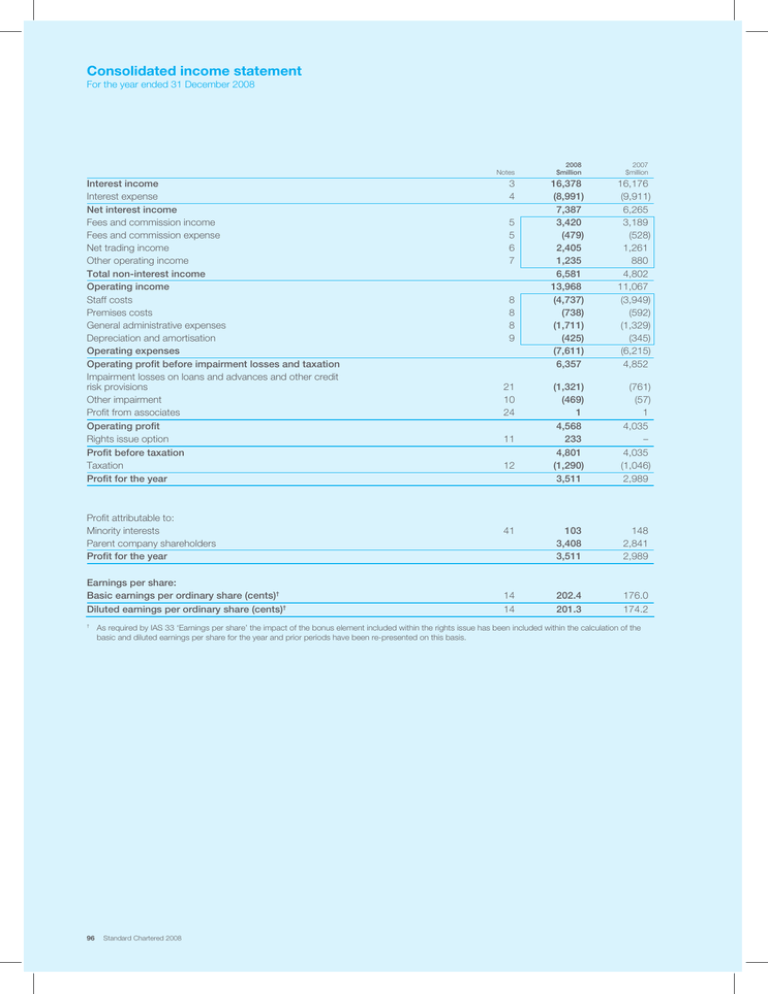

Consolidated income statement

advertisement

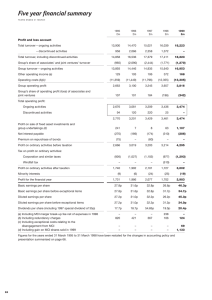

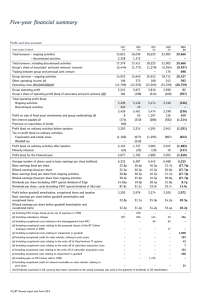

Consolidated income statement For the year ended 31 December 2008 Notes Interest income Interest expense Net interest income Fees and commission income Fees and commission expense Net trading income Other operating income Total non-interest income Operating income Staff costs Premises costs General administrative expenses Depreciation and amortisation Operating expenses Operating profit before impairment losses and taxation Impairment losses on loans and advances and other credit risk provisions Other impairment Profit from associates Operating profit Rights issue option Profit before taxation Taxation Profit for the year Profit attributable to: Minority interests Parent company shareholders Profit for the year Earnings per share: Basic earnings per ordinary share (cents)† Diluted earnings per ordinary share (cents)† † 96 3 4 2008 $million 2007 $million 16,378 (8,991) 7,387 3,420 (479) 2,405 1,235 6,581 13,968 (4,737) (738) (1,711) (425) (7,611) 6,357 16,176 (9,911) 6,265 3,189 (528) 1,261 880 4,802 11,067 (3,949) (592) (1,329) (345) (6,215) 4,852 (1,321) (469) 1 4,568 233 4,801 (1,290) 3,511 (761) (57) 1 4,035 – 4,035 (1,046) 2,989 41 103 3,408 3,511 148 2,841 2,989 14 14 202.4 201.3 176.0 174.2 5 5 6 7 8 8 8 9 21 10 24 11 12 As required by IAS 33 ‘Earnings per share’ the impact of the bonus element included within the rights issue has been included within the calculation of the basic and diluted earnings per share for the year and prior periods have been re-presented on this basis. Standard Chartered 2008