Data Definitions

advertisement

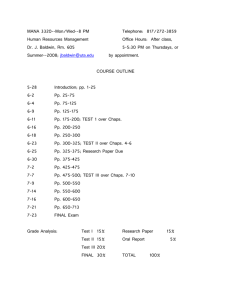

Data Definitions Data Definitions i In this chapter… 1 Restated Annual Data Definitions 1 Footnote Codes 1 Compustat North America Data Definitions Accounting Changes – Cumulative Effect Annual & Quarterly footnote codes Accounts Payable Annual & Quarterly footnote code Accounts Payable and Accrued Liabilities – Increase (Decrease) (Statement of Cash Flows) Accounts Receivable – Decrease (Increase) (Statement of Cash Flows) Accrued Expense Accumulated Depreciation of Real Estate Property Accumulated Other Comprehensive Income (Loss) Acquisition/Merger After-Tax Acquisition/Merger Basic EPS Effect Acquisition/Merger Diluted EPS Effect Acquisition/Merger Pretax Acquisitions – Income Contribution Acquisitions – Sales Contribution Annual footnote codes Acquisitions (Statement of Cash Flows) Active/Inactive Flag Codes Adjustment Factor (Cumulative) by Ex-Date Adjustment Factor (Cumulative) by Payable Date Adjustment Factor (Raw) by Ex-Date ADR Ratio Advertising Expense Amortization of Intangibles Annualized Dividend Rate Compustat North America 8/2003 Chapter 5 – Data Definitions 2 2 2 3 4 4 5 6 7 7 8 8 8 9 9 9 10 10 11 11 12 16 17 17 18 18 19 i Assets – Other Assets – Other – Excluding Discontinued Operations Assets – Total (Restated) Assets – Total/Liabilities and Stockholders’ Equity – Total Annual & Quarterly footnote codes Quarterly only footnote codes Assets and Liabilities – Other (Net Change) (Statement of Cash Flows) Auditor/Auditor’s Opinion Book Value per Share Calendar Year Canadian Index Code Canadian Index Code – Current Capital Expenditures (Compustat Business Information Files) Capital Expenditures (Restated) Capital Expenditures (Statement of Cash Flows) Annual & Quarterly footnote code Capital Surplus Annual & Quarterly footnote code Cash Cash and Cash Equivalents – Increase (Decrease) (Statement of Cash Flows) Cash and Short-Term Investments Cash Dividends (Statement of Cash Flows) Cash Equivalent Distributions per Share by Ex-Date Changes in Current Debt (Statement of Cash Flows) Class Code Common Equity – Liquidation Value Common Equity – Tangible Common Equity – Total Common Shareholders Common Shares Issued Common Shares Outstanding Quarterly footnote code Common Shares Reserved for Conversion – Convertible Debt Common Shares Reserved for Conversion – Preferred Stock Common Shares Reserved for Conversion – Stock Options Common Shares Reserved for Conversion – Total Common Shares Reserved for Conversion – Warrants and Other Common Shares Traded Common Shares Used to Calculate Earnings per Share – 12 Months Moving Common Shares Used to Calculate Earnings per Share (Basic) Common Shares Used to Calculate Earnings per Share (Basic) (Restated) Common Shares Used to Calculate Earnings per Share (Diluted) Common Stock Annual & Quarterly footnote codes Common Stock – Per Share Carrying Value Annual footnote code Common Stock Equivalents – Dollar Savings Common Stock Float Shares – Canada Company Name Compensating Balance Contingent Liabilities – Guarantees Annual footnote code Convertible Debt and Preferred Stock Cost of Goods Sold Annual & Quarterly footnote codes ii Chapter 5 – Data Definitions 20 22 23 24 24 24 25 26 28 29 29 29 30 30 30 31 31 33 33 34 35 36 37 37 38 38 39 39 40 40 40 41 41 42 42 42 43 43 44 44 45 45 46 47 47 47 48 48 48 49 49 49 50 50 52 Compustat North America 8/2003 Cost of Goods Sold (Restated) Currency Translation Rate Current Assets of Discontinued Operations Current Assets – Other Current Assets – Other – Excluding Discontinued Operations Current Assets – Other – Excluding Prepaid Expense Current Assets – Total Current Liabilities – Other Current Liabilities – Other – Excluding Accrued Expense Current Liabilities – Total Customer Identifier (Compustat Business Information Files) Customer Name (Compustat Business Information