DRAFT Financial Services Curriculum Framework - HSC Content overview - FINANCIAL...

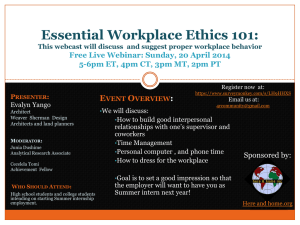

advertisement

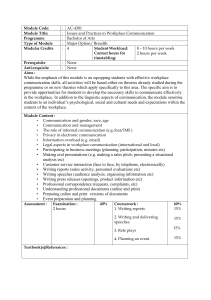

DRAFT Financial Services Curriculum Framework - HSC Content overview - FINANCIAL OPERATIONS communication problem solving FNSACC301A Process financial transactions and extract interim reports Associated units of competency Employability skills FNSACC303A Perform financial calculations planning and organising learning technology assets credit debit depreciation definitions expenses income liabilities revenue owners equity legislative, industry and organisational requirements accountability auditing conventions/doctrines importance for processes accounting procedures compliance workplace/enterprise employee auditing consequences of non-compliance for business structures client creditors and debtors an understanding of journal data integrity relationships between financial systems ledger matching petty cash book financial information trial balance unclassified classified system and accounts types balance sheet report validity financial records interim adjustment/credit note delivery docket unadjusted income statement invoice/tax invoice source documents preparation purchase order source documents receipt processing statement importance of client workplace/enterprise petty cash voucher accuracy consequences of making errors workplace documentation sources of information rechecks common errors correction of errors ensuring quality outcomes client records data and statistics other authorisation industry validity data entry routine procedures/processes Financial operations methods reconciliation special transactions manual electronic input data principle system resources financial transactions double entry bookkeeping transaction processing calculator equipment computers software process standards formats the general journal recording outcomes journals industry workplace/enterprise calculation worksheets and other workplace/enterprise documentation bookkeeping practice specialised journals storage formats Chart of Accounts loan calculators task specifications item batching accounting equation tax tables compound interest tables supporting documentation verification balancing depreciation factors government errors electronic hard copy importance of ledgers accuracy the general/nominal ledger posting to ledger consequences of incorrect data entry and calculations ensuring quality outcomes client workplace/enterprise rechecks the trial balance common computational errors deposit addition withdrawal cheque security and safety precautions item batching subtraction division multiplication banking percentages banking method deposit facility arithmetic operations financial calculations card voucher cash management processes mathematical concepts numerical operations decimal fractions proof of lodgment sourcing appropriate formulae and equations reconciliation correct values for formulae terms claim vouchers mathematical formulae and equations application to a range of workplace tasks petty cash use within reconciliation Goods and Services Tax (GST) inflation effects interest workplace calculations simple compound credit interest loan mark up and break even straight-line depreciation spreadsheets charts and graphs DRAFT Financial Services Curriculum Framework - HSC Content overview - INDUSTRY CONTEXT communication BSBWOR203A Work effectively with others Associated units of competency problem-solving FNSINC301A Work effectively in the financial services industry Employability skills planning and organising learning features primary role sectors and departments nature of the industry direct interrelationships between sectors/departments characteristics verbal psychological occupational areas examples of organisations/businesses indirect physical services provided bullying and harassment customer service types underpinning principles industry approaches to service delivery principles employees reciprocal rights and responsibilities industry standards anti-discrimination intent of legislation employers workplace policy, guidelines and procedures anti-discrimination acts differences between workplace/organisational policy and procedures recourse available regulations codes of practice legislative requirements strategies to eliminate bias and harassment consequences and legal ramifications how work is organised and undertaken strategies for establishing quality service sexual purpose and intent relevant to a particular sector/department governance application for specific workplace and job role inappropriate workplace behaviour Australian Securities and Investments Commission (ASIC) career pathways and knowledge and skills required key regulatory bodies full-time part-time casual underpinning values, principles and ethics contract consequences of non-compliance work standards working in the industry terms and conditions for specific job role for specific job role seeking opportunities to improve work practices and client outcomes employee and employer rights and responsibilities principles of equal employment opportunity (EEO) employment difference between employer and employee groups unions workplace/organisation specific expected standards difference and application contract professional associations industry-wide value award agreement Australian Prudential Regulation Authority (APRA) Reserve Bank of Australia (RBA) Industry context types Australian Competition and Consumer Commission (ACCC) primary role/function of key industry