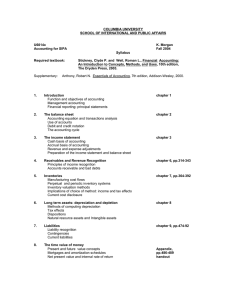

Principles of Accounting II: Chapters 15 and 16 Chapter 15

advertisement

Principles of Accounting II: Chapters 15 and 16 Chapter 15 1. One potential advantage of financing corporations through the use of bonds rather than common stock is a. the interest on bonds must be paid when due. b. the corporation must pay the bonds at maturity. c. the interest expense is deductible for tax purposes by the corporation. d. a higher earnings per share is guaranteed for existing common shareholders. 2. When the maturities of a bond issue are spread over several dates, the bonds are called a. serial bonds b. bearer bonds c. debenture bonds d. term bonds 3. If the market rate of interest is 6%, the price of 8% bonds paying interest semiannually with a face value of $100,000 will be a. Equal to $100,000 b. Greater than $100,000 c. Less than $100,000 d. Greater than or less than $100,000, depending on the maturity date of the bonds 4. The present value of $40,000 to be received in one year, at 6% compounded annually, is (rounded to nearest dollar) a. $37,736 b. $42,400 c. $40,000 d. $2,400 5. The present value of $30,000 to be received in two years, at 12% compounded annually, is (rounded to nearest dollar) a. $23,916 b. $37,632 c. $23,700 d. $30,000 6. When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at a. a premium b. their face value c. their maturity value d. a discount 7. A corporation issues for cash $8,000,000 of 8%, 30-year bonds, interest payable semiannually. The amount received for the bonds will be a. present value of 60 semiannual interest payments of $320,000, plus present value of $8,000,000 to be repaid in 30 years b. present value of 30 annual interest payments of $640,000 c. present value of 30 annual interest payments of $640,000, plus present value of $8,000,000 to be repaid in 30 years d. present value of $8,000,000 to be repaid in 30 years, less present value of 60 semiannual interest payments of $320,000 8. When the market rate of interest was 12%, Newman Corporation issued $1,000,000, 11%, 10-year bonds that pay interest annually. The selling price of this bond issue was a. $ 321,970 b. $1,000,000 c. $ 943,494 d. $621,524 9. Two companies are financed as follows: Bonds payable, 9% issued at face Common stock, $20 par X Co. $5,000,000 3,000,000 Y Co. $3,000,000 3,000,000 Income tax is estimated at 40% of income. Determine for each company the earnings per share of common stock, assuming that the income before bond interest and income taxes is $1,500,000 each. X Co. Y Co. Earnings before interest and taxes Deduct interest on bonds Income before income tax Deduct income tax Net income ========== ========== Earnings per share on common stock 10. (a) (b) Prepare the journal entry to issue $200,000 bonds which sold for $195,000. Prepare the journal entry to issue $200,000 bonds which sold for $204,000. (a) (b) Chapter 16 11. On the statement of cash flows, the cash flows from operating activities section would include a. receipts from the issuance of capital stock b. receipts from the sale of investments c. payments for the acquisition of investments d. cash receipts from sales activities 12. Cash paid to purchase long-term investments would be reported in the statement of cash flows in a. the cash flows from operating activities section b. the cash flows from financing activities section c. the cash flows from investing activities section d. a separate schedule 13. Which of the following does not represent an outflow of cash and therefore would not be reported on the statement of cash flows as a use of cash? a. purchase of noncurrent assets b. purchase of treasury stock c. discarding an asset that had been fully depreciated d. payment of cash dividends 14. A ten-year bond was issued at par for $150,000 cash. This transaction should be shown on a statement of cash flows under a. investing activities b. financing activities c. noncash investing and financing activities d. operating activities 15. A company purchases equipment for $29,000 cash. This transaction should be shown on the statement of cash flows under a. investing activities b. financing activities c. noncash investing and financing activities d. operating activities 16. Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method? a. depreciation expense b. amortization of premium on bonds payable (results in a decreased interest expense) c. a loss on the sale of equipment d. dividends declared and paid 17. Which one of the following below would not be classified as an operating activity? a. interest expense b. income taxes c. payment of dividends d. selling expenses 18. The following information is available from the current period financial statements: Net income .................................... $140,000 Depreciation expense ..................... 28,000 Increase in accounts receivable ....... 16,000 Decrease in accounts payable ......... 21,000 The net cash flow from operating activities using the indirect method is a. $131,000 b. $163,000 c. $107,000 d. $205,000 19. On the basis of the following data for Teller Co. for 2006 and the preceding year ended December 31, 2005, prepare a statement of cash flows. Use the indirect method of reporting cash flows from operating activities. Assume that equipment costing $125,000 was purchased for cash and equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000; that the stock was issued for cash; and that the only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000. Year Year 2006 2005 Cash $100,000 $ 78,000 Accounts receivable (net) 78,000 85,000 Inventories 101,500 90,000 Equipment 410,000 370,000 Accumulated depreciation (150,000) (158,000) $539,500 $465,000 Accounts payable (merchandise creditors) Cash dividends payable Common stock, $10 par Paid-in capital in excess of par-common stock Retained earnings Teller Co. Statement of Cash Flows For Year Ended December 31, 2006 $ 58,500 5,000 200,000 $ 55,000 4,000 170,000 62,000 214,000 $539,500 60,000 176,000 $465,000