Files) Customer Revenues (Compustat Business Information Files) Customer Type (Compustat Business Information Files) Customer Type Classifications CUSIP Issue Number and Check Digit CUSIP Issuer Code Data Quarter Data Year Debt – Capitalized Lease Obligations Annual footnote codes Debt – Consolidated Subsidiary Annual footnote codes Debt – Convertible Annual footnote codes Debt – Debentures Annual footnote codes Debt – Due In One Year Debt – Finance Subsidiary Annual footnote codes Debt – Maturing in 2nd, 3rd, 4th, and 5th Years Annual footnote code Debt – Mortgage and Other Secured Debt – Notes Annual footnote codes Debt – Senior Convertible Annual footnote codes Debt – Subordinated Annual footnote codes Debt – Subordinated Convertible Annual footnote codes Debt – Unamortized Debt Discount and Other Debt in Current Liabilities Quarterly footnote code Deferred Charges Deferred Compensation Deferred Revenue – Current Deferred Revenue – Long-Term Deferred Taxes – Federal Deferred Taxes – Foreign Deferred Taxes – State Deferred Taxes (Balance Sheet) Deferred Taxes (Income Account) Deferred Taxes (Statement of Cash Flows) Deferred Taxes and Investment Tax Credit (Balance Sheet) Compustat North America 8/2003 Chapter 5 – Data Definitions 52 53 53 53 55 55 56 57 58 59 60 60 61 61 61 62 62 63 63 64 64 64 64 65 65 65 65 66 66 66 66 67 67 67 68 68 69 69 69 69 70 70 70 71 71 73 73 73 74 74 74 75 75 76 76 iii Depletion Expense (Schedule VI) Depreciation (Accumulated) – Beginning Balance (Schedule VI) Depreciation (Accumulated) – Buildings Depreciation (Accumulated) – Construction in Progress Depreciation (Accumulated) – Ending Balance (Schedule VI) Depreciation (Accumulated) – Land and Improvements Depreciation (Accumulated) – Leases Depreciation (Accumulated) – Machinery and Equipment Depreciation (Accumulated) – Natural Resources Depreciation (Accumulated) – Other Depreciation (Accumulated) – Other Changes (Schedule VI) Depreciation (Accumulated) – Retirements (Schedule VI) Depreciation and Amortization (Income Statement) Annual & Quarterly footnote codes Depreciation and Amortization (Restated) Depreciation and Amortization (Statement of Cash Flows) Depreciation and Amortization of Property Depreciation Expense (Schedule VI) Depreciation, Depletion, and Amortization (Accumulated) (Balance Sheet) Annual & Quarterly footnote code Annual only footnote codes Dilution Adjustment Dilution Available - Excluding Discontinued Operations Dividends – Common Dividends – Common – Indicated Annual Dividends – Preferred Dividends – Preferred – In Arrears Dividends per Share by Ex-Date Dividends per Share by Payable Date Duplicate File Code Earnings per Share (Basic) – Excluding Extraordinary Items Annual & Quarterly footnote codes Annual only footnote codes Quarterly only footnote codes Earnings per Share (Basic) – Excluding Extraordinary Items – 12 Months Moving Earnings per Share (Basic) – Excluding Extraordinary Items (Restated) Earnings per Share (Basic) – Including Extraordinary Items Annual & Quarterly footnote codes Annual only footnote codes Quarterly only footnote codes Earnings per Share (Basic) – Including Extraordinary Items (Restated) Earnings per Share (Diluted) – Excluding Extraordinary Items Earnings per Share (Diluted) – Excluding Extraordinary Items – 12 Months Moving Earnings per Share (Diluted) – Excluding Extraordinary Items (Restated) Earnings per Share (Diluted) – Including Extraordinary Items Earnings per Share (Diluted) – Including Extraordinary Items (Restated) Earnings per Share from Operations Annual & Quarterly footnote codes Earnings per Share from Operations (Basic) – 12 Months Moving Earnings per Share from Operations (Diluted) Earnings per Share from Operations (Diluted) – 12 Months Moving Earnings per Share – Historical Employees Annual footnote code iv Chapter 5 – Data Definitions 77 77 77 77 78 78 78 79 79 79 80 80 81 82 83 83 84 