Investment Appraisal

advertisement

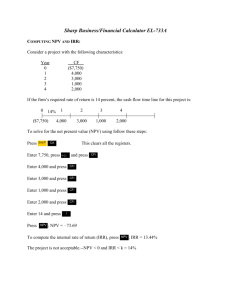

Investment Appraisal Article relevant to F1 Business Mathematics and Quantitative Methods Author: Pat McGillion, current Examiner. Questions 1 and 6 often relate to Investment Appraisal, which is underpinned by Section 1 of the Syllabus. The following example relates to a typical question on this topic, which has been successfully and sometimes rather unsuccessfully attempted by students. Although the mathematical computation may be correct, the lack of knowledge of the principles and the inability to analyse the result exposes major gaps in understanding! The general principles, process and theory is set out in the following example. Example. The DIB Manufacturing Company Ltd. has decided to computerise its accounting systems. The company has received quotations from two companies. Company A has offered to install the total system for a price of €170,000. Company B has proposed to phase in the system to accommodate the company’s present systems at a cost of €160,000. Both systems have significantly different cash flows, which have been estimated by the company’s financial director. The expected after tax cash flows for each proposal are set out below. The life of both systems will be 5 years with no residual value. You have been asked to evaluate both systems by using NPV and IRR using a cost of capital of 12%. As part of your report you are required to explain the principles behind your analysis and any conflicts that arise in your analysis. Investment Residual value Life After tax cash flows: Years 1 to 3 per year Years 4 and 5 per year Proposal A €170,000 NIL 5 years €50,715 €50,715 Proposal B €160,000 NIL 5years €23,000 €100,000 Report on the Computerisation of DIB Accounting Systems. Introduction. Capital budgeting or investment decisions involve multi year investments and significant amounts of a firm’s available funds. Careful evaluation of such decisions and proposals is of strategic importance. The primary objective of the questions relating to investment decisions is to evaluate the costs and benefits of such investments by numerical means. These investments are often referred to as fixedasset investments. The investments (often in plant, machinery and equipment) may extend for many years. The benefit stream, measured in cash flows, is often subject to risk and, in business; sensitivity analysis is done on the costs and benefits to test exposure of the bottom line to unexpected/unpredictable variations. Several methods are used for evaluating investment decisions, two of the most common being: Net Present Value (NPV) and Internal Rate of Return (IRR). Every expenditure analysis involves three components - identification of all relevant elements - identification of all cash flows and timing - procedure for evaluating the benefit relative to the costs. Net Present Value Method: This compares the present value of cash inflows with the cost of the investment. The cost is equal to the present value of cash outflows needed to undertake the investment. The NPV is determined by subtracting the cost of the investment from the present value of the cash inflows. By focussing on both cash flows and the present values of these cash flows, the NPV method explicitly considers the time value of money. In order to determine the present value, the rate or return or discount rate from the investment is required as well as the amounts and timing of cash flows. The required rate of return is considered to be equal to the investments cost of capital. Determining the cost of capital is a complex area beyond the scope of this section of the course. In this subject we are provided with the cost of capital, K. (However, it must be remembered that the cost of capital rate selected is very important for the proper evaluation of capital proposals.) Therefore, the NPV = present value of cash inflows (PVCI) - net investment outflows (I). In the ‘real world’ we deal with after tax cash flows – in this subject we are provided with cash flows (which we can assume are after tax). Therefore, PVCI = ∑CFt /(1 + k)t, where ∑ represents the summation of each years discounted cash flow beginning with year 1, then adding the PV amount for year 2 (t=2) and continuing to add the present value amounts through year n. If the value of the investment exceeds its cost, the investment should be accepted, that is, if the NPV is positive, accept the investment, if negative, reject. Internal Rate of return. The IRR is the discount rate that equates the PV of the cash flows with the investment or the IRR is the discount rate that results in a zero NPV, that is, (PVCI - I) = NPV = 0 at the IRR: ∑CFt /(1 + k)t = I. Finding the IRR for a proposal is a trial-and-error process. The present value of cash inflows must be found at some selected discount rate for the proposal. Then you must subtract the investment outlay from the PVCI to determine how close the NPV is to zero. If the NPV is positive a different discount rate must be applied. This process continues until the NPV of the cash inflows is approximately equal to the net initial investment. At this point we have found the projects internal rate of return. Other methods are used to support these mechanisms such as Payback and Average Rate of Return but are outside the scope of Formation 1 syllabus. Relationship between NPV and IRR. The algebraic structure of the NPV and IRR methods reveals the close relationship between the two methods. The NPV method addresses the question “How much is the investment worth?”. The IRR method addresses the question “What rate of return will the investment produce?” Therefore if an investment is acceptable in terms of the NPV method it will also be acceptable to terms of the IRR method and vica versa. Both methods will give the same accept or reject verdict. When NPV and IRR methods do not agree, there are two types of situation in which all acceptable investment decisions cannot be undertaken and, thus, in which conflicts between the IRR and NPV methods may surface. These two types of situations occur generally when investments are mutually exclusive and when the company employs capital rationing, that is, the company is limited by the amount of capital available and must make decisions on the most acceptable proposal within these capital constraints. Proposal A. Assume an initial investment of €170,000 with a 12% rate of return required. Year Cash Inflows (after tax) € 1 50,715 2 50,715 3 50,715 4 50,715 5 50,715 Since the cash flows are an annuity Present value of cash inflows = €50,715 x PV factor of an annuity at 12% = €50,715 x 3.605 = €182,827. NPV = €182,827 - €170,000 = €12,827. IRR: PV interest factor of an annuity x €50,715 = €170,000. Therefore, PVIFA = €170,000 = 3.352 €50,715 Interest rate from annuity tables = 15%. Proposal B. Assume initial investment of €160,000 with a 12% rate of return required. Year Cash Inflows (after tax) € PV factor @ 12% PV € 1 23,000 2 23,000 3 23,000 4 100,000 5 100,000 0.893 0.797 0.712 0.636 0.567 20,539 18,331 16,376 63,600 56,700 Present Value = €175,546 NPV = €175,546 - €160,000 = €15,546. IRR: 14.89%. (Using trial and error to derive the IRR, 15% discount rate gives a negative NPV of €568; using 14% gives a positive NPV of €4483; extrapolating between both gives 14.89% - or the result can be achieved graphically by plotting against NPV). Summary. Based on the above analysis Proposal B is acceptable with a higher NPV. But proposal A gives a marginally higher return by means of the IRR. Which proposal should be accepted? The difference in cash flow patterns is responsible for the conflicting rankings given by the NPV and IRR methods. Proposal A’s cash flows are steady throughout while B’s increase substantially at the end of the investment life. Proposal A’s IRR implies that the cash benefits can be reinvested at 15%. Proposal B’s IRR implies that the cash benefits can be reinvested at 14.89%. The NPV method implies that the cash flow benefits will be reinvested at the cost of capital rate of 12%. When rankings conflict, the NPV method is preferable. At higher discount rates the value of the larger postponed cash flow decreases.