) (92) 6 1 9 Movement in cash and cash equivalents (note b) Cash and cash equivalents at 1 January (20) 250 (145) 328 (78) 328 Cash and cash equivalents at end of period (note c) 230 183 250 Cash inflows from government capital grants of less than £1 million (first half 2007 – £1 million, full year 2007 – £nil) have been offset against purchases of property, plant and equipment and intangible assets. 15684 12/08/2008 Proof 3 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 12 12 GKN plc Half Year Report 2008 CONSOLIDATED CASH FLOW STATEMENT — NOTES FOR THE HALF YEAR ENDED 30 JUNE 2008 Note a: Cash generated from operations Unaudited Cash generated from operations Operating profit Adjustments for: Amortisation of non-operating intangible assets arising on business combinations Changes in fair value of derivative financial instruments Tangible fixed asset impairments/reversals Depreciation and amortisation Amortisation of capital grants Net profits on sale of fixed assets Charge for share-based payments Movement in post-employment obligations Changes in working capital and provisions First half 2008 £m First half 2007 £m Full year 2007 £m 133 113 221 5 4 1 85 (1) (1) 2 (6) (63) 3 1 (1) 74 (2) (1) 2 (4) (87) 8 10 (9) 151 (2) (8) 6 (29) (49) 159 98 299 First half 2007 £m Full year 2007 £m Note b: Movement in net debt Unaudited First half 2008 £m Net movement in cash and cash equivalents Net movement in borrowings Currency variations on borrowings Finance leases Subsidiaries acquired and sold (20) (4) 1 – – (145) (5) 1 1 – (78) 4 (7) 1 – (23) (148) (80) Net debt at beginning of period (506) (426) (426) Net debt at end of period (529) (574) (506) Movement in period Note c: Reconciliation of cash and cash equivalents Unaudited 30 June 2008 £m 30 June 2007 £m 31 December 2007 £m Cash and cash equivalents per balance sheet Bank overdrafts included within ‘Current liabilities – Borrowings’ 246 (16) 206 (23) 282 (32) Cash and cash equivalents per cash flow 230 183 250 15684 12/08/2008 Proof 3 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 13 13 GKN plc Half Year Report 2008 NOTES TO THE HALF YEAR CONSOLIDATED FINANCIAL STATEMENTS FOR THE HALF YEAR ENDED 30 JUNE 2008 1 Segmental analysis The Group is managed by type of business. Segmental information is provided having regard to the nature of the goods and services provided and the markets served. FOR THE HALF YEAR ENDED 30 JUNE 2008 (UNAUDITED) Automotive Driveline £m Other Automotive £m Powder Metallurgy £m OffHighway £m Aerospace £m 1,142 280 Corporate £m Total £m 2,270 48 333 467 – EBITDA Depreciation and impairment charges Amortisation of intangible assets 116 (44) (1) – (2) – 27 (16) – 31 (6) – 63 (13) (3) (6) – – 231 (81) (4) Trading profit/(loss) Restructuring Amortisation of business combination non-operating intangibles Changes in fair value of derivative financial instruments 71 (4) (2) – 11 – 25 – 47 – (6) – 146 (4) (1) – – (1) (3) – (5) 1 1 1 (1) (6) – (4) Operating profit/(loss) 67 (1) 12 23 38 (6) 133 8 4 – – – – 12 45 2 – – 18 – 5 – 15 4 – – 83 6 1 – – – – 1 2 Driveline £m Other Automotive £m Powder Metallurgy £m OffHighway £m Aerospace £m Corporate £m Total £m Sales 969 57 309 219 377 – 1,931 EBITDA Depreciation and impairment charges Amortisation of intangible assets 110 (38) (1) 2 (2) – 30 (15) – 24 (5) – 51 (10) (3) (6) – – 211 (70) (4) Trading profit/(loss) Restructuring Other impairments Amortisation of business combination non-operating intangibles Profits and losses on sale or closures of businesses Changes in fair value of derivative financial instruments 71 (9) – – – 1 15 (5) – 19 – – 38 – – (6) – – 137 (14) 1 – – – (7) – – (1) – (2) – – – (3) (7) (1) – – – – – (1) Operating profit/(loss) 61 (6) 10 18 36 (6) 113 7 5 – – – – 12 39 1 1 – 15 – 4 – 12 8 – – 71 9 1 – – – – 1 2 Sales Share of post-tax earnings of joint ventures Other segment items Fixed asset additions Property, plant and equipment Intangible assets Other non-cash expenses (share-based payments) FOR THE HALF YEAR ENDED 30 JUNE 2007 (UNAUDITED) Automotive Share of post-tax earnings of joint ventures Other segment items Fixed asset additions Property, plant and equipment Intangible assets Other non–cash expenses (share-based payments) 15684 12/08/2008 Proof 3 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 14 14 GKN plc Half Year Report 2008 NOTES TO THE HALF YEAR CONSOLIDATED FINANCIAL STATEMENTS CONTINUED FOR THE HALF YEAR ENDED 30 JUNE 2008 1 Segmental analysis continued FOR THE YEAR ENDED 31 DECEMBER 2007 Automotive Driveline £m Other Automotive £m Powder Metallurgy £m OffHighway £m