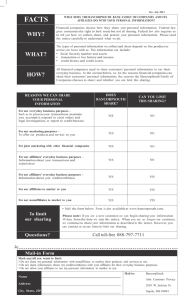

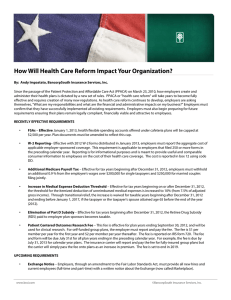

Health Care Reform Timeline 2014 2010 2012

advertisement

Health Care Reform Timeline 2010 • • • • • • • • • • • • • Temporary high risk pool Early retiree reinsurance program Small business tax credit Dependent coverage for adult children until age 26 No pre-existing condition exclusions for individuals until age 19 Rescissions prohibited except for fraud or non-payment Lifetime dollar limits prohibited Annual dollar limits restricted Preventive services with no cost sharing (G) Pediatricians as PCPs, direct access to OB/GYNs (G) ER coverage as in-network, no prior authorization (G) Appeals process and external review (G) Medicare Part D rebate for beneficiaries in the gap 2014 2012 2011 • • • • • • • • • • Summary of Benefits and Coverage and Uniform Glossary • Expanded woman’s preventive services (G) Annual rate review process • 60 day advance notice of material Medical loss ratio (MLR): 85% for modification large group; 80% for small group and • Accountable Care Organization individual requirements HSAs/HRAs/FSAs: limitations for OTC • Quality bonus begins for Medicare medications Advantage plans Increase penalty for non-qualified • Administrative simplification begins HSA withdrawals • 1st medical loss ratio rebates to be Small business wellness grants paid by August (and each subsequent Annual fee on pharmaceutical manuAugust) facturers begins Discounts in Medicare Part D “donut hole” Non discrimination rules apply to insured plans (G) (implementation delayed) Auto-enrollment for Groups with 200+ FTEs (implementation delayed) 2013 • • • • • • • • Health benefit marketplace (Individual and small group) • Guaranteed issue and renewal rules (G) • No annual limits Exchange notices to employees • No pre-existing condition exclusions Employers to report value of employer• Rating restrictions (G) sponsored health benefits on W2s • Individual mandate FSA contributions limited to $2,500 • Tax credits and subsidies for individuals High earner tax begins and small employers Annual fee on medical device sales • Essential health benefits begins • Waiting period limit (90 days) Deduction for expenses to the Part • Mandatory coverage for clinical trials (G) D subsidy for “qualified prescription • Reinsurance fee drug plans” eliminated • Annual insurance industry tax Comparative effectiveness fee for • Cost-sharing limits (G) certain plans • Wellness programs • ICD-10 code adoption 2015 & BEYOND • Employer mandate penalties • States can open Exchange to CHIP eligibles (2015) and all employers (2017) • High-value plan excise tax “Cadillac Tax” begins (2018) • Medicare Part D “Donut hole” closed (by 2020) Rev. 8/1/2013 BancorpSouth Insurance Services Inc. is a wholly owned subsidiary of BancorpSouth Bank. Insurance products are • Not a deposit • Not FDIC insured • Not insured by any federal government agency • Not guaranteed by the bank • May go down in value. Services provided by BancorpSouth Insurance Services, Inc. are supplemental to the insurance carrier and your legal counsel. © BancorpSouth Insurance Services, Inc.