How Will Health Care Reform Impact Your Organization?

advertisement

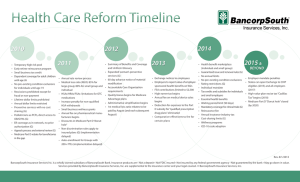

How Will Health Care Reform Impact Your Organization? By: Andy Impastato, BancorpSouth Insurance Services, Inc. Since the passage of the Patient Protection and Affordable Care Act (PPACA) on March 23, 2010, how employers create and administer their health plans is dictated by a new set of rules. PPACA or "health care reform" will take years to become fully effective and requires creation of many new regulations. As health care reform continues to develop, employers are asking themselves, “What are my responsibilities and what are the financial and administrative impacts on my business?” Employers must confirm that they have successfully implemented all existing requirements. Employers must also begin preparing for future requirements ensuring their plans remain legally compliant, financially viable and attractive to employees. RECENTLY EFFECTIVE REQUIREMENTS • FSAs – Effective January 1, 2013, health flexible spending accounts offered under cafeteria plans will be capped at $2,500 per year. Plan documents must be amended to reflect this cap. • W-2 Reporting– Effective with 2012 W-2 forms distributed in January 2013, employers must report the aggregate cost of applicable employer-sponsored coverage. This requirement is applicable to employers that filed 250 or more forms in the preceding calendar year. Reporting is for informational purposes and is meant to provide useful and comparable consumer information to employees on the cost of their health care coverage. The cost is reported in box 12 using code DD. • Additional Medicare Payroll Tax – Effective for tax years beginning after December 31, 2012, employers must withhold an additional 0.9 % from the employee’s wages over $200,000 for single taxpayers and $250,000 for married couples filing jointly. • Increase in Medical Expense Deduction Threshold – Effective for tax years beginning on or after December 31, 2012, the threshold for the itemized deduction of unreimbursed medical expenses is increased to 10% (from 7.5% of adjusted gross income). Through transitional relief, the increase is waived for taxable years beginning after December 31, 2012 and ending before January 1, 2017, if the taxpayer or the taxpayer’s spouse attained age 65 before the end of the year (2012). • Elimination of Part D Subsidy – Effective for tax years beginning after December 31, 2012, the Retiree Drug Subsidy (RDS) paid to employer plan sponsors becomes taxable. • Patient Centered Outcomes Research Fee – This fee is effective for plan years ending September 30, 2012, and will be used for clinical research. For self-funded group plans, the employer must report and pay the fee. The fee is $1 per member per year for the first year and $2 per member per year thereafter. The fee is reported on IRS form 720. The fee and form will be due July 31st for all plan years ending in the preceding calendar year. For example, the fee is due by July 31, 2013 for calendar year plans. The insurance carrier will report and pay the fee for fully-insured group plans but the carrier will simply pass the fee onto plans as an increase in premium. The fee is set to end in 2019. UPCOMING REQUIREMENTS • Exchange Notice – Employers, through an amendment to the Fair Labor Standards Act, must provide all new hires and current employees (full-time and part-time) with a written notice about the Exchange (now called Marketplace). www.bxsi.com ©BancorpSouth Insurance Services, Inc. Model notices are available. For employers who offer (or will offer) coverage, the notice must also contain information regarding minimum value and affordability and the consequences of dropping employer-sponsored coverage. This provision was originally effective March 1, 2013 but has since been extended to October 1, 2013. • Employer Mandate – This provision will require applicable large employers to provide affordable minimum essential coverage to full-time employees and their dependents or potentially pay a penalty. A large employer is an employer that employed an average of at least 50 full-time employees on business days during the preceding calendar year. For purposes of determining whether an employer is a large employer, they must include not only full-time employees but also a full-time equivalent for employees who work part-time. A full-time employee is as an employee who works 30 or more hours per week. There is a special rule for seasonal employees and there are safe harbor methods to determine fulltime status. Shared Responsibility: If a large employer does not offer any coverage, a penalty is triggered when a fulltime employee receives a premium subsidy and enrolls in a product through a State Exchange. The penalty is $2,000 per each full-time employee minus the first 30. Large employers who do not offer affordable minimum essential coverage may also be penalized. The penalty is $3,000 per each full-time employee who receives a premium subsidy and enrolls in a product on a State Exchange. “Affordability” is based on an employee’s household income. Employers may use an employee’s W-2 wages to determine household income. Employers may also use rate of pay or federal poverty level safe harbors. “Minimum value” is based on an employer’s portion of total allowed costs under the plan. Employers will have the option of using a government-provided calculator or checklist or obtaining an actuarial certification to prove minimum value. In order to be eligible for a premium subsidy, an employee must be lawfully present in the United States, have an income between 100% and 400% of the Federal Poverty Level (FPL) and cannot be eligible for Medicare, Medicaid, CHIP, certain veteran’s coverage or affordable minimum essential employer-sponsored coverage. This provision was originally set to become effective on January 1, 2014. However, on July 2, 2013, the Internal Revenue Service (“IRS”) announced a delay of this