Aerospace £m Corporate £m Total £m 1,922 109 602 416 820 – 3,869 Sales EBITDA Depreciation and impairment charges Amortisation of intangible assets 227 (75) (3) 2 (5) – 58 (28) (1) 39 (10) – 112 (24) (5) (10) – – 428 (142) (9) Trading profit/(loss) Restructuring Other impairments Amortisation of business combination non-operating intangibles Profits and losses on sale or closures of businesses Changes in fair value of derivative financial instruments 149 (19) – (3) – 2 29 (14) – 29 – – 83 – – (10) – – 277 (33) 2 (1) – – (7) – – (2) – (5) – – – (8) (7) (1) (1) (1) (2) (5) – (10) Operating profit/(loss) 128 (9) 14 25 73 (10) 221 14 10 – – – – 24 94 3 2 – 38 – 11 1 28 16 1 – 174 20 2 – 1 – 1 2 6 Share of post-tax earnings of joint ventures Other segment items Fixed asset additions Property, plant and equipment Intangible assets Other non-cash expenses (share-based payments) All business segments shown above are continuing. EBITDA is earnings before interest, tax, depreciation and amortisation. 15684 12/08/2008 Proof 3 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 15 15 GKN plc Half Year Report 2008 2 Basis of preparation These half year condensed consolidated financial statements for the six months ended 30 June 2008 have been prepared in accordance with the Disclosure and Transparency Rules of the Financial Services Authority and International Financial Reporting Standards, as adopted by the European Union, in accordance with IAS 34 ‘Interim Financial Reporting’. These financial statements provide an update of previously reported information and should be read in conjunction with the audited consolidated financial statements for the year ended 31 December 2007. These financial statements, which were approved by the Board of Directors on Monday 4 August 2008, are unaudited but have been reviewed by the auditors. The accounting policies applied in these financial statements are the same as those applied in the audited consolidated financial statements for the year ended 31 December 2007. These financial statements do not constitute statutory accounts for the purpose of s240 of the Companies Act 1985. A copy of the audited consolidated statutory accounts for the year ended 31 December 2007 has been delivered to the Registrar of Companies and contained an unqualified auditors’ report in accordance with s235 of the Companies Act 1985 and did not contain statements made under either s237(2) or 237(3) of the Companies Act 1985. No new standards, amendments or interpretations have been adopted in the period. Subject to European Union endorsement, the following relevant interpretation will be adopted for the year ended 31 December 2008: IFRIC 14 ‘The limit on a defined benefit asset, minimum funding requirements and their interaction’. This interpretation will not have a material impact on the results or financial position of the Group. The following relevant standards, amendments and interpretations have been issued and will be adopted for periods beginning after 1 January 2009, subject to European Union endorsement where applicable: ● ● ● ● ● ● IFRS 8 ‘Operating Segments’ IAS 23 ‘Borrowing costs’ (revised) IFRS 2 ‘Share-based payment’ (amendment) IAS 1 ‘Presentation of financial statements’ (revised) IFRS 3 ‘Business combinations’ (revised) IAS 27 ‘Consolidated and separate financial statements’ (revised) The Group is currently assessing the impact of the above on the presentation, results and net assets of the consolidated financial statements. Comparative information has been presented for the six months ended 30 June 2007 and for the year ended 31 December 2007. Amendments as a result of the finalisation of provisional fair values on acquisitions made in the twelve months to 30 June 2007 have been shown as a prior period restatement. As a consequence of the finalisation of fair value adjustments in respect of the acquisition of the Teleflex Aerospace Manufacturing Group on 29 June 2007 and of Liuzhou Steel Rim Factory on 16 November 2006 the consolidated balance sheet at 30 June 2007 has been restated. There have been no amendments to the fair values disclosed in the consolidated financial statements for the year ended 31 December 2007. The impact of the restatements on previously reported results is set out below: First half 2007 As previously reported 283 111 1,348 515 (812) (100) (6) 1,080 14.2 14.2 Intangible assets — goodwill Intangible assets — other Property, plant and equipment Inventories Trade and other payables Provisions Deferred tax Net assets Basic earnings per share (p) Diluted earnings per share (p) 15684 12/08/2008 