bodies legal ethical legal and ethical framework worker industry purpose and value of code of conduct legal and ethical issues organisational legal and ethical obligations strategies to maintain client industry currency compliance and meaning for worker industry purpose and requirements accreditation conflict of interest workplace policy and procedures importance individual privacy/confidentiality issues affecting the industry training consequences of non-compliance industry registration requirements what constitutes a breach ramifications DRAFT Financial Services Curriculum Framework - HSC Content overview - SAFETY communication BSBOHS303A Contribute to OHS hazard identification and risk assessment Associated units of competency problem-solving Employability skills FNSINC301A Work effectively in the financial services industry planning and organising learning incident accident difference between emergency manageable first aid emergency situations range of common incidents, accidents and emergencies health meaning safety range of possible workplace injuries and their causes human strategies to reduce workplace accidents and injuries emergency situations location use cost of workplace injury incidents, accidents and emergencies seeking assistance social economic organisational emergency signals, alarms and exits occupational health and safety response procedures notification workplace/organisation policy and procedures primary role of key OHS bodies sources sources of information and data procedures to follow internal external research skills reporting taking initiative role of personnel in emergencies levels of authority basic principles of first aid and management of injuries and conditions problem-solving decision-making hazard risk difference between Occupational Health and Safety Act 2000 (NSW) and amendments legislation Occupational Health and Safety Regulations 2001 (NSW) and amendments self OHS Consultation colleagues potential hazards to clients legislation and codes of practice Risk Assessment codes of practice Manual Handling visitors purpose tools and equipment application to industry and specific job role manual handling materials work processes and practices work environment self others Safety range of hazards expertise/specialist advice employee legislative requirements human factors safety signs and symbols meaning of colour and shape placement and positioning risk management strengths and limitations external employer consequences of non-compliance biological internal rights and responsibilities hazard identification responsibility of all in the workplace application in the workplace tools, techniques, processes and methods OHS committee/representative OHS compliance risk assessment election/formation roles and responsibilities requirements eliminate industry workplace substitution modification isolation formal/informal monitoring and reporting minimise risk control engineering control written verbal to appropriate persons purpose and importance administrative safe work practices types how, when, to whom other controls self-assessment PPE supervisor/team leader/manager monitor and review OHS representative/committee workplace inspection and testing ergonomics selection, use and maintenance of personal protective equipment (PPE) manual handling techniques clean up procedures waste disposal formal/official assessor consultants specialist technical advisors practices and procedures and their purposes safe work practices and procedures housekeeping OHS and the environment importance of specific to workplace/organisation within the industry DRAFT Financial Services Curriculum Framework - HSC Content overview - WORK communication teamwork problem-solving BSBWOR203A Work effectively with others Associated units of competency FNSINC301A Work effectively in the financial services industry initiative and enterprise Employability skills planning and organising self management learning technology information management system importance of collegial relationships in provision of quality customer service databases establishing contact word processor spreadsheets financial workplace protocols and procedures client contact systems proprietary communication working with colleagues, clients and others software technology definition working with others team work industry specific internet and intranet characteristics of effective teamwork benefits examples of teams/work groups selection and use appropriate to task delivering quality customer service through team work and work groups technological skills industry bodies passive professional associations aggressive differences between being sources assertive when working with others in the delivery of service causes of misunderstanding and conflict unions journals internet conflict networks sources of information positive job description effects negative role/duty statement resolution techniques access and use misunderstandings and conflict negotiation approaches workplace/organisation manuals manager/supervisor/team leader problem solving colleagues conflict management strategies for understanding and clarifying work instructions mediation workplace policy and procedures with colleagues and clients individual response to conflict or misunderstandings process/cycle personal approach to management and resolution of conflict verbal when and from whom to seek assistance types cultural awareness effective verbal, non-verbal and written concepts of communication inclusiveness general characteristics cultural expectations non-verbal written cultural