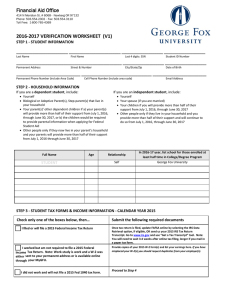

2016-2017 Verification Worksheet

advertisement

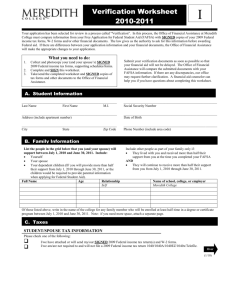

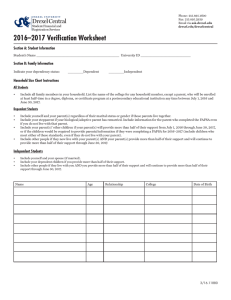

2016-2017 Verification Worksheet LMU Financial Aid Office 6965 Cumberland Gap Parkway Harrogate, TN 37752 Phone: 423.869.6336 Fax: 423.869.6347 Independent V6 Your 2016-2017 Free Application for Federal Student Aid (FAFSA) was selected for a process called verification. The Federal Regulations say that before awarding Federal Student Aid, we must ask you to confirm the information you (and your spouse, if married) reported on your FAFSA. To verify that you provided correct information, our financial aid administrator will compare your FAFSA with the information on this worksheet and with any other required documents. If there are differences, your FAFSA information may need to be corrected. You must complete and sign this worksheet, attach any required documents, and submit the form and other required documents to the financial aid office. We may ask for additional information. If you have questions about verification, contact the financial aid office as soon as possible so that your financial aid will not be delayed. What you should do: 1. If you did not use the IRS Data Retrieval Tool on your FAFSA, you must submit a 2015 tax return transcript from the IRS. Per federal regulations, a copy of your federal tax return is no longer acceptable. 2. Complete all sections of the worksheet and provide the required signature(s). 3. Talk to your financial aid administrator if you have questions about completing this worksheet. 4. Deliver, mail, or fax the completed worksheet, tax return transcript, and any other documents to the Financial Aid Office as soon as possible in order for your financial aid to be processed A. Student Information Last name First name M.I. Date of birth Address (include apt. no.) City LMU ID State Phone number (include area code) ZIP Code B. Family Information List the people in your household, including: • yourself and your spouse if you have one, and • your children, if you will provide more than half of their support from July 1, 2016 through June 30, 2017, even if they do not live with you, and; • other people if they now live with you, and you provide more than half of their support and will continue to provide more than half of their support from July 1, 2016 through June 30, 2017. Write the names of all household members in the space(s) below. Also write in the name of the college for any household member who will be attending at least half time between July 1, 2016 and June 30, 2017, and will be enrolled in a degree, diploma, or certificate program. If you need more space, attach a separate page. Full Name Age Relationship Self College Lincoln Memorial University Student Name: _____________________________ Student ID #: ___________________________ C. Student’s Tax Forms and Income Information Independent V6 **NOTE: Tax filers must attach a copy of their IRS Federal 2015 tax return transcript if they did not use the IRS Data Retrieval Tool available on the FAFSA. To obtain a copy of your IRS Tax Return Transcript, go to http://www.irs.gov/Individuals/Get-Transcript or call 1-800-908-9946. 1. Did you file a 2015 Federal Tax Return? Yes, I filed a 2015 Federal Tax Return and I used the IRS Data Retrieval Tool. (skip to section D) Yes, I filed a 2015 Federal Tax Return and I am attaching a copy of my tax return transcript. (skip to section D) No, I did not file and was not required to file a 2015 Federal Tax Return. (If no, please answer question 2.) 2. TAX RETURN NONFILERS – Complete this section if you will not file and are not required to file a 2015 income tax return with the IRS. Check the box that applies: The student was not employed and had no income earned from work in 2015. The student was employed in 2015. Please complete the table below and attach copies of all W-2s. List every employer, even if the employer did not issue a W-2 form. (Attach another sheet if additional space is needed.) Income earned from work: Use the W-2 or other earnings statements (Non-tax filers only) Employer(s) Name 2015 Amount Earned W-2 Attached? $ $ D. Spouse’s Tax Forms and Income Information (if applicable) 1. Did your spouse file a 2015 Federal Tax Return? Yes, my spouse filed a 2015 Federal Tax Return and used the IRS Data Retrieval Tool. (skip to section E) Yes, my spouse filed a 2015 Federal Tax Return and is attaching a copy of the tax return transcript. (skip to section E) No, my spouse did not file and was not required to file a 2015 Federal Tax Return. (If no, please answer question 2.) 