Dr. M.D. Chase

advertisement

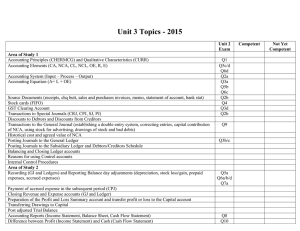

Dr. M.D. Chase Advanced Accounting-305-16B Long Beach State University Purchase: Analysis/Eliminations Page 1 I. PURCHASE EXAMPLE WITH ANALYSIS, ELIMINATIONS AND WORKSHEET Facts: 1. “P" pays $790,000 for 80% of "S" (8,000) shares on 3/1/x1. 2. $25,000 of direct acquisition costs are also incurred in the purchase, of which $15,000 covered SEC related expenses. 3. At the time of the purchase "S" had the following balance sheet: Historical Assets Inventory.......................... Dr. (Cr) Cost $ Land............................... FMV 75,000 $ Difference 80,000 150,000 200,000 Building .......................... 600,000 500,000 A/D-Building.. (300,000) Equipment.......................... 150,000 A/D-Equipment. (50,000) Goodwill........................... $ 5,000 50,000 200,000 net 80,000 ( 20,000) Note the presence of pre-existing GW…What implications does this have for your analysis? 125,000 Total assets................. $ 750,000 Liabilities and Equities Current............................ $ Bonds (6% due 12/31/x4)...... 50,000 $ 200,000 50,000 Common Stock ($10 par)......... 100,000 n/a PIC in excess of par 150,000 n/a 250,000 n/a Retained earnings.............. Total liabilities........ $ $ 186,752 750,000 0 13,248 $ 243,248 $ 194,598 .8 Remember: This represents the excess of cost>BV necessary to bring all the accounts up to FMV… OTHER DATA: a) the remaining life of the building is 20 years b) the remaining life of the equipment is 5 years c) the market rate of interest on the bond is 8%. d) “S” had net income of $70,000 (of which $10,000 was earned prior to 3/1/x1) and paid dividends of $20,000 in year x1. e) During year x1 "P" and "S" had the following totals: "P" Sales.... 350,000 "S" 210,000 COS..... 150,000 80,000 Expenses.... 120,000 60,000 REQUIRED: a. This is critical information. Remember, “P” is not entitled to consolidate income earned by “S” prior to the purchase. This represents “Purchased NI” and must be accounted for (eliminated) during the analysis of the investment. Analyze the investment b. Analyze the investment assuming that "P" had paid only $490,000 instead of $790,000 as above. c. Analyze the investment assuming that "P" had paid only $390,000. d. present the consolidated elimination entries for requirement a. e. compute total NI; MI NI; controlling NI; MI f. prepare the consolidated worksheet Dr. M.D. Chase Advanced Accounting-305-16B Long Beach State University Purchase: Analysis/Eliminations Page 2 SOLUTION-REQUIREMENT a: Analyze the investment: A. Analysis based on cost of $790,000 Cost ($790,000 + $10,000)............................ $ Purchased BV C/S: Remember: All charges related to SEC or stock issuance costs are expensed in a purchase consolidation; other charges are capitalized. 800,000 100,000 PIC: 150,000 RE: 250,000 500,000 (.8) .......... 400,000 Excess of cost over BV.................................... 400,000 Add: Preexisting GW (125,000)(.8)............... Be certain you note how pre-existing GW is treated… 100,000 Adjusted excess:............................................. 500,000 As noted on the prior page, Purchased NI is another problematic issue. Do you understand what it is and how it was computed? Attributable to: Purchased net income: ................ 8,000 FMV accounts (CA;Liabilities;MES): Inventory (.8)(5,000)..... 4,000 Liabilities (.8)(13,248).......... 10,598 Available to NCA: Purchased NI is Subsidiary NI earned prior to the purchase in the year of purchase. This is income that “P” is not entitled to include in the consolidated net income and therefore must be accounted for in the purchase. 22,598 477,402 NCA: Land (.8)(50,000)................. Building (.8)(200,000)............ Equipment (.8)(20,000 cr)..... In this case you were told that “S” earned $10,000 prior to acquisition. Since “P” acquired and 80% interest, purchased NI is 10,000(.8) or $8,000 40,000 160,000 184,000 (16,000) Balance to Goodwill................... 293,402 SOLUTION-REQUIREMENT b: Analysis based on cost of $490,000 Cost ($490,000 + $10,000)................. Purchased BV C/S: $ 500,000 100,000 PIC: 150,000 RE: 250,000 500,000 (.8) .......... 400,000 Excess of cost over BV.................................... 100,000 Add: Preexisting GW.... It is essential to take note that this is GW created by the purchase after eliminating (adding back) the pre-existing GW. REMEMBER: ALL GOODWILL RECOGNIZED IN THE CONSOLIDATION MUST BE A RESULT OF THE PURCHASE AND NOT PREEXISTING… 100,000 Adjusted excess:............................................. 200,000 Attributable to: Purchased net income: ................ 8,000 FMV accounts (CA;Liabilities;MES): Inventory (.8)(5,000) Liabilities (.8)(13,248).......... 4,000 402 10,598 22,598 Available to NCA: 177,402 NCA: Land (See table).................. 38,308 Building (See table).............. 