FAST-DAM-KKT

advertisement

Applying Karush-Kuhn-Tucker (KKT) Optimality Conditions for Pricing Analysis in

DAM under the proposed Future AS

Introduction to concepts

The simplified hypothetical DAM optimization problem is presented below.

Simplifications:

(i)

(ii)

(iii)

(iv)

(v)

Transmission constraints, PTPs, block offers and bids are not considered

A single AS product (generically called AS) is considered

Load Resources are not considered

Energy Offer and AS Offer are covering the entire MW range from LSL to HSL

No constraints on how much AS can be awarded to a single resource

(vi)

𝐶𝑖

, 𝐶𝑖

, 𝐶𝑖

are the submitted bids ($/MWh) , energy offers

($/MWh), AS offers ($/MW) respectively. For simplicity, these bids and offers are considered

to be constant for the entire MW bid or offered.

Resource commitment not considered – all Resources considered to be online and only

online AS and Energy Offers considered

All AS Offers from Generation Resources are considered to be inclusive with respect to their

EOC.

Temporal constraints not modeled

AS Self Arrangement set to zero

Other simplifications compared to actual DAM ….

(vii)

(viii)

(ix)

(x)

(xi)

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

𝐴𝑆𝑂𝑓𝑓𝑒𝑟

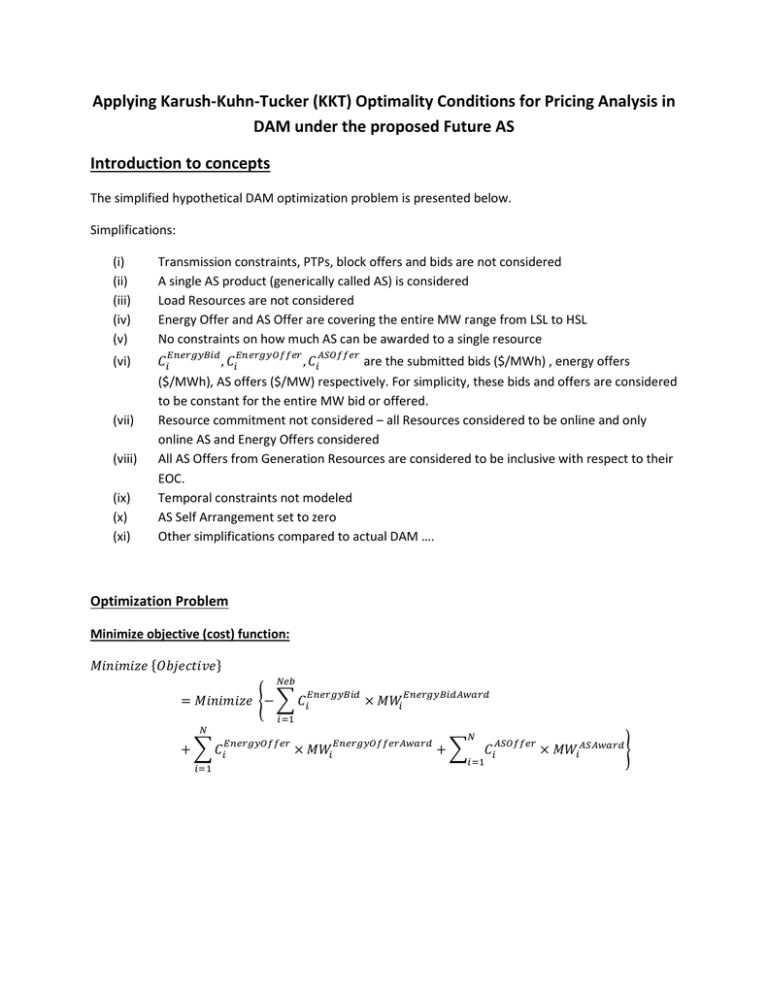

Optimization Problem

Minimize objective (cost) function:

𝑀𝑖𝑛𝑖𝑚𝑖𝑧𝑒 {𝑂𝑏𝑗𝑒𝑐𝑡𝑖𝑣𝑒}

𝑁𝑒𝑏

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

= 𝑀𝑖𝑛𝑖𝑚𝑖𝑧𝑒 {− ∑ 𝐶𝑖

× 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

𝑖=1

× 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

𝑁

+∑

𝐴𝑆𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑖=1

× 𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 }

Subject to:

Ignoring transmission constraints and focusing on power balance, AS procurement and Resource limit

constraints, the set of constraints are given below:

System wide constraints:

a) Power Balance: (Shadow price =

𝜆)

𝑁𝑒𝑏

𝑁

∑ 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

𝑖=1

− ∑ 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

=0

𝑖=1

b) AS Procurement: (Shadow price =

𝑁

∑

𝛼)

𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 − 𝐴𝑆𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡 ≥ 0

𝑖=1

Individual Energy Bid constraints:

c) Energy Bid MW constraint for every energy bid 𝑖 = 1,2,3 … 𝑁𝑒𝑏 : (Shadow price = 𝜃𝑖𝑒𝑏

respectively)

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

≥0

Individual Resource constraints:

Each Resource will have its own set of constraints to ensure awards are within bounds of its own upper

