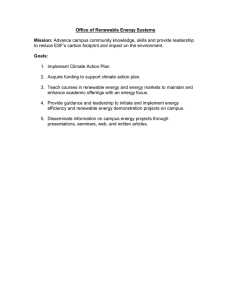

Successful Business Models for New and Renewable APEC Energy Working Group

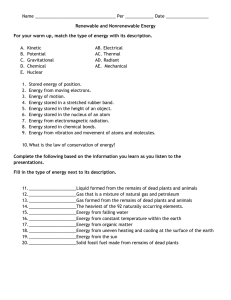

advertisement