VALUATION OF QUINCY SHIPYARD: THE YARD FOR INDUSTRIAL WATER-DEPENDENT USES by

advertisement

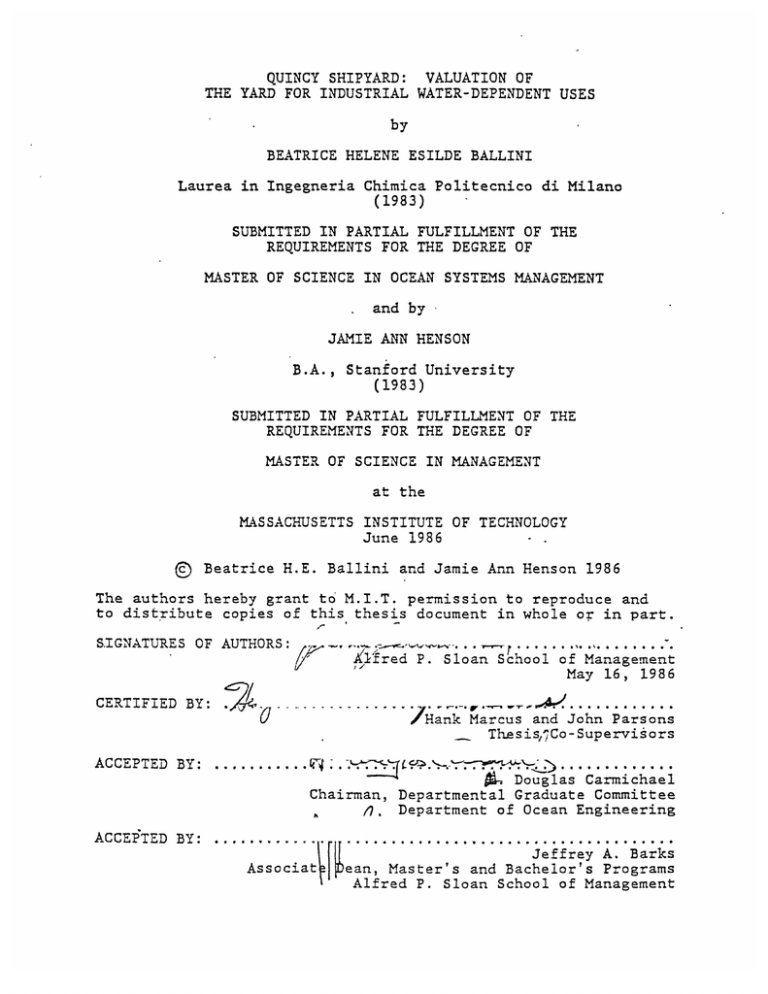

QUINCY SHIPYARD: VALUATION OF

THE YARD FOR INDUSTRIAL WATER-DEPENDENT USES

by

BEATRICE HELENE ESILDE BALLINI

Laurea in Ingegneria Chimica Politecnico di Milano

(1983)

SUBMITTED IN PARTIAL FULFILLMENT OF THE

REQUIREMENTS FOR THE DEGREE OF

MASTER OF SCIENCE IN OCEAN SYSTEMS MANAGEMENT

and by

JAMIE ANN HENSON

B.A., Stanford University

(1983)

SUBMITTED IN PARTIAL FULFILLMENT OF THE

REQUIREMENTS FOR THE DEGREE OF

MASTER OF SCIENCE IN MANAGEMENT

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

June 1986

©

Beatrice H.E. Ballini and Jamie Ann Henson 1986

The authors hereby grant to M.I.T. permission to reproduce and

to distribute copies of this thesis document in whole or in part.

SIGNATURES OF AUTHORS:

...........

.

red P. Sloan School of Management

May 16, 1986

CERTIFIED BY:

..

.

.

Hank

..

Marcus

0 a0 0*

and John Parsons

Thesis,/Co-Supervisors

ACCEPTED BY:

............ .:. 0••

............

$. Douglas Carmichael

Chairman, Departmental Graduate Committee

I

/. Department of Ocean Engineering

ACCEPTED BY:

Jeffrey A. Barks

Associat

ean, Master's and Bachelor's Programs

Alfred P. Sloan School of Management

QUINCY SHIPYARD: VALUATION OF

THE YARD FOR INDUSTRIAL WATER-DEPENDENT USES

by

BEATRICE HELENE ESILDE BALLINI

Submitted to the Department of Ocean Engineering on

May 16, 1986, in partial fulfillment of the requirements for

the Degree of Master of Science in Ocean Systems Management

and by

JAMIE ANN HENSON

Submitted to the Alfred P. Sloan School of Management on

May 16, 1986, in partial fulfillment of the requirements for

the Degree of Master of Science in Management

ABSTRACT

This thesis evaluates the proposed sale of the Quincy

shipyard by General Dynamics Corporation. Its purpose is to

understand the economic factors which characterize the sale

transaction and to develop a conceptual framework for

evaluation of such situations. The shipyard has been chosen

for study because it represents an unresolved market

transaction, in which the public sector is considering direct

or indirect intervention to protect public interest. Further,

because much of the data used is specific to the shipbuilding

industry, this thesis also contributes insight into the more

general problem of shipyard conversion in times of worldwide

overcapacity.

The content has two major focuses: (i) determination of a

fair market price for the shipyard to a private investor,

given future diversification opportunities in industrial

water-dependent activities; and (ii) identification and

analysis of externalities related to the sale. Both are

important to an understanding of the process which will

eventually culminate in an agreement on the shipyard's market

price.

Due to the complexity of this topic, as well as to the

timing of the inquiry, many of the issues addressed are

controversial and highly publicized. The findings are based

on an extensive volume of data collected, in large part,

through interviews with parties involved in different sides of

the transaction.

Thesis Co-Supervisor:

Title:

Henry S. Marcus

Associate Professor of Marine Systems

Thesis Co-Supervisor:

Title:

John Parsons

Professor of Management

-2-

TABLE OF CONTENTS

CHAPTER 1:

Page

8

INTRODUCTION ................................

CHAPTER 2:

HISTORICAL OVERVIEW .........................

A.

The

1.

2.

3.

4.

5.

B.

C.

The

1.

2.

3.

4.

5.

B.

C.

15

15

20

25

28

31

36

36

38

42

44

48

57

57

61

61

65

THE THIRD HARBOR TUNNEL PROJECT .............

67

Description of Alternatives ....................

1. Bored Tunnel versus Sunken Tube Tunnel .....

2. Concrete versus Steel ......................

Steel Tube Construction and Site Requirements

Value of the Steel Tube Construction and

Outfitting Project at the Quincy Shipyard ......

1. Cash Flows .................................

2. Discount Rate ..............................

3. Calculation of Project Value ...............

70

70

72

74

CHAPTER 4:

A.

Quincy Shipyard and General Dynamics .......

History of the Quincy Shipyard .............

General Dynamics' Tenure ...................

The Decision to Close the Shipyard .........

The Impact on Labor ........................

Potential Buyers of the Shipyard ...........

Public Sector Interest in the Future of

Quincy Shipyard ................................

1. The Task Force of the Reuse of the Quincy

Shipyard ...................................

2. Intervention Options Held by the State of

Massachusetts ..............................

a. Exercise of Licensing Powers ...........

b. Participation in Purchase of the

Quincy Shipyard ........................

CHAPTER 3:

A.

Shipbuilding Industry ......................

International Scene: Overview and Trends ..

The U.S. Shipbuilding Industry .............

