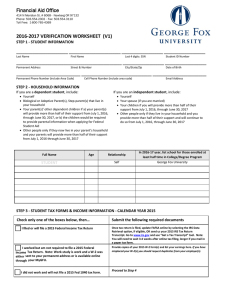

2016-2017 Verification Worksheet

advertisement

2016-2017 Verification Worksheet Student Name: ________________________________________ Student I. D. Number: _______________________________ Permanent Address: ____________________________________________________________________________________________ Street Address City State Zip Phone Number: _______________________ Preferred Email: _______________________ Will you be attending classes in the Summer 2016 semester? □ Yes □ No (you must complete a Summer Aid Request Form to be considered for Summer Financial Aid). Verification: Checklist: Your financial aid application has been selected for review. Please provide us with all requested information within 30 days. Include the student’s name and student ID on all documents to ensure proper identification. Further information about the Verification process can be found on the 2016-2017 Verification Information Fact Sheet. □ Complete all sections of the Verification Worksheet and sign. □ Obtain and attach all 2015 Federal IRS Tax Return Transcripts. Provide copies of all W2’s if required. A Federal IRS Tax Return Transcript can be obtained by visiting www.irs.gov or by calling 1-800-908-9946. □ Collect and submit any other required documentation. □ Submit all information to the Student Financial Aid Office. SECTION 1: HOUSEHOLD INFORMATION DEPENDENT STUDENT: List the people in your parents’ household. Include yourself (the student); your parents; your parents’ other children if your parents will provide more than half of their support between July 1, 2016– June 30, 2017; and any other people that now live with your parents if your parents will provide more than half of their support, and will continue to provide more than half their support between July 1, 2016 – June 30, 2017. Definition of Parent: A parent is defined as the biological or adoptive parent(s) of the student. If parents are married to each other, both parents’ information must be included. If parents are not married to each other but still live together in the same household, both parents’ information must be included. If the student’s parents are divorced or separated, use the information for the parent the student lived with more during the past 12 months. If that parent is remarried, the data must include the stepparent’s information. A legal guardian, grandparent, or foster parent is not considered a parent unless they have legally adopted the student. INDEPENDENT STUDENT: List the people in your household. Include yourself; your spouse; your children if you will provide more than half their support between July 1, 2016 – June 30, 2017; and any other people that now live with you and you provide more than half their support, and will continue to provide more than half their support between July 1, 2016 – June 30, 2017. Please read guidelines above before completing. Student’s Name Date of Birth Household Member’s Name Date of Birth Relationship to Student Name of college they will attend at least half time during 2016-2017 (if applicable) SECTION 2: TAX FILING STATUS Student & Spouse Filing Status (all students) Parent/Stepparent(s) Filing Status (dependent students only) □ I completed my 2015 federal income tax return. If you filed a joint federal tax return with a spouse, attach all copies of your and your spouse’s 2015 W2’s. □ My parents completed their 2015 federal income tax return. If your parents filed a joint federal tax return, attach all copies of their 2015 W-2’s □ I’m not going to file a 2015 federal income tax return. However, in 2015, I earned: $_______________. Attach all copies of your and your spouse’s (if applicable) 2015 W-2’s. □ My parents are not going to file a 2015 federal income tax return. However, in 2015 my parents earned: $_______________. Attach all copies of your parent’s 2015 W-2’s. □ I’m not going to file a 2015 federal income tax return, and I did not work in 2015. □ My parents are not going to file a 2015 federal income tax return and did not work in 2015. *DEPENDENT STUDENT: Obtain and submit a copy of your and your parents/stepparents’ 2015 Federal IRS Tax Return Transcript. If your parents/stepparents filed Married Filing Jointly, provide copies of all 2015 W-2 forms from all employers. *INDEPENDENT STUDENT: Obtain and submit a copy of your and your spouse’s 2015 Federal IRS Tax Return Transcript. If you are married and filed your tax return as Married Filing Jointly, provide copies of all 2015 W-2 forms from all employers. A Federal IRS Tax Return Transcript can be obtained online or by mail free of charge by visiting www.irs.gov or by calling 1-800-908-9946. Be sure to request a “Return Transcript” and not an “Account Transcript.” If you or your parent/stepparent has a Tax Extension, you may submit IRS form 4868 and all related 2015 W2’s. If you or a parent/stepparent has business income, you may submit a 2014 Federal IRS Tax Return Transcript. We will then estimate your 2015 tax information. You must then provide a copy of a 2015 Federal IRS Tax Return Transcript once you or your parent/stepparent completes your taxes, no later than October 31, 2016. State tax documents and electronically filed tax returns (Form 8453 and 8879) cannot be accepted. SECTION 3: UNTAXED INCOME INFORMATION Do not leave any question in this section blank. Enter “0” or “NA” if no income was received from one of the sources listed below. If any amount is entered other than “0” or “N/A”, documentation is required. Student/Spouse $__________ Additional Income Information For Calendar Year 2015 (Provide documentation if any amount entered other than “0” or “N/A”) Military Combat Pay or Special Combat Pay that was taxable (FOR MILITARY VETERANS ONLY). Only include amount that was taxable and included in your Adjusted Gross Income. Combat pay is reported on your 2015 W-2 in Box 12, letter Q. Parent(s) or Stepparent $__________ Documentation Required: Copy of 2015 W-2 from employer where you earned combat pay. Child support paid because of divorce or separation. Don’t include support for children in your (or your parents’) household. $__________ $__________ Documentation Required: Statement from the Bureau of Child Support, or signed statement from the parent who received the payments. Documentation must include the names and ages of the children, and the total amount received for each child in 2015. Taxable earnings from Federal Work Study or other need-based work programs. Documentation Required: Copy of 2015 W-2 from employer where you