Proof 3 Restated 271 133 1,354 513 (811) (109) (12) 1,080 14.2 14.2 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 16 16 GKN plc Half Year Report 2008 NOTES TO THE HALF YEAR CONSOLIDATED FINANCIAL STATEMENTS CONTINUED FOR THE HALF YEAR ENDED 30 JUNE 2008 3 Operating profit The analysis of the non trading components of operating profit is shown below: 3a Restructuring and impairment charges Unaudited First half 2008 £m Restructuring Other impairments First half 2007 £m Full year 2007 £m (4) – (14) 1 (33) 2 (4) (13) (31) Restructuring Restructuring charges in the first half of 2008 relate to the final actions under the Group’s strategic reorganisation. Costs charged relate mainly to reorganisation costs, including incremental costs borne by the Group as a consequence of dedicated restructuring and transition teams and equipment relocation costs attributable to the transfer of equipment between closing facilities and continuing operations, incremental premium freight and product homologation costs. The costs were incurred in Driveline operations in North America and Europe. In the first half of 2007 restructuring charges arose primarily in respect of the closure of a North American Powder Metallurgy manufacturing facility and continuation of the Driveline strategic fixed headcount reduction programme, which primarily affected its European operations. Restructuring cash outflow was £13 million (first half 2007 – £20 million, full year 2007 – £40 million). The 2007 cash outflow in the first half and full year was net of a £4 million property receipt. Other impairments The £1 million impairment reversal recognised in the first half of 2007 (full year 2007 – £2 million) arose in relation to the Group’s UK cylinder liner manufacturing operation. During 2007 the business disposed of fixed assets at a value greater than the theoretical net book value of the assets had they not been impaired, consequently, a proportion of the previously recognised impairment was reversed. 3b Amortisation of non-operating intangible assets arising on business combinations Unaudited First half 2008 £m Brands/trademarks Proprietary technology rights and know-how Other intellectual property rights Customer contracts and relationships and agreements not to compete First half 2007 £m Full year 2007 £m – (1) (1) (3) – – (1) (2) – (2) (1) (5) (5) (3) (8) 3c Profits and losses on sale or closures of businesses Unaudited First half 2008 £m Profits and losses on closures of businesses Trading losses of the UK cylinder liner manufacturing operation 15684 12/08/2008 Proof 3 – First half 2007 £m (7) Full year 2007 £m (7) 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 17 17 GKN plc Half Year Report 2008 3 Operating profit continued 3d Derivative financial instruments Unaudited First half 2008 £m Forward currency and commodity contracts Embedded derivatives 4 First half 2007 £m Full year 2007 £m (4) – – (1) (10) – (4) (1) (10) Joint ventures Unaudited Group share of results of joint ventures Sales Operating costs and other income Net financing costs First half 2008 £m First half 2007 £m Full year 2007 £m 132 (117) – 125 (109) – 253 (221) – Profit before taxation 15 16 32 Taxation (3) (4) (8) Share of post-tax earnings 12 12 24 Segmental analysis of the Group share of joint venture sales and trading profit Sales Driveline Other Automotive OffHighway 76 54 2 63 60 2 130 120 3 132 125 253 10 5 – 8 8 – 17 15 – 15 16 32 First half 2007 £m Full year 2007 £m Trading profit Driveline Other Automotive OffHighway 5 Other net financing charges Unaudited First half 2008 £m Expected return on pension scheme assets Interest on post-employment obligations 15684 12/08/2008 Proof 3 81 (82) 74 (75) 146 (149) (1) (1) (3) 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 18 18 GKN plc Half Year Report 2008 NOTES TO THE HALF YEAR CONSOLIDATED FINANCIAL STATEMENTS CONTINUED FOR THE HALF YEAR ENDED 30 JUNE 2008 6 Taxation Unaudited First half 2008 £m First half 2007 £m Full year 2007 £m Analysis of charge in period Current tax Current period Utilisation of previously unrecognised tax losses and other assets Adjustments in respect of prior periods Net movement on provisions for uncertain tax positions 28 (7) (1) (1) 18 (1) (2) 1 38 (9) 3 4 Deferred tax 19 – 16 (18) 36 (35) – 2 – 19 – 1 (10) – – 71 – – 84 6 2 Deferred tax on changes in fair value of derivative financial instruments Total tax charge for the period Tax on items included in equity Deferred tax on post-employment obligations Deferred tax on non-qualifying assets Deferred tax on foreign exchange provisions Tax in respect