Cost Disadvantages of U.S. Shipyards in

Commercial Shipbuilding ....................

Changes in Federal Support and Protection

Programs ...................................

Proposed Solutions to Revitalize the U.S.

Shipbuilding Industry ......................

13

83

84

88

93

VALUATION OF A CALL OPTION

Variables Determining the Potential Value of

the Shipyard to Private and Public Buyers ......

-3-

97

B.

98

Application of Options Pricing Theory ..........

Description of Options and Their Valuation .....

C.

Calculation of the Call Option .................

D.

100

102

EXTERNALITIES ...............................

111

A.

Return on Public Investments ...................

1. General Issues .............................

2. Analysis of Three Types of Investments .....

3. Deadweight Loss of Tax Revenues ............

4. Conclusion .................................

117

117

120

131

134

B.

The

1.

2.

3.

136

136

136

138

138

141

147

CHAPTER 5:

Existence of Externalities .................

A General Definition of Externalities ......

Externalities and the Quincy Shipyard ......

Discussion of Potential Externalities ......

a. Impacts on the Local Economy ...........

b. Education of the Work Force ............

c. Commercial Navigation Activity .........

d. Impact on Other Industrial Activities

Around the Weymouth-Fore River Basin ...

e. Potential Loss of the Port Facility

for Future Use .........................

f. Pollution ..............................

g. Change in the Character of Quincy ......

h. Loss of Defence Mobilization

Capability .............................

151

153

154

158

159

....................................

162

CONCLUSION ..................................

166

FOOTNOTES ...............................................

170

C.

Conclusion

CHAPTER 6:

-4-

LIST OF EXHIBITS

Page

Exhibit

1:

2:

3:

4:

5:

6:

7:

8:

9:

10:

11:

12:

13:

14:

15:

16:

17:

18:

19:

20:

21:

22:

23:

24:

25:

26:

27:

28:

29:

30:

31:

32:

New Building Orders and Total Orderbook ........

1983 Shipbuilding Costs, U.S. and Japan .......

New Building Orders for Merchant Ships

in the U .S. ....................................

Trend in U.S. Shipyard Shut-Downs ..............

Comparison of Labor Costs in Real Terms

Between a U.S. and a Japanese Shipyard ........

The State of U.S. Shipbuilding ................

Proposals to Revitalize the Shipbuilding

Industry ......................................

Quincy Shipyard Location .......................

Layout of the Third Harbor Tunnel .............

Sunken Tube Construction Method ...............

Recent Construction of Tunnels in the U.S .....

Construction Operations .......................

Harbor Tunnel Metal Sunken Tube ................

General Dynamics Quincy Shipyard Plan .........

Construction Schedule for Third Harbor

Tunnel ........................................

Cash Flows for the STCO Project Expressed

in 1990 Dollars ...............................

Project Costs and Discounted Cash Flows .......

Discount Rate for the STCO Project ............

STCO Project Decision Tree .........................

Payoff Diagrams ...............................

Calculation of Upper and Lower State Asset

and Call Values ................................

Calculation of the Call Option Value ..........

The Value of the Call Option Under Different

Probability Assumptions .......................

Dredging Projects at Weymouth-Fore River ......

Industrial Facilities with Waterfronts on

Town River Bay, Fore River Bay and King Cove ..

Weymouth-Fore River 35-Foot Project Costs .....

Map of Fore River Bridge ......................

Breakdown of Estimated Costs for Bridge

Reconstruction ................................

% Training Obtained in Different Occupations

On-the-Job versus Off-Production Site .........

Weymouth-Fore River Freight Traffic 1983 ......

Type of Activities Conducted by Industries

Located on the Waterfront in Town or Fore

River Basins ..................................

Net Spillover Benefits: Decisions Available

to the Public Sector ..........................

-5-

19

21

23

24

26

30

32

37

71

73

75

77

78

81

85

86

89

92

99

103

106

108

109

121

123

125

127

130

146

149

150

168

ACKNOWLEDGEMENTS

The authors would like to express gratitute to

Professors John Parsons and Hank Marcus whose guidance

made this thesis possible.

Thanks are also extended to Peter Gwyn, Judy

Kildow, Carl Boutilier, and our anonymous sources, who

provided insights and information that made much of

this thesis possible.

-6-

to our mothers,

-7-

CHAPTER 1:

INTRODUCTION

After a 102-year history, the Quincy shipyard is

closing.

The shipyard, owned by General Dynamics

Corporation, adds its name to a long list of U.S.

shipbuilding facilities which have shut-down over the

last ten years.

Thus, its closure serves as testimony

to the decline of the U.S. shipbuilding industry, and

raises interesting questions about future shipyard

conversion.

General Dynamics' decision to sell the

yard was only the beginning of its problems.

Private

industrial buyers have not shown significant interest

in the yard.

In addition, the public sector, in

particular state agencies and the city of Quincy, have

expressed strong concern about the shipyard's future.

Quincy's conversion process represents a

fascinating and timely opportunity to understand the

economic forces behind a heavily publicized event.

The authors approach this challenging topic through

the use of financial and economic analysis and

concepts, and base their findings on an extensive

volume of data collected, in large part, through

interviews with the various parties involved in the

-8-

situation.

The purpose of this thesis is to understand the

economic factors characterizing the Quincy shipyard

sale transaction.

Given potential opportunities for

diversifying into industrial water-dependent projects,

the authors assess a fair market price for the

shipyard, from the perspective of a private industrial

investor.

The recognition that this assessment, based

on well-proven financial models, constitutes only part

of a more complex problem, leads to an analysis of

public interest in the outcome of the sale.

In the case of Quincy, political pressure has been

asserted to protect social welfare.

The claims for

such protection are based on assumptions of varying

degrees of legitimacy, but the aggregate effect is

interference in a transaction between two private

entities, and modification of market mechanisms.

Thus, interested parties -- the buyer, the seller and

the public sector -- may all have different

assessments of value for the same economic good.

Based on this background, the study proceeds to

identify economic factors which may cause price

-9-

misplacement.

Two potential factors are the expected

return on public investments and the effects of

externalities.

An assessment of the validity of these

issues leads to the finding that public concern in the

sale transaction is justified.

Therefore, the sale of

Quincy shipyard represents a case of market failure,

where social benefits and costs are connected with the

private characteristics of the asset.

Under these circumstances, the public sector has a

legitimate reason to steer the market toward a

decision which takes account of spillover costs and

benefits.

The public sector should therefore

participate in the sale so as to maximize social

welfare.

However, there are reasons, described in our

conclusion, why the government may in fact not

intervene, despite a valuation of net spillover costs.

This thesis begins in Chapter 2 with a description

of the current economic situation characterizing the

U.S. shipbuilding industry.

The recession in the

world shipping industry and the loss of competitive

advantage by U.S. shipbuilders are presented as the

major causes for present excess capacity and for the

recent closure of shipyards.

Chapter 2 then proceeds

-10-

with a more specific analysis of the history of the

Quincy yard and the factors leading to General

Dynamics' decision to sell.

Alternative proposals for

helping the industry and Quincy to survive are also

presented.

The authors argue that diversification in

activities related to ship construction is the best

strategy in the current environment.

Chapter 3 analyzes a real diversification project

which has been proposed for the Quincy shipyard,

namely the steel tube fabrication for the Third Harbor

Tunnel.

A cash flow analysis results in a positive

net present value for the project in year 1990, when

it is expected to begin.

The project's present value

is then determined for use in the option pricing

calculation in the following chapter.

