M28 FIXED WING TRANSPORT AIRCRAFT ...

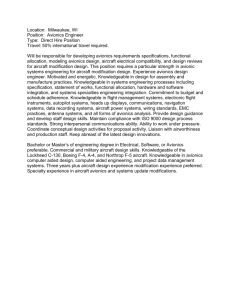

advertisement