Problem 14-11A: Part 1

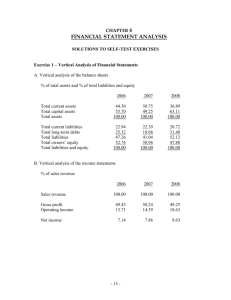

Problem 14-11A: Part 1 a. Working Capital = Current Assets – Current Liabilities:

This year: $1,520,000 – $800,000 = $720,000

Last year: $1,090,000 – $430,000 = $660,000 b. Current Ratio = Current Assets ÷ Current Liabilities:

This year: $1,520,000 ÷ $800,000 = 1.90

Last year: $1,090,000 ÷ $430,000 = 2.53

c. Acid-test (quick) ratio = (Cash + Marketable Securities +

Accounts Receivable) ÷ Current Liabilities

This year: ($70,000 + $0 + $480,000) ÷ $800,000 = 0.69

Last year: ($150,000 + $18,000 + $300,000) ÷ $430,000 =

1.09

1

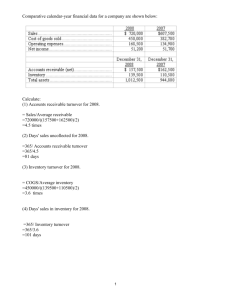

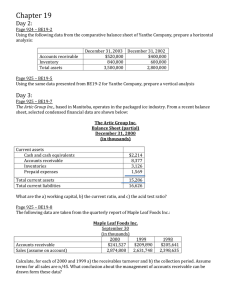

Problem 14-11A: Part 1 d. Average Collection Period = 365 ÷ Accounts Receivable

Turnover

Accounts Receivable Turnover = Credit Sales ÷ Average

Accounts Receivable

Average Accounts Receivable = (Beginning + Ending) ÷ 2

This year: Average Accounts Receivable = ($300,000 +

$480,000) ÷ 2 = $390,000

Accounts Receivable Turnover = $5,000,000 ÷ $390,000 =

12.8

Average Collection Period = 365 ÷ 12.8 = 28.5 days

Last year: Average Accounts Receivable = ($250,000 +

$300,000) ÷ 2 = $275,000

Accounts Receivable Turnover = $4,350,000 ÷ $275,000 =

15.8

Average Collection Period = 365 ÷ 15.8 = 23.1 days

2

Problem 14-11A: Part 1 e. Average Sales Period = 365 ÷ Inventory Turnover

Inventory Turnover = Cost of Goods Sold ÷ Average Inventory

Average Inventory = (Beginning + Ending) ÷ 2

This year: Average Inventory = ($600,000 +

$950,000) ÷ 2 = $775,000

Inventory Turnover = $3,875,000 ÷ $775,000 = 5.0

Average Sales Period = 365 ÷ 5.0 = 73.0 days

Last year: Average Inventory = ($500,000 +

$600,000) ÷ 2 = $550,000

Inventory Turnover = $3,450,000 ÷ $550,000 = 6.3

Average Sales Period = 365 ÷ 6.3 = 58.0 days

3

1

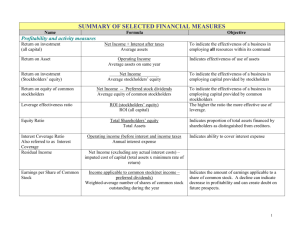

Problem 14-11A: Part 1 f. Debt-to-Equity Ratio = Total Liabilities ÷ Stockholders’ Equity