Chapter 4 values the implicit option that a

potential industrial buyer can acquire by purchasing

the Quincy shipyard today.

The option's future and

present values will depend, for the most part, on the

availability of projects, like the Third Harbor Tunnel

project.

The price that an investor will,

theoretically, be willing to pay is the sum of the

option value and the value of the land.

-11-

Chapter 5 addresses the main dilemma of the Quincy

shipyard.

If a private investor can theoretically

assess that the shipyard has a positive market value,

then why does the private sector refuse to buy and why

should the public sector intervene.

the chapter explores two issues:

More precisely,

(i) the existence of

a gap between the price sought by General Dynamics and

the price that a private investor may be willing to

offer; and (ii) the motivations for public sector

intervention in a transaction between private

parties.

The distortion from competitive market

conditions is explained by studying externalities,

which are the costs and benefits that the community

will have to bear as a result of the transaction.

Chapter 5 proceeds with a detailed assessment of

each externality related to closure of the shipyard.

The authors conclude that there are compelling reasons

for public concern with the fate of the shipyard.

The

public sector therefore has an incentive to intervene

in a private market transaction.

Obviously, this

condition adds an element of complexity to the Quincy

shipyard situation, since the seller, the potential

buyer, and numerous public entities have conflicting

interests and different assessments of the asset's

value.

-12-

CHAPTER 2:

HISTORICAL OVERVIEW

This chapter is an introduction to the industrial

setting in which the Quincy shipyard, owned by General

Dynamics, operates.

An explanation of past and

current events in the shipbuilding industry and at the

Quincy shipyard leads to a discussion of the current

decision to sell the yard.

The purpose of this chapter is two-fold.

First,

the authors want to understand the factors that have

affected the destiny of the Quincy shipyard.

Second,

the authors want to understand what alternative

opportunities can be envisioned both for U.S.

shipyards in general, and for the Quincy shipyard in

particular.

The first goal is achieved by considering

overviews of the U.S. shipbuilding industry and of the

tenure of General Dynamics at Quincy.

International

competition and changes in government policies which

affect the U.S. shipbuilding industry are explored in

section A of this chapter.

The relative competitive

position of the Quincy shipyard and its managerial

-13-

implications are described in section B.

The second goal really underlies the entire thesis

project, but it already becomes relevant here.

In

general, the authors advocate that shipyards should

diversify their product lines in order to survive the

current recession in the shipbuilding industry.

However, when this concept is applied to the specific

case of Quincy, several concerns and constraints

become apparent.

An initial description of these

issues is undertaken in sections B and C of this

chapter.

In particular, section C concentrates on the

interest of the public sector in the fate of the

Quincy shipyard.

Several agencies and public concerns

advocate a claim on the outcome of the decision to

sell the shipyard.

Their role and their regulatory

power are also described in section C.

-14-

A.

THE SHIPBUILDING INDUSTRY

1.

International Scene:

Overview and Trends

The demand for new ships, which constitutes the

primary product of any shipyard, is derived from the

demand for trade of physical goods.

Any impact on

shipping services is reflected in shipbuilding sales.

In fact, at any given moment in time, there is a

certain stock of ships in the world.

Some of them may

be under repair, and others temporarily laid up, but

their supply potential is real.

When demand for

shipping services is strong and ships' capacities are

fully utilized, a rush of orders for new ships affects

the shipbuilding industry; but as soon as demand for

shipping services decreases below full capacity,

orders are converted or cancelled.

The shipbuilding

industry is therefore heavily dependent on the status

and on the expectations of the shipping industry.

With the volume of world trade increasing rapidly

and ninety-five percent of all international physical

trade movements made by sea [11,

there is no doubt

that the shipping and shipbuilding industries have to

compete within an international environment.

-15-

Besides

the fact that most countries tend to protect and

subsidize their own fleets, advocating some kind of

mercantilistic policy, international competition

largely affects the shipping industry.

Vessels with

lower operating costs, due to a lower cost of national

labor, have a competitive advantage vessels over

nations with higher wages, especially when there is a

general surplus in shipping capacity.

Shipyards,

where most of the value added to input materials is

represented by labor costs, also strive in an

international environment for some form of cost

advantage.

Dependency of the shipbuilding industry on

the demand for shipping services and the international

competition characteristic of both industries are two

critical factors that will underline the analysis of

this section.

Before we investigate the competitive position of

U.S. shipyards with respect to foreign shipyards, we

need to discuss two issues:

a. recent trends in the shipping industry;

b.

recent trends in shipbuilding orders and

their worldwide geographical distribution.

-16-

The analysis is kept at a general level and is focused

on the commercial sector.

In fact, our intent is to

develop a perception of major constraints and

potential opportunities facing the U.S. shipbuilding

industry.

From 1974 until now, the supply of world shipping

capacity in the merchant fleet has exceeded demand

causing a world surplus that reached 160 million dead

weight tons (dwt) in 1984. [21

(Dead weight tons

measure the weight that a ship can carry in tons.)

The two major sectors of the world merchant marine

fleet, the dry-bulk and the tanker sectors, are both

in trouble.

The dry-bulk sector is experiencing a

chronic overcapacity, and the tanker sector is just

beginning to emerge from a decade of loss-making

freight rates, still with an urgent need to reduce

fleet surplus.

In 1985 the amount of surplus dry-bulk carrier

tonnage was estimated to be at almost 50 million dwt.

[3]

Little comfort comes from a possible boost in the

demand for dry-bulk shipping caused by a growth in the

world's GDP, since the growth in the world's GDP in

1985 was only 2.7% in real terms, and forecasts for

-17-

1986 are not much higher.

Also, the scrapping rate

(the rate at which ships are sold for scrap when not

used for transportation anymore) for dry bulk carriers

was 3.5 million dwt in 1984, 4 million dwt in 1985,

and is expected to reach 6 million dwt in 1986; but

the rate is still too small to considerably improve

the current overcapacity.

The tanker fleet also

reduced its tonnage to 276 million dwt in 1985, down

by 28.2 million dwt from 1984.

However, only if the

recent drop in oil prices continues over a long-term

period and the market does not plunge into a rush of

new orders, will the tanker market eventually emerge

from its chronic overcapacity.

The surplus tonnage in the merchant fleet has

caused a slowdown in new building orders.

Exhibit 1

reports new building orders in 1983 and 1984, and the

world orderbook (record of backlog orders for ship

construction) in 1984 and 1985.

The Exhibit shows a

decrease in both new building and cumulative new

orders worldwide.

The recession of the shipping

industry therefore has a direct negative impact on the

shipbuilding industry.

This negative impact affects some nations more

-18-

EXHIBIT 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

I~i::::::::

.r..~........

....~·a~l~i

...[-[.

........................................

....................li~I~~~ii~~):

.. . .. . . .. . . .. . . .. . . .. . .

..

.

.

.

.

.

.° .

.

..

7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

3

,4

1980 1981 1982 1983 1984

Sources:" US Shipping and Shipbuilding:

Trends and Policy Choices,"

Congress of the US,

Congressional Budget Office,

August 1984

" Shipping Shipyards and Sealift:

Issues of National Security and

Federal Support,"

Nacoa Report, preliminary draft,

1985

. . .• •.

..

.

. .

. . . . .

. . . . . . . .

. . . . . .

. . . .° . .

.... .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

•.

.

.

.

..

.

.

..

.

.

.

.

.

.

.

.

.

.

.

. .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.o

.

.

.

. ,

•..

. .

.

.

.

.

.