(HSL/MPC) and low (LSL/LPC) limits.

d) LSL Constraint for every modeled Generation Resource 𝑖 = 1,2,3 … 𝑁: (Shadow price = 𝜃𝑖𝐿𝑆𝐿 )

𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− 𝐿𝑆𝐿𝑖 ≥ 0

e) HSL Constraint for every modeled Generation Resource 𝑖 = 1,2,3 … 𝑁: (Shadow price = 𝜃𝑖𝐻𝑆𝐿 )

𝐻𝑆𝐿𝑖 − 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 ≥ 0

Analysis by Applying KKT optimality conditions:

The objective and constraints are combined to form the Lagrange function:

ℒ = {𝑂𝑏𝑗𝑒𝑐𝑡𝑖𝑣𝑒 − ∑ 𝑆ℎ𝑎𝑑𝑜𝑤𝑝𝑟𝑖𝑐𝑒𝑖 × 𝐶𝑜𝑛𝑠𝑡𝑟𝑎𝑖𝑛𝑡𝑖 }

𝑖

𝑁𝑒𝑏

ℒ=

𝑁

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

{− ∑ 𝐶𝑖

𝑖=1

𝑁

× 𝑀𝑊𝑖

+∑

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

× 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝐴𝑆𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑖=1

× 𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 }

𝑁𝑒𝑏

𝑁

− 𝜆 (∑ ∆𝑀𝑊𝑖

𝑖=1

𝑁

− 𝛼 (∑

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− ∑ ∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

)

𝑖=1

𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 − 𝐴𝑆𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡 )

𝑖=1

𝑁𝑒𝑏

− ∑ 𝜃𝑖𝑒𝑏 (𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

)

𝑖=1

𝑁

− ∑ 𝜃𝑖𝐿𝑆𝐿 (𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− 𝐿𝑆𝐿𝑖 )

𝑖=1

𝑁

− ∑ 𝜃𝑖𝐻𝑆𝐿 (𝐻𝑆𝐿𝑖 − 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

At optimal solution ∇ℒ = 0 (optimality condition)

i.e. the partial derivative of ℒ with respect to each award

(𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

, 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

, 𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 ) will equate to zero at the optimal solution.

Taking the partial derivative of ℒ with respect to each award

(𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

, 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

, 𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 ) we get:

𝑁𝑒𝑏

∇ℒ𝑀𝑊 = 0 =

𝑁

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

× ∆𝑀𝑊𝑖

{− ∑ 𝐶𝑖

𝑖=1

𝑁

𝐴𝑆𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

× ∆𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 }

𝑖=1

− 𝜆 (∑ ∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

𝑖=1

− ∑ ∆𝑀𝑊𝑖

𝑖=1

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁𝑒𝑏

𝑁

𝛼 (∑ ∆𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑

𝑖=1

) + ∑ 𝜃𝑖𝑒𝑏 (∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁

− ∑ 𝜃𝑖𝐿𝑆𝐿 (∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

)

𝑖=1

𝑁

+ ∑ 𝜃𝑖𝐻𝑆𝐿 (∆𝑀𝑊𝑖

𝑖=1

× ∆𝑀𝑊𝑖

𝑁𝑒𝑏

𝑁

−

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

+ ∆𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 )

)

)

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

Rearranging the terms by ∆𝑀𝑊𝑖

f)

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

, ∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

, ∆𝑀𝑊𝑖𝐴𝑆𝐴𝑤𝑎𝑟𝑑 we get:

For each energy bid 𝑖 = 1,2,3, … 𝑁𝑒𝑏, the following equation holds true

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

𝐶𝑖

= 𝜆 − 𝜃𝑖𝑒𝑏

If the energy bid i is marginal to the power balance constraint, then 𝜃𝑖𝑒𝑏 = 0 and the energy bid i

sets the shadow price for the power balance constraint (System Lambda (𝜆))

g) For each Resource energy offer 𝑖 = 1,2,3, … 𝑁, the following equation holds true

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

= 𝜆 − 𝜃𝑖𝐻𝑆𝐿 + 𝜃𝑖𝐿𝑆𝐿

If the energy offer i is marginal to the power balance constraint, then in most cases, 𝜃𝑖𝐻𝑆𝐿 =

0, 𝜃𝑖𝐿𝑆𝐿 = 0 and the energy offer i sets the shadow price for the power balance constraint

(System Lambda (𝜆))

h) For each Resource AS offer 𝑖 = 1,2,3, … 𝑁, the following equation holds true

𝐴𝑆𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

= 𝛼 − 𝜃𝑖𝐻𝑆𝐿

If the AS offer i is marginal to the AS procurement constraint, then in most cases, 𝜃𝑖𝐻𝑆𝐿 = 0and

the AS offer i sets the shadow price for the AS procurement constraint (typically referred to as

the AS MCPC (𝛼))

Pricing Analysis Example:

Let there be a Resource g whose capacity has been partly awarded energy and partly awarded AS such

that the sum of the energy award and AS award equals Resource g HSL.

