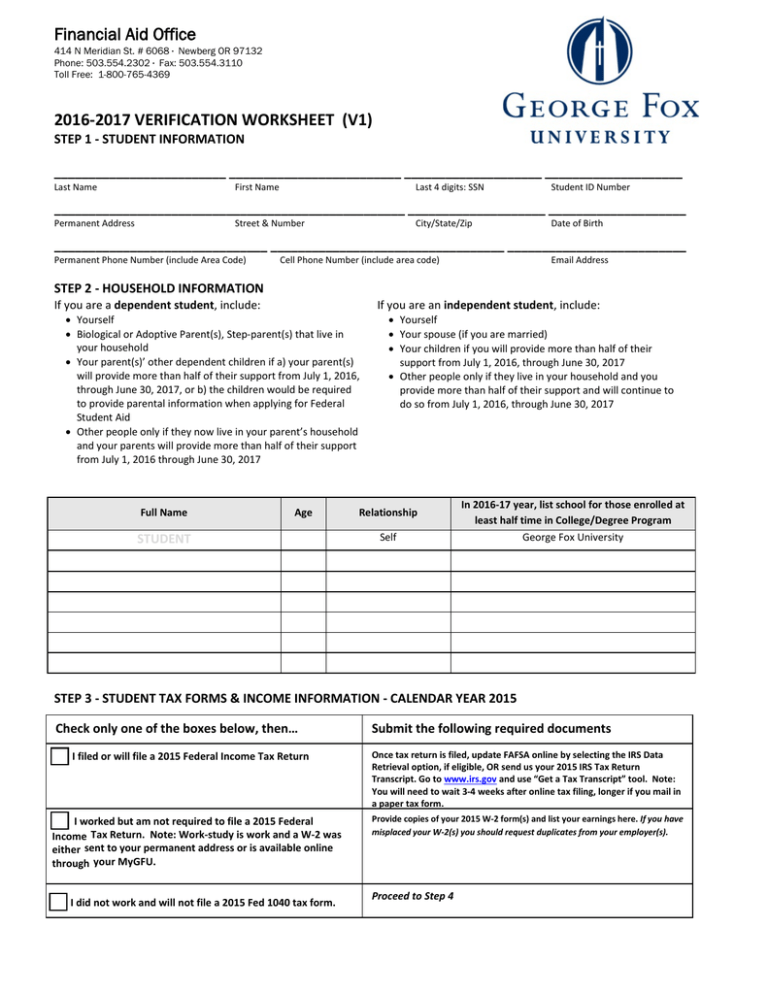

2016-2017 VERIFICATION WORKSHEET (V1) Financial Aid Office

advertisement

Financial Aid Office 414 N Meridian St. # 6068 · Newberg OR 97132 Phone: 503.554.2302 · Fax: 503.554.3110 Toll Free: 1-800-765-4369 2016-2017 VERIFICATION WORKSHEET (V1) STEP 1 - STUDENT INFORMATION _________________________ _________________________ ____________________ ____________________ Last Name First Name Last 4 digits: SSN Student ID Number ___________________________________________________ ____________________ ____________________ Permanent Address Street & Number City/State/Zip Date of Birth _______________________________ __________________________________ __________________________ Permanent Phone Number (include Area Code) Cell Phone Number (include area code) STEP 2 - HOUSEHOLD INFORMATION If you are a dependent student, include: • Yourself • Biological or Adoptive Parent(s), Step-parent(s) that live in your household • Your parent(s)’ other dependent children if a) your parent(s) will provide more than half of their support from July 1, 2016, through June 30, 2017, or b) the children would be required to provide parental information when applying for Federal Student Aid • Other people only if they now live in your parent’s household and your parents will provide more than half of their support from July 1, 2016 through June 30, 2017 Full Name Age STUDENT Email Address If you are an independent student, include: • Yourself • Your spouse (if you are married) • Your children if you will provide more than half of their support from July 1, 2016, through June 30, 2017 • Other people only if they live in your household and you provide more than half of their support and will continue to do so from July 1, 2016, through June 30, 2017 Relationship Self In 2016-17 year, list school for those enrolled at least half time in College/Degree Program George Fox University STEP 3 - STUDENT TAX FORMS & INCOME INFORMATION - CALENDAR YEAR 2015 Check only one of the boxes below, then… I filed or will file a 2015 Federal Income Tax Return I worked but am not required to file a 2015 Federal Income Tax Return. Note: Work-study is work and a W-2 was either sent to your permanent address or is available online through your MyGFU. I did not work and will not file a 2015 Fed 1040 tax form. Submit the following required documents Once tax return is filed, update FAFSA online by selecting the IRS Data Retrieval option, if eligible, OR send us your 2015 IRS Tax Return Transcript. Go to www.irs.gov and use “Get a Tax Transcript” tool. Note: You will need to wait 3-4 weeks after online tax filing, longer if you mail in a paper tax form. Provide copies of your 2015 W-2 form(s) and list your earnings here. If you have misplaced your W-2(s) you should request duplicates from your employer(s). Proceed to Step 4 STEP 4 - SPOUSE OR PARENT TAX FORMS & INCOME INFORMATION - CALENDAR YEAR 2015 Submit the following required documents Check only one of the boxes below, then… STEP 4 - SPOUSE OR PARENT TAX FORMS & Once tax return is filed, update FAFSA online by selecting the IRS Data Retrieval option, if eligible, OR send us