.

.

.

.

.

.

.

. .o .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

,.

..

.

.

.

.

. .• .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. .• .

.

.

.

.

. .• .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. .• .

.

.

.

.

.

.

.

.

. .

.

.

.

.

.

.

.

.

.

.

. .

-19-

than others, namely those nations that are at a

comparative disadvantage in building ships, either

because of higher costs or use of less advanced

technologies.

The results from Exhibit 1 indicate

that two nations, Japan and Korea, have the largest

share of world merchant shipbuilding orders, and

therefore should have some form of competitive

advantage or strong government support to maintain

their dominant positions.

In fact, more efficient

production methods, low real cost of labor, and a

supportive national industrial policy have enabled

Japan and South Korea to cut their shipbuilding costs

and gain a competitive edge.

Exhibit 2 shows

shipbuilding costs in the U.S. and Japan.

It

indicates that, for example, a merchant ship built in

Japan costs one third as much as the same ship built

in the United States. [4]

2. The U.S. Shipbuilding Industry

The excess capacity in the world shipping industry

and the competitive cost advantage of foreign yards

have put the U.S. shipbuilding industry in an

unfavorable situation.

A large part of that

industry's business has historically come from two

-20-

EXHIBIT 2

(90 ,000dwt)

country built

Japan

69.0

96.0

US

22.5

34-3

source: "US Shipping and Shipbu ilding: Trends and

Policy Choices," Congres

.

.84

, 8

Congressional Budget Of .ic

s

of

.

the

.

•

----------------------------

-21-

.

•

US,

•

.

•

.

•

•

.....

•

• •

•

•

•

•

.

•..

major sectors:

commercial and military.

Commercial

shipbuilding orders have reached very low levels in

the last five years, and naval orders have not been

sufficient to support the shipbuilding capacity of

major yards in the United States.

(Major yards are

defined as having at least one shipbuilding position

large enough for a vessel of minimum 475 foot length

by 68 foot beam.)

In 1982, out of twenty-seven major

shipyards in the U.S., only three were doing

commercial work.

Four have since gone out of business

or run out of ships to build, and ten more will finish

Navy construction projects in the next three years.

[51

If we add to this situation the decline in

building orders for merchant ships over the period

1981-1983 and the inadequate recovery of 1984, we have

the major reasons for an increase in plant shutdowns.

Exhibit 3 shows the trend in new shipbuilding orders

for merchant ships in the U.S., and Exhibit 4 the

trend in plant shutdowns.

The decline in commercial shipbuilding orders is

caused by the following factors:

a.

the real cost disadvantage of U.S. shipyards

with respect to yards in Japanese, South

-22-

EXHIBIT 3

1983

million

grt

1984

market

share W

million

grt

1985

market

million

share W

grt

new building orders

SJapan

11.13

56.8

8.39

55.4

6.63

South Korea

3.74

19.1

2.29

15.1

1.2

WORLD TOT AL

19.6

100

15.14

100

n.a

20 2

43

South Korea

7.05

15

4.67

VORLD TOT AL

47

100

27.5

total orderbook

SJapan

SSource: Lloyd's Register, Far eastern Economic R vie.w

Feb.13, 1986, pp 47

:.South Korea

3.74

19.1

2.29

15.1

-23-

10.45 .

1..2

.

EXHIBIT 4

...........

•.......~.••.....o..o.......o.o....

. .•

.•

.°

.. °

.

•.

.

.

•

.

. . •.

. .. . .

.

. .

.•........•.......•....°•...o..........••...

...................

°°..=.•.o•...........•....

.°........•..................°.•.°.......•....

.

•

.

•

°

.

. ° . .

.

.

.

°

.

.

•

.

.

.

•

. .

. .

.

.

.

•

. .

.

.

.

.

:::::::::::::::::::::::rQ

....

,..................................

..........

...........................

.....................................

........................................

1956-65

.....

o.,.•.....

•........

•o.•

1966-75

1976-85

Source: Booz Allen & Hamilton,

"Potential reuse study of the Quincy

Shipyard," February 1986

•

•.

.o

.

.

:

.•

.* . .

•

°

.-

-.

....

. °

. *••

° *. . •

-24-

•.

• .* .*.

.

.

.. .

.

°

.

.•.

. •

°

Korean and Taiwanese yards, stemming from the

lower productive efficiency and higher cost of

labor (in real terms) at the U.S. yards;_

b.

changes in federal support and programs

protecting the maritime industry.

Both factors are analyzed hereafter and supported by

industry data.

3.

Cost Disadvantages of U.S. Shipyards in

Commercial Shipbuilding

It is estimated that 34% of a ship's value comes

from input materials and 66% from the labor intensive

manufacturing process. [6]

Thus the cost of labor and

labor productivity are two critical parameters for the

measurement of competitive position in the

shipbuilding industry.

The higher cost of labor in

real terms has put U.S. yards at a competitive

disadvantage with respect to yards in Asia.

Exhibit 5

shows a comparison of labor costs in real terms

between a U.S. and a Japanese shipyard.

Not only are

U.S. costs higher than foreign costs, but also

production efficiency is lower.

-25-

It is estimated that

EXHIBIT 5

.. . . .......

. .. ..

.. . .. . . . ..

. . .. . . .. . .. ..

.. . . . . .....

.. ..

....

....... ..... .. .......-... ....I................ . I

.....

. . . . . .• .

..w..

. . 't..

.

,. . .l,:

. . . . . . . . . . . . . . . ..

..- . . .

. =.. . .

.

t.. . ..

6=

iI .bs-b-O

9• * in ==..................

inflation rate ( i. in %)

1980

4.9

1981

2.6

1982

1729

1773

i

JAPAN

Labor cost in manufacturing

of transport equipment (gen/hr)

inflation rate ( i in

%)

109

Labor cost i n manufacturing

10-39

2.6

11-12

of transport equipment (yen/hr)

inflation rate ( i

10

in %)

us

Exchange rate ( E $/__enl

.0049

6

.0045

.0042

.0043

.0040

7.43

7.09

X

Real Exchange rate( __$gen

(i+i

X= E

(1+i

)

ja

)

us

Real Japanese vges in $

sources: Yearbook of Labor Statistics, tnternational Labour Office

of Geneva, 43rd issue, 1983

.1

International Moody's,1981,1982,1983

!

.. . . . . . . . .. . . . . . . . . .. . . . . . . . .

::·-:·

·:·i·

· · · :·:-·:·

· ·:- ·

:·

........................................................

-26-

the delivery time of yards in Asia is almost always

less than for a U.S.-built ship.

For example, a

recent proposal by Lykes Bros. Steamship Company to

build C-9 container ships calculated a delivery time

of 24 months for foreign-built ships and 36 months for

American-built ships. [7]

Historically, the competitive disadvantage of the

U.S. maritime industry has been supported by

construction and operating subsidies (CDS and ODS

respectively) to make up for the cost differentials in

constructing and operating U.S. vessels.

Cargo

preferences under the Jones Act have also supported

the U.S. flag shipping industry by requiring that all

cargo shipped by water from one U.S. port to another

U.S. port must be carried in U.S. flag ships, built in

U.S. shipyards, and owned by U.S. citizens.

Financing

subsidies under Title XI, the Capital Construction

Fund (CCF) and Investment Tax Credit (ITC) legislation

have provided substantial incentives for capital

investments in ship construction.

-27-

4.

