An Overview of the Medical Tourism Industry in Chennai, India

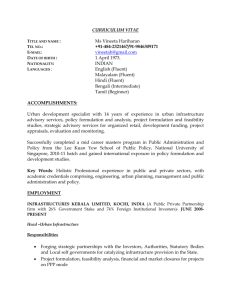

advertisement