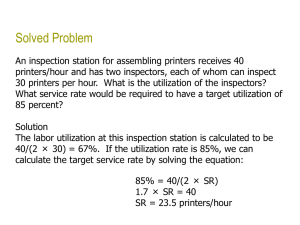

Weighted-Average Costing Problem: Transferred-In Costs

advertisement

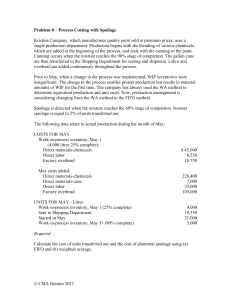

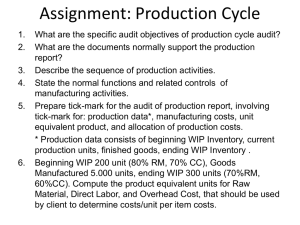

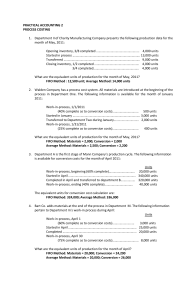

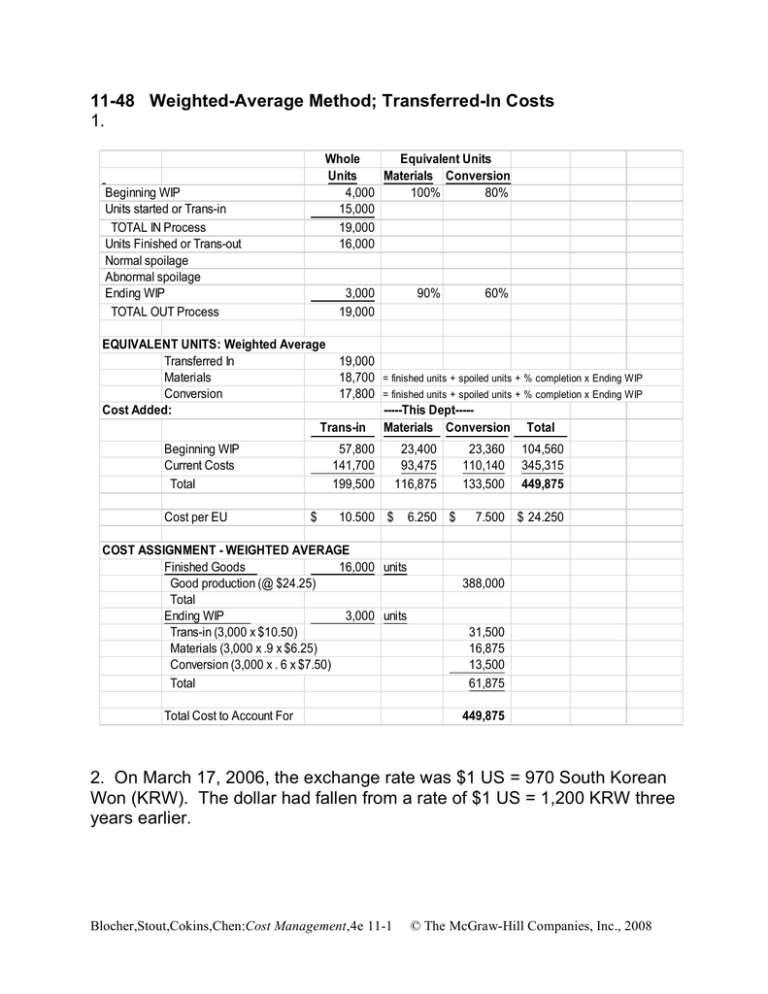

11-48 Weighted-Average Method; Transferred-In Costs 1. Whole Equivalent Units Units Materials Conversion 4,000 100% 80% 15,000 19,000 16,000 Beginning WIP Units started or Trans-in TOTAL IN Process Units Finished or Trans-out Normal spoilage Abnormal spoilage Ending WIP TOTAL OUT Process 3,000 19,000 EQUIVALENT UNITS: Weighted Average Transferred In 19,000 Materials 18,700 Conversion 17,800 Cost Added: Trans-in Beginning WIP Current Costs Total Cost per EU 90% = finished units + spoiled units + % completion x Ending WIP = finished units + spoiled units + % completion x Ending WIP -----This Dept----Materials Conversion 57,800 141,700 199,500 $ 60% 23,400 93,475 116,875 10.500 $ COST ASSIGNMENT - WEIGHTED AVERAGE Finished Goods 16,000 units Good production (@ $24.25) Total Ending WIP 3,000 units Trans-in (3,000 x $10.50) Materials (3,000 x .9 x $6.25) Conversion (3,000 x . 6 x $7.50) Total Total Cost to Account For 6.250 $ 23,360 110,140 133,500 Total 104,560 345,315 449,875 7.500 $ 24.250 388,000 31,500 16,875 13,500 61,875 449,875 2. On March 17, 2006, the exchange rate was $1 US = 970 South Korean Won (KRW). The dollar had fallen from a rate of $1 US = 1,200 KRW three years earlier. Blocher,Stout,Cokins,Chen:Cost Management,4e 11-1 © The McGraw-Hill Companies, Inc., 2008 11-50 FIFO Method 1. Quantity Schedule (not required) Input Work-in-process inventory, 6/1 Units started Total units to account for 15,000 80,000 95,000 Output Units completed Work-in-process inventory, 6/30 Total units accounted for 70,000 25,000 95,000 Equivalent Units -- FIFO Method: Material A Units completed 70,000 Work-in-process inventory, 6/30 25,000 x 100% = 25,000 Total 95,000 Less: EU in WIP inventory, 6/1 15,000 x 100% = (15,000) Total equivalent units 80,000 Material B Units completed 70,000 Work-in-process inventory, 6/30 25,000 x 100% = 25,000 Total 95,000 Less: EU in WIP inventory, 6/1 15,000 x 0% = ( 0) Total equivalent units 95,000 Conversion: Units completed Work-in-process inventory, 6/30 25,000 x 65% = Total Less: EU in WIP inventory, 6/1 15,000 x 40% = Total equivalent units Blocher,Stout,Cokins,Chen:Cost Management,4e 11-2 70,000 16,250 86,250 ( 6,000) 80,250 © The McGraw-Hill Companies, Inc., 2008 . Problem 11-50 (Continued) 2. Costs per equivalent unit: Costs Material A Material B Conversion Costs incurred in June $260,000 $403,750 $461,437.50 Divided by EU 80,000 95,000 80,250 Unit cost $3.25 $4.25 $5.75 3. Cost of units transferred out: Work-in-process inventory, June 1 $ 85,437.50 Cost to finish beginning WIP: Material B 15,000 x $4.25 = $63,750 Conversion 15,000 x 60% x $5.75 = 51,750 115,500.00 Total $200,937.50 Cost of units started and completed: ($3.25 + $4.25 + $5.75) x (70,000 - 15,000) = 728,750.00 Cost of units transferred out $929,687.50 4. Cost of ending work-in-process inventory: Material A $3.25 x 25,000 = Material B $4.25 x 25,000 = Conversion $5.75 x 16,250 = Blocher,Stout,Cokins,Chen:Cost Management,4e 11-3 $ 81,250.00 106,250.00 93,437.50 $280,937.50 © The McGraw-Hill Companies, Inc., 2008