Changes in Federal Support and Protection

Programs

The Reagan administration has discontinued the CDS

program, granted ODS and CCF for foreign-built ships,

and cancelled Title XI. [8]

These actions are

intended to boost the U.S. shipping industry and its

participation in world trade.

With no direct

subsidies and few orders, the U.S. shipbuilding

industry is undergoing a major shake-out period.

The

shipyards that still survive are those which have been

able to secure Navy contracts and position themselves

to best compete for Navy ships.

The Naval ship construction program has expanded

during the Reagan administration.

The Five Year

Defense Plan (FYDP) for 1984-1988 had an allocated

budget in 1984 of more than $12 billion, and the FYDP

for 1985-1989 has only slightly been lowered from the

1984 level. [9]

However, there are two major problems

with the Navy business, and those are:

a.

Orders are not distributed evenly across the

major shipyards, and therefore are not

sufficient to support all of those yards;

-28-

b.

Navy projects are somewhat volatile.

It is estimated that 75% of Navy construction work

(in terms of budget) goes to the few major yards that

have successfully positioned themselves to handle the

sophisticated technological requirements of Navy

work.

Among these stand Newport News Shipbuilding in

Virginia, Bath Iron Works in Maine, and Ingalls in

Mississippi.

The remaining 25% of the Navy budget

includes construction of auxiliary ships or the

conversion of existing ships.

The number of Navy

vessels under construction at private shipyards is

shown in Exhibit 6.

Many of the major shipyards have

not been able to position themselves for the bulk of

Navy work.

They must compete for the remaining

portion of it and experience conditions of chronic

overcapacity.

The reliance on a single buyer (the Navy) in the

shipbuilding industry represents a monopsony

situation, with substantial bargaining power in the

hands of the buyer.

This creates an unstable

situation for many commercial shipyards since not only

can the Navy's FYDP change substantially from one year

-29-

EXHIBIT 6

The @QoDG of9M@[pbOiDOin

i

------

--

---

I ------

Number of vessels under construction •

or on order at private shipyards

Litter (Ingalls)

Pasca gouia, MS

Bell Aeroespace, Textron

. New Orleans. LA .

Todd Shipyards

Galveston, TX ,

11 shltps

ship .

I..

1

SIthip

Soum: US Navy. March 1985

~

I-

-30-

-

-

-

_1 ------· 111~--

to the next, but also there are limited alternative

sources of work for the major shipyards.

5.

Proposed Solutions to Revitalize the U.S.

Shipbuilding Industry

The future of the U.S. shipbuilding industry can

derive little from the present situation, and many

different groups have proposed solutions to help the

industry overcome its current problems.

A brief

description of some proposals to revitalize the U.S.

shipbuilding industry follows hereafter.

In general, all proposed solutions affect

commercial shipping and shipbuilding since the two

industries are tightly connected.

categories of solutions:

There are two broad

those implying federal

support - direct, indirect or political; and those

advocating the benefits of free market competition.

Exhibit 7 lists the different types of proposals

according to the two categories and their effects on

the shipping or shipbuilding industries.

Solutions implying federal support are based on

assumptions that the U.S. shipbuilding industry cannot

-31-

EXHIBIT 7

°

.

•

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

•..

.•.

.

.

.

.

.

.

. .

.

.

.

.

.

.

.

Shi pbuildi ng

Shi ppjng

direct

Shipbuilder

Council of

America ,L Rice

Shipbuilder

Council of

America, L.Rice

policies

Cargo Preference

Cargo Preference

Navy

John Lehman

John Lehman

NACOA report

-authors" opinion-

Federal

suRPort

Free market

Source - authors

'. * .

..

.

.. . .

.

.

.

.

.

.

.

-32-

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

compete under free market conditions and that the

maritime industry in general should be treated as an

integral part of the economic and defense policies of

the U.S. government.

The resurrection of the CDS

program and the build-and-charter program

(constructing from the government's account and then

chartering to private operators) are examples of

direct federal support and intervention.

The cargo

preference regime is another example of a supportive

policy that allocates a fixed percentage of U.S.

traded cargo to U.S. ships.

Finally, the Navy (listed under federal support

because its FYDP budget is approved by the government)

is considered a solution to survival of the shipping

industry.

The rationale behind supporting

shipbuilding through Navy contracts has recently been

explained by John Lehman, Secretary of the Navy. [10]

Lehman claims that the Navy, with its system of

competitive bidding, helps to keep the shipbuilding

industry alive by creating a competitive environment.

Whether this view is legitimate or not, the point

remains that some rationalization of the industry may

in fact be undertaken through Navy contracts.

-33-

Among advocates of free market conditions to help

revitalize U.S. shipping and shipbuilding industries

is the National Advisory Committee on Oceans and

Atmosphere (NACOA).

NACOA recommendations include:

a

co-production ten year plan under the Jones Act to

relax domestic building provisions; and liberalization

of CCF provisions to allow reinvestment of the tax

deferral of U.S. flag shipping profits in foreign ship

construction.

The authors of these proposals think that one way

to save the productive capacities of shipbuilding

facilities is to diversify the activities of shipyards

into related products and to support technological

innovation in the production process.

By broadening

their product lines, shipyards can lower the risks

associated with the widely fluctuating demand pattern

for new ships and can potentially disentangle the fate

of their business from that of the shipping industry.

Diversification would also mitigate the effects of

dependence on a single buyer in shipbuilding.

Further, through support of technological innovation,

shipyards can maintain a competitive position by

offering products that are differentiated in terms of

their technological content.

-34-

The Quincy Shipbuilding Division of General

Dynamics, aka "the Quincy shipyard," is an example of

a major U.S. shipyard forced to close as a result of

both the slump in the shipping industry and the

effects of international competition among shipyards.

The issue of shipyard conversion in the U.S., given

the reality of shipbuilding overcapacity, and the

roles played by both the public and private sectors in

deciding the fate of individual yards are discussed in

this thesis.

The controversy surrounding the Quincy

shipyard is seen as representative of that which other

U.S. shipyards potentially face or are currently

facing.

Quincy is therefore used to outline issues

and to introduce an analytical framework for

definition of public interest in shipyard conversion.

-35-

B.

THE QUINCY SHIPYARD AND GENERAL DYNAMICS

1.

History of the Quincy Shipyard

The Quincy Shipyard was founded in 1884 as The

Fore River Engine Company by Thomas A. Watson, a

machinist reknown for his association with Alexander

Graham Bell, in East Braintree.

Watson moved the yard

downstream to its present location, as shown on

Exhibit 8, in 1900. The initial business at the yard

was in farm engines, but later expanded to include

first marine engines and then construction of marine

vessels.

In 1913, Watson sold the yard to Bethlehem

Steel Corporation, under whose auspices it was renamed

the Fore River Shipbuilding Corporation.

Fifty years

later in early 1963, Bethlehem Steel closed the yard

due to a lack of Navy contracts.

In December, 1963,

it was sold to General Dynamics Corporation for $5

million.

Throughout the yard's 101-year history, more than

six hundred vessels have been designed and built

there, with output levels closely paralleling U.S. war

activities. [11]

Production peaks have occurred

during the Spanish-American War in 1898, later during

-36-

EXHIBIT 8

QiwMUE

B@jhciPtf Latioo

RAINSFORD i.

SHUZC£

AV

A

SHEEP .1'

1U2Jy'c V NA V

35' TURNING

(1NIEK

*r

:RAPE 1.

8' STATE

LATEI

QUINCY

RPS OF ENGINEER

-37-

World Wars I and II, and finally in the late 1960s,

reflecting American involvement in Vietnam.