your 2015 IRS Tax Return Transcript. Go to www.irs.gov and use “Get a Tax Transcript” tool. Note: You will need to wait 3-4 weeks after online tax filing, longer if you mail in a paper tax form. I filed or will file a 2015 Federal Income Tax Return Provide copies of your 2015 W-2 form(s) and list your earnings here. If you have misplaced your W-2(s) you should request duplicates from your employer(s) I worked but am not required to file a 2015 Federal Income Tax Return. Note: Work-study is work and a W-2 was either sent to the permanent address or is available through the student’s MyGFU. I did not work and will not file a 2015 Fed 1040 tax form. Proceed to Step 5 STEP 5 - VERIFICATION OF CHILD SUPPORT PAID Did you or someone in your household pay child support in 2015? Yes No If yes, complete the section below, sign and return to Financial Aid Office. If no, proceed to step 6. If more space is needed, provide a separate page that includes the student’s name and ID number at the top. Age of Child for Amount of Child Name of Person Who Paid Name of Person to Whom Name of Child for Whom Whom Support Paid in Child Support Child Support was Paid Support Was Paid Support 2015 Was Paid $ $ $ $ $ STEP 6 - VERIFICATION OF FOOD STAMP (SNAP) BENEFITS Did student receive Food Stamp (SNAP) Benefits in 2014 or 2015? No Yes Did parent receive Food Stamp (SNAP) Benefits in 2014 or 2015? No Yes Untaxed Income (Payments to tax deferred retirement plans, child support received, clergy housing allowance, Veterans non-educational benefits.) STUDENT $__________ SOURCE(S): _____________________ PARENT/SPOUSE $____________ SOURCE(S): _____________________________ STEP 7 - VERIFICATION OF ALL EXPENSES, INCOME AND RESOURCES PER MONTH The income reported by you and/or your parents on your FAFSA does not appear to have been sufficient to have met basic living expenses for the 2015 calendar year. Please provide detailed income and resource information below. List all expenses for 2015 (per month) Student’s Spouse Student’s Mother Student (if Married) (if Dependent) Student’s Father (if Dependent) Housing/Utilities $ $ $ $ Food $ $ $ $ Other $ $ $ $ List all income and resources for 2015 (per month) Student’s Spouse Student’s Mother Student (if Married) (if Dependent) Student’s Father (if Dependent) Income Earned $ $ $ $ Unemployment $ $ $ $ Child Support Received $ $ $ $ Alimony Received $ $ $ $ Pension/Disability $ $ $ $ Social Security/SSI $ $ $ $ VA Benefits $ $ $ $ TANF/WIC/SNAP $ $ $ $ Money Paid on your Behalf $ $ $ $ Other Untaxed Income $ $ $ $ $ $ $ $ Specify: Financial Aid Received STEP 8 - CERTIFICATION: By signing this worksheet, I certify all the information reported is complete and correct. _____________________________________________________________________________________________ Student Signature Date Student Name (Please Print) _____________________________________________________________________________________________ Parent Signature (If student is dependent) Date Parent Name (Please Print) Note: Incomplete forms will be returned which may cause a delay in your financial aid being finalized in time for disbursement.