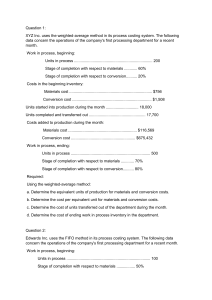

PRACTICAL ACCOUNTING 2 PROCESS COSTING 1. Department II of Charity Manufacturing Company presents the following production data for the month of May, 2011: Opening inventory, 3/8 completed …………………………………………….. 4,000 units Started in process ……………………………………………………………………….. 13,000 units Transferred …………………………………………………………………………………. 9,000 units Closing inventory, 1/2 completed ………………………………………………. 4,000 units 3/4 completed……………………………………………….. 4,000 units What are the equivalent units of production for the month of May, 2011? FIFO Method : 12,500 unit; Average Method: 14,000 units 2. Walden Company has a process cost system. All materials are introduced at the beginning of the process in Department One. The following information is available for the month of January 2011: Work-in-process, 1/1/2011 (40% complete as to conversion costs)………………………….. 500 units Started in January ……………………………………………………………………….. 3,000 units Transferred to Department Two during January…………………………. 2,000 units Work-in-process, 1/31/2011 (25% complete as to conversion costs)………………………….. 400 units What are the equivalent units of production for the month of May, 2011? FIFO Method: Materials = 2,000; Conversion = 2,000 Average Method: Materials = 2,500; Conversion = 2,200 3. Department A is the first stage of Mann Company’s production cycle. The following information is available for conversion costs for the month of April 2011: Work-in-process, beginning (60% complete)………………………….. Started in April ……………………………………………………………………….. Completed in April and transferred to department B……………… Work-in-process, ending (40% complete)…………………………….. Units 20,000 units 340,000 units 320,000 units 40,000 units The equivalent units for conversion cost calculation are: FIFO Method: 324,000; Average Method: 336,000 4. Bart Co. adds materials at the end of the process in Department M. The following information pertain to Department m’s work-in process during April: Units Work-in-process, April 1 (60% complete as to conversion costs)……………………… 3,000 units Started in April ………………………………………………………………………… 25,000 units Completed ………………………………………………………………………………. 20,000 units Work-in-process, April 30 (75% complete as to conversion costs)………………………….. 8,000 units What are the equivalent units of production for the month of April? FIFO Method: Materials = 20,000; Conversion = 24,200 Average Method: Materials = 20,000; Conversion = 26,000 5. Sussex Corporation’s production cycle starts in the Mixing department. The following information is available for April: Units WIP, April 1 (50% complete)…………………………………………..…….. 40,000 units Started in April ……………………………………………………………………….. 240,000 units WIP, April 30 (60% complete)………………………………….…………….. 25,000 units Materials are added at 50% stage of completion in the Mixing Department. What are the equivalent units of production for the month of April? FIFO Method: Materials = 280,000; Conversion = 250,000 Average Method: Materials = 280,000; Conversion = 270,000 6. On September 30, work-in-process totaled 9,000 units 60% complete (based on conversion costs added uniformly throughout the department and material added at the start of the process). A total of 100,000 units were transferred to the next department during October. On October 31, a total of 8,000 units 40% complete (based on conversion costs) were still in process in Department A. Using the weighted-average cost flow method, which of the following equivalent units should be used in the calculation of costs for October? Transfer Costs = 108,000; Materials = 108,000; Conversion = 103,200 7. BWIP was 60% complete as to conversion costs, and EWIP was 45% complete as to conversion costs. The peso amount of the conversion cost included in EWIP (using the weighted average method) is determined by multiplying the average unit conversion costs by what percentage of total units in EWIP? 45% 8. The following data refer to the units processed by the grinding department for a recent month. Beginning work-in-process ………………………..………………………….. 12,000 Units started ………………………………………………………………………….. 200,000 Units completed ………………………………………………………………..…… 192,000 Ending work-in-process ……………………………………..………………….. 20,000 The beginning work-in-process was 60% complete, and the ending work-in-process is 70% complete. What are the equivalent units of production for the month? FIFO Method: 198,800; Average Method: 206,000 9. With the following data for a company using the FIFO process cost system, calculate the equivalent units for materials and conversion costs: Percent Complete Whole Conversion Units Materials Costs Beginning inventory…………………….. 10 100% 30% Transferred in ………………………………. 100 Transferred out ……………………………. 80 Ending inventory ………………………….. 30 100% 40% Materials = 100; Conversion Costs = 89 10. A company produces plastic drinking cups and uses a process cost system. Cups go through three departments – mixing, molding, and packaging. During the month of June, the following information is known about the mixing department. Work-in-process, at June 1 …………………………….