Opening statement by Supachai Panitchpakdi Secretary-General of UNCTAD

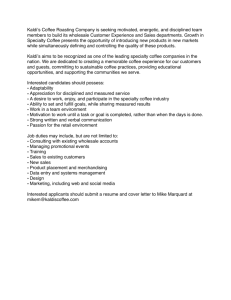

advertisement

Opening statement by Supachai Panitchpakdi Secretary-General of UNCTAD to the Secretary-General’s Multi-stakeholder Consultation on Trade and Development Issues relating to Coffee Geneva, 8 April 2009 Ministers, Excellencies, Distinguished Participants, Ladies and Gentlemen: It is a great honour for me to welcome you to this consultation on coffee. This is the second in a new series of consultations on a specific commodity. The first, held in December 2008, was devoted to cotton. UNCTAD XII, held in Accra in April 2008, reconfirmed UNCTAD’s mandate to play a key role in addressing the trade and development problems associated with the commodity economy. The “Accra Accord” also stipulated that the UNCTAD secretariat, under the guidance and leadership of the Secretary-General, should contribute more effectively to the efforts of developing countries to formulate strategies and policies to respond to the challenges, and utilize the opportunities, of commodity markets. This meeting is intended as one step towards fulfilling that mandate, and has two objectives: First, to review the opportunities and challenges for trade in coffee in the evolving global economic and trade environment. And second, to identify ways in which low-income coffee-exporting countries can be assisted in responding to the challenges and opportunities of commodity markets. The idea, ultimately, is to enhance the sector's contribution to economic growth, development, and poverty reduction. We believe that this meeting is important for a number of our member countries, for several reasons: First, because coffee is the most valuable tropical agricultural product. It is produced in over 50 countries in Africa, Asia and Latin America and contributes substantially to job creation, export earnings, economic growth, and the overall development process. Second, coffee generates cash incomes in subsistence economies, and because it is labour-intensive, it provides rural employment for both men and women, making it instrumental to poverty reduction. The third key fact about coffee is that its consumption has been growing steadily worldwide, at about 2.5% per annum, and was estimated at around 128 million 60kilo bags in 2008. And fourth, this consumption is concentrated in the mature markets of Western Europe and North America, but it is growing much faster in emerging markets, including in Eastern Europe and Asia, and in the coffee-producing countries themselves. But this potential has to be weighed against reality. Coffee prices, like those of most agricultural commodities, have always been highly cyclical in nature. We all remember the most recent coffee price crisis, which began in 2000 and continued until the end of 2004. During those five years, many coffee producers were unable to cover their production costs and only continued to produce coffee because they had no alternative. This led to a slump of more than 50%, which translated into losses in earnings for coffee-producing countries of more than $30 billion. In the years that followed, coffee prices have recovered considerably. Export revenues of producing countries in the “coffee year” 2007/08 were estimated at $15.2 billion – as compared to just $6.2 billion between 2000 and 2004. Unfortunately, the financial crisis is turning the tide yet again: Coffee prices fell by almost 20% between late August and December 2008. How has the crisis affected the coffee market, from consumption and production to trade? Consumer behaviour differs, of course, from one market to another. In North America, Europe and Japan, which account for about 58% of world consumption, coffee consumption is holding up well. Instead of reducing overall intake, the response of consumers in those regions is more likely to consist of a shift from out-ofhome consumption to in-home consumption. Elsewhere, the situation is less clear. As to coffee production, there have been considerable gains in coffee productivity over the past two decades. However, production costs have also risen considerably, mostly because of rising prices of key inputs, such as fertilizers, transportation and labour. Even at the higher coffee prices that prevailed prior to the onset of the financial crisis last September, producers, especially those of Arabica coffee, could barely meet their production costs, and as a result had little incentive to invest in new plantings. While current levels of production are just about sufficient to meet demand, they are not enough to meet the projected future rise in consumption. A major determinant of the response of individual countries will be exchange rate policy. In key coffee-producing countries like Brazil and Colombia, with floating exchange rates, the depreciation of the dollar in recent years had a major impact on profitability. Their growers could not reap the full benefits of the recovery in coffee prices since 2004. By contrast, producers in countries whose currencies are linked to the dollar, such as Viet Nam, were able to take advantage of higher prices on the international market. The situation is now likely to be reversed. Indeed, currency movements are now a key force in the price behaviour of futures markets for many commodities, and coffee is no exception. This brings me to the effect of the crisis on world trade in coffee. At the macroeconomic level, export revenues from coffee are expected to fall. Despite successful diversification in most coffee-producing nations, the crisis is likely to affect those countries that are still heavily dependent on coffee exports for a significant share of their export earnings. These include Burundi (52%), Ethiopia (31%), Honduras (23%), Uganda (17%), Nicaragua (17%) and Guatemala (12%). Retailers have become more cautious; consolidation is taking place; economic agents are seeking to diversify their client base even more; and hedging has become more 2 expensive. At the same time, barriers to trade persist in some importing markets. Tariff escalation in particular – that is, higher tariffs on processed coffee – continues to impede full market access by a number of coffee-producing countries. Distinguished Delegates, Ladies and Gentlemen: Let me turn now to some of the strategic development issues deriving from current trends. As coffee prices generally trend downwards in the long term (i.e., in inflationadjusted terms), the need to address these issues becomes rather critical. The need is reinforced by the cyclical nature of the coffee market. It is thus pertinent to adopt measures that can restore some balance between supply and demand in order to improve prices. This is particularly the case when one considers the difficulties of pursuing alternative economic activities in many coffee-dependent countries. The excellent paper before you from the International Coffee Organization contains a long list of possible measures and strategic areas for action, based on the specific objectives in Article 1 of the International Coffee Agreement 2007. From both our perspectives, undoubtedly the most urgent area is the promotion of a sustainable coffee economy. Climate change is expected to exert an increasing influence on coffee production in the coming years, necessitating appropriate adaptation and mitigation strategies. The ICO also seeks to promote the use of environmentally friendly technologies throughout the production and processing chain; integrated biological pest control; and improved technology for the washing process. There are other key areas, such as increased consumption and market development; quality enhancement; diversification; improvement of marketing systems; R&D of new technologies; and rehabilitation of production capacity. I hope our deliberations today will identify the technical assistance required to take action in these areas, particularly in the poorer coffee-producing countries. I look forward to a highly productive consultation. Thank you very much. * *** * 3

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)