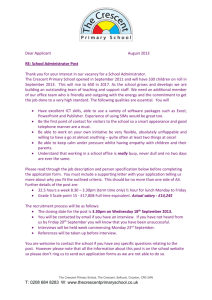

C r e s

advertisement