This year: $1,400,000 ÷ $1,600,000 = 0.875

Last year: $1,030,000 ÷ $1,430,000 = 0.720

g. Times Interest Earned Ratio = Net Income Before Interest and

Taxes ÷ Interest Expense

This year: $472,000 ÷ $72,000 = 6.6

Last year: $352,000 ÷ $72,000 = 4.9

4

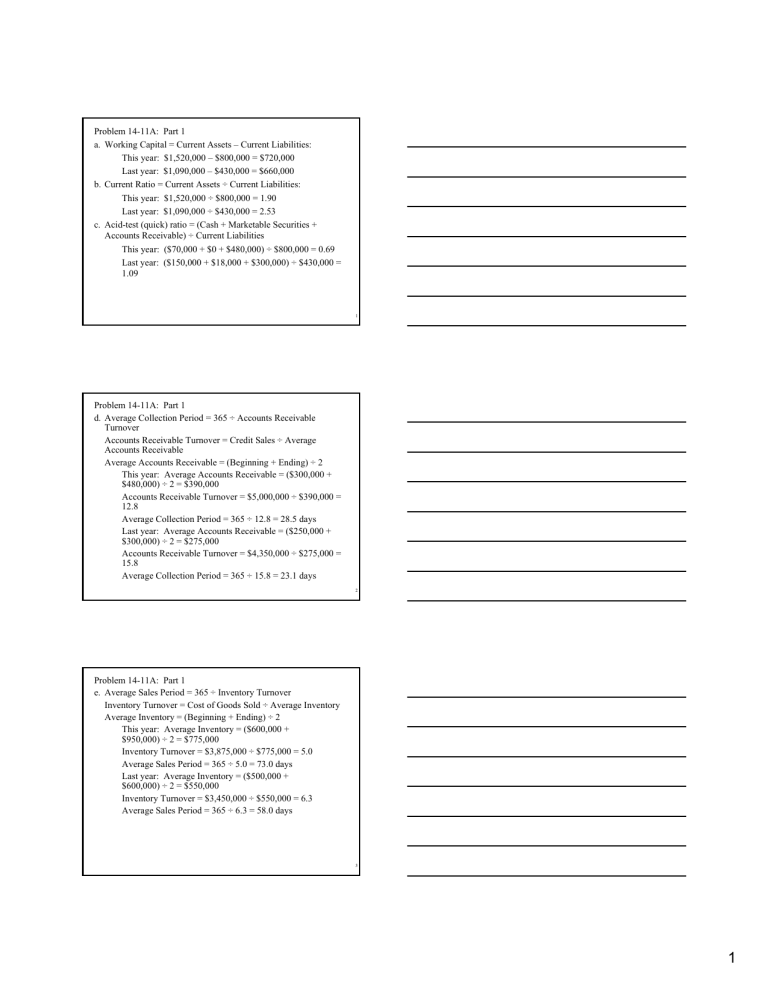

Part 2:

Current Assets:

Cash

Marketable securities

Accounts receivable

Inventory

Prepaid expenses

Total current assets

Plant and equipment (net)

Total assets

Sabin Electronics

Common-Size Balance Sheets

This year

2.3%

0.0%

16.0%

31.7%

0.7%

50.7%

49.3%

100.0%

Current liabilities

Bonds payable

Total liabilities

Stockholders’ equity

Preferred stock, $25 par, 8%

Common stock, $10 par

Retained earnings

26.7%

20.0%

46.7%

8.3%

16.7%

28.3%

Total stockholders’ equity 53.3%

Total liabilities and stockholders’ equity 100.0%

Last year

6.1%

0.7%

12.2%

24.4%

0.9%

44.3%

55.7%

100.0%

17.5%

24.4%

41.9%

10.2%

20.3%

27.6%

58.1%

100.0%

5

Part 2:

Sales

Cost of goods sold

Gross margin

Operating expenses

Net operating income

Interest expense

Net income before taxes

Income taxes

Net income

Sabin Electronics

Common-Size Income Statements

This year

100.0%

77.5%

22.5%

13.1%

9.4%

1.4%

8.0%

2.4%

5.6%

Last year

100.0%

79.3%

20.7%

12.6%

8.1%

1.7%

6.4%

1.9%

4.5%

6

2

Part 3:

Ratios:

Although the company’s working capital increased, its current and quick ratios significantly decreased from 2.53 to 1.90 and 1.09 to 0.69 respectively. Last year, both ratios were consistent with the industry averages, but are now well below the industry averages. Unless the company takes action immediately, it could well find itself unable to pay its bills as they come due.

The average collection period and average sales period both increased from last year to the current year. The average collection period moved from 23.1 days to 28.5 days indicating that on average, customers are taking longer to pay. In addition, with the credit terms of 2/10, n/30, the average collection period for both years shows that customers are not taking advantage of the credit terms. For both years, the average collection period was greater than the industry average. This may be the result of financial problems being experienced by the customers, or customers who are poor credit risks. The average sales period increased significantly from 58 days to 73 days, compared to the industry average of 60 days. This indicates that the company is holding its inventory longer than in the previous year, and longer than comparable companies.

The debt-to-equity ratio increased from 0.72 to 0.875, but is still below the industry average of 0.90, as is the times interest earned ratio.

7

Part 3:

Income Position:

Not withstanding the just discussed problems that the company appears to be experiencing, its income position appears to be good. The gross margin improved from 20.7% to 22.5%. Although the operating expenses increased as a percentage of sales, the overall operating income improved primarily because of the improvement in gross margin.

Should the loan be approved?

Given the current situation, the loan should not be approved. If, however, the company is able to get its accounts receivable and inventory under control, then the company’s cash position should improve, and it should be able to handle the added debt. If the cash position improved enough, the loan may not be needed.

8

3