of restructuring and impairment charges Current tax – (3) (7) Deferred tax – (2) 2 – (5) (5) There is a net £nil deferred tax charge in the period, as previously unrecognised deferred tax assets have been recognised, principally in the UK offsetting a charge arising from the reversal, via use, of other deferred tax assets, again principally in the UK. The recognition of the previously unrecognised deferred tax assets has been based on management projections which indicate an ongoing improvement in future taxable profits in the UK and other relevant territories. The tax charge arising on profits before the non-trading components of operating profit as identified in note 3 was £19 million (first half 2007 – £3 million) giving an effective tax rate of 16.0% (first half 2007 – 2.7%). The principal reason for the increase in effective rate is due to deferred tax. Although previously unrecognised deferred tax assets were recognised in both first half 2007 and first half 2008, the benefit arising from this in 2008 is smaller than the 2007 benefit and has also been offset by the reversal, via use, of other recognised deferred tax assets. There was no tax in respect of amortisation of non-operating intangible assets arising on business combinations and profits and losses on sale or closures of businesses. 15684 12/08/2008 Proof 3 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 19 19 GKN plc Half Year Report 2008 7 Earnings per share Basic earnings per share Basic earnings per share are calculated by dividing the profit attributable to equity shareholders by the weighted average number of Ordinary Shares in issue during the period, excluding Ordinary Shares purchased by the Company and held as treasury shares. Diluted earnings per share Diluted earnings per share are calculated by adjusting the weighted average number of Ordinary Shares outstanding to assume conversion of all dilutive potential Ordinary Shares. The Company has only one category of dilutive potential Ordinary Shares: share options. The calculation is performed for the share options to determine the number of shares that could have been acquired at fair value (determined as the average market share price of the Company’s shares) based on the monetary value of the subscription rights attached to outstanding share options. The number of shares calculated as above is compared with the number of shares that would have been issued assuming the exercise of the share options. Earnings per share are computed as follows: Unaudited First half 2008 First half 2007 Full year 2007 Earnings per share p Earnings £m Weighted average number of shares m Earnings per share p 27.9 Earnings £m Weighted average number of shares m Earnings per share p Earnings £m Weighted average number of shares m 97 704.5 13.8 100 702.9 14.2 196 703.4 – 2.1 – 1.9 – – 2.9 97 706.6 100 704.8 14.2 196 706.3 Basic eps: Profit attributable to ordinary shareholders Dilutive securities: Dilutive potential Ordinary Shares Diluted eps (0.1) 13.7 (0.1) 27.8 Adjusted earnings per share Adjusted earnings per share are stated before the non-trading components of operating profit as analysed in note 3. Adjusted earnings per share, which the Directors consider gives a useful additional indicator of underlying performance, is calculated as follows: Unaudited First half 2008 Profit attributable to equity shareholders Charges/(credits) included in operating profit: Restructuring and impairment charges Amortisation of non-operating intangible assets arising on business combinations Profits and losses on sale or closures of businesses Changes in fair value of derivative financial instruments Taxation on charges/(credits) included in operating profit Adjusted earnings attributable to equity shareholders First half 2007 Full year 2007 £m p £m p £m p 97 13.8 100 14.2 196 27.9 4 0.6 13 1.9 31 4.4 5 – 4 – 0.6 – 0.6 – 3 7 1 (3) 0.4 1.0 0.1 (0.4) 8 7 10 (5) 1.1 1.0 1.4 (0.7) 110 15.6 121 17.2 247 35.1 Diluted adjusted earnings per share attributable to 15.6 equity shareholders 15684 12/08/2008 Proof 3 17.2 35.0 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 20 20 GKN plc Half Year Report 2008 NOTES TO THE HALF YEAR CONSOLIDATED FINANCIAL STATEMENTS CONTINUED FOR THE HALF YEAR ENDED 30 JUNE 2008 8 Dividends Unaudited Equity dividends paid in the period Previous year final: 9.2p (2007 – 8.7p) per share Current year interim: (2007 – 4.3p) per share First half 2008 £m First half 2007 £m Full year 2007 £m 65 – 61 – 61 30 65 61 91 An interim dividend of 4.5p per share (2007 – 4.3p per share) has been declared by the Directors. Based on shares ranking for dividend at 30 June 2008 the interim dividend is anticipated to absorb resources amounting to £32 million (2007 – £30 million). 