Document 11590447

advertisement

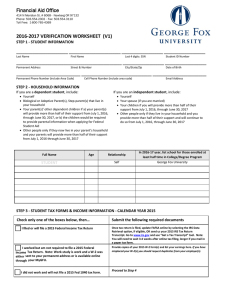

Office of Financial Aid 201 Community College Drive Baton Rouge, LA 70806 225-216-8000 225-216-8010 (Fax) 2015-2016 Independent Verification Worksheet (V1) Your FAFSA was selected for review in a process called fdfdfdfdf “Verification.” In this process Baton Rouge Community College is required to compare information from your FAFSA with other documentation such as an official IRS Tax Return Transcript for you and your spouse(s). If you and/or your spouse (s) were not required to file a federal tax return you must submit copies of any W-2 forms or earnings statements. The law says we have a right to ask you for this information before awarding federal aid. If there are differences between your FAFSA and your financial documents we may need to send corrections electronically to have your information reprocessed. WHAT YOU SHOULD DO Complete this worksheet. All SECTIONS MUST BE FILLED IN. Write N/A (not applicable) or enter a zero if the field does not pertain to you. You and at least one parent, if applicable, MUST sign the worksheet. Send or bring the completed worksheet, plus copes of your parent(s)’ IRS Tax Return Transcript and W-2 forms (if applicable) to the Financial Aid Office at Baton Rouge Community College. We must review the requested information under the financial aid program rules (CFR Title 34, Part 668). Student Information Name ____________________________________________________ Student ID# _________________________________________________ Mailing Address: (P.O. Box): _______________________________________________________________________________________________ City: ______________________________________________State: _____________________________________Zip: _______________________ Home Phone: (_____)__________________________________Cell Phone: (_____)___________________________________________________ Family Information (verifying number in household and number in college) Dependent student: List the people in your parents’ household. Include yourself, your parent(s), and other children if (a) your parents will provide more than half of their support, or (b) if the children would be required to provide parental information when applying for Federal Student Aid. Include also, any other people who now live with you and your spouse and for whom you and your spouse will provide more than half of their support. Write the names of the people in the household where you live. Also write in the name of the college where any family member, excluding your parent(s), will be enrolled at least half-time in a degree or certificate program. If you need more space, attach a separate page. Yourself, on the first line Your spouse Your children, if any, if you will provide more than half of their support from July 1, 2015, through June 30, 2016, or if the child would be required to provide your information if they were completing a FAFSA for 2015-2016. Include children who meet either of these standards, even if they do not live with you. Other people if they now live with you and your spouse and you provide more than half of their support and will continue to provide more than half of their support. Full Name Age Year of Birth Relationship College Attending Self Baton Rouge Community College Student’s Information 1. Check only one box below. A Tax Return Transcript can be obtained online at www.irs.gov or calling 1-800-908-9946. Check here if you used the IRS Data Retrieval Tool in FAFSA on the Web to retrieve and transfer IRS income information into the FAFSA. YOU DO NOT NEED TO PROVIDE A COPY OF AN IRS TAX RETURN TRANSCRIPT. Check here if you are attaching a copy of your IRS Tax Return Transcript. (A paper copy of your federal 1040 form is not acceptable documentation). Check here if you have arranged for a copy of your IRS Tax Return Transcript to be submitted to Baton Rouge Community College by ___________(date). Check here if you will not file and are not required to file a federal income tax return. 2. If you did not file and are not required to file a federal income tax return, list below your employer(s) and any income received last year. Please submit copies of any W-2 forms or other earnings statement Sources 2014 Income Additional Information Be sure to enter zeros if no funds were paid. Student Amount of annual Child Support paid Child Support paid to Name(s) of Eligible Child(ren) If you need more space, attach a separate page Do you receive Food Stamps-Supplemental Nutrition Assistance Program (SNAP)? $ Spouse $ Yes No Yes No Be sure all items listed below are completed and checked off before submission. A value has been entered for every blank Student and parent(s) have signed the Verification Worksheet A copy of all W-2’s if student and/or parent did not file taxes Sign This Worksheet By signing this worksheet, we certify the information reported is complete and correct. At least one parent must sign. Warning: If you purposefully give false or misleading information on this worksheet, you may be fined, be sentenced to jail or both. Student Signature_____________________________________________________________________________Date___________________________________________ Spouse Signature_______________________________________________________________________ Date___________________________________________