earned Federal Work Study. $__________ $__________ $__________ Earnings from work under a cooperative education program. Enter here any amounts you earned from work under a cooperative education program offered by an institution of higher education. Do not include Federal Work Study or Graduate Assistantships. $__________ Documentation Required: Copy of 2015 W-2 from employer of your co-op and documentation from your college showing your job was a co-op. Student grant, scholarship, and fellowship aid, including AmeriCorps awards reported to the IRS in your (or your parents’) 2015 Federal Tax Return. $__________ Student/Spouse $__________ $__________ Documentation Required: Signed copy of 2015 Federal Tax Return with all pages and schedules, showing amount reported in scholarships and grants. Untaxed Income Information For Calendar Year 2015 (Provide documentation if any amount entered other than “0” or “N/A”) Child Support received for all children. Don’t include foster care or adoption payments. Documentation Required: Statement from the Bureau of Child Support, or signed statement from the parent who made the payments. Documentation must include the names and ages of the children, and the total amount paid for each child in 2015. Federal Nutrition Assistance Program (SNAP) received by any member of the household. $__________ $__________ $__________ Parent(s) or Stepparent $__________ $__________ Documentation Required: Statement from the agency that issued the SNAP benefit or other documentation that includes the amount received in 2014 or 2015. Payments to tax-deferred pension and/or savings plans (paid directly or withheld from earnings), including but not limited to amounts reported on the 2015 W-2 Form in box 12 codes D,E,F,G,H, & S. Documentation Required: Copy of 2015 W-2 from employer(s) where you made payments to a tax-deferred pension. Housing, food, and other living allowances paid to members of the military, clergy, and others (including cash payments and cash value of benefits). $__________ $__________ $__________ Documentation Required: Copy of 2015 W-2 from employer(s). Veteran’s non-education benefits such as Disability, Death Pension, or Dependency & Indemnity Compensation (DIC) and/or VA Educational WorkStudy allowances. $__________ $__________ Documentation Required: Statement showing amount received in 2015. Untaxed portions of IRA Distributions reported on 2015 Federal tax return (Line 15a-15b on 1040, or Line 11a-11b on 1040a). Please check box if this was a rollover. $__________ Rollover $__________ If this was a rollover, please mark box provided. Untaxed portions of Pension & Annuities reported on 2015 Federal tax return (Line 16a-16b on 1040, or Line 12a-12b on 1040b). Please check box if this was a rollover. Rollover $__________ Rollover $__________ Rollover If this was a rollover, please mark box provided. Any other untaxed income or benefits not reported elsewhere. Examples include but are not limited to: worker’s compensation, untaxed portions of railroad retirement benefits, Black Lung Benefits, disability, money received or paid on applicant’s behalf, and combat pay not included in AGI on tax return (tax filers only). DO NOT INCLUDE student aid, Earned Income Credit, Additional Child Tax Credit, TANF (welfare) payments, untaxed Social Security benefits, Supplemental Security Income (SSI), Workforce Investment Act (WIA) educational benefits, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion, or credit for federal tax on special fuels. Documentation Required: Statement from the agency providing the funds. Combat pay is reported on 2015 W-2 in Box 12, letter Q. $__________ SECTION 4: SOURCES OF INCOME STATEMENT You must complete this section if you are the parent/stepparent of a dependent student, and the income you earned during 2015 was $20,000 or less. Use the chart below to report all 2015 income or assistance received from friends, relatives, or any other resource. EXPENSES TOTAL ASSISTANCE RECEIVED SOURCE OF ASSISTANCE Housing Food Personal (clothing) Other (miscellaneous) Total amount received in 2015 Please provide a detailed explanation of your income during 2015. The explanation must include how expenses such as housing, food, utilities, etc. were paid throughout the year. Please add additional sheets if necessary. __________________________________________________________________________________________ __________________________________________________________________________________________ __________________________________________________________________________________________ Name of parent writing statement: _________________________________________________________________ SECTION 5: SIGNATURES This form must be signed by the student and spouse (if independent and married), or by the student and at least one parent (if dependent). By signing this application, you hereby affirm that all information reported on this form and any attachment hereto is true, complete, and accurate to the best of your knowledge. If asked by an authorized official, you agree to provide additional proof of information provided on this form. You understand that the Student Financial Aid Office at Kent State University will correct the FAFSA application, as necessary, based on the information submitted. You agree that you understand that if you received federal student aid based on incorrect information, you will need to repay it. You may also be required to pay fines and fees. By signing below, you certify that you (1) will use federal and/or state student financial aid only to pay the cost of attending an institution of higher education, (2) are not in default on a federal student loan or have made satisfactory arrangements to repay it, (3) do not owe money back on a federal student grant or have made satisfactory arrangements to repay it, (4) will notify your college if you default on a federal student loan and (5) will not receive a Federal Pell Grant from more than one college for the same period of time. _______________________________________________________________ _____________________ Student Signature Date _______________________________________________________________ _____________________ Student’s Spouse Signature (if applicable) Date ______________________________________________________________ _____________________ Parent/Stepparent Signature (if student is dependent) Date PO Box 5190 STUDENT FINANCIAL AID OFFICE Kent, OH 44242-0001 330-672-2972 FAX 330-672-4014 www.kent.edu/financialaid finaid@kent.edu VF-VFWKST-17