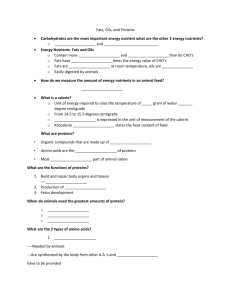

IT [NATIONAL NUTRITION PLANNING

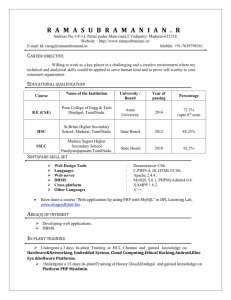

advertisement