Merchandise Inventory include:__________

advertisement

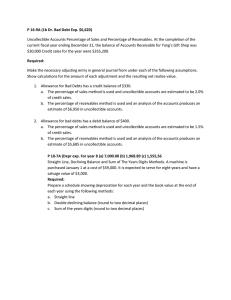

BUS210 Practice for Second Exam.Fall 2012 Merchandise Inventory 1. When a customer pays the freight on a purchase, the journal entry would include:__________ 2. Which of the following is closed with a debit? Freight In; Freight Out; Purchases: Purchases Returns and Allowances; or Sales Discount 3. Assuming that net purchases during the year were $170,000 and that ending inventory was $4,000 more than the beginning inventory of $30,000, how much was the cost of goods sold?________ 4. Which of the following is not considered in computing net purchases? Freight paid on goods shipped to customers; Purchases Discount; Purchases; Freight paid on purchased goods; or Purchases Returns and Allowances 5. Net income results when gross margin exceeds which of the following: the cost of goods sold; the cost of goods available for sale; purchases; the cost of goods sold plus operating expenses; or operating expenses 6. A sale on July 21 with terms of n/10 is due to be collected by:__________ 7. How is Net Sales is computed?________ 8. How is Cost of Goods Sold computed?_______ 9. When is COGS an account? BUS210 Practice for Second Exam.Fall 2012 10. What are the entries to record a purchase of inventory on account under the periodic and perpetual methods?______ (Gross and Net 2/10, n/30) 11. What are the entries to record the sale of inventory on account under the periodic and perpetual methods?_______ (Gross and Net 2/10, n/30) 12. Assuming a periodic inventory system is used, use the following information to answer question(s) below: April 1 Inventory 200 units $3.00 April 6 Purchase 300 $3.40 April 13 Purchase 100 $3.60 April 20 Purchase 200 $3.90 April 25 Purchase 40 $4.20 Sold 620 units o Using LIFO, the cost assigned to ending inventory is______ o Using FIFO, the cost assigned to ending inventory is______ o Using the average-cost method, the cost assigned to ending inventory is_______ BUS210 Practice for Second Exam.Fall 2012 13. Assume a perpetual inventory system, use the following information to calculate ending inventory and cost of goods sold on a: LIFO basis FIFO basis May 1 Beginning Inventory 70 units @ $7 May 9 Purchases 30 units @ $8 May 17 Sales 25 units May 22 Purchases 15 units @ $9 May 27 Sales 40 units 14. Rene Company uses the perpetual inventory system and the FIFO inventory costing method. All purchases and sales were cash transactions. The records reflected the following for November: Units Unit Cost Beginning Inventory, November 1 100 $1.00 Purchase, November 6 200 $1.20 Sale, November 10 (at $2.40 per unit) 110 Purchase, November 14 100 Sale, November 29 (at $2.60 per unit) 170 $1.30 Determine the following amounts: a. Goods Available for Sale $.................... b. Ending Inventory $ c. Cost of Goods Sold $ Prepare the journal entries for November 6 and November 10. d. BUS210 Practice for Second Exam.Fall 2012 Cash and Accounts Receivable Use the following to answer questions 1. - 4. Accounts Receivable shows a debit balance of $50,000. The Allowance for Uncollectible Accounts has a credit balance of $1,000. Net Sales for the year were $500,000. In the past 2% of sales has proven uncollectible, and an aging of Accounts Receivable accounts results in an estimate of $13,500 of uncollectible accounts receivable. 1. Using the percentage of net sales, the Allowance for Uncollectible Accounts balance (after adjustment) would be__________. 2. Using the percentage of net sales method, Uncollectible Accounts Expense would be debited for________. 3. Using the accounts receivable aging method, Uncollectible Accounts Expense would be debited for__________. 4. Using the accounts receivable method, the Allowance for Uncollectible Accounts balance (after adjustment) would be_________. Use the following to answer questions 5.-8. Accounts Receivable shows a debit balance of $25,000. The Allowance for Uncollectible Accounts has a debit balance of $1,500. Net Sales for the year were $250,000. In the past 3% of sales has proven uncollectible, and an aging of Accounts Receivable accounts results in an estimate of $10,000 of uncollectible accounts receivable. 5. Using the percentage of net sales, the Allowance for Uncollectible Accounts balance (after adjustment) would be__________. 