… 10,000 units An average of 3/4 complete Units completed …………………………………………………. 140,000 units Work-in-process, at June 30 ………………………….… 10,000 units An average of 1/4 complete Materials are added two points in the process: Material A is added at the beginning of the process and Material B at the midpoint of the mixing process. Conversion costs are incurred uniformly throughout the mixing process. Under a FIFO costing flow, the equivalent units for Material A, Material B, and conversion costs respectively for the month of June (assuming no spoilage) would be: 150,000; 130,000; 137,500 11. Glo Co., a manufacturer of combs, budgeted sales of 125,000 units for the month of April. The following additional information is provided: Number of units Actual inventory at April 1 Work-in-process ……………………………………………..……………………… None Finished goods ………………………………………………………………………… 37,500 Budgeted inventory at April 30 Work-in-process (75% processed) …………………………………………… 8,000 Finished goods ………………………………………………………………………… 30,500 How many equivalent units of production did Glo budget for April? 123,500 12. Bronson Company, which had 6,000 units in work-in-process at January 1 that were 60% complete as to conversion costs. During January, 20,000 units were completed. At January 31, 8,000 units remained in WIP which were 40% complete as to conversion costs. Materials are added at the beginning of the process. Using the weighted-average method, the equivalent units for January for conversion costs were? 23,200 13. Using the same information at No. 12, how many units were started during January? 22,000 14. Kew Co. had 3,000 units in work-in-process at April 1 which were 60% complete as to conversion cost. During April, 10,000 units were completed. At April 30, 4,000 units remained in work-inprocess which were 40% complete as to conversion cost. Direct materials are added at the beginning of the process. How many units were started during April? 11,000 15. The Wiring Department is the second stage of Flem Company’s production cycle. On May 1, the BWIP contained 25,000 units which were 60% compete as to conversion costs. During May, 100,000 units were transferred –in from the first stage of Flem’s production cycle. On May 31, EWIP contained 20,000 units which were 80% complete as to conversion costs. Materials added at the end of the process. Using the weighted – average method, the EUP on May 31 were : Transferred-in Costs = 125,000; Materials = 105,000; Conversion Costs = 121,000 16. If 100 units are 70% complete, 30 units 60% complete, 200 units 40% complete, and 60 units 5% complete, how many EUP have been produced? 171 17. Department Z of the Libra Mfg. Corporation had the following data for the month of October, 2011: Beginning work in process, 70% complete …………………………………………….. 40,000 units Started in process during the month ………………………………………………………. 300,000 units Ending work in process, 80% complete ………………………………………………….. 60,000 units The cost of the beginning work in process was P140,000, and the production costs for the month amounted to P1,172,000. How many equivalent production units were completed in October, 2011 using FIFO Method? 300,000 18. Richardson Company computed the flow of physical units completed for Department M for the month of March 2011 as follows: Units completed: From work-in-process on March 1, 2011 ……………………………………….. 15,000 From March production …………………………………………………………………. 45,000 60,000 Materials are added at the beginning of the process. The 12,000 units of work in process at March 31, 2011, were 80% complete as to conversion costs. Using the FIFO method, the equivalent units for March conversion costs were: 60,600 19. Pure Spring Water Co. bottles spring water. The spring water first undergoes filtration in Department 1 and is eventually bottled in Department 2. A quantity schedule for May 2011 follows: Department 1: Units started in process ……… 110,000 Units transferred to Dept. 2…… 80,000 Units in process, end …………….. 30,000 Department 2: Units received from Dept. 1 ………… 80,000 Units transferred to finish stock…… 61,400 Units in process, end ……………….….. 18,600 Units in process at the end in both departments are 72%. In Department 2, what is the equivalent production for conversion costs? 74,792 20. On November 1, Yankee Company had 20,000 units of WIP in Department No. 1 which were 100% complete as to material costs and 20% complete as to conversion costs. During November, 160,000 units were started in Department No.1 and 170,000 units were completed and transferred to Department No. 2. WIP on November 30 was 100% complete as to material cost and 40% complete as to conversion costs. By what amount would the equivalent units for conversion costs for the month of November differ if FIFO method were used instead of the weighted average method? 