5.1: Compound interest Section 5.1-5.3

advertisement

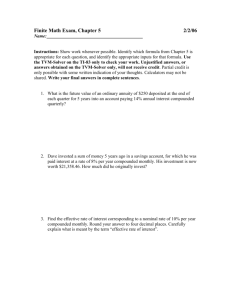

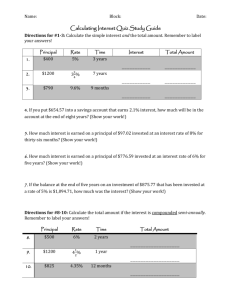

Notes for math 141 Section 5.1-5.3 Finite Mathematics 5.1: Compound interest Definition: Simple Interest Formulas If I denotes the interest on a principal P (in dollars) at an interest rate of r (as a decimal) per year for t years, then we have: Interest: Accumulated Amount Example 1: Find the simple interest on a $2, 000 investment made for 3 months at an interest rate of 6% per year. What is the accumulated amount? Example 2:An investment paying simple interest at the rate of 5% per year grew to $3,100 in 10 months. Find the principal. 1 Notes for math 141 Section 5.1-5.3 Finite Mathematics Example 3: Find the annual simple interest rate required for an investment to grow from $1,000 to $2,500 in 18 months. Example 4: Find the accumulated amount after 3 years if $3,500 is invested at 5% interest per year compounded annually. Example 5: Find the accumulated amount after 3 months if $1,000 is invested at an annual interest rate of 4.5% compounded monthly. 2 Notes for math 141 Section 5.1-5.3 Finite Mathematics Definition: Compound Interest Formula where A = Accumulated amount at the end of the time period P =Principal r =Nominal interest rate per year m = Number of compounding periods per year t =number of years Example 6: Find the accumulated amount after 5 years if $3500 is invested at an interest rate of 3.8% per year compounded quarterly? 3 Notes for math 141 Section 5.1-5.3 Finite Mathematics Calculator Use: TVM Solver: We can use the TVM Solver on our calculator to solve problems involving compound interest. To access the Finance Menu, you need to press APPS →1:Finance (Please note that if you have a plain TI-83, you need to press 2nd x−1 to access the Finance Menu). Below we define the inputs on the TVM Solver: • N =the total number of compounding periods • I% = interest rate (as a percentage) • PV = present value (principal amount). Entered as a negative number if invested, a positive number if borrowed. • PMT = payment amount (0 if no payments are involved) • FV =future value (accumulated amount) • P /Y = C/Y =the number of compounding periods per year. Move the cursor to the value you are solving for and hit ALPHA and then ENTER. In all of the problems we do make sure that END is highlighted at the bottom of the screen. This represents that payments are received at the end of each period. 4 Notes for math 141 Section 5.1-5.3 Finite Mathematics Example 7: How much is in an account after 10 years if $1000 is invested at 2.4% annual interest compounded a) annually? b) quarterly? c) monthly? d) weekly? e) daily? f) continuously? 5 Notes for math 141 Section 5.1-5.3 Finite Mathematics Definition: Continuous Compound Interest Formula A = P ert where P=principal, r=Annual interest rate compounded continuously (as a decimal), t =Time in years, A=Accumulated amount at the end of t years. Definition: Suppose a sum of money is invested at an annual rate of r expressed as a decimal and is compounded m times per year. The effective yield is the equivalent interest rate if compounding was only done once a year and can be found as follows: Example 8: What is the effective yield of 7.58% per year compounded monthly? 6 Notes for math 141 Section 5.1-5.3 Finite Mathematics Calculator Use: We use the C:Eff( option on the Finance Menu to compute the effective yield. The inputs are as follows: Eff(annual interest rate as a percentage, the number of compounding periods per year) 7 Notes for math 141 Section 5.1-5.3 Finite Mathematics Example 9: Find the present value of $30,000 due in 6 years at an interest rate of 8%/year compounded monthly. Example 10: How long will it take an investment of $8,000 to grow to $10,000 if the investment earns interest at the rate of 6%/year compounded daily? Example 11: How long will it take an investment to double if it is invested in an account that earns an annual interest rate of 5.25% compounded quarterly? 8 Notes for math 141 Section 5.1-5.3 Finite Mathematics Annuities,Sinking Funds and Amortization Definition: An annuity is a sequence of payments made at regular time intervals. In general, the amounts in the payments need not be equal. Definition: An Ordinary Annuity is an annuity in which payments are made of at the end of each payment period. Definition: An Annuity Due is an annuity in which payments are made at the beginning of each payment period. Definition: A Simple Annuity is an annuity in which the payment period coincides with the conversion period. In this course, we will study annuities with the following properties: 1. The terms are given by fixed time intervals. 2. The periodic payments are equal in size. 3. The payments are made at the end of the payment periods. 4. The payment periods coincide with the interest conversion periods. Definition: Any account that is established for accumulating funds to meet a future need is called a sinking fund. 9 Notes for math 141 Section 5.1-5.3 Finite Mathematics Example 1: Since you are a poor college student you currently have $10 in your bank account. If you put $50 each month into your bank account that earns 3.45% compounded monthly, how much would you have when you retire? (Lets assume that is 46 years from now) Example 2: How much would you need to put into that same bank account which earns 3.45% compounded monthly if you want $1;000;000 when you retire? (i.e. 46 years from now) How much money did you actually put into the bank account? Example 3: If instead you waited 10 years to start putting payments into your bank account, how much would the payments need to be to have $1;000;000 when you retire? How much money did you actually put into the bank account? (Use the same information from Example 2) 10 Notes for math 141 Section 5.1-5.3 Finite Mathematics Example 4: You are searching for a new car and not sure what you can afford. Youve discovered that you can get a 60 month loan with a 5.24% interest rate compounded monthly. Looking at your current income, youve decided that you can afford a $400 monthly car payment. Whats the most expensive car that you can afford? Example 5: At the beginning of 2000 Jenny and Eddie bought a house for $170,000. They financed it for 30 years at a 6.9% annual interest rate compounded monthly on the unpaid balance. a) What were their monthly payments? b) How much total interest would they end up paying? c) At the beginning of 2004 they decided to refinance their house with a 30 year mortgage that has a 5.325% annual interest rate compounded monthly on the unpaid balance. What are their new monthly payments? d) How much total interest are they saving by refinancing? 11 Notes for math 141 Section 5.1-5.3 Finite Mathematics Example 6: Angie has graduated from college and is ready to start paying back her student loans. She has determined that she will need to make monthly payments to pay back her student loans of $30,000 over a 20 year period with a 6.125% annual interest rate compounded monthly on the unpaid balance. a) What will her monthly payments be? b) How much total interest will she be paying? c) Angie has received good advice from her family and friends and has decided to pay $100 extra each month towards the principal. How long will it take her to pay-off the student loans now? d) How much total interest will she be paying now that she is paying an extra $100 a month? e) How much money is Angie saving in interest by paying the extra $100 each month? Example 7: You purchase a $150,000 home. You put 10% down and then fiance the remaining balance with a 30 year mortgage that has an interest of 5.75%/year compounded monthly. a) What is your required monthly payment? b) If you decide to pay $400 extra each month, how long will it take you to pay-off the mortgage? c) Create an amortization schedule for the first two payments and the 101st payment without the extra payment. d) Create an amortization schedule for the first two payments and the 101st payment with the extra payment. 12