9 Post-employment obligations Actuarial assessments of the key defined benefit pension and post-employment medical plans (representing 98% of liabilities and 98% of assets) were carried out as at 30 June 2008. Post-employment obligations as at the period end comprise: Unaudited 30 June 2008 £m Pensions Medical – funded – unfunded – funded – unfunded 30 June 2007 £m 31 December 2007 £m (142) (260) (10) (38) (28) (253) (27) (47) (24) (260) (9) (38) (450) (355) (331) Unaudited 30 June 2008 UK £m (122) 15684 12/08/2008 Proof 3 Americas £m (70) Europe £m (248) ROW £m (10) Total £m (450) 30 June 2007 £m (355) 31 December 2007 £m (331) 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 21 21 GKN plc Half Year Report 2008 9 Post-employment obligations continued Assumptions Actuarial assessments of all the principal defined benefit retirement plans were carried out as at 30 June 2008. The major assumptions used were: At 30 June 2008 Rate of increase in pensionable salaries Rate of increase in payment and deferred pensions Discount rate Inflation assumption Rate of increases in medical costs: initial long term At 30 June 2007 Rate of increase in pensionable salaries Rate of increase in payment and deferred pensions Discount rate Inflation assumption Rate of increases in medical costs: initial long term At 31 December 2007 Rate of increase in pensionable salaries Rate of increase in payment and deferred pensions Discount rate Inflation assumption Rate of increases in medical costs: initial long term UK % Americas % Europe % ROW % 4.7 3.8 6.5 3.7 3.5 2.0 6.7 2.5 2.50 1.75 6.20 1.75 2.0 n/a 2.3 1.0 8.0 4.5 9.0 5.0 n/a n/a n/a n/a 4.3 3.4 5.8 3.3 3.5 2.0 6.1 2.5 2.50 1.75 5.30 1.75 2.0 n/a 2.5 1.0 8.0 4.5 10.0 5.0 n/a n/a n/a n/a 4.3 3.4 5.9 3.3 3.5 2.0 6.4 2.5 2.50 1.75 5.60 1.75 2.0 n/a 2.3 1.0 8.0 4.5 9.0 5.0 n/a n/a n/a n/a No adjustments to mortality assumptions have been made in the period to those used as at 31 December 2007. The UK scheme assumption is based on PA92 (year of birth) tables adjusted by 2.5 years to reflect actual scheme experience and using medium cohort projections. In the USA CL2007 tables are used, whilst in Germany RT2005G tables were again used. Assumption sensitivity analysis The impact of a one percentage point movement in the primary assumptions on the defined benefit net obligations as at 30 June 2008 is set out below: UK £m 256 (312) (240) 216 Discount rate +1% Discount rate –1% Rate of inflation +1% Rate of inflation –1% 15684 12/08/2008 Proof 3 Americas £m 30 (37) – – Europe £m 31 (39) (25) 22 ROW £m 3 (3) – – 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 22 22 GKN plc Half Year Report 2008 NOTES TO THE HALF YEAR CONSOLIDATED FINANCIAL STATEMENTS CONTINUED FOR THE HALF YEAR ENDED 30 JUNE 2008 10 Changes in equity Unaudited At 1 January Share issues Transfer from income statement Actuarial gains and losses arising on post-employment obligations, including tax — subsidiaries — joint ventures Deferred tax on other items Share-based payments Dividends paid to shareholders Dividends paid to minority interests Currency variations Changes in minority interests Derivative financial instruments – translational hedging – transactional hedging At end of period First half 2008 £m First half 2007 £m Full year 2007 £m 1,196 – 99 908 3 101 908 5 198 (95) – – 2 (65) – 58 1 128 – – 2 (61) – (12) – 140 1 (8) 6 (91) (1) 66 – (32) 11 (28) – – – 1,164 1,080 1,196 11 Property, plant and equipment (unaudited) During the six months ended 30 June 2008 the Group acquired assets with a cost of £83 million (first half 2007 – £71 million). Assets acquired through business combinations were £nil (first half 2007 – £19 million – restated). Assets with a carrying value of £1 million (first half 2007 – £6 million) were disposed of during the six months ended 30 June 2008. 12 Related party transactions (unaudited) In the ordinary course of business, sales and purchases of goods take place between subsidiaries and joint venture companies priced on an ‘arm’s length’ basis. A Group subsidiary also provides short–term financing facilities in respect of one joint venture company. There have been no significant changes in the nature of transactions between subsidiaries and joint ventures that have materially affected the financial statements in the period. Similarly, there has been no material impact on the financial statements arising from changes in the aggregate compensation of key management. 