In this case:

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

𝑀𝑊𝑔

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

+ 𝑀𝑊𝑔

= 𝐻𝑆𝐿𝑔

The HSL constraint is binding, i.e. 𝜃𝑖𝐻𝑆𝐿 > 0

The LSL constraint is not binding, i.e. 𝜃𝑖𝐿𝑆𝐿 = 0

And,

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝐴𝑆𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

− (𝜆 + 𝜃𝑖𝐻𝑆𝐿 ) = 0

− (𝛼 + 𝜃𝑖𝐻𝑆𝐿 ) = 0

Rearranging we get

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

𝜆 − 𝐶𝑖

𝐴𝑆𝑂𝑓𝑓𝑒𝑟

𝛼 − 𝐶𝑖

= 𝜃𝑖𝐻𝑆𝐿

= 𝜃𝑖𝐻𝑆𝐿

Equating the two equations we get

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

𝜆 − 𝐶𝑖

𝐴𝑆𝑂𝑓𝑓𝑒𝑟

= 𝛼 − 𝐶𝑖

This demonstrates that at the optimal solution Resource g is indifferent to whether its capacity is used

for energy or AS. This is because for each MW sold from the resource for energy or AS, the additional

revenue from energy or AS, over submitted offer price, is the same.

DAM Pricing Analysis Applying KKT Optimality Conditions– Future AS

The simplified DAM optimization problem under the proposed Future Ancillary Service framework is

presented below.

Simplifications:

(i)

(ii)

(iii)

Transmission constraints, PTPs, block offers and bids are not considered

Energy Offer are covering the entire MW range from LSL to HSL

No constraints on how much AS can be awarded to a single resource but AS awards cannot

exceed the MW amount in the AS Offer

(iv)

𝐶𝑖

, 𝐶𝑖

, 𝐶𝑖

, 𝑒𝑡𝑐. are the submitted bids ($/MWh) , energy offers

($/MWh), RegUp offers ($/MW), etc. respectively. For simplicity, these bids and offers are

considered to be constant for the entire MW bid or offered.

Resource commitment not considered – all Resources considered to be online and only

online AS and Energy Offers considered

All AS Offers from Generation Resources are considered to be inclusive with respect to their

EOC.

Temporal constraints not modeled

AS Self Arrangement set to zero

Other simplifications compared to actual DAM ….

(v)

(vi)

(vii)

(viii)

(ix)

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

𝑅𝑒𝑔𝑈𝑝𝑂𝑓𝑓𝑒𝑟

Optimization Problem

Minimize objective (cost) function:

𝑁𝑔

𝑁𝑒𝑏

𝑀𝑖𝑛𝑖𝑚𝑖𝑧𝑒

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

{− ∑ 𝐶𝑖

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

× 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

× 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑅𝑒𝑔𝑈𝑝𝑂𝑓𝑓𝑒𝑟

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

𝐶𝑖

× 𝑀𝑊𝑖

𝑖=1

𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

𝐹𝑅𝑅𝑆𝑈𝑝𝑂𝑓𝑓𝑒𝑟

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∑

𝐶𝑖

× 𝑀𝑊𝑖

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

𝑅𝑒𝑔𝐷𝑛𝑂𝑓𝑓𝑒𝑟

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

∑

𝐶𝑖

× 𝑀𝑊𝑖

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

𝑁𝑓𝑐𝑙

𝐹𝑅𝑅𝑆𝐷𝑛𝑂𝑓𝑓𝑒𝑟

𝑃𝐹𝑅𝑂𝑓𝑓𝑒𝑟

∑

𝐶𝑖

× 𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 + ∑ 𝐶𝑖

𝑖=1

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

𝑁𝑔+𝑁𝑐𝑙

+∑

+

+

+

𝐶𝑅1𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

𝑆𝑅1𝑂𝑓𝑓𝑒𝑟

× 𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 + ∑ 𝐶𝑖

𝑖=1

𝑁𝑏𝑙+𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

+

∑

× 𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁𝑏𝑙

𝐹𝐹𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

×

𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁𝑏𝑙

𝐹𝐹𝑅2𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

× 𝑀𝑊𝑖𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁𝑏𝑙

𝐶𝑅2𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

𝑖=1

× 𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑

𝑆𝑅2𝑂𝑓𝑓𝑒𝑟

× 𝑀𝑊𝑖𝐶𝑅2𝐴𝑤𝑎𝑟𝑑 + ∑ 𝐶𝑖

𝑖=1

× 𝑀𝑊𝑖𝑆𝑅2𝐴𝑤𝑎𝑟𝑑 }

Subject to:

Ignoring transmission constraints and focusing on power balance, AS procurement and Resource limit

constraints, the set of constraints are given below:

System wide constraints:

𝜆)

a) Power Balance: (Shadow price =

𝑁𝑔

𝑁𝑒𝑏

∑ 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− ∑ 𝑀𝑊𝑖

𝑖=1

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

b) RegUp Procurement (including FRRS-Up): (Shadow price =

𝑁𝑔+𝑁𝑐𝑙

∑

𝑖=1

𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

+∑

𝑀𝑊𝑖

𝑖=1

𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

𝑀𝑎𝑥𝐹𝑅𝑅𝑆𝑈𝑝 − ∑

𝑀𝑊𝑖

𝑖=1

𝑖=1

𝑀𝑊𝑖

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

𝑁𝑓𝑐𝑙

+∑

𝑖=1

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

𝑁𝑓𝑐𝑙

𝑀𝑎𝑥𝐹𝑅𝑅𝑆𝐷𝑛 − ∑

𝑖=1

∑

𝛽)