6. Using the percentage of net sales method, Uncollectible Accounts Expense would be debited for________. 7. Using the accounts receivable aging method, Uncollectible Accounts Expense would be debited for__________. 8. Using the accounts receivable method, the Allowance for Uncollectible Accounts balance (after adjustment) would be_________. BUS210 Practice for Second Exam.Fall 2012 9. You received notice that Wes Deed, a customer of yours with an Accounts Receivable balance of $200 has gone bankrupt and will not be making future payments. a. Assume you use the allowance method, the journal entry you make is: b. Assume Floyd pays his overdue account after write-off, the recovery entries are: 10. What is the operating cycle? How do you compute it? 11. What is a financing gap? How do you compute it? Why is it important to know if it exists? BUS210 Practice for Second Exam.Fall 2012 Property, Plant, and Equipment and Intangibles 1. Joy Auto purchased a neighboring lot for a new building and parking lot. Indicate whether each of the following expenditures is properly charged to (a) Land, (b) Land Improvements, or (c) Buildings. 1. Paving costs 2. Architects' fee for building design 3. Cost of clearing the property 4. Cost of the property 5. Building construction costs 6. Lights around the property 7. Building permit 8. Interest on the construction loan 2. Tell whether each of the following transactions related to an office building is a revenue expenditure (RE) or a capital expenditure (CE). 1. The hallways and ceilings in the building are repainted at a cost of $6,250. 2. The hallways, which have tile floors, are carpeted at a cost of $28,000. 3. A new wing is added to the building at a cost of $105,470. 4. Furniture is purchased for the entrance to the building at a cost of $13,250. 5. The air-conditioning system is overhauled at a cost of $21,153. The overhaul extends the useful life of the air-conditioning system by ten years. 6. A cleaning firm is paid $150 per week to clean the newly installed carpets. 3. Zollett Manufacturing purchased land next to its factory to be used as a parking lot. The expenditures incurred by the company were as follows: purchase price, $600,000; broker's fees, $48,000; title search and other fees, $4,400; demolition of a cottage on the property, $16,000; general grading of property, $8,400; paving parking lots, $80,000; lighting for parking lots, $64,000; and signs for parking lots, $12,800. Determine the amounts that should be debited to the Land account and the Land Improvements account. BUS210 Practice for Second Exam.Fall 2012 4. Diane Company purchased property with a warehouse and parking lot for $1,500,000. An appraiser valued the components of the property if purchased separately as follows: Building $1,000,000; Land $300,000; and Furniture $300,000. Determine the cost to be assigned to each component. 5. Anna Back purchased a car wash for $480,000. If purchased separately, the land would have cost $120,000, the building $270,000, and the equipment $210,000. Determine the amount that should be recorded in the new business's records for land, building, and equipment. 6. Tell's Fitness Center purchased a new machine for $16,500. The apparatus is expected to last four years and have a residual value of $1,500. What will the depreciation expense be for each year under the straight-line method? 7. Assume that the machine has an estimated useful life of 8,000 hours and was used for 2,400 hours in year 1, 2,000 hours in year 2, 2,200 hours in year 3, and 1,400 hours in year 4. How much would depreciation expense be in each year? 8. Assume that the machine is depreciated using the double-declining-balance method. How much would depreciation expense be in each year? BUS210 Practice for Second Exam.Fall 2012 10. On January 13, 2010, Mercury Oil Company purchased a drilling truck for $45,000. The company expects the truck to last five years or 200,000 miles, with an estimated residual value of $7,500 at the end of that time. During 2011, the truck is driven 48,000 miles. Mercury's year end is December 31. a. Compute the depreciation for 2011 under each of the following methods: (1) straightline, (2) production, and (3) double-declining-balance. b. Using the amount computed in (3), prepare the entry in journal form to record depreciation expense for the second year, and show how the Drilling Truck account would appear on the balance sheet. 