84 85 85 85 86 86 86 87 88 88 89 89 90 91 91 92 92 92 93 94 94 95 95 95 95 96 96 97 98 98 99 99 100 100 101 101 101 102 Compustat North America 8/2003 Employees (Compustat Business Information – Segment Item Value Files) Footnote code Employees (Restated) Employer Identification Number Equity in Earnings Annual footnote codes Equity in Earnings (Compustat Business Information File) Footnote code Equity in Net Loss (Earnings) (Statement of Cash Flows) Exchange Listing and S&P Major Index Code Exchange Rate Effect (Statement of Cash Flows) Excise Taxes Export Sales (Compustat Business Information Files) External Revenues (Compustat Business Information Files) Extraordinary Items Extraordinary Items and Discontinued Operations Extraordinary Items and Discontinued Operations (Restated) Extraordinary Items and Discontinued Operations (Statement of Cash Flows) File Identification Code Financing Activities – Net Cash Flow (Statement of Cash Flows) Financing Activities – Other (Statement of Cash Flows) Fiscal Year-end Month of Data Foreign Currency Adjustment (Income Account) Annual & Quarterly footnote code Format Code (Statement of Cash Flows) Fortune Industry Code Fortune Rank 4-Digit Data Year 4-Digit S&P Calendar Year Funds from Operations – Other (Statement of Cash Flows) Funds from Operations – Total (Statement of Changes) Gain/Loss After-Tax Gain/Loss Basic EPS Effect Gain/Loss Diluted EPS Effect Gain/Loss Pretax Gain/Loss on Sale of Property Geographic Area Code (Compustat Business Information Files) Geographic Area Type (Compustat Business Information Files) Global Industry Classification Standard – Current Global Industry Classification Standard – Monthly Goodwill Goodwill Amortization Annual & Quarterly footnote code Goodwill Amortization – Note Annual & Quarterly footnote code IPO Date Identifiable/Total Assets (Compustat Business Information Files) Impairments of Goodwill After-Tax Annual & Quarterly footnote code Impairments of Goodwill Basic EPS Effect Impairments of Goodwill Diluted EPS Effect Impairments of Goodwill Pretax Annual & Quarterly footnote code Implied Option Expense In Process Research & Development Expense Compustat North America 8/2003 Chapter 5 – Data Definitions 102 102 102 103 103 103 104 104 104 105 106 106 107 107 108 109 110 110 111 112 112 113 114 114 114 115 116 116 116 116 117 118 118 119 119 120 120 121 121 122 122 123 123 123 123 123 124 124 124 125 125 126 126 126 127 v Income Before Extraordinary Items Annual & Quarterly footnote codes Income Before Extraordinary Items (Statement of Cash Flows) Income Before Extraordinary Items (Restated) Income Before Extraordinary Items – Adjusted for Common Stock Equivalents – Dollar Savings Annual & Quarterly footnote code Income Before Extraordinary Items – Available for Common Income Tax Refund Income Taxes – Accrued – Increase (Decrease) (Statement of Cash Flows) Income Taxes – Federal Current Annual footnote code Income Taxes – Foreign Current Annual footnote code Income Taxes – Other Annual footnote code Income Taxes – State Current Annual footnote code Income Taxes – Total Annual & Quarterly footnote codes Income Taxes – Total (Restated) Income Taxes Paid (Statement of Cash Flows) Income Taxes Payable Annual & Quarterly footnote code Incorporation ISO Country Code (Compustat Business Information Files) Increase in Investments (Statement of Cash Flows) Industry Name Intangibles Intangibles – Other Interest Capitalized Interest Capitalized – Net Income Effect Interest Expense Annual & Quarterly footnote codes Interest Expense (Restated) Interest Expense – Total (Financial Services) Interest Expense on Long-Term Debt Interest Income Interest Income – Total (Financial Services) Interest Paid – Net (Statement of Cash Flows) Inventories – Finished Goods Inventories – LIFO Reserve Inventories – Other Inventories – Raw Materials Inventories – Total Inventories – Work