Taxable Income Lecture notes for PET 472 Spring 2011

Taxable Income

Lecture notes for PET 472

Spring 2011

Prepared by:

Thomas W. Engler, Ph.D., P.E.

Taxable Income Components

Taxable Income = Net Revenue

– Gross operating expenses

– state/local production taxes

– depreciation

– depletion

Federal Taxes = Taxable Income * Federal Tax Rate

Operating Expenses Components

Field Personnel

•

Time of pumper, roustabouts etc dedicated to lease

•

Typically expressed as $/month

Utilities

•

Expendables such as electric or gas costs

•

Typically accounted as $/KW or $/mmbtu, however usually expressed as

$/month

Workovers

•

Costs for remedial expense type work; e.g., rod parts, pump changes

•

Typically incur cost as $/event where one workover per year.

Water disposal

• Costs incurred for water hauling and disposal.

• Expressed as $/bbl. Sensitive to method: truck hauling and disposal is $0.50-

1.00/bbl; but disposal directly into a SWD well or injection well is $0.05 –

0.15/bbl.

Operating Expenses

• On a per barrel basis:

$2(excellent)

$3 (good)

$6 (poor)

• On a monthly basis:

Flowing well

Pumping well

High volume wells

Gas wells

General estimates

$/month/well

$500-$1000

$1000

$1500-$2000 (subs, GL)

<$500

Operating Expenses Economic Limit

Net operating Revenue = Gross Operating Expenses + Sales Taxes

(bopd) * (oilprice) * (NRI)

(mcfd) * (gasprice) * (NRI)

*

1

Advol

* (1

Sev)

(GOE) * (WI) where,

NRI

WI

GOE

= net revenue interest in lease (less royalty)

= working interest in lease

= gross operating expenses, $/day

Oilprice

Gas price

Advol

Sev

= sales price, $/bbl

= gas price, $,mscfd

= local tax rate on revenue, tax $/revenue$, decimal

= state tax rate on revenue, tax$/revenue$, decimal

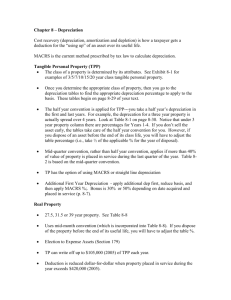

Depreciation

Asset depreciation

Economic physical functional

Book

Accounting

Tax

For calculating taxes to IRS

Depreciation Factors

• Depreciable property must be:

– Used in business or held for production of income

– Have a definite service life

– Something that loses value over time

• Cost basis

– Represents the total cost that is claimed as an expense over the asset’s life; i.e., the sum of the annual depreciation expenses.

Depreciation MACRS

•

M odified A ccelerated C ost R ecovery S ystem developed by IRS and approved by Congress to provide a simple and rapid depreciation method.

– Guidelines were set which created several classes of assets, each with an arbitrary life called a recovery period – not related to useful life.

– Prescribed depreciation rates for each class

– Under MACRS the salvage value of a property is always treated as zero.

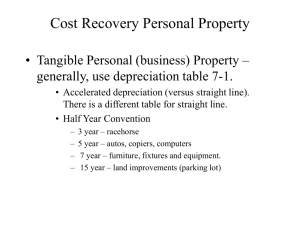

Depreciation

Recovery ADR* Asset

Period midpoint class

3-year ADR < 4

Speical tools for manufacture of plastic products, fabricated metal products and motor vehicles

5-year

7-year

27.5-year

4<ADR<10

Autos, light trucks, high-tech equipment, equipment used for R&D, computerized telephone switching systems

10<ADR<16 Manufacturing equipment, office furniture, fixtures

10-year 16<ADR<20 Vessels, barges, tugs, railroad cars

15-year 20<ADR<25

20-year 25<ADR

Waste-water plants, telephone distribution plants or similar utility property

Municipal sewers, electrical power plant

Residential rental property

39-year

Nonresidental real property including elevators and escalators

* ADR: Asset Depreciation Range, published by IRS

MACRS

Depreciation MACRS

• Half year convention

– Assumes assets in place by midyear, thus only half year depreciation in first year

– Full year depreciation in subsequent years

– Remaining half year’s depreciation taken in the final year

• Depreciation methods

– Declining balance to straight line

Depreciation

MACRS

Year

7

8

9

10

11

4

5

6

1

2

3

3

Class

5 7

Depreciation rate in percent

33.33

44.45

14.81

7.41

20.00

32.00

19.20

11.52

11.52

5.76

14.29

24.49

17.49

12.49

8.93

8.92

8.93

4.46

Bold represents year switch from declining balance to straight line

10

10.00

18.00

14.40

11.52

9.22

7.37

6.55

6.55

6.56

6.55

3.28

Depletion Description

If you own mineral property such as oil, gas geothermal or standing timber, you may be able to claim a deduction as you deplete the resource. A capital investment in natural resources needs to be recovered as the natural resources are being removed and sold. The process of amortizing the cost of natural resources in accounting periods is called depletion .

The objective of depletion is the same as that for depreciation; i.e., to amortize the cost in a systematic manner over the asset’s useful life.

There are two methods to determine depletion: cost depletion and percentage depletion . These methods are used for book as well as tax purposes. In most instances, depletion is calculated by both methods and the larger value is taken as the depletion allowance for the year. For most oil and gas wells, only cost depletion is allowable.

Depletion Cost depletion

• Same concept as units-of-production method

• Generally more favorable for taxpayer

D

B

P

P

R

• D – annual cost depletion allowance, $

• P – oil or gas production sold or for which payment was received during the tax year.

• R – remaining reserves at the end of the tax year

• B – “adjusted basis” of property

Depletion Cost depletion example

Peters oil purchases a waterflood at $3 per recoverable barrel. If reserves are

146,000 BO, then the initial investment is $438,000. Calculate the annual cost depletion allowance for the production schedule below.

R = 146,000

Year

1

P, Mstb

46

Depletion allowance,

D, $

138

B = $438,000

2 35 105

3

4

5

6

7

25

15

10

8

7

75

45

30

24

21

Sum = $438,000

Depletion Percent Depletion

• Requires no starting basis

• Simply percentage deduction based upon net income from the sale of production from the property

• Allowed to small independents only….1000 bopd or 6000 mcfd, net

• Depletion rate for oil and gas wells, 15%

• Sum limited to 50% of a company’s taxable income from the property excluding the depletion deduction.

Depletion

Net revenue (less royalty)

Operating Expenses

Income (BFIT) depletion allowance, 15% of net revenue

Allowable limit, 50% of taxable income

Depletion allowance

Taxable Income (BFIT)

A, $M

973

438

535

146

267

146

389

Percent Depletion Example

B, $M

973

876

97

146

48

48

49