Document 10290811

advertisement

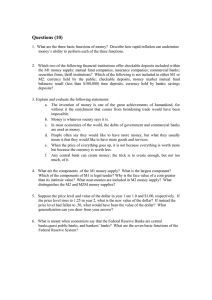

Chapter 16 – Money and Banking Be Mean Green! Please consider the environment before printing this Chapter Outline. It’ll be available online throughout the semester. The Functions of Money (in the economy): 1. Medium of exchange – used for buying and selling goods/services 2. Unit of account – a yardstick for measure of the relative worth of a wide variety of goods/services & resources 3. Store of value – money serves as a store of value that enables people to Transfer Purchasing Power from the present to the future Liquidity – The ease with which an asset can be converted into cash, with little or no loss in purchasing power. The more liquid an asset is, the more quickly it can be converted into cash. The Components of Money Supply Money definitions: M1 – currency (coins & paper money) in the hands of the non-bank public [supplied by the government/government agencies] – all checkable deposits (where checks of any amount can be drawn) [provided by commercial banks and “thrift” or savings institutions] Thrift institutions – Savings and loan associations, mutual savings banks, or credit unions that offer savings and checking accounts. However, currency held by the U.S. Treasury, the Federal Reserve Banks, commercial banks, and thrift institutions is excluded from M1. (see definition above – held by non-bank public). Also, checkable deposits of the government, or the Federal Reserve that are held by commercial or thrift institutions are excluded. These are done to avoid double counting. These exclusions are designed to enable assessment of the amount of money available to the private sector for potential spending. 1 M2 – All of M1 + – savings deposits, including Money Market Deposits – Small time deposits (< $100,000) – Money Market Mutual Funds What ‘Backs” the Money Supply? The money supply in the United States is “backed” (guaranteed) by the government’s ability to keep the value of money relatively stable. Are Credit Cards money? Credit cards are not money. They are a means of obtaining a short-term loan from the financial institutions that issued the cards. Money Supply is controlled by the Federal Reserve in the United States (or, the Central bank of any country). The Federal Open Market Committee (FOMC) aids the Board of Governors of the Federal Reserve in conducting Monetary Policy of the U.S. 2