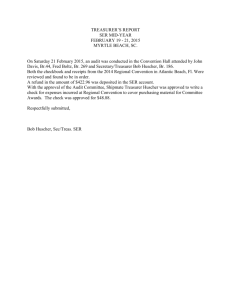

Una audited F Financia

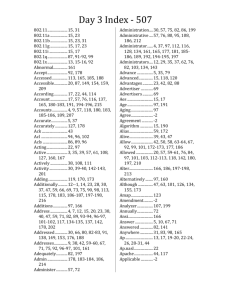

advertisement