11. Safe Alarm Company purchased a computer for $2,240. It has an estimated useful life of four years and an estimated residual value of $240. Compute the depreciation charge for each of the four years using the double-declining-balance method. BUS210 Practice for Second Exam.Fall 2012 12. E Printing owned a piece of equipment that cost $16,200 and on which it had recorded $9,000 of accumulated depreciation. The company disposed of the equipment on January 2, the first day of business of the current year. 1. Calculate the carrying value of the equipment. 2. Calculate the gain or loss on the disposal under each of the following assumptions: a. The equipment was discarded as having no value. b. The equipment was sold for $3,000 cash. c. The equipment was sold for $8,000 cash. d. Trade in for dissimilar asset costing $25,000 and paying $14,000 cash. e. Trade in for dissimilar asset costing $25,000 and paying $20,000 cash. BUS210 Practice for Second Exam.Fall 2012 Investments 1. TF Investments are valued on the balance sheet at the original purchase price, even if the price has changed since the date of purchase. 2. TF If a long-term investment suffers a permanent decline in value, a loss must be recorded, even though the investment has not yet been sold. 3. TF Another term for short-term investments is marketable securities. 4. TF Investments with a maturity of less than a year are classified as cash equivalents. 5. TF As long as an investment can be sold within a short period of time, it must be classified as a current asset. 6. TF Available-for-sale securities may be classified as either short- or long-term, depending on how long management intends to keep them. 7. TF When the equity method is used to account for an investment in stock, the investor will report its share of the investee's annual earnings as income regardless of how much the investee distributes in the form of dividends. 8. On November 28, 2009, Barry Company purchased 20,000 shares of HAL Corporation stock for $360,000. Barry's management intends to hold the shares for a short period of time. On December 31, 2009, the price of HAL stock was $15 per share. Finally, on January 19, 2010, Barry sells all 20,000 shares for $375,000. In the journal provided below, prepare Barry's entries for November 28, December 31, and January 19. (Omit explanations). 9. The following transactions and information pertain to Lange Corporation for 20xx. Prepare entries in journal form, without explanations, to record these transactions. May 1 Purchased 1,000 shares of Grange Corporation's common stock at $180 per share (representing 5 percent of Grange's total outstanding stock) as a long-term investment. BUS210 Practice for Second Exam.Fall 2012 Sept. Dec. 10. 1 31 Received a cash dividend of $6.00 per share from Grange. End of Lange’s accounting year. Grange's market price per share is $168. Knobe Corporation purchased 3,000 shares of Duncan Corporation common stock for $80 per share on January 1, 2009, as a long-term investment. Duncan reported net income of $70,000 and $90,000 for 2009 and 2010, respectively, and paid dividends of $25,000 and $30,000 during 2009 and 2010, respectively. Duncan has a total of 10,000 shares outstanding. Compute the following amounts. a. Amount of investment income recognized by Knobe Corporation during 2009 b. Balance of Investment in Duncan Corporation account at end of 2009 c. Amount of investment income recognized by Knobe Corporation during 2010 d. Balance of Investment in Duncan Corporation account at end of 2010 11. On January 1, Chaplin Corporation purchased, as long-term investments, 10 percent of the voting stock of Paxton Corporation for $75,000 and 25 percent of the voting stock of Colb Corporation for $150,000. During the year, Paxton Corporation had earnings of $40,000 and paid dividends of $15,000 on October 15, and Colb Corporation had earnings of $20,000 and paid dividends of $12,000 on November 10. The market value of neither investment declined nor rose during the year. Prepare journal entries without explanations to record this information as appropriate in Chaplin Corporation's general journal form.