𝜔𝐹𝑅𝑅𝑆𝐷𝑛 )

𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 ≥ 0

CR Procurement (CR1 & CR2): (Shadow price =

𝑁𝑔+𝑁𝑐𝑙

≥0

𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 − 𝑅𝑒𝑔𝐷𝑛𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡 ≥ 0

e) FRRS-Dn maximum procurement limit: (Shadow price =

f)

− 𝑅𝑒𝑔𝑈𝑝𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡 ≥ 0

𝜔𝐹𝑅𝑅𝑆𝑈𝑝 )

d) RegDn Procurement (including FRRS-Dn): (Shadow price =

𝑁𝑔+𝑁𝑐𝑙

𝛼)

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

c) FRRS-Up maximum procurement limit: (Shadow price =

∑

=0

𝑖=1

𝛾)

𝑁𝑏𝑙

𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑

𝑖=1

+ ∑ 𝑀𝑊𝑖𝐶𝑅2𝐴𝑤𝑎𝑟𝑑 − 𝐶𝑅𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡 ≥ 0

𝑖=1

g) CR1 minimum procurement : (Shadow price =

𝜔𝐶𝑅1 )

𝑁𝑔+𝑁𝑐𝑙

∑ 𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑖𝑛𝐶𝑅1 ≥ 0

𝑖=1

𝛿)

h) SR Procurement (SR1 & SR2): (Shadow price =

𝑁𝑔+𝑁𝑐𝑙

∑

𝑁𝑏𝑙

𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑

+ ∑ 𝑀𝑊𝑖𝑆𝑅2𝐴𝑤𝑎𝑟𝑑 − 𝑆𝑅𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡 ≥ 0

𝑖=1

i)

𝑖=1

SR1 minimum procurement : (Shadow price =

𝜔𝑆𝑅1 )

𝑁𝑔+𝑁𝑐𝑙

∑ 𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑖𝑛𝑆𝑅1 ≥ 0

𝑖=1

j)

𝜙)

PFR+FFR1+FFR2 Procurement: (Shadow price =

𝑁𝑔+𝑁𝑐𝑙

∑

𝑁𝑏𝑙+𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑

+𝑅×(

∑

𝑖=1

𝑁𝑏𝑙

𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑

𝑖=1

+ ∑ 𝑀𝑊𝑖𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

− (𝑃𝐹𝑅𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡 + 𝑅 × 𝐹𝐹𝑅𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡) ≥ 0

k) FFR1+FFR2 Maximum procurement limit : (Shadow price =

𝑁𝑏𝑙+𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

𝑀𝑎𝑥𝐹𝐹𝑅 −

∑

𝑁𝑏𝑙

𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑

𝑖=1

l)

𝜔𝐹𝐹𝑅 )

− ∑ 𝑀𝑊𝑖𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑 ≥ 0

𝑖=1

FFR1 Maximum procurement limit : (Shadow price =

𝜔𝐹𝐹𝑅1 )

𝑁𝑏𝑙+𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

𝑀𝑎𝑥𝐹𝐹𝑅1 −

𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

∑

𝑖=1

Individual Energy Bid constraints:

m) Energy Bid MW constraint for every energy bid 𝑖 = 1,2,3 … 𝑁𝑒𝑏 : (Shadow price = 𝜃𝑖𝑒𝑏

respectively)

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

≥0

Individual Resource constraints:

Each Resource will have its own set of constraints to ensure awards are within bounds of its own upper

(HSL/MPC) and low (LSL/LPC) limits.

n) LSL Constraint for every modeled Generation Resource 𝑖 = 1,2,3 … 𝑁𝑔 : (Shadow price = 𝜃𝑖𝐿𝑆𝐿 )

𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

− 𝐿𝑆𝐿𝑖 ≥ 0

o) HSL Constraint for every modeled Generation Resource 𝑖 = 1,2,3 … 𝑁𝑔 : (Shadow price = 𝜃𝑖𝐻𝑆𝐿 )

𝐻𝑆𝐿𝑖 − 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑

≥0

p) AS Offer MW constraint for every modeled Generation Resource 𝑖 = 1,2,3 … 𝑁𝑔 : (Shadow price

𝑔−𝐴𝑆𝑢𝑝

= 𝜃𝑖

𝑔−𝐴𝑆𝑑𝑛

, 𝜃𝑖

respectively)

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

≥0

q) MPC & LPC Constraint for every modeled “Blocky” Load Resource 𝑖 = 1,2,3 … 𝑁𝑏𝑙 : (Shadow price

= 𝜃𝑖𝑏𝑙 )

Note that a “blocky” Load Resource is awarded only one AS product.