requirement. IRS is providing transition relief in 2014 for the employer shared responsibility provision and its corresponding reporting requirements. For more information, please see IRS Notice 2013-45. • Guaranteed Availability – This provision will require insurance carriers to accept every employer in that state that applies for coverage. However, carriers will generally be permitted to impose minimum employer contribution and participation requirements to the extent they are consistent with applicable state law. Employers will also be permitted to restrict enrollment by using open and special enrollment periods. Network capacity may also be an exception. • Guaranteed Renewability – This provision will require insurance carriers to renew or continue coverage at the option of the employer. The only exceptions are for nonpayment of premiums, fraud or violation of contribution or participation requirements. • Rating Restrictions – This provision will require insurance carriers providing coverage to non-grandfathered small group plans to limit the ways it can rate a particular group. Currently, rates can vary for several factors (e.g., gender, health status, claims history, UW, group size and industry). In 2014, carriers will only be able to rate based on coverage category (single or family), geography, age (but only 3:1) and tobacco use (but only 1.5:1). • Pre-Existing Condition Exclusions – This provision will prohibit insurance carriers and employers from imposing preexisting condition exclusions on all plan participants (currently prohibited from children under age 19). This prohibition will eventually replace the Health Insurance Protection and Portability Act’s (HIPAA) existing provisions and make the need to track look back periods, limitation periods and creditable coverage periods obsolete. • Essential Health Benefits – This provision will require insurance carriers and employers sponsoring non-grandfathered small group plans to cover essential health benefits. The Department of Health and Human Services has provided ten general categories but individual states have been given a lot of flexibility to define the specific benefits. Products will be labeled based on their respective actuarial value (e.g., Bronze, Silver, etc.). There will also be catastrophic plans available for young adults who cannot afford coverage. • Annual Limits – This provision will prohibit (currently restricted) insurance carriers and employers from imposing annual limits on essential health benefits. • Waiting Periods – This provision will prohibit insurance carriers and employers from imposing waiting or probationary periods in excess of 90 days. “Days” are defined as calendar days, not business days. Also, it is 90 days exactly. Initial enrollment dates of first of the month following 90 days will not be permitted. www.bxsi.com ©BancorpSouth Insurance Services, Inc. • Cost-Sharing Limits – This provision will require insurance carriers and employers sponsoring non-grandfathered plans to limit cost-sharing. Out-of-pocket amounts will not be able to exceed high deductible health plan (HDHP) limits ($6, 350 for self-only coverage and $12,700 for family coverage). Also, all cost-sharing (co-pays included) with the exception of premiums, balance billing and non-covered services must accrue towards the out-of-pocket amount. Finally, deductible amounts for small non-grandfathered groups will be capped at $2,000 for single coverage and $4,000 for family coverage. • Clinical Trials – This provision prohibits non-grandfathered group plans from denying participation in a clinical trial, denying or limiting coverage of routine patient costs for items and services furnished in connection with the trial or discriminate against the individual based on participation in the trial. • Increase in Permitted Wellness Incentives – This provision builds on HIPAA’s existing regulatory framework by increasing the maximum permissible employer reward from 20% to 30% (or up to 50% for programs designed to prevent or reduce tobacco use). • Reinsurance Program Fee – This fee is effective from 2014 through 2016 and is intended to stabilize premiums in the individual market both on and off the Exchanges. For self-funded group plans, the employer must report and pay the fee. The insurance carrier will report and pay the fee for fully-insured group plans but the carrier will simply pass the fee onto plans as an increase in premium. The fee is $63 per member per year. • Insurance Industry Fee – This fee is intended to pay for premium subsidies available through public Exchanges. The fee will be allocated proportionately across the industry according to market share. The fee does not apply to self-funded groups. The insurance carrier will report and pay the fee for fully-insured group plans but the carrier will simply pass the fee onto plans as an increase in premium. As for the amount, predictions are that it could be up approximately $109 per member per year. If you would like more information, contact the authors at healthcarereform@bxsi.com. This publication is provided for educational and informational purposes only and does not contain legal advice. You should not act on any information provided without consulting legal counsel. To comply with U.S. Treasury Regulations, we also inform you that, unless expressly stated otherwise, any tax advice contained in this communication is not intended to be used and cannot be used by any taxpayer to avoid penalties under the Internal Revenue Code. BancorpSouth Insurance Services Inc. is a wholly owned subsidiary of BancorpSouth Bank. Insurance products are • Not a deposit • Not FDIC insured • Not insured by any federal government agency • Not guaranteed by the bank • May go down in value. Services provided by BancorpSouth Insurance Services, Inc. are supplemental to the insurance carrier and your legal counsel.— ©, 2013, BancorpSouth Insurance Services, Inc. www.bxsi.com ©BancorpSouth Insurance Services, Inc.