155,771 Equipment (.8)(20,000 cr)....... . (16,667) Excess available to GW................ 177,402 -0- Excess Available to NCA + (BV of NCA)(% ownership) $177,402 + (150,000+300,000+100,000)(.8)= $617, 402 Allocate to NCA in proportion of relative FMV; Rel. $ Rel % Adj. NCA FMV FMV TV Val BV Land 200 200/ 617,402 158,308 120,000 780 Build 500 500/ 617,402 395,771 240,000 780 Equip 80 80/7 617,402 63,323 80,000 80 Total 780 780/ 617,402 780 Adj. Req. 38,308 155,771 (16,667) 177,402 Dr. M.D. Chase Advanced Accounting-305-16B Long Beach State University Purchase: Analysis/Eliminations Page 3 SOLUTION-REQUIREMENT c: Analysis based on cost of $390,000 Cost ($390,000 + $10,000)............ Purchased BV C/S: $ 400,000 100 PIC: 150 RE: 250 500 (.8) ..... 400,000 Excess of cost over BV.................................... -0- Add: Preexisting GW....................................... 100,000 Adjusted excess:............................................. 100,000 Attributable to: Purchased net income: ..... 8,000 FMV accounts (CA;Liabilities;MES): Inventory (.8)(5,000)............. 4,000 Liabilities (.8)(13,248).......... 10,590 22,598 Available to NCA: NCA: Adj. Req. 12,667 91,668 (26,933) 77,402 77,402 Land (See table). 12,667 Building (See table).......... Equipment (See table).... Excess Available to NCA + (BV of NCA)(% ownership) $77,402 + (150,000+300,000+100,000)(.8)= $517, 402 Allocate to NCA in proportion of relative FMV; Rel. $ Rel % Adj. NCA FMV FMV TV Val BV Land 200 200/ 517,402 132,667 120,000 780 Build 500 500/ 517,402 331,668 240,000 780 Equip 80 80/7 517,402 53,067 80,000 80 Total 780 780/ 617,402 780 91,668 (26,933) 77,402 Excess available to GW................ -0- SOLUTION-REQUIREMENT d: Consolidated elimination entries based on requirement (a) (Parent is on the equity method) a. Eliminate current year investment account entries: Equity in "S" NI........................ 48,000 Dividends............................ 16,000 Investment in "S".................... 32,000 You are expected to understand how to use the “effective interest method” of bond amortization necessary to solve this problem. If you don’t, please review your Intermediate Accounting and/or see me at office hours. b. Eliminate "P" pro rata share of "S" SHE: "S" C/S (.8)($100,000).................. 80,000 "S" PIC (.8)($150,000)................. 120,000 "S" RE (.8)($250,000)................. 200,000 Investment in "S"................... 400,000 c. Allocate the excess of cost over book value per analysis: Purchased NI (.8)(10,000)......... 8,000 COS (inventory assumes FIFO)(.8)($5,000).. 4,000 Liabilities (per analysis)................ 10,598 Land (.8)($50,000).................. 40,000 A/D Building (.8)($200,000)............... 160,000 Goodwill (per analysis)..... 193,402 Equipment (.8)($20,000).............. ** Carrying value of bonds at 1/1/x1: $200,000 (.8) = Less: discount (200,000-186,752)(.8) 160,000 10,598 Carrying Value 149,402 16,000 Investment in "S".................... 400,000 d. Amortize the excess of cost over book value (the dif. between values based on "P" life and values and "S" life and values) Depreciation expense (8,000)(10/12). 6,667 Year Bond Amortization Expense (2,352)(10/12) 1,960 A/D (16,000/5) (10/12).................... 2,667 A/D PP&E ($160,000/20) (10/12)...... 6,667 Discount on B/P (2,352)(10/12)....... 1,960** Depreciation expense-building........ 2,667 Note that GW is not subject to amortization; GW is checked annually for “impairment” and written off against NI (expensed) if its value has declined : 8% 6% Effective Stated Rate Rate Amort. Carrying Value 0 149,402 1 11,592 9,600 2,352 151,754 2 12,140 9,600 2,540 154,294 3 12,344 9,600 2,744 157,038 4 12,563 9,600 2,963 160,001 Total 48,639 10,599 Dr. M.D. Chase Advanced Accounting-305-16B Long Beach State University Purchase: Analysis/Eliminations Page 4 e. compute total net income, MI net income and controlling interest net income Adjustments/Eliminations _ "P" Inc. "S" Inc. Sales........................................ (350,000) (210,000) Cost of goods sold........................... 150,000 80,000 Expenses..................................... 120,000 60,000 Dr 230,000 6,667 Amortization Expense (Downstream)............ 1,960 (2,667) Depreciation Expense-Building (Downsream) ( 80,000) 185,960 ( 70,000) 8,627 ( 2,667) Total net [income] loss...................... to Minority interest (MI%)(SIGNI+UPCR-UPDR)=(.2)(70,000)............................................ to Controlling interest PIGNI+P%(SADJNI)+DNCR-DNDR)=-(80,000)+(.8)(70,000)+2,667-8,627............. Total Income of the Consolidated Entity Net Income ( 560,000) Depreciation Expense (Downstream)............ Internally Generated Net Income.............. Consolidated CR ( 144,040) 14,000 income 130,040 income (144,040) SOLUTION-REQUIREMENT f: The consolidated worksheet can be created and checked against the results of part e above.