diversity effective questioning and listening techniques general features benefit cultural diversity need for tolerance and respect in the workplace benefits methods/equipment used Work selection importance of respect and sensitivity promoting workplace diversity accommodating individual differences strategies to overcome barriers to effective communication cultural groups within Australia proactive strategies use workplace diversity culturally appropriate work practices personal attributes and work ethic effective cross-cultural communication skills worker interpersonal skills personal presentation and hygiene presentation standards for specific workplace and job role impact of personal values, opinions and ethics on everyday work for a specific job role relationship between individual and team roles roles and responsibilities purposes and uses of documentation difference between individual and workplace/organisational goals and plans organisation/workplace policy and protocols and regulatory requirements confidentiality privacy philosophy, values and objectives of a workplace/organisation definition lines of communication and reporting role of employees in quality improvement, auditing and accreditation recording and reporting importance of implications of non-adherence to quality improvement program document maintenance storage inventories relationship to a specific job role legislative and regulatory requirements definition standard procedures information management financial services worker quality improvement performance management key components why, when and how used access and release connection between evaluating work performance and improving work practices industry standards workplace policy, guidelines and procedures strategies implementing and maintaining in accordance with maintain current knowledge and skills enhance ongoing professional development value to individual, workplace and industry colleagues client workplace personal reflection effect of poor work practices on sources industry work practices service delivery work practices awareness of emerging technologies affecting strategies working sustainably direct/indirect positive/negative feedback strategies for obtaining and interpreting dealing with environmental issues definition 'environmentally sustainable work practice' formal/informal positive feedback negative feedback responsibility to provide feedback DRAFT Financial Services Curriculum Framework - HSC Content overview - ACCOUNTING STREAM communication BSBFIA302A Process payroll Associated units of competency problem-solving BSBFIA401A Prepare financial reports Employability skills FNSACC302A Administer subsidiary accounts and ledgers learning technology creditors invoice authorisation for payment identifying ledger remit payments to creditors cheque requisition accounts payable process accounts paid report payments documented supplier statements reconcile balances outstanding receipts types source update debtors records prepare statements subsidiary accounts and ledgers process monies owed (debt) to monies paid investigate discrepancies common causes amend entries workplace/enterprise credit policy accounts receivable verify debt status payroll systems recovery actions communication with client measures to collect recovery plan types confidentiality security doubtful identify client in default debtors ledger manual electronic bad records management legal action recording and reporting payroll records property storage legislative requirements source documents standard equipment differences between pay period variations Accounting employee details liquid/current asset calculating depreciation deductions depreciation of fixed/non-current assets process payroll prepayments accruals common irregularities depreciation of fixed/non-current assets irregularities referred for resolution record of disposal of fixed/non-current assets prepare payroll general journal entries debts balance day adjustments authorisation produce payroll record straight-line method disposal of fixed/non-current assets timelines reconcile total wages correction of irregularities reducing balance method depreciation schedule calculate payment due individual pay advice bank accounts payroll data allowances payroll cash asset register pay rate plant fixed/non-current asset financial reports arrange payment bad doubtful inventories reversing security closing payroll enquiries trading profit and loss post journal entries to ledger reporting period cost of goods sold revenue statement end of period financial reports profit assets balance sheet liabilities equity common errors errors correction of errors referred for resolution gross net DRAFT Financial Services Curriculum Framework - HSC Content overview - FINANCIAL SERVICES STREAM FNSACM303A Process payment documentation communication FNSRTS301A Provide customer service in a retail agency Associated units of competency FNSRTS308A Balance cash holdings problem-solving Employability skills BSBRKG304B Maintain business records planning and organising technology define agency financial services institution role range products and services benefits application related documentation financial services institution transactions phone (hotline) industry privacy legislative and regulatory personnel requirements scope of capacity to offer advice workplace/enterprise policy and procedures level of authorisation relationship with the institution what is/is not a record understanding of when a record should be made protocols for referrals maintaining up-to-date