Considering Risk Appetite Using Quantitative Risk Analysis 29 May 2012 Sydney

advertisement

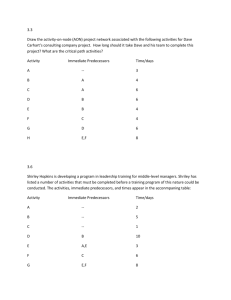

Considering Risk Appetite Using Quantitative Risk Analysis 29 May 2012 Sydney Andrew Kight Why undertake risk analytics? Median TCOIR Per $1,000 of Revenue ($) Organisations that: Use risk analytics Do not use risk analytics Difference 2009/10 5.52 7.59 -27.3% 2010/11 6.44 7.63 -15.6% Source: Aon’s Australasian Risk Management Benchmarking Survey Median TCOIR per $1,000 Revenue over the last two years is 21.4% less for organisations that use risk analytics Aon Risk Solutions | Global Risk Consulting 1 Outline Risk Appetite Theory Case Study – Insurable Risk Further Considerations Aon Risk Solutions | Global Risk Consulting 2 Definitions There are various definitions of risk tolerance and risk appetite, however, we define them as follows: – Risk Tolerance: an organisation’s financial ability to retain additional risk. On a strict interpretation of the definition it would describe the ability to absorb an unbudgeted loss whilst continuing as a going concern. – Risk Appetite: an organisation’s desire to retain risk and will depend on the views of the Board and management (conservative or aggressive), as well as being influenced by other stakeholders (banks, governments and shareholders / owners). Tolerance should be bigger than Appetite?! Aon Risk Solutions | Global Risk Consulting 3 How to express Risk Appetite This is not easy! Car Insurance Example Excess ($) Premium ($) Option 1 500 1,000 Option 2 1,000 800 Option 3 5,000 400 Option 4 No insurance 0 What is driving your decision? – Risk vs Reward? – Risk Appetite? – Both? How would you express your risk appetite? Is it qualitative or quantitative? Aon Risk Solutions | Global Risk Consulting 4 Aon’s Global ERM Survey 43% of organisations new to ERM (Initial / Lacking & Basic) still evaluate risk appetite based on ‘gut feel’ 0% of Advanced ERM organisations evaluate risk appetite on ‘gut feel’ 26% of survey participants do not have a formalised risk appetite evaluation methodology 23% of survey respondents have had success quantifying risk appetite / tolerance “Origin Energy now takes a very quantitative approach to risks and expresses them in terms of the volatility they introduce to key financial measures reflecting profitability, liquidity and our equity position.” John Rodda, Origin Energy Aon Risk Solutions | Global Risk Consulting 5 Aon’s Global ERM Survey Organisations with mature ERM programs use more sophisticated quantification techniques to leverage risk-based information to support decision making 43% of Advanced ERM organisations utilise stochastic / Monte Carlo simulation to understand risk and measure the value of ERM While most respondents with mature ERM programs utilise qualitative tools to assess risk, the use of sophisticated quantification tools including value at risk, actuarial analysis and stochastic modelling drop significantly Aon Risk Solutions | Global Risk Consulting 6 How to express Risk Appetite Risk Appetite Statements Can be qualitative and quantitative – – – – – Financial measures (ie. profit, banking covenants etc.) Based on likelihood and impact grid Qualitative statements Key indicators – risk, control and performance Impact on credit ratings Our job (and our challenge): – Qualitative statements into quantitative amounts – Translate technical / quantitative models for decision-makers Aon Risk Solutions | Global Risk Consulting 7 Sensitivity Analysis g Sensitivity Analysis - Earnings Before Interest & Tax (EBIT) $500m $450m $446.2m $436.2m $421.2m $396.2m $400m Earnings Before Interest & Tax EBIT cannot drop more than 25% below budget $346.2m $350m $300m $246.2m $250m $200m $146.2m $150m $100m $50m $0m 2011 $10m $25m $50m $100m $200m $300m Unbudgeted Loss Scenario Aon Risk Solutions | Global Risk Consulting 8 Risk Categories The entire risk portfolio must be taken into consideration when making decisions on risk appetite How is the aggregate risk appetite spread across different risk categories? Insurable risk: deemed to be between 30% to 40% of a risk portfolio Aon Risk Solutions | Global Risk Consulting 9 Risk financing strategy Aon Risk Solutions | Global Risk Consulting 10 Case Study Details Large Manufacturing Company Significant growth in last five years Scope Determine the optimal insurable risk financing strategy How are we to do this? 1. 2. 3. Sensitivity Analysis -> Determine insurable risk appetite Provide Options Within Appetite -> Test existing program structure is within risk appetite and alternative options for consideration Total Cost Comparison -> Calculate most cost-efficient option Aon Risk Solutions | Global Risk Consulting 11 Sensitivity Analysis g Sensitivity Analysis - Interest Cover 14 12.6 12.1 12 11.4 Interest Cover (times) 10.3 Interest Cover cannot drop below 3.0 10 8.4 8 6 5.2 4 2.8 2 0 Budget $10m $25m $50m $100m $200m $300m Self-Insured Loss Scenario Aon Risk Solutions | Global Risk Consulting 12 Sensitivity Analysis g Sensitivity Analysis - Earnings Per Share 45 40 39.8 38.8 37.2 35 Earnings Per Share (cents) EPS cannot be less than 20 cents per share 34.6 29.4 30 25 18.9 20 15 10 8.4 5 0 Budget $10m $25m $50m $100m $200m $300m Self-Insured Loss Scenario Aon Risk Solutions | Global Risk Consulting 13 Sensitivity Analysis g Sensitivity Analysis - Earnings Before Interest & Tax (EBIT) $500m $450m $446.2m $436.2m $421.2m $396.2m $400m Earnings Before Interest & Tax EBIT cannot drop more than 25% below budget $346.2m $350m $300m $246.2m $250m $200m $146.2m $150m $100m $50m $0m Budget $10m $25m $50m $100m $200m $300m Unbudgeted Loss Scenario Aon Risk Solutions | Global Risk Consulting 14 Program Structure Risk Class Deductible ($) Directors' and Officers' Liability 10,000 Professional Indemnity 25,000 9 9 8 8 8 500 500 1,000 8 8 8 Property 10,000,000 Liability 10,000,000 Motor Minor Risk Classes ‐ Corporate Travel ‐ Personal Accident ‐ Marine Transit ‐ etc… 1,000 Which risk classes are relevant from a risk appetite perspective? Aon Risk Solutions | Global Risk Consulting 15 Risk Appetite Assume Group Risk Appetite is $100m $40m is allocated to Insurable Risk How can we use this? Let’s test this against the existing program structure Loss Experience Property: Two large losses in last five years Liability: One large loss in last five years Deterministic Approach Risk Class Property Liability Total Deductible $10m $10m Aon Risk Solutions | Global Risk Consulting Worst Case Number of Losses 2 2 Max Exposure $20m $20m $40m What conclusions can be drawn from this? What else needs to be considered? – Likelihood – Correlation 16 Loss Analysis Loss Frequency Analysis (Losses over $1m) Property Year Exposure Count 2008 2009 2010 2011 2012 2013 Total (2008 ‐ 2012) Freq per 1,000 Exp Forecast (2013) Aon Risk Solutions | Global Risk Consulting 2,000 2,500 2,500 4,000 4,500 5,000 15,500 5,000 0 1 0 1 0 Exposure 2,000 2,500 2,500 4,000 4,500 5,000 Liability % Dev Dev Exp 100% 95% 90% 60% 20% Count 2,000 2,375 2,250 2,400 900 0 0 1 0 0 2 0.129 9,925 1 0.101 0.65 5,000 0.50 17 Selected Distributions Loss Band Attritional (Losses < $1m) Property mean 2,000,000 std dev 1,000,000 Liability mean 3,000,000 std dev 500,000 Large Losses (Losses $1m to $50m) Freq Freq 0.65 Severity mean std dev lower upper Catastrophic Losses (Losses > $50m) Aon Risk Solutions | Global Risk Consulting Lognormal 10,000,000 20,000,000 1,000,000 50,000,000 Not applicable 0.50 Severity mean std dev lower upper Lognormal 15,000,000 16,000,000 1,000,000 50,000,000 Not applicable 18 Results Loss Forecast Retained Losses Deductibles ($m) Property Liability Annual Losses ($m) Average Std Dev Unbudgeted Losses 10 10 12.6 8.0 Risk Appetite ($m) Return Periods ($m) 1 in 4 year high 1 in 10 year high 1 in 20 year high 1 in 50 year high 1 in 100 year high 1 in 250 year high 0.0 8.0 40.0 16.6 24.2 27.7 33.6 36.5 41.6 4.0 11.5 15.1 21.0 23.9 28.9 * assumes that average losses are budgeted Aon Risk Solutions | Global Risk Consulting 19 Results Retained Losses Current Option 1 Option 2 Option 3 Deductibles ($m) Property Liability Annual Losses ($m) Average Std Dev 10 10 20 20 30 30 50 50 12.6 8.0 15.4 11.9 16.5 13.9 17.0 15.2 Risk Appetite ($m) Return Periods ($m) 1 in 4 year high 1 in 10 year high 1 in 20 year high 1 in 50 year high 1 in 100 year high 1 in 250 year high 16.6 24.2 27.7 33.6 36.5 41.6 23.2 31.6 39.0 46.7 52.9 60.4 23.2 36.0 44.2 54.9 62.8 71.3 23.2 38.7 48.8 60.3 68.7 79.9 Probability: Unbudgeted Losses > Risk Appetite Unbudgeted Losses Current Option 1 Option 2 Option 3 0.0 8.0 0.0 11.9 0.0 13.9 0.0 15.2 40.0 40.0 40.0 40.0 4.0 11.5 15.1 21.0 23.9 28.9 7.8 16.3 23.6 31.3 37.5 45.1 6.8 19.6 27.7 38.5 46.3 54.9 6.2 21.7 31.8 43.3 51.7 62.9 0.04% 0.82% 1.81% 2.68% * assumes that average losses are budgeted for each option Aon Risk Solutions | Global Risk Consulting 20 Selected Distributions Unbudgeted Risk vs Risk Appetite 70 60 Unbudgeted Risk ($m) 50 40 30 20 10 0 1 in 10 year high 1 in 20 year high 1 in 50 year high 1 in 100 year high 1 in 250 year high Return Periods Current $10m Aon Risk Solutions | Global Risk Consulting Option 1 $20m Option 2 $30m Option 3 $50m Risk Appetite 21 TCOIR Comparison Current Deductibles Property Liability Base Premium ‐ Property Base Premium ‐ Liability Aon Risk Solutions | Global Risk Consulting TCOIR Comparison Option A Option B Option C $10m $10m $20m $10m $10m $20m $20m $20m 4,000,000 3,500,000 2,500,000 3,500,000 4,000,000 1,500,000 2,500,000 1,500,000 22 TCOIR Comparison Current Deductibles Property Liability TCOIR Comparison Option A Option B Option C $10m $10m $20m $10m $10m $20m $20m $20m Base Premium ‐ Property Base Premium ‐ Liability 4,000,000 3,500,000 2,500,000 3,500,000 4,000,000 1,500,000 2,500,000 1,500,000 Total Base Premium Statutory Charges Average Retained Losses 7,500,000 1,480,000 12,655,871 6,000,000 1,030,000 13,789,305 5,500,000 1,320,000 14,257,066 4,000,000 870,000 15,390,499 Average Total Cost of Insurable Risk 21,635,871 20,819,305 21,077,066 20,260,499 0 816,567 558,806 1,375,372 Average Saving From Current Aon Risk Solutions | Global Risk Consulting 23 Within Risk Appetite? Assume TCOIR Budget of $20m: Unbudgeted Risk ($m) 1 in 10 year high 1 in 20 year high 1 in 50 year high 1 in 100 year high 1 in 250 year high Current Option A Option B Option C 13.2 16.7 22.8 25.8 30.9 14.1 20.6 27.4 32.2 38.1 15.5 21.8 29.8 34.6 41.3 16.5 24.3 31.9 37.7 46.2 Option C is the optimal program structure – It is cheapest option from a ‘total cost’ perspective and is still within the organisation’s insurable risk appetite What if we don’t need $40m? Aon Risk Solutions | Global Risk Consulting 24 Other Uses Models exist for other risk