𝑀𝑃𝐶𝑖 − 𝐿𝑃𝐶𝑖 − 𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

or

𝑀𝑃𝐶𝑖 − 𝐿𝑃𝐶𝑖 − 𝑀𝑊𝑖𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑 ≥ 0

or

𝑀𝑃𝐶𝑖 − 𝐿𝑃𝐶𝑖 − 𝑀𝑊𝑖𝐶𝑅2𝐴𝑤𝑎𝑟𝑑 ≥ 0

or

𝑀𝑃𝐶𝑖 − 𝐿𝑃𝐶𝑖 − 𝑀𝑊𝑖𝑆𝑅2𝐴𝑤𝑎𝑟𝑑 ≥ 0

r) AS Offer MW constraint for every modeled “Blocky” Load Resource 𝑖 = 1,2,3 … 𝑁𝑏𝑙 : (Shadow

price = 𝜃𝑖𝑏𝑙−𝐴𝑆 )

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

or

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑 ≥ 0

or

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖𝐶𝑅2𝐴𝑤𝑎𝑟𝑑 ≥ 0

or

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖𝑆𝑅2𝐴𝑤𝑎𝑟𝑑 ≥ 0

s) MPC & LPC Constraint for every modeled Controllable Load Resource 𝑖 = 1,2,3 … 𝑁𝑐𝑙 : (Shadow

price = 𝜃𝑖𝑐𝑙 )

𝑀𝑃𝐶𝑖 − 𝐿𝑃𝐶𝑖 − 𝑀𝑊𝑖

≥0

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑

t) AS Offer MW constraint for every Controllable Load Resource 𝑖 = 1,2,3 … 𝑁𝑐𝑙 : (Shadow price =

𝑐𝑙−𝐴𝑆𝑢𝑝

𝜃𝑖

, 𝜃𝑖𝑐𝑙−𝐴𝑆𝑑𝑛 respectively)

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

≥0

u) HSL & LSL Constraint for every “Quick/Fast” Resource qualified for FRRS-Up and FFR1 and partly

𝑓𝑔

modeled as Generation Resource 𝑖 = 1,2,3 … 𝑁𝑓𝑔 : (Shadow price = 𝜃𝑖 )

𝐻𝑆𝐿𝑖 − 𝐿𝑆𝐿𝑖 − 𝑀𝑊𝑖

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

v) AS Offer MW constraint for every “Quick/Fast” Resource qualified for FRRS-Up and FFR1 and

𝑓𝑔−𝐴𝑆

partly modeled as Generation Resource 𝑖 = 1,2,3 … 𝑁𝑓𝑔 : (Shadow price = 𝜃𝑖

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

)

− 𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

w) MPC & LPC Constraint for every “Quick/Fast” Resource qualified for FRRS-Up, FRRS-Dn and FFR1

𝑓𝑐𝑙

and partly modeled as Controllable Load Resource 𝑖 = 1,2,3 … 𝑁𝑓𝑐𝑙 : (Shadow price = 𝜃𝑖 )

𝑀𝑃𝐶𝑖 − 𝐿𝑃𝐶𝑖 − 𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 − 𝑀𝑊𝑖

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

x) AS Offer MW constraint for every “Quick/Fast” Resource qualified for FRRS-Up and FFR1 and

partly modeled as Controllable Load Resource 𝑖 = 1,2,3 … 𝑁𝑓𝑐𝑙 : (Shadow price =

𝑓𝑐𝑙−𝐴𝑆𝑢𝑝

𝜃𝑖

𝑓𝑐𝑙−𝐴𝑆𝑑𝑛

, 𝜃𝑖

respectively)

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

− 𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 ≥ 0

𝐴𝑆𝑂𝑓𝑓𝑒𝑟𝑀𝑊𝑖 − 𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 ≥ 0

Pricing Analysis By Applying KKT optimality conditions:

The objective and constraints are combined to form the Lagrange function:

ℒ = {𝑂𝑏𝑗𝑒𝑐𝑡𝑖𝑣𝑒 − ∑ 𝑆ℎ𝑎𝑑𝑜𝑤𝑝𝑟𝑖𝑐𝑒𝑖 × 𝐶𝑜𝑛𝑠𝑡𝑟𝑎𝑖𝑛𝑡𝑖 }

𝑖

At optimal solution ∇ℒ = 0 (KKT optimality condition)

i.e. the partial derivative of ℒ with respect to each award

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

(𝑀𝑊𝑖

solution.

, 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

, 𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

, 𝑒𝑡𝑐) will equate to zero at the optimal

Taking the partial derivative of ℒ with respect to each award

(𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

, 𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

, 𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

, 𝑒𝑡𝑐. ) results in:

𝑁𝑒𝑏

∇ℒ𝑀𝑊 = 0 =

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

× ∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

× ∆𝑀𝑊𝑖

{− ∑ 𝐶𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

𝑖=1

{

𝑁𝑔

+ ∑ 𝐶𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

+∑

𝑅𝑒𝑔𝑈𝑝𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑖=1

𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

+∑

𝐹𝑅𝑅𝑆𝑈𝑝𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

+∑

𝑅𝑒𝑔𝐷𝑛𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑖=1

𝑁𝑓𝑐𝑙

+∑

𝑖=1

× ∆𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

× ∆𝑀𝑊𝑖

× ∆𝑀𝑊𝑖

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

𝑁𝑔+𝑁𝑐𝑙

𝐹𝑅𝑅𝑆𝐷𝑛𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

×

∆𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑

× ∆𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

𝑁𝑔+𝑁𝑐𝑙

𝐶𝑅1𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

𝑆𝑅1𝑂𝑓𝑓𝑒𝑟

× ∆𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 + ∑ 𝐶𝑖

𝑖=1

𝑁𝑏𝑙+𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

+

𝑃𝐹𝑅𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

𝑖=1

𝑁𝑏𝑙

𝐹𝐹𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

∑

× ∆𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑

×

∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑

𝐹𝐹𝑅2𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

𝑖=1

× ∆𝑀𝑊𝑖𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑

𝑖=1

𝑁𝑏𝑙

𝑁𝑏𝑙

𝐶𝑅2𝑂𝑓𝑓𝑒𝑟

+ ∑ 𝐶𝑖

𝑆𝑅2𝑂𝑓𝑓𝑒𝑟

× ∆𝑀𝑊𝑖𝐶𝑅2𝐴𝑤𝑎𝑟𝑑 + ∑ 𝐶𝑖

𝑖=1

× ∆𝑀𝑊𝑖𝑆𝑅2𝐴𝑤𝑎𝑟𝑑 }

𝑖=1

𝑁𝑔

𝑁𝑒𝑏

− 𝜆 (∑ ∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− ∑ ∆𝑀𝑊𝑖

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

∆𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∆𝑀𝑊𝑖

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

+∑

𝑖=1

𝑁𝑓𝑐𝑙

+∑

𝑖=1

∆𝑀𝑊𝑖

𝑁𝑏𝑙

𝑖=1

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

𝑖=1

𝑁𝑏𝑙

∆𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑

+ ∑ ∆𝑀𝑊𝑖𝑆𝑅2𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

− 𝜙 ( ∑ ∆𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑 + 𝑅

𝑖=1

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∆𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 )

− 𝛾 ( ∑ ∆𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 + ∑ ∆𝑀𝑊𝑖𝐶𝑅2𝐴𝑤𝑎𝑟𝑑 )

−𝛿( ∑

)

𝑖=1

− 𝛼 (∑

− 𝛽 (∑

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

)

𝑁𝑏𝑙+𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

×(

𝑁𝑏𝑙

∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑

∑

+ ∑ ∆𝑀𝑊𝑖𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑 ))

𝑖=1

𝑖=1

𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

+ 𝜔𝐹𝑅𝑅𝑆𝑈𝑝 (∑

∆𝑀𝑊𝑖

𝑖=1

𝑁𝑔+𝑁𝑐𝑙

− 𝜔𝐶𝑅1 ( ∑

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

𝑁𝑓𝑐𝑙

) + 𝜔𝐹𝑅𝑅𝑆𝐷𝑛 (∑

𝜔𝑆𝑅1 ( ∑ ∆𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

𝑁𝑏𝑙+𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

𝑁𝑏𝑙

∑

∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 + ∑ ∆𝑀𝑊𝑖𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

𝑖=1

+ 𝜔𝐹𝐹𝑅 (

𝑁𝑏𝑙+𝑁𝑓𝑔+𝑁𝑓𝑐𝑙

+ 𝜔𝐹𝐹𝑅1 (

∑

∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 ) + ∑

𝑖=1

𝑁𝑔

𝑖=1

𝑁𝑔

+

+

+

+

+

+

+

+

+

+

+

+

𝜃𝑖𝐿𝑆𝐿 (∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

− ∆𝑀𝑊𝑖

𝑁𝑒𝑏

𝑖=1

𝜃𝑖𝑒𝑏 (∆𝑀𝑊𝑖

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

)

)

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

𝜃𝑖𝐻𝑆𝐿 (∆𝑀𝑊𝑖

+ ∆𝑀𝑊𝑖

+ ∆𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑

𝑖=1

∆𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 + ∆𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑 )

𝑁𝑔

𝑔−𝐴𝑆𝑢𝑝

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∑ 𝜃𝑖

+ ∆𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑 + ∆𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑

(∆𝑀𝑊𝑖

𝑖=1

𝑁𝑔

𝑔−𝐴𝑆𝑑𝑛

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

∆𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑 ) + ∑ 𝜃𝑖

(∆𝑀𝑊𝑖

)

𝑖=1

𝑁𝑏𝑙

∑ 𝜃𝑖𝑏𝑙 (∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 𝑜𝑟 𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑 𝑜𝑟 𝐶𝑅2𝐴𝑤𝑎𝑟𝑑 𝑜𝑟 𝑆𝑅2𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

𝑁𝑏𝑙

∑ 𝜃𝑖𝑏𝑙−𝐴𝑆 (∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 𝑜𝑟 𝐹𝐹𝑅2𝐴𝑤𝑎𝑟𝑑 𝑜𝑟 𝐶𝑅2𝐴𝑤𝑎𝑟𝑑 𝑜𝑟 𝑆𝑅2𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

𝑁𝑐𝑙

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∑ 𝜃𝑖𝑐𝑙 (∆𝑀𝑊𝑖

+ ∆𝑀𝑊𝑖

+ ∆𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑 + ∆𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑

𝑖=1

∆𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑 )

𝑁𝑐𝑙

𝑐𝑙−𝐴𝑆𝑢𝑝

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∑ 𝜃𝑖

+ ∆𝑀𝑊𝑖𝑃𝐹𝑅𝐴𝑤𝑎𝑟𝑑 + ∆𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑

(∆𝑀𝑊𝑖

𝑖=1

𝑁𝑐𝑙

𝑅𝑒𝑔𝐷𝑛𝐴𝑤𝑎𝑟𝑑

∆𝑀𝑊𝑖𝑆𝑅1𝐴𝑤𝑎𝑟𝑑 ) + ∑ 𝜃𝑖𝑐𝑙−𝐴𝑆𝑑𝑛 (∆𝑀𝑊𝑖

)

𝑖=1

𝑁𝑓𝑔

𝑓𝑔

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∑

𝜃𝑖 (∆𝑀𝑊𝑖

+ ∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

𝑁𝑓𝑔

𝑓𝑔−𝐴𝑆

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∑

𝜃𝑖

+ ∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 )

(∆𝑀𝑊𝑖

𝑖=1

𝑁𝑓𝑐𝑙

𝑓𝑐𝑙

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∑

𝜃𝑖 (∆𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 + ∆𝑀𝑊𝑖

+ ∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 )

𝑖=1

𝑁𝑓𝑐𝑙

𝑓𝑐𝑙−𝐴𝑆𝑢𝑝

𝐹𝑅𝑅𝑆𝑈𝑝𝐴𝑤𝑎𝑟𝑑

∑

𝜃𝑖

+ ∆𝑀𝑊𝑖𝐹𝐹𝑅1𝐴𝑤𝑎𝑟𝑑 )

(∆𝑀𝑊𝑖

𝑖=1

+∑

+

∆𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 )

𝑁𝑔+𝑁𝑐𝑙

∆𝑀𝑊𝑖𝐶𝑅1𝐴𝑤𝑎𝑟𝑑 ) −

𝑖=1

−∑

𝑖=1

𝑁𝑓𝑐𝑙

+∑

𝑓𝑐𝑙−𝐴𝑆𝑑𝑛

𝜃𝑖

𝑖=1

(∆𝑀𝑊𝑖𝐹𝑅𝑅𝑆𝐷𝑛𝐴𝑤𝑎𝑟𝑑 )

}

Rearranging the terms by ∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑𝐴𝑤𝑎𝑟𝑑

, ∆𝑀𝑊𝑖

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟𝐴𝑤𝑎𝑟𝑑

, ∆𝑀𝑊𝑖

𝑅𝑒𝑔𝑈𝑝𝐴𝑤𝑎𝑟𝑑

, 𝑒𝑡𝑐. we get:

a) For each energy bid 𝑖 = 1,2,3, … 𝑁𝑒𝑏, the following equation holds true

𝐸𝑛𝑒𝑟𝑔𝑦𝐵𝑖𝑑

𝐶𝑖

= 𝜆 − 𝜃𝑖𝑒𝑏

b) For each energy offer from modeled Generation Resource 𝑖 = 1,2,3, … 𝑁𝑔 , the following

equation holds true

𝐸𝑛𝑒𝑟𝑔𝑦𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

= 𝜆 − 𝜃𝑖𝐻𝑆𝐿 + 𝜃𝑖𝐿𝑆𝐿

c) For each RegUp offer from modeled Generation Resource 𝑖 = 1,2,3, … 𝑁𝑔 , the following

equation holds true

𝑅𝑒𝑔𝑈𝑝𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑔−𝐴𝑆𝑢𝑝

= 𝛼 − 𝜃𝑖𝐻𝑆𝐿 − 𝜃𝑖

d) For each RegDn offer from modeled Generation Resource 𝑖 = 1,2,3, … 𝑁𝑔 , the following

equation holds true

𝑅𝑒𝑔𝐷𝑛𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑔−𝐴𝑆𝑑𝑛

= 𝛽 − 𝜃𝑖𝐿𝑆𝐿 − 𝜃𝑖

e) For each PFR offer from modeled Generation Resource 𝑖 = 1,2,3, … 𝑁𝑔 , the following equation

holds true

𝑃𝐹𝑅𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

f)

𝑔−𝐴𝑆𝑢𝑝

= 𝜙 − 𝜃𝑖𝐻𝑆𝐿 − 𝜃𝑖

For each CR1 offer from modeled Generation Resource 𝑖 = 1,2,3, … 𝑁𝑔 , the following equation

holds true

𝐶𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑔−𝐴𝑆𝑢𝑝

= 𝛾 + 𝜔𝐶𝑅1 − 𝜃𝑖𝐻𝑆𝐿 − 𝜃𝑖

g) For each SR1 offer from modeled Generation Resource 𝑖 = 1,2,3, … 𝑁𝑔 , the following equation

holds true

𝑆𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑔−𝐴𝑆𝑢𝑝

= 𝛿 + 𝜔𝑆𝑅1 − 𝜃𝑖𝐻𝑆𝐿 − 𝜃𝑖

h) For each FFR1 offer from modeled “blocky” Load Resource 𝑖 = 1,2,3, … 𝑁𝑏𝑙 , the following

equation holds true

𝐹𝐹𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

i)