2. TAX RETURN NONFILERS – Complete this section if your spouse will not file and is not required to file a 2015 income tax return with the IRS. Check the box that applies: Spouse was not employed and had no income earned from work in 2015. Spouse was employed in 2015. Please complete the table below and attach copies of all W-2s. List every employer, even if the employer did not issue a W-2 form. (Attach another sheet if additional space is needed.) Income earned from work: Use the W-2 or other earnings statements (Non-tax filers only) Employer(s) Name 2015 Amount Earned W-2 Attached? $ $ E. Other Information to be Verified 1. Did you or your spouse pay child support in 2015? Name of Person Who Paid Child Support Yes (If yes, complete the chart below) Name of Person to Whom Child Support was Paid Name of Child for Whom Child Support was Paid No Amount of Child Support Paid in 2015 $ $ 2. During 2014 or 2015, did any member of the household receive SNAP (food stamps) benefits? Yes No Student Name: _____________________________ Student ID #: ___________________________ F. Other Untaxed Income Independent V6 **Please attach ALL 2015 W2 forms if student and spouse (if married) earned income from work in 2015.** Answer each question below as it applies to the student and the student’s spouse (if married). If any item does not apply, enter “0.” 2015 Untaxed Income Student Payments to tax-deferred pension and retirement savings $ List any payments (direct or withheld from earnings) to tax-deferred pension and retirement savings plans (e.g., 401(k) or 403(b) plans), including, but not limited to, amounts reported on W-2 forms in Boxes 12a through 12d with codes D, E, F, G, H, and S. Child support received for all children Spouse (if married) $ /year $ /year $ List the actual amount of any child support received in 2015 for the children in your household. /year /year Do not include foster care payments, adoption payments, or any amount that was court-ordered but not actually paid. Housing, food, and other living allowances paid to members of the military, clergy and others $ $ /year Include cash payments and/or the cash value of benefits received. /year Do not include the value of on-base military housing or the value of a basic military allowance for housing. Veteran’s noneducation benefits $ List the total amount of veterans non-education benefits received in 2015. Include Disability, Death Pension, Dependency and Indemnity Compensation (DIC), and/or VA Educational Work Study allowances. $ /year /year Do not include federal veterans educational benefits such as: Montgomery GI Bill, Dependents Education Assistance Program, VEAP Benefits, Post-9/11 GI Bill Other Untaxed Income $ List the amount of other untaxed income not reported and not excluded elsewhere on this form. Include untaxed income such as workers’ compensation, disability, Black Lung Benefits, untaxed portions of health savings accounts from IRS Form 1040 Line 25, Railroad Retirement Benefits, etc. $ /year /year Do not include any items reported or excluded in A – D above. In addition, do not include student aid, Earned Income Credit, Additional Child Tax Credit, Temporary Assistance to Needy Families (TANF), untaxed Social Security benefits, Supplemental Security Income (SSI), Workforce Investment Act (WIA) educational benefits, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion, or credit for federal tax on special fuels. Money received, or paid on your behalf (e.g. bills), not reported elsewhere on this form List any money received or paid on the student’s behalf (e.g., payment of student’s bills) and not reported elsewhere on this form. Enter the total amount of cash support the student received in 2014. Include support from a parent whose information was not reported on the student’s 2016–2017 FAFSA, but do not include support from a parent whose information was reported. For example, if someone is paying rent, utility bills, etc., for the student or gives cash, gift cards, etc., include the amount of that person's contributions unless the person is the student’s parent whose information is reported on the student’s 2016–2017 FAFSA. Amounts paid on the student’s behalf also include any distributions to the student from a 529 plan owned by someone other than the student or the student’s parents, such as grandparents, aunts, and uncles of the student. $ $ /year /year G. Sign this Worksheet By signing this worksheet, I certify that all the information reported on this worksheet is complete and correct. I also understand that if any of the information reported on this form is inconsistent with what has been reported on the FAFSA, additional documentation may be required. WARNING: Student’s Signature Date Spouse’s Signature (Optional) Date If you purposely give false or misleading information on this worksheet, you may be fined, be sentenced to jail, or both.