2.

General Dynamics' Tenure

General Dynamics has pursued both commercial and

government contracts in an effort to maintain

production activities at the shipyard.

Although the

relative proportion of government to commercial

contracts has oscillated over time, 7% of all merchant

ships produced in the U.S. in the last 22 years were

built at Quincy. [121

Commercial business has primarily been in the

construction of tankers and barge carriers.

Quincy

was the world's leading producer of liquified natural

gas (LNG) tankers, until demand for those ships

disappeared.

Its "LNG program" was a response to the

disappearance of Navy work in the early 1970s.

The

program lasted from 1972, when the first LNG contracts

were negotiated, to 1981, when the last tanker was

delivered.

In total, 10 LNG tankers were constructed.

[13]

As part of the LNG program, General Dynamics

-38-

invested heavily (more than $75 million) in new

equipment specific to LNG tanker production.

The

result of that investment is that Quincy is one of the

most modern shipyard facilities in the U.S. with a

very high steel throughput capacity.

The major

improvement which were made include:

a.

conversion of two conventional sliding ways

ways to large construction basins;

b.

new steel fabrication process line with a

a substantial amount of updated equipment;

c.

1,200-ton Goliath bridge crane which is the

largest in the Western hemisphere;

d.

new materials handling equipment including two

200-ton transporters and robotics equipment;

e.

new facility at Charlestown, South Carolina,

for the fabrication of spherical tanks. [14]

This investment program reflected management's

prediction that the LNG business would expand and

their consequent strategic decision to create a niche

-39-

for Quincy in that market.

Demand for LNG tankers

eventually waned, however, due to a number of factors,

which included:

the softening of oil prices, an

increase in concerns about the safety of storing LNG

tankers in urban harbors, and the failure of the U.S.

and Algerian governments to reach contract agreement

regarding LNG transport.

The demise of the LNG program dealt a severe blow

to the Quincy yard.

Because LNG tankers require

substantial steel work and throughput, while Navy

construction contains a high proportion of outfitting,

investments made under the LNG program equipped the

yard for a market which no longer exists.

In the end,

much of the new equipment purchased was barely used,

and, having been built into the facility through

concrete foundation for specific shipbuilding uses,

cannot be resold except to a new shipbuilder operator

with similar steel work requirements.

The LNG program represented Quincy's largest

investment in commercial shipbuilding.

Because they

sustained substantial losses, management was hesitant

to pursue commercial work requiring any significant

initial investment the'reafter.

-40-

The commercial

shipbuilding industry in the U.S. has since dried up

almost completely, as discussed in the previous

section, and Quincy is predominantly dependent on

government contracts for shipbuilding.

General Dynamics is a major military contractor,

and owns two shipyards: its Quincy Shipbuilding

Division and its Electric Boat Division in Groton,

Connecticut.

The two yards have focused on different

ends of the Naval shipbuilding industry:

Quincy

builds smaller, less complex support ships including

auxiliary, amphibious and merchant hulls; and Electric

Boat builds submarines.

Quincy's market is more

competitive, as many other shipyards have the capacity

for support ship construction, but not for submarine

construction.

In addition, Quincy's contracts are

individually less valuable and of shorter duration.

Specifically, the estimated total value of support

ship contracts should be $17 billion during the

1986-1995 period, while those of submarine contracts

only will be approximately $15.5 billion [15]; and the

production period for support ships averages 2 to 3

years, while that of submarines is 4 to 6 years [16].

The demand for support ship construction has

-41-

steadily diminished over the last 30 years, as the

Navy has chosen to overhaul old support ships or

convert commercial ships, rather than commission new

orders. [17]

The trend has intensified competition

among the numerous shipyards geared towards this

market.

Quincy won its last contract for two Marine

Prepositioning Ships (MPS) on August 18, 1982; the

contract was expanded to include three more ships the

following year.

delivered:

Four MPS vessels have been

the "2nd Lt. John P. Bobo" on January 19,

1985, the "Pfc. Dewayne T. Williams" on May 18, 1985,

the "Ist Lt. Baldomero Lopez" on October 26, 1985, and

the "Ist Lt. Jack Lummus" on February 22, 1986.

The

fifth MPS, the "Sgt. William R. Button" is scheduled

for delivery in May, 1986. [18]

3.

The Decision to Close the Shipyard

On July 24, 1985, General Dynamics announced that

it would close the Quincy shipyard after the last MPS

vessel is delivered.

Gary Grimes, the yard's vice

president and general manager, stated that the

decision to close was made "after assessing upcoming

Navy contracts and deciding Quincy had little if any

chance of winning them."

[19]

-42-

Another probable reason

behind the decision is that the shipyard does not meet

General Dynamics' expected return on investment.

According to the company, of the 21 years to 1985 that

General Dynamics owned the shipyard, 9 years were

profitable and 11 unprofitable. [20]

Prior to the decision to close, General Dynamics

lost three bids for contracts.

The first was for a

$341 million commercial contract to build container

ships; that contract was lost to a foreign bidder in

October, 1984. [21]

The second bid for a $525 million

Navy contract to build three fleet oil tankers was

awarded to Avondale Shipyards Inc. of Avondale, La.,

and Pennsylvania Shipbuilding Co. of Chester, Pa.

[22]

The third bid for a $130 million Navy contract

to construct two TAGS surveillance ships went to

Bethlehem Steel of Sparrows Point, Md.

Loss of the third bid was a particular blow to the

Quincy yard.

The contract was expected to generate

1,000 jobs per year into 1988. [23]

Industry sources

affirm that Bethlehem's bid, which was substantially

below the Navy's cost estimates, will not support

completion of the ships.

They also claim that because

Bethlehem does not have sufficient cash from

-43-

-'I

operations to cover cost "overruns" (which will

obstensibly be due to design alterations), the Navy

will be obliged to provide further financing to ensure

the ships' completion in the future. [24]

The government charged General Dynamics with using

the same strategy in the past, i.e. bidding under cost

and later overcharging for design alterations in order

to win contracts.

That and other charges have

resulted in law suits which are still pending against

General Dynamics may have contributed to the company's

recent lack of success in obtaining contracts for

Quincy.

Increased public scrutiny and credibility

problems ensure that the company's bidding will remain

conservative for the duration of legal proceedings.

4.

The Impact on Labor

Employment at the shipyard has fluctuated widely

with production levels:

from 812 workers during the

Depression to 32,000 during World War II, and from 0

in 1963, when the yard was closed by Bethlehem, to

over 11,000 in the late 1960s. [25]

During General

Dynamics' recent tenure, the shipyard employed, on

average, 6,000 to 7,000 workers in the 1970s, and

-44-

4,000 to 5,000 workers in the 1980s. [26]

In 1984,

employment grew to 6,300 when work on the MPS vessels

was at its peak. [27]

On April 30, 1985, General Dynamics announced that

because it had not secured any contracts for future

work, 3,100 of the 5,267 workers on payroll would be

laid off by the end of the year. [28]

Layoffs had

already been occuring as MPS work decreased, but the

announcment in April served to formalize management's

expectations regarding future contract opportunities.

By July 24, 1985 when the company announced that the

yard would be closed, there were 4,203 workers left on

the payroll. [291

About one-quarter of those are

salaried white-collar workers who are expected to keep

their jobs but transfer to new locations. [30]

The

remaining 3,300 hourly workers have been laid off in

stages to be completed in May, 1986 when the final MPS

vessel is delivered.

Thereafter, a skeleton crew will

be maintained until December, 1986.