in Process Inventory – Decrease (Increase) (Statement of Cash Flows) Inventory Valuation Method Invested Capital – Total Investing Activities – Net Cash Flow (Statement of Cash Flows) Investing Activities – Other (Statement of Cash Flows) Investment Tax Credit (Balance Sheet) Investment Tax Credit (Income Account) Annual footnote codes Investments and Advances – Equity Method Investments and Advances – Other Investments at Equity (Compustat Business Information Files) vi Chapter 5 – Data Definitions 127 128 128 128 129 129 129 130 130 131 132 132 132 132 133 133 133 134 134 135 135 136 136 136 137 138 138 139 141 142 142 143 143 143 144 144 145 145 146 146 146 147 147 148 149 150 151 151 152 152 153 153 154 154 156 Compustat North America 8/2003 Issue Status Code Issue Trading Exchange Labor and Related Expense Annual footnote code Liabilities and Stockholders’ Equity – Total/Assets – Total Annual & Quarterly footnote codes Quarterly only footnote codes Liabilities – Other Liabilities – Total Long-Term Assets of Discontinued Operations Other Long-Term Assets Long-Term Debt – Issuance (Statement of Cash Flows) Long-Term Debt – Other Annual footnote codes Long-Term Debt – Reduction (Statement of Cash Flows) Long-Term Debt – Tied to Prime Annual footnote code Long-Term Debt – Total Annual & Quarterly footnote codes Annual only footnote code Long-Term Debt – Total (Restated) Long-Term Investments – Total Marketable Securities Adjustment (Balance Sheet) Minority Interest (Balance Sheet) Minority Interest (Income Account) Minority Interest (Restated) Net Asset Value per Share Net Charge-Offs Net Income (Loss) Annual & Quarterly footnote codes Net Income (Loss) (Restated) Net Income – Adjusted for Common Stock Equivalents Net Interest Income (Tax Equivalent) Net Interest Margin Net Operating Loss Carry Forward – Unused Portion Non-Core Gain/Loss Pretax Non-operating Income (Expense) Non-operating Income (Expense) – Excluding Interest Income Non-operating Income (Expense) (Restated) Non-performing Assets – Total North American Industrial Classification System (NAICS) File (Compustat Business Information Files) Notes Payable Operating Activities – Net Cash Flow (Statement of Cash Flows) Operating Income After Depreciation Annual footnote codes Operating Income Before Depreciation Operating Income Before Depreciation (Restated) Operating Profit (Loss) (Compustat Business Information Files) Footnote codes Operating Segment Type (Compustat Business Information Files) Operating Segment Types Order Backlog Order Backlog (Compustat Business Information File) Pension – Accumulated Benefit Obligation 156 157 157 157 158 158 158 158 160 160 160 161 162 162 162 163 164 165 166 166 166 166 167 167 168 168 168 169 169 169 170 170 171 171 171 172 173 175 175 175 Chapter 5 – Data Definitions vii Compustat North America 8/2003 176 177 178 178 179 179 180 180 181 181 181 182 182 183 Pension – Accumulated Benefit Obligation (Underfunded) Pension – Additional Minimum Liability Pension – Other Adjustments Pension – Other Adjustments (Underfunded) Pension – Prepaid/Accrued Cost Annual footnote code Pension – Prepaid/Accrued Cost (Underfunded) Annual footnote code Pension – Projected Benefit Obligation Pension – Projected Benefit Obligation (Underfunded) Pension – Unrecognized Prior Service Cost Pension – Unrecognized Prior Service Cost (Underfunded) Pension – Vested Benefit Obligation Pension – Vested Benefit Obligation (Underfunded) Pension and Retirement Expense Pension Benefits – Information Date Pension Benefits – Net Assets Pension Benefits – Present Value of Nonvested Pension Benefits – Present Value of Vested Pension Costs – Unfunded Past or Prior Service Pension Costs – Unfunded Vested Benefits Pension Discount Rate (Assumed Rate of Return) Annual & Quarterly footnote code Pension Plan Assets Pension Plan Assets (Underfunded) Pension Plans – Anticipated Long-Term