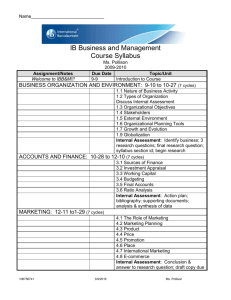

Chapter 15

advertisement

Chapter 15 Business Cycles © 2003 South-Western College Publishing The Business Cycle The rise and fall of economic activity relative to the economy’s long-term growth trend 2 Types and Lengths of Cycles Minor cycles relatively mild intensity, noticeable but not severe short numerous Major cycles wide fluctuations, serious contractions or depressions widespread unemployment lower output low profits or net losses 3 Other Types of Cycles Long-wave building cycles Commodity price fluctuations Stock market price fluctuations 4 Duration of Business Cycles since WWII Number Average duration Longest cycle Shortest cycle Average expansion Shortest expansion Longest expansion* Average recession Shortest recession Longest Recession *as of February, 2000 10 56 months 120 months (1991-2001) 28 months (1980-1982) 57 months 12 months (1980-1981) 120 months (1991 - 2001) 11 months 6 months (1980) 17 months (1981-1982) 5 Phases of the Business Cycle Real GDP Peak: highest level of economic activity in a particular cycle Contraction: noticeable drop in the level of business activity Expansion: rising level of economic activity Trough: lowest level of business activity in a particular cycle Time 6 Phases and Measurement of Cycles Trend Directional movement of the economy over an extended time, usually 20-30 years Seasonal Variations Recurring fluctuations in activity in a given period, usually 1 year Random Fluctuations Changes in activity caused by unexpected events Cyclical Fluctuations Changes in activity that occur regardless of trend, seasonal variations, or random forces 7 Patterns of Cycles Two kinds of elements or forces bring about business cycles Internal: elements within the very sphere of business activity itself: production, income, demand, credit, interest rates, inventories External: elements outside the normal scope of business activity: population growth, wars, basic changes in nation’s currency, national economic policies, natural disasters 8 Trough Output Pessimism HIGH Employment Income Price LOW Costs Profits Investment 9 Expansion External factors Cost-price relationship Replacement of depleted inventories Low interest rates Investment increases Demand increases Employment and income increase 10 Peak Output Employment Income Price HIGH Optimism Profits Investment 11 Contraction Output, employment, income at peak Consumer demand tapers off Prices level out, inventories increase Costs increase, profit margins diminish Demand slackens, firms reduce excess inventories Output is cut, and so are income and employment Investments discouraged & outlook pessimistic 12 Business Cycle Indicators Leading Indicators Group of 11 indexes whose upward and downward turning points generally precede the peaks and troughs in general business activity Roughly Coincident Indicators Group of 4 indexes whose turning points usually correspond to the peaks and troughs of general business activity Lagging Indicators Group of 7 indexes whose turning points occur after the turning points for the general level of business activity have been reached 13 Leading Indicators Average work week for production workers in manufacturing Rate of layoffs in manufacturing New orders for consumer goods and materials New business formations Contracts and orders for plant an equipment Vendor performance, measured as a % of companies reporting slower deliveries from suppliers 14 Leading Indicators (cont.) Number of new building permits issued for private housing units Net change in inventories Change in sensitive prices Change in total liquid assets Changes in money supply 15 Coincident Indicators Number of employees on nonagricultural payrolls Personal income less transfer payments Industrial production Manufacturing and trade sales volume 16 Lagging Indicators Average duration of employment Change in labor cost per unit of output Average prime rate charged by banks Commercial and industrial loans outstanding Ratio of consumer installment loans outstanding to personal income Change in the CPI for services Ratio of manufacturing and trade inventories to sales 17 Real or Physical Causes of the Business Cycle Innovation theory Business cycles are caused by breakthroughs in the form of new products, new methods, new machines, or new techniques Agricultural theories Business cycles relate the general level of business activity to the weather 18 Psychological Causes of the Business Cycle Psychological theory When investors and consumers react according to some belief about future conditions, their actions tend to transform their outlook into reality Rational expectations theory Suggests that individuals and businesses act or react according to what they think is going to happen in the future, after considering all available information 19 Monetary, Spending & Saving Causes of the Business Cycle Monetary theory Business cycle is caused by the free and easy expansion of the money supply Spending and saving causes Underconsumption theories: cycles are caused by the failure to spend all national income, resulting in unsold goods, reduced total production, and consequent reductions in employment and income Underinvestment theories: recessions occur because of inadequate investment in the economy 20 1991-2001 Business Cycle Longest cyclical expansion in U.S. history & subsequent recession one of the mildest Causes of expansion Usual ingredients for cyclical recovery Monetary and fiscal policies conducive to economic growth Rapid introductions of new applications of innovations in communication and computer technology, including Internet 21 1991-2001 Business Cycle Productivity gains Low energy costs Causes of contraction September 11th and its impact on travel related industries Collapse of several major companies such as Enron, WorldCom, etc. Declines in equity markets and their impact on personal wealth 22