Of the 3,300 hourly workers scheduled for layoff,

800 are from Quincy, 1,000 from Boston, and the

remainder from other parts of the state.

Of that same

number, 1,000 have worked at the shipyard for 15 years

-45-

or longer, 1,200 for 5 to 15 years, and 1,100 five

years or less. [31]

The majority of hourly workers scheduled for

layoff fall predominantly into the following type of

skill categories:

shipfitters, riggers, loftsmen,

welders/flamecutters, machinists, electricians,

pipefitters, sheetmetal workers, boilermakers and

electronics mechanics, rigger-erectors, production

laborers, carpenters, chippers and burners.

Only the

first three categories are unique to shipbuilding; the

others are in general use in equipment manufacture and

construction industries. [32]

Demand for these labor categories is relatively

elastic, except when demands for the products of

industries competing for labor are rising.

Since

rising demand does not typify the current economic

condition of most competing industries, demand for

Quincy's labor force is at present relatively elastic.

The economy may be unable to absorb the highly-paid,

skilled workforce from Quincy at wages to which they

are accustomed, and the expected hardship to those

workers is of major concern to the state government.

In particular, workers from the first three skill

-46-

categories and those who are least mobile will be

hardest hit.

The traditionally cyclical nature of work in

shipbuilding is similar to that of the construction

industry, which has in fact provided the most direct

competition for shipbuilding labor in the past.

Construction work could eventually offer the single

most significant source of comparable work to Quincy's

labor force.

Construction pays more on average than

shipyards for the same skills, even though

shipbuilders work under dirtier, more cramped, and

noisier conditions; this wage differential is due to

the fact that shipyards offer more stable employment

in a fixed location.

Workers have been willing to

trade off those benefits for lower wages. [33]

The

possibility that a sizable percentage of workers will

be employed, within Massachusetts or nearby states, in

construction activities is important in that, under

this scenario, remobilization of the workforce at

Quincy would be possible sometime in the future.

Remobilization potential is an important factor to

shipbuilders or other industrial operators who

consider purchasing the yard.

-47-

5.

Potential Buyers of the Shipyard

When General Dynamics publicly announced that the

Quincy yard would be closed, the company indicated

that it "would consider conversion of the yard to

other uses and sale of the yard to another shipyard,

to employees, or to developers seeking to use the yard

for an industrial park or condominiums."

[34]

Initially General Dynamics focused on other

shipbuilders as the major pool of potential buyers.

The company's sales effort included a mass mailing of

brochures to all major U.S. defense contractors and

shipyard owners.

However, due to the present

condition of the U.S. shipbuilding industry, as

previously discussed, most large shipbuilders are

unwilling at this time to acquire new capacity.

The possibility that a smaller, entrepreneurial

shipbuilder with experience in Naval contracting could

run a profitable business at the shipyard, either now

or sometime in the medium-term future, can not be

dismissed.

General Dynamics has not specifically

targeted this type of shipbuilder in its marketing

activities as the company prefers to sell the entire

-48-

yard to a single buyer.

A shipbuilder could use only

a portion of the yard's capacity because of the

current scarcity in large Naval contracts, but such a

buyer could eventually complement other industrial

buyers if the yard is diversified.

General Dynamics did enter into negotiations with

one entrepreneurial buyer, Frank Rack.

Rack had

worked with General Dynamics for 17 years, but left

his position as deputy operations manager at Quincy in

1973.

In December 1985, Rack founded Genesis

Shipbuilding and signed a tentative agreement with

General Dynamics to purchase the shipyard.

Rack

intended to produce four $200 million luxery liner

cruise ships, which could be converted to military

uses during wartime, at Quincy.

The success of his

plan depended, however, on the provision of $75

million per ship in subsidies by the federal

government.

The tentative agreement with General

Dynamics expired in January 1986, when Rack failed to

gain the cooperation of Congress or the Armed Services

Committee. [35]

Since that time, General Dynamics has

not reported any other solicitations from shipbuilder

entrepreneurs.

-49-

~,QLclSZ~;~.-d~4~M1S118;4i~jF~748~(~WI~* rrmmr

In examining industrial conversion of the yard,

General Dynamics has focused on large single buyers.

Large manufacturing companies, specifically those

involved in industries which require heavy lift, heavy

machining and ocean access, are viewed as the second

most-likely target buyer group.

The main problems

General Dynamics has encountered in attracting these

types of companies have included the relatively high

wage rates, expensive real estate, low unemployment

rate, and lack of state-sponsored business incentives

in Massachusetts.

Large manufacturing companies

easily locate, or relocate, wherever costs are lowest,

as they usually are not dependent on retaining skilled

labor.

Other constraints are that the yard has limited

highway and rail access.

The yard is located at a

distance from main highway arteries.

And, although

one Conrail spur services the Braintree end of the

shipyard, its overhead bridge allowances are low.

The

flat railcars used for steel transport are of an

acceptable height, but most container-type cars,

particularly those used for shipping, are too tall for

the overpasses.

Large U.S.-based manufacturers often

rely on highway and rail access for receipt of

-50-

supplies and product distribution, rather than on

ocean transport.

For this reason, shipyard conversion

or diversification in nations like Japan, Taiwan and

South Korea would be less problematic in that many of

their industries are water-dependent.

Advocates of diversification believe that smaller

industrial businesses or projects could be found to

utilize the shipyard's productive capacity.

Such

projects would ideally be water-dependent, need some

proportion of skilled labor, and require geographic

location either within the region or in the state of

Massachusetts.

The last characteristic would typify,

for example, small manufacturers with local suppliers/

buyers or public works projects.

Coordination of this

type of many-project or many-buyer diversification

requires creativity, a long-term perspective and

dedication to the conversion plan.

A large, private

military contractor such as General Dynamics, using

its own industry-specific requirement for return on

investment, would generally show little interest in

directing such an effort.

Groups, such as the South Shore Conversion

Committee (SSCC), believe that the failure of General

-51-

Dynamics to find a successful means of converting the

shipyard to other industrial uses is due to management

inflexibility.

They believe that a large enough

number of projects could have been found to generate

the company's required return on investment.

Further,

the SSCC charges that General Dynamics did not

seriously pursue conversion because the community

support for that alternative made it a political

issue.

They have proposed that the yard be used to

produce "plant ships" that could generate electricity

or process timber at sea (designed by the Applied

Physics Lab of John Hopkins University).

However,

neither private investors nor public utilities have as

yet shown an interest in plant ship investment. [36]

Leaders of the shipbuilders union in Quincy have

steadfastly opposed conversion of the shipyard.

They

believe that their members would, in all probability,

be forced to accept lower wages for any other type of

work which could be done at the shipyard.

They

believe that either General Dynamics or another large

shipbuilder operator could make the yard profitable

through employment of more modern shipbuilding

methods, such as pre-outfitting or modular

construction, methods currently used in Japan.

-52-

They

accuse General Dynamics of failure to make the

appropriate capital investments and lack of managerial

know-how. [37]

In fact, General Dynamics would be the first to

admit that it made a strategic error in its massive

LNG investment program during the 1970s.

Whether or

not they should have foreseen that the LNG business

would wane is arguable.

Although the union's

accusations may be true, the fact that no private

investor is now willing to invest in modernizing the

shipyard reflects:

the decreased demand in the

shipbuilding industry, as previously discussed; and

the unlikelihood that a large shipbuilder under

current economic conditions will be able to obtain an

acceptable return on investment.

There has been a recent proposal that former

workers buy the shipyard with state financing.