categories, so this process can be easily replicated for other risk categories. Risk Appetite sets the strategy for how risk is financed across the organisation and within each risk category Aon Risk Solutions | Global Risk Consulting 25 A Broader View of a Risk Portfolio Let’s look a things across the whole organisation (or across a project) Develop a risk register: – Inherent risk (Gross Risk): before controls – Controls: Risk mitigation (ie. contracts, RM procedures, insurance etc.) – Residual risk (Net Risk): after controls – Likelihood and Impact ratings – using ratings scales (ie. 1 to 5) Aon Risk Solutions | Global Risk Consulting 26 Risk Matrix Risk Score Likelihood Rating 1 Certain / Will occur For Example An event you can expect to happen (Once per year or more) 2 Likely to occur An event that can be anticipated to happen and this area or a similar organisation have experienced such an event (1 in 3 year event) 3 Possible / Could occur or have heard of it happening An event that can be envisaged but has not occurred in this area or in this organisation (1 in 10 year event) 4 Unlikely to occur An event that can be envisaged but hasn’t occurred in the company history (e.g. requires a combination of two or more events to occur) (1 in 30 year event) 5 Rare / Practically impossible An event that can be conceived but is considered to be very difficult to realise (e.g. requires a combination of several events to occur) (1 in 100 year event) Aon Risk Solutions | Global Risk Consulting 27 A Simplistic Example Risk Risk 1 Risk 2 Risk 3 Risk 4 Risk 5 Risk 6 Risk 7 Risk 8 Risk 9 Risk 10 Risk 11 Risk 12 Risk 13 Risk 14 Risk 15 Risk 16 Risk 17 Risk 18 Risk 19 Risk 20 Residual Risk Rating Likelihood Impact 2 5 1 5 3 4 2 4 1 4 3 3 3 3 2 3 4 2 3 2 3 2 2 2 2 2 2 2 1 2 4 1 3 1 3 1 2 1 2 1 Aon Risk Solutions | Global Risk Consulting Likelihood 1 in 30 1 in 100 1 in 10 1 in 30 1 in 100 1 in 10 1 in 10 1 in 30 1 in 3 1 in 10 1 in 10 1 in 30 1 in 30 1 in 30 1 in 100 1 in 3 1 in 10 1 in 10 1 in 30 1 in 30 Impact >$25m >$25m $10m ‐ $25m $10m ‐ $25m $10m ‐ $25m $2.5m‐ $10m $2.5m‐ $10m $2.5m‐ $10m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m <$500k <$500k <$500k <$500k <$500k Validated Impact $60m ‐ $80m $50m ‐ $150m $10m ‐ $25m $10m ‐ $25m $10m ‐ $25m $2.5m‐ $10m $2.5m‐ $10m $2.5m‐ $10m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m $500k ‐ $2.5m <$500k <$500k <$500k <$500k <$500k Likelihood RiskBinomial Impact RiskPert 28 Sample Distribution of Unbudgeted Risk Unbudgeted Risk vs Risk Appetite 90% Unbudgeted Risk exceeds Risk Appetite 0.6% of the time 80% 70% Percentile 60% 50% 40% 30% 20% 10% 0% 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 Amount($'000) Unbudgeted Risk Aon Risk Solutions | Global Risk Consulting Risk Appetite 29 Further Considerations and Improvements Sensitivity Analysis - Earnings Before Interest & Tax (EBIT) $500m $450m EBIT cannot drop more than 25% below budget $446.2m $425.8m $417.0m Earnings Before Interest & Tax $400m $370.5m $355.8m $334.4m $350m $300m $250m $200m $150m $100m $50m $0m Budget 1 in 10 year high 1 in 20 year high 1 in 50 year high 1 in 100 year high 1 in 250 year high Unbudgeted Loss Scenario Aon Risk Solutions | Global Risk Consulting 30 Further Considerations and Improvements Sensitivity Analysis of Model Inputs Detailed Validation of Likelihood and Severity of major risks Correlation Upside risk? Aon Risk Solutions | Global Risk Consulting 31 Contact Information Andrew Kight Aon Global Risk Consulting +61 3 9211 3205 andrew.kight@aon.com Aon Risk Solutions | Global Risk Consulting 32