Rate of Return on Plan Assets Annual & Quarterly footnote code Pension Plans – Interest Cost Pension Plans – Other Periodic Cost Components (Net) Pension Plans – Rate of Compensation Increase Annual & Quarterly footnote code Pension Plans – Return on Plan Assets (Actual) Pension Plans – Service Cost Periodic Pension Cost (Net) Periodic Postretirement Benefit Cost (Net) Postretirement Benefit – Asset (Liability) (Net) Preferred Stock – Carrying Value Preferred Stock – Convertible Preferred Stock – Liquidating Value Annual footnote code Preferred Stock – Nonredeemable Preferred Stock – Redeemable Preferred Stock – Redemption Value Annual footnote code Prepaid Expense Pretax Income Pretax Income (Restated) Pretax Income – Domestic Annual footnote code Pretax Income – Foreign Annual footnote code Price – Close Price – High Price – Low Price – Fiscal Year – Close viii Chapter 5 – Data Definitions 183 184 184 185 186 186 186 187 187 188 188 189 189 190 190 192 192 192 192 193 193 193 194 194 195 195 196 196 196 197 197 197 198 198 198 199 199 200 200 200 201 201 202 202 202 204 204 204 205 205 205 205 205 206 207 Compustat North America 8/2003 Price – Fiscal Year – High Price – Fiscal Year – Low Product Identifier (Compustat Business Information Files) Product Name (Compustat Business Information Files) Property, Plant, and Equipment – Beginning Balance (Schedule V) Property, Plant, and Equipment – Buildings at Cost Property, Plant, and Equipment – Buildings (Net) Property, Plant, and Equipment – Capital Expenditures (Schedule V) Property, Plant, and Equipment – Construction in Progress at Cost Property, Plant, and Equipment – Construction in Progress (Net) Property, Plant, and Equipment – Ending Balance (Schedule V) Property, Plant, and Equipment – Land and Improvements at Cost Property, Plant, and Equipment – Land and Improvements (Net) Property, Plant, and Equipment – Leases at Cost Property, Plant, and Equipment – Leases (Net) Property, Plant, and Equipment – Machinery and Equipment at Cost Property, Plant, and Equipment – Machinery and Equipment (Net) Property, Plant, and Equipment – Natural Resources at Cost Property, Plant, and Equipment – Natural Resources (Net) Property, Plant, and Equipment – Other at Cost Property, Plant, and Equipment – Other (Net) Property, Plant, and Equipment – Other Changes (Schedule V) Property, Plant, and Equipment – Retirements (Schedule V) Property, Plant, and Equipment – Total (Gross) Annual footnote codes Property, Plant, and Equipment – Total (Net) Annual footnote codes Property, Plant, and Equipment – Total (Net) (Restated) Provision for Loan/Asset Losses Purchase of Common and Preferred Stock (Statement of Cash Flows) Real Estate Property – Total Receivables – Current – Other Receivables – Estimated Doubtful Receivables – Total Receivables – Trade Record Number Rental Commitments – Minimum – 1st, 2nd, 3rd, 4th, and 5th Years Annual footnote code Rental Commitments – Minimum – Five Years Total Rental Commitments – Thereafter Rental Expense Annual footnote codes Rental Income Report Date of Quarterly Earnings Research and Development (Compustat Business Information Files) Footnote code Research and Development Expense Annual & Quarterly footnote codes Reserve for Loan/Asset Losses Restructuring Costs Aftertax Restructuring Costs Basic EPS Effect Restructuring Costs Diluted EPS Effect Restructuring Costs Pretax Annual & Quarterly footnote code Retained Earnings Compustat North America 8/2003 Chapter 5 – Data Definitions 207 207 208 208 209 209 209 209 210 210 211 211 211 212 212 212 213 213 214 214 215 215 215 216 218 218 218 218 219 219 220 221 222 222 224 225 225 225 226 226 226 226 227 227 227 227 228 228 229 229 230 231 231 232 232 ix Annual & Quarterly footnote code Retained Earnings (Restated) Retained Earnings – Cumulative Translation Adjustment Retained Earnings – Other Adjustments Retained