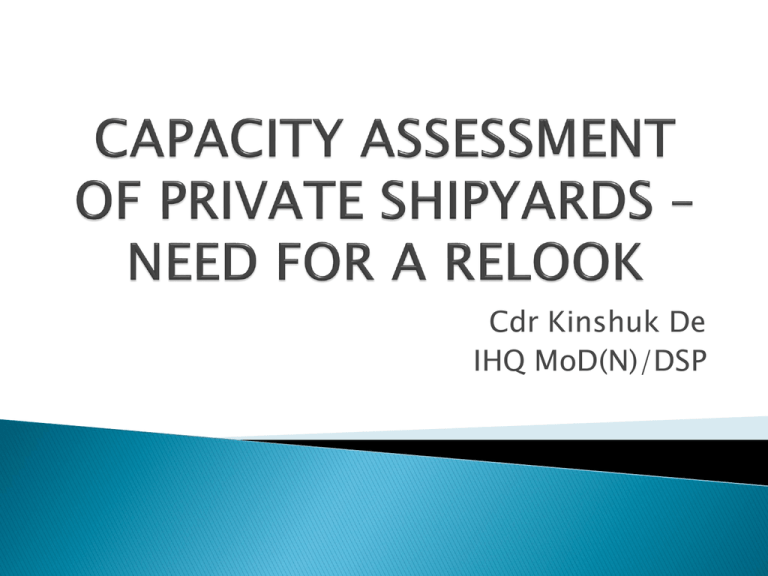

capacity assessment of private shipyards – need for a relook

advertisement

Cdr Kinshuk De IHQ MoD(N)/DSP • • • • • • • • • Organisation & Infrastructure Shipbuilding Experience Product Profile Details of Collaboration Turnover and Financial Health Personnel with Background Orders Executed in last 05 years Orders in Hand and Future Orders Plans • • • • Production facilities and Process Control Design Capability Quality Control Procedures Legal Issues Capacity Assessment Committee scrutinises Report of WOT with inputs of Domain experts • Report approved by CWP&A • RFP for Type of ships are thereafter issued to Shipyards with valid and current Capacity Assessment • Validity is Two Years • SHIPBUILDING COUNTRY MAJOR SHIPS UNDER CONSTRUCTION PERCENTAGE Western Europe Russia USA India Turkey South Korea Poland Portugal Malaysia Argentina Japan Denmark Australia China Indonesia Chile Colombia Iran Thailand 109 40 33 22 20 9 7 6 5 5 4 3 3 2 2 2 2 1 1 39.5 14.5 12.0 8.0 7.2 3.3 2.5 2.2 1.8 1.8 1.4 1.1 1.1 0.7 0.7 0.7 0.7 0.4 0.4 S NO CLASS OF SHIP INDIAN YARDS (a) Aircraft Carrier 1 (b) Destroyer 3 (c) Frigate 3 (d) Corvette 4 (e) Offshore Patrol Vessel 4 (f) Replenishment Tanker (g) Submarine (h) Fast Attack Craft/Extra Fast Attack Vessels (FAC/XFAC) (i) Sail Training Ship 1 (j) Survey 6 (k) Landing Ship Tank (L) 4 6 10 62% vessels are delivered in good quality, within the budget and on time. 27% of vessels are delivered beyond one year after delivery date. •11% orders either get cancelled or land up in arbitration • Strengths Maturity of Defence. Rise in private shipyards participation. Strategic location. No. 2 in trained manpower. Low building cost. Low cost of labour. Opportunities Continual enhancement of Defence budget outlay for Capital acquisition. Allowances of 26% FDI by Government of India. Likely to be raised soon. Setting up of 1600 Km ship building park. Overwhelming response exhibited by industry & academia. Active participation by private industry for development of products. Weaknesses Capital intensive Economy of Scale Insufficient level of indigenisation. Lack of expertise to develop weapon system. Dependence on foreign suppliers for upgrades. limited capacity. Long gestation period in design and construction. Threats Delays arising out of long procurement procedure. Time and cost overruns. Critical technology not transferred through ToT. Private Sector participation will improve the overall cost benefit, competition, participation, sector development, widen expertise etc • Due diligence, risk assessment during the decision making process • Need for continuous assessment of the shipyards for their capacity and competence to deliver Naval Warships • Private shipyards have defaulted to deliver Yardcrafts and Survey vessels on time primarily due poor financial health, error in assessment of costs and shipyard capacity • Issuance of RFPs may have been an error due in-accurate assessment of financial strength • Limited Domain expertise within Navy to look at Balance Sheets • Shipyard’s ability to compete and stay in business is greatly affected by its ability to know what it costs to do business • Need for rigorous financial assessment as per checklists prior to Capacity Assessment by Credit Rating agencies with knowledge of present market dynamics, risks, rating of clients, management etc • Process initiated • • Check Lists • Financial assessment by Credit Rating Agencies • Reputation of management, Promoters, track record and experience • Assessment of production facilities, production process, productivity, • Logistics • Current order book, • Knowledge, innovation, product mix, workforce Check Lists • Planning & design infrastructure • Organization & HR practices • Procurement procedures • Subcontractors, quality assurance, safety, health and environment • Relationship with unions Need for weighted consideration of factors in Capacity Assessment with emphasis on financial assessment for Risk Assessment to ensure Quality Warships, Within Costs and on Time for our Navy Questions