Despite potential assistance from the state, the

receipt of federal support, in the form of loan

guarantees, would also be needed to ensure the idea's

success.

The plan is to obtain small shipbuilding

contracts, and to supplement those revenues with

temporary diversification projects, until shipbuilding

-53-

,~X1Pr*-~~~~n~.4.p*~,~·tBlrNi-~~~k-

-~BDB*ll~r~YII~1I~YPYiT~j5fir~~~~B1~M~~~UY

'~p~-e~~U~Wlls~·~~rrr~Ul~(i41CUI~~~

becomes economically feasible at some point in the

future.

The union is thus far divided on the issue,

because the plan's success will depend on the

acceptance of lower wages by the small portion of

workers who are allowed to remain.

The state is

tentatively interested in this particular alternative,

and may request a $100,000 ($75,000 from the state and

$25,000 from the union) study on the feasibility of an

employee buyout. [38]

Factors which influence the

state's concern and degree of potential participation

are discussed in both section C of this chapter and in

Chapter 5.

General Dynamics requests that all bids and

proposals be submitted by August, 1986.

The company

has expressed a willingness to cooperate with state

and union representatives in selling the site for a

price lower than that optimally obtainable from the

market [39]; whether they will actually take such

action remains to be seen.

A number of private

developers have contacted both General Dynamics and

the Quincy Planning Department to express interest in

purchasing the yard for commercial and residential

development.

The yard would have to be rezoned for

those types of uses, as described in Chapter 5,

-54-

however the booming South Shore economy may enable a

developer to offer a price which is higher than that

currently obtainable from the industrial sector.

In conclusion, the authors of this thesis hold the

view that if industrial diversification is undertaken,

particularly with the participation of a shipbuilder

entrepreneur and/or former shipyard workers, the

shipyard could survive profitably, while maintaining a

sizable number of blue-collar jobs and its industrial

water-dependent setting.

Without diversification, the

shipyard may remain idle, may eventually be sold to a

large industrial manufacturer with no need for skilled

labor, or may be rezoned for residential uses.

Given this range of potential outcomes, various

government agencies and representatives are concerned

about sale of the yard and its impact on the public.

Due to the fact that no single shipbuilder, or

industrial buyer similar to General Dynamics, has been

found, a smooth transition (from the public's

perspective) to a new owner is less likely.

The

government bears the responsiblity of ensuring that

public interests are protected in the decision-making

process.

Major public entities currently involved in

-55-

resolution of this situation, and their respective

mandates, are described in the next section.

-56-

C.

PUBLIC SECTOR INTEREST IN THE FUTURE OF QUINCY

SHIPYARD

1.

The Task Force of the Reuse of the Quincy

Shipyard

When General Dynamics announced that the Quincy

shipyard would be closed, the Massachusetts state

Governor, Michael S. Dukakis, established a task force

to investigate possible alternatives for use of the

shipyard.

That group met for the first time on August

13, 1985 in Boston.

A representative of the state's

Department of Industrial Services, an agency designed

to help companies facing economic troubles, chairs the

task force.

The other seventeen members include state

Labor Secretary Paul Eustace, Secretary of Economic

Development Evelyn Murphy, the economic advisor to

Governor Dukakis, state legislators from Quincy,

Boston, Weymouth, and other South Shore communities,

Local 5 of the Marine and Shipbuilding Workers Union

at Quincy, General Dynamics, and representatives from

a variety of other state agencies.

The state is interested in outcome of the sale

because of the potential direct impacts on the local

-57-

economy, which include:

loss of state tax revenue,

state expense for unemployment benefits, loss of

property tax to the cities of Quincy and Braintree,

and loss of income to businesses which supply or

service the shipyard.

Government agents are also

concerned about the personal hardship to former

shipyard employees, most of whom are state residents,

and about any potential less tangible effect on the

community and on the local environment.

Finally, the shipyard is a "designated port area"

(DPA), a state classification usually given to

developed areas with port facilities, often used for

heavy industry, where few or no natural land forms or

vegetation remain. [40]

The state is concerned that

maintenance of Quincy as a DPA may be of sufficient

value to the public that an alternative which uses its

industrial and port capacities should be enforced.

Each of the government's concerns regarding direct and

indirect effects of closure of the shipyard are

discussed in Chapter 5 in greater detail.

Two state agencies were interviewed by the

authors:

the Department of Industrial Services and

the Office of Coastal Zone Management.

-58-

The opinions

of each of those offices are described below.

The Department of Industrial Services favors that

alternative industrial use which promises to support

the maximum number of former shipyard workers.

They

are strongly opposed to any use which would not employ

blue-collar workers.

In particular, the agency

believes that a shipyard should be maintained on the

site, whether it uses all of the yard's capacity, or

part of it in conjuction with other diversified

industrial activities.

The Executive Director of

Industrial Services hired Booz-Allen & Hamilton, a

management consulting firm, on behalf of the task

force to prepare a $100,000 report on reuse of the

shipyard; that firm concluded that the U.S.

shipbuilding industry will be revitalized in the

medium to long-term future, and that other industrial

diversification opportunities will not fully utilize

the yard's capacity. [41]

The office of Coastal Zone Management (MCZM) is a

policy and planning branch of the Executive Office of

Environmental Affairs.

Its policies are implemented

by the Department of Environmental Quality Engineering

(DEQE) and various other agencies.

-59-

The MCZM is

primarily concerned with the fact that the shipyard

site is a designated port area, and as such, must be

used in accordance with waterways regulations which

give preference to marine-related industrial uses at

port areas.

In other words, if there is a viable

water-dependent industrial use for the shipyard, the

MCZM is obliged to give priority to that use through

the DEQE licensing procedure and, when necessary, to

enforce it.

The MCZM's general guidelines are clear;

its problem in this case is to ascertain whether a

viable water-dependent industrial use for Quincy

actually exists and, if one does, how to steer the

private sector toward that preferred use. [42]

Each government player has slightly different

jurisdiction in the protection of public interest, but

a general consensus exists among state representatives

on the optimality of continued shipbuilding and/or

alternative water-dependent industrial uses at the

Quincy site.

Of course, the latter use is qualified

to exclude industrial uses which cause excessive

environmental pollution or disruption as detailed in

the Environmental Impact Report (explained below).

If one or more buyers appear that fit the optimal

-60-

use profile, the state can facilitate the transaction.

However, if shipbuilder or industrial buyers fail to

appear, the state will have to decide whether or not

to intervene in the situation.

The state's various

alternatives to influence the outcome of the sale are

described in the next section.

2.

Intervention Options Held by the State of

Massachusetts

Although the state usually prefers not to

intervene in private sector transactions, it is

empowered to take whatever action is needed to enforce

public interest.

Government agencies are responsible

for protection of the environment and certain limited

resources, the economy (if possible), and the "quality

of life" of persons living under their jurisdiction.

For these purposes, the state of Massachusetts has

regulations, ownership of specified public lands "ad

infinitum," and income from taxes, from which the

following options for intervention stem:

a.

exercise of licensing powers

Any new owner of the shipyard property will have

-61-

to go through an elaborate licensing process to gain

permission to use or in any way alter facilities under

the state's control, which include all facilities

located seaward from the historical mean high water

mark. [43]

These lands are owned by the state of

Massachusetts "ad infinitum" and are protected by laws

which regulate their usage.

The historical mean high

water mark at Quincy is landward from all drydocks,

and in some areas may include a substantial proportion

of the industrial facilities.

In fact, a considerable