4,000 decrease 21. A company produces white paint in bulk. On May 1, the mixing department, which has used a weighted-average process costing system, had 12,000 unfinished gallons of paint in process approximately 50% complete with regard to conversion costs. Materials are added at the beginning of the process and yield a gallon of paint for each gallon of materials added to the process. During the month of May, 100,000 gallons of material were added and 10,000, 80% complete with regard to conversion, were in process at the end of May. What is the difference in material and conversion equivalent units, respectively, incurred during May if the first-in, first-out process costing method is employed, rather than the weighted average method? Difference in Material Equivalent Units = 12,000 decrease Difference in Conversion Equivalent Units = 6,000 decrease 22. The following data for the month of September were taken from the cost records of Department I of Pro-life Products which uses process costing system: Opening inventory of work-in-process: Units – 500 (with all materials added and 50% of labor and overhead) Cost - Materials ……………………………………………………………………………………….. P 2,400 Labor ………………………………………………………………………………………………. 1,500 Factory overhead …………………………………………………………………………… 760 Put into production: Units – 5,000 Cost - Materials ……………………………………………………………………………………….. P25,100 Labor ………………………………………………………………………………………………. 19,380 Factory overhead …………………………………………………………………………… 14,900 Completed and transferred – 4,8000 units Ending inventory of work-in-process: Units – 700 (with all materials, and 60% of labor and overhead) The cost per equivalent unit, order (rounded to nearest centavo): FIFO =11.92 ; Average = 12.00 23. Cost and statistics for Department 2 of a company manufacturing a single product in three department follows: Work-in-process, October 1: Cost in Department 1 ………………………………………………………………………. P11,380 Cost in Department 2 Materials …………………………………………………………………………….. None Labor ……………………………………………………………………………………. P500 Factory overhead ………………………………………………………………… 50 Cost in Department 2 in October Materials …………………………………………………………………………….. None Labor ……………………………………………………………………………………. P13,000 Factory overhead ………………………………………………………………… 450 Units in process, October 1, 60% completed as to conversion cost ………………………………………………………….. 500 Units received from Department 1 in October at P2.60 per unit …….. 6,700 Units completed and transferred to Department 3 in October ………... 6,800 Units in process, October 31, half completed as to conversion cost …………………………………………………………… 400 Compute the conversion cost per equivalent unit (rounded to nearest centavo) FIFO = 2.01; Average = 2.00 24. Wilson Company manufactures the famous ticktock watch on an assembly line basis. January 1, work-in-process consisted of 5,000 units partially completed. During the month an additional 11,000 units were started and 105,000 units were completed, the ending work-in-process was 3/5 complete as to conversion costs. Conversion costs are added evenly throughout the process. The following conversion costs were incurred. Beginning costs for work-in-process ……………………………………………………….. P 1,500 Total current conversion costs ………………………………………………………………… 273,920 The conversion costs assigned to ending work-in-process totaled P15360 using the FIFO method process costing. What was the percentage of completion, as to conversion costs on the 5,000 units in BWIP? 80% 25. Barnet Company adds materials at the beginning of the process in Department m. Conversion costs were 75% complete as to the 8,000 units in WIP at May 1 and 50% complete as to 6,000 units in WIP at May 31. During May, 12,000 units were completed and transferred to the next department. An analysis of the costs relating to WIP at May 1 and to production activity for May is as follows: Costs Materials Conversion WIP, May 1 ……………………………………….. P 9,600 P 4,800 Costs added in May …………………………… 15,600 14,400 Total cost per equivalent unit for May was: FIFO = 3.16; Average = 2.68 26. Given for a certain process: Beginning work in process, 2/5 completed ……………………………………………………. Transferred in ………………………………………………………………………………………………… Normal spoilage …………………………………………………………………………………………….. Abnormal spoilage …………………………………………………………………………………………. Goods completed and transferred out …………………………………………………………… Ending work in process, 1/3 completed ………………………………………………………… Conversion costs in beginning inventory ……………………………………………………….. Current period conversion costs …………………………………………………………………….. 500 units 2,000 units 200 units 300 units 1,700 units 300 units P 610 P 3,990 All spoilage occurs at the end of the process. The conversion cost per equivalent unit amounted to: FIFO Method = 1.90; Average Method = 2.00 27. Using the same information in No. 26, the conversion costs components of normal spoilage: FIFO Method = 380; Average Method = 400 28. Using the same information in No. 26, the conversion costs components of normal spoilage: FIFO Method = 570; Average Method = 600