knowledge agreed timeframe standard operating procedures for processing transactions types characteristics purposes and use active characteristics quality service records agency stages of use archival website contacts taxation financial transactions reporting rules and requirements benefits types customers needs, preferences and expectations organisation/workplace policy and protocols confidentiality privacy legislative and regulatory requirements sources of information enquiries business/records system handling difficult or abusive customers common enquiries customer service importance of effective responses creation of records maintenance of records procedures for contact with customers customer interaction record-keeping records continuum seeking assistance complaints handling policy and procedures record management disposal of records customer dissatisfaction and complaints access security release common complaints effective responses to complaints seeking assistance organisation/workplace requirements method supervisor colleagues electronic from external requests priority information required manual Financial Services authenticity processing transactions completeness elements reports accuracy consider reconciliation level of security range typical to financial services institution cash transactions non-cash transactions integrity security deposit, withdrawal and transfer system controls cash float accuracy time frame systems and accounts budget client and payee database cash holdings data entry understanding of takings related systems balance facility periodic end of day documentation opening cash verification authorisation payment status common discrepancies correction of discrepancies balancing the terminal cash received cash given out payment name and general features payment system discrepancies range of equipment common across the financial services industry effect payment storage access and release standard procedures working knowledge maintenance cash and non-cash transactions importance of information management purpose and limitations opening, closing and clearing the terminal accuracy workplace records cash and non-cash handling procedures traceable confidentiality security workplace/enterprise policy industry standards recording takings credit arrangements transference of tender legislative requirements processing and proofing maintenance of cash float cash and non-cash balancing calculations balance cash holdings reconcile takings discrepancies workplace documentation time frames accuracy workplace/enterprise policy and procedures common discrepancies correction of discrepancies DRAFT Financial Services Curriculum Framework - HSC Content overview - CERTIFICATE II SCHOOL-BASED TRAINEESHIP STREAM FNSFLT203A Develop an understanding of debt and consumer credit Associated units of competency FNSFLT205A Develop an understanding of the Australian financial systems and markets FNSFLT206A Develop and understanding of taxation communication Employability skills learning assessable income deductions Pay as you go (PAYG) superannuation contribution key terminology Tax File Number (TFN) taxable income Business Activity Statement (BAS) local State role and use in the Australian economy history federal legislative requirements risk credit rating taxes levies creditor/lender collection methods debt duties debtor/borrower role of Australian Taxation Office (ATO) sources of information declaration forms rates assessment default equity taxation Tax File Number (TFN) return an understanding of regulatory bodies financial institution personal taxation consumer advisory bodies tax liability interest loan payment sole trader role of credit within Australian society partnership effect of debt on Australian economy trust effect of business structure advantages and disadvantages company Australian Business Number (ABN)/Australian Company Number (ACN) return business loan tax liability payment debt and consumer credit finance credit facilities options implications of under or over payment brief history equity/share credit card overdraft secured/unsecured implications of defaulting financial institutions bond futures derivatives provision and management of credit types financial markets money costs investors interest participants speculators consumers effect on monetary policy meeting minimum payments credit reference Reserve Bank of Australia (RBA) credit rating credit history Australian financial system and markets functions of money Australia global monetary cycle Australia's monetary system short-term money market impact of decreases and increases money supply importance of regulation primary (raw materials) secondary (products) sectors tertiary (services) current events and issues State minimising fees and charges avoiding credit card fraud motivation for holding money Commonwealth variable managing debt effective use financial intermediaries role/function Australian economy fixed comparison rate government importance Australian economy role and effect of government domestic interest rates consumer activity credit reference agencies fees and charges financial institutions financial institutions regulatory bodies consumer advisory bodies foreign exchange banks store card revolving Certificate II School-based Transship purpose leases fixed employee superannuation contribution options debt individual business taxation rates assessment credit impact of change Australian Prudential Regulation Authority (APRA) Australian Securities and Investments Commission (ASIC) role of regulators reports agencies