Earnings – Unadjusted Quarterly footnote code Retained Earnings – Unrestricted Retained Earnings Restatement Risk-Adjusted Capital Ratio – Tier 1 Risk-Adjusted Capital Ratio – Total S&P Common Stock Ranking S&P Industry Index Code – Historical S&P Industry Index Relative Code S&P Long-Term Domestic Issuer Credit Rating – Current Annual & Quarterly footnote code S&P Long-Term Domestic Issuer Credit Rating - Historical Annual & Quarterly footnote code S&P Long-Term Domestic Issuer Credit Rating – Footnote – Current S&P Major Index Code – Historical S&P Primary Index Marker S&P Primary Index Marker – Monthly S&P Secondary Index Identifier S&P Short-Term Domestic Issuer Credit Rating – Current S&P Short-Term Domestic Issuer Credit Rating – Historical S&P Subordinated Debt Rating S&P Subordinated Debt Rating – Current S&P Subset Index Identifier Sale of Common and Preferred Stock (Statement of Cash Flows) Sale of Investments (Statement of Cash Flows) Sale of Property, Plant, and Equipment (Statement of Cash Flows) Sale of Property, Plant, and Equipment and Sale of Investments – Loss (Gain) (Statement of Cash Flows) Sales (Net) Annual & Quarterly footnote codes Quarterly only footnote codes Quarterly only footnote codes (cont.) Sales (Net) (Compustat Business Information Files) Footnote codes Sales (Restated) Segment Identifier (Compustat Business Information File) Segment Name (Compustat Business Information File) Selling, General, and Administrative Expense Annual & Quarterly footnote code Selling, General, and Administrative Expense (Restated) Settlement (Litigation/Insurance) Aftertax Annual & Quarterly footnote code Settlement (Litigation/Insurance) Basic EPS Effect Settlement (Litigation/Insurance) Diluted EPS Effect Settlement (Litigation/Insurance) Pretax Annual & Quarterly footnote code Short-Term Borrowing – Average Short-Term Borrowings – Average Interest Rate Short-Term Investments Short-Term Investments – Change (Statement of Cash Flows) Source Document Code x Chapter 5 – Data Definitions 233 234 234 234 235 235 235 235 236 236 237 237 238 238 238 239 242 242 242 243 243 243 244 245 246 249 249 249 250 251 252 254 255 256 257 257 259 259 260 260 260 262 262 262 263 263 263 264 264 264 265 265 266 267 Compustat North America 8/2003 Source Fiscal Year End Month Source Year Sources of Funds – Other (Statement of Changes) Sources of Funds – Total (Statement of Changes) Special Items Special Items Aftertax – Other Special Items Basic EPS Effect – Other Special Items Diluted EPS Effect – Other Special Items Pretax – Other Standard Industry Classification (SIC) Code – Historical Standard Industry Classification Code – Primary Standard Industrial Classification (SIC) Code – Primary (Compustat Business Information File) Standard & Poor's Calendar Quarter Standard & Poor's Calendar Year Stock Compensation Expense Stockholders' Equity Adjustments – Other Stockholders’ Equity (Restated) Stockholders’ Equity – Total Stock Ownership Code Stock Ticker Symbol Trading Location Treasury Stock (Dollar Amount) – Common Annual footnote code Treasury Stock (Dollar Amount) – Preferred Treasury Stock – Memo Entry Treasury Stock – Number of Common Shares Treasury Stock – Total Dollar Amount Type Code for the SIC Update Code Update Code (Compustat Business Information Files) Uses of Funds – Other (Statement of Changes) Uses of Funds – Total (Statement of Changes) Working Capital (Balance Sheet) Working Capital (Restated) Working Capital Change – Other – Increase (Decrease) (Statement of Changes) Working Capital Change – Total (Statement of Changes) Writedowns Aftertax Writedowns Basic EPS Effect Writedowns Diluted EPS Effect Writedowns Pretax Compustat North America 8/2003 Chapter 5 – Data Definitions 270 270 270 271 271 273 273 274 274 275 275 276 277 277 278 278 279 279 280 280 282 283 283 283 283 284 284 285 285 286 286 287 287 287 288 288 289 289 290 290 xi