13 Other financial information (unaudited) Commitments relating to subsidiaries’ future capital expenditure at 30 June 2008 amounted to £64 million (30 June 2007 – £50 million) and the Group’s share relating to joint ventures amounted to £nil (30 June 2007 – £nil). 204,513 Ordinary Shares were issued in the six months ended 30 June 2008 (first half 2007 – 1,627,294) which generated a cash inflow of less than £1 million (first half 2007 – £3 million). 15684 12/08/2008 Proof 3 1568 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 23 23 GKN plc Half Year Report 2008 INDEPENDENT REVIEW REPORT TO GKN plc Introduction We have been engaged by the Company to review the condensed consolidated financial statements in the half year report for the six months ended 30 June 2008 which comprises the Consolidated Income Statement, Consolidated Statement of Recognised Income and Expense, Consolidated Balance Sheet, Consolidated Cash Flow Statement and the related notes. We have read the other information contained in the half year report and considered whether it contains any apparent misstatements or material inconsistencies with the information in the condensed consolidated financial statements. Directors’ responsibilities The half year report is the responsibility of, and has been approved by, the Directors. The Directors are responsible for preparing the half year report in accordance with the Disclosure and Transparency Rules of the United Kingdom’s Financial Services Authority. The accounting policies applied in the condensed consolidated financial statements are the same as those applied in the audited consolidated financial statements for the year ended 31 December 2007. The condensed consolidated financial statements included in this half year report have been prepared in accordance with International Accounting Standard 34, ‘Interim Financial Reporting’, as adopted by the European Union. Our responsibility Our responsibility is to express to the Company a conclusion on the condensed consolidated financial statements in the half year report based on our review. This report, including the conclusion, has been prepared for and only for the Company for the purpose of the Disclosure and Transparency Rules of the Financial Services Authority and for no other purpose. We do not, in producing this report, accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save where expressly agreed by our prior consent in writing. Scope of review We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410, ‘Review of Interim Financial Information Performed by the Independent Auditor of the Entity’ issued by the Auditing Practices Board for use in the United Kingdom. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion. Conclusion Based on our review, nothing has come to our attention that causes us to believe that the condensed consolidated financial statements in the half year report for the six months ended 30 June 2008 are not prepared, in all material respects, in accordance with International Accounting Standard 34 as adopted by the European Union and the Disclosure and Transparency Rules of the United Kingdom’s Financial Services Authority. PricewaterhouseCoopers LLP Chartered Accountants 4 August 2008 Birmingham Notes: (a) The maintenance and integrity of the GKN plc website is the responsibility of the Directors; the work carried out by the auditors does not involve consideration of these matters and, accordingly, the auditors accept no responsibility for any changes that may have occurred to the half year report since it was initially presented on the website. (b) Legislation in the United Kingdom governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions. 15684 12/08/2008 Proof 3 15684GKNPLC:15684GKNPLC 12/8/08 14:01 Page 24 24 GKN plc Half Year Report 2008 CONTACT DETAILS Corporate Centre PO Box 55 Ipsley House Ipsley Church Lane Redditch Worcestershire B98 0TL Tel: +44 (0)1527 517715 Fax: +44 (0)1527 517700 London Office 50 Pall Mall London SW1Y 5JH Tel: +44 (0)20 7930 2424 Fax: +44 (0)20 7930 3255 email: information @gkn.com Website: www.gkn.com Registered in England No. 4191106 Registrar Equiniti Aspect House Spencer Road Lancing West Sussex BN99 6DA Tel: 0871 384 2962 (+44 121 415 7039 from outside UK) Fax: 0871 384 2100 (+44 1903 702424 from outside UK) Websites: www.equiniti.com www.shareview.co.uk The half year results were announced on 5 August 2008. This half year report was published on 12 August 2008. 15684 12/08/2008 Proof 3 1568 15684GKNPLC:15684GKNPLC 12/8/08 GKN www.gkn.com 15684 12/08/2008 Proof 3 14:01 Page 26