= 𝑅𝜙 − 𝜔𝐹𝐹𝑅 − 𝜔𝐹𝐹𝑅1 − 𝜃𝑖𝑏𝑙 − 𝜃𝑖𝑏𝑙−𝐴𝑆

For each FFR2 offer from modeled “blocky” Load Resource 𝑖 = 1,2,3, … 𝑁𝑏𝑙 , the following

equation holds true

𝐹𝐹𝑅2𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

j)

= 𝑅𝜙 − 𝜔𝐹𝐹𝑅 − 𝜃𝑖𝑏𝑙 − 𝜃𝑖𝑏𝑙−𝐴𝑆

For each CR2 offer from modeled “blocky” Load Resource 𝑖 = 1,2,3, … 𝑁𝑏𝑙 , the following

equation holds true

𝐶𝑅2𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

= 𝛾 − 𝜃𝑖𝑏𝑙 − 𝜃𝑖𝑏𝑙−𝐴𝑆

k) For each SR2 offer from modeled “blocky” Load Resource 𝑖 = 1,2,3, … 𝑁𝑏𝑙 , the following

equation holds true

𝑆𝑅2𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

l)

= 𝛿 − 𝜃𝑖𝑏𝑙 − 𝜃𝑖𝑏𝑙−𝐴𝑆

For each RegUp offer from modeled Controllable Load Resource 𝑖 = 1,2,3, … 𝑁𝑐𝑙 , the following

equation holds true

𝑅𝑒𝑔𝑈𝑝𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑐𝑙−𝐴𝑆𝑢𝑝

= 𝛼 − 𝜃𝑖𝑐𝑙 − 𝜃𝑖

m) For each RegDn offer from modeled Controllable Load Resource 𝑖 = 1,2,3, … 𝑁𝑐𝑙 , the following

equation holds true

𝑅𝑒𝑔𝐷𝑛𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

= 𝛽 − 𝜃𝑖𝑐𝑙 − 𝜃𝑖𝑐𝑙−𝐴𝑆𝑑𝑛

n) For each PFR offer from modeled Controllable Load Resource 𝑖 = 1,2,3, … 𝑁𝑐𝑙 , the following

equation holds true

𝑃𝐹𝑅𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑐𝑙−𝐴𝑆𝑢𝑝

= 𝜙 − 𝜃𝑖𝑐𝑙 − 𝜃𝑖

o) For each CR1 offer from modeled Controllable Load Resource 𝑖 = 1,2,3, … 𝑁𝑐𝑙 , the following

equation holds true

𝐶𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑐𝑙−𝐴𝑆𝑢𝑝

= 𝛾 + 𝜔𝐶𝑅1 − 𝜃𝑖𝑐𝑙 − 𝜃𝑖

p) For each SR1 offer from modeled Controllable Load Resource 𝑖 = 1,2,3, … 𝑁𝑐𝑙 , the following

equation holds true

𝑆𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑐𝑙−𝐴𝑆𝑢𝑝

= 𝛿 + 𝜔𝑆𝑅1 − 𝜃𝑖𝑐𝑙 − 𝜃𝑖

q) For each FRRS-Up offer from “Quick/Fast” Resource partly modeled as Generation Resource 𝑖 =

1,2,3, … 𝑁𝑓𝑔 , the following equation holds true

𝐹𝑅𝑅𝑆𝑈𝑝𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑓𝑔

𝑓𝑔−𝐴𝑆

= 𝛼 − 𝜔𝐹𝑅𝑅𝑆𝑈𝑝 − 𝜃𝑖

− 𝜃𝑖

r) For each FFR1 offer from “Quick/Fast” Resource partly modeled as Generation Resource 𝑖 =

1,2,3, … 𝑁𝑓𝑔 , the following equation holds true

𝐹𝐹𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑓𝑔

= 𝑅𝜙 − 𝜔𝐹𝐹𝑅 − 𝜔𝐹𝐹𝑅1 − 𝜃𝑖

𝑓𝑔−𝐴𝑆

− 𝜃𝑖

s) For each FRRS-Up offer from “Quick/Fast” Resource partly modeled as Load Resource 𝑖 =

1,2,3, … 𝑁𝑓𝑐𝑙 , the following equation holds true

𝐹𝑅𝑅𝑆𝑈𝑝𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑓𝑐𝑙

= 𝛼 − 𝜔𝐹𝑅𝑅𝑆𝑈𝑝 − 𝜃𝑖

𝑓𝑐𝑙−𝐴𝑆𝑢𝑝

− 𝜃𝑖

t) For each FRRS-Dn offer from “Quick/Fast” Resource partly modeled as Load Resource 𝑖 =

1,2,3, … 𝑁𝑓𝑐𝑙 , the following equation holds true

𝐹𝑅𝑅𝑆𝐷𝑛𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑓𝑐𝑙

= 𝛽 − 𝜔𝐹𝑅𝑅𝑆𝐷𝑛 − 𝜃𝑖

𝑓𝑐𝑙−𝐴𝑆𝑑𝑛

− 𝜃𝑖

u) For each FFR1 offer from “Quick/Fast” Resource partly modeled as Load Resource 𝑖 =

1,2,3, … 𝑁𝑓𝑐𝑙 , the following equation holds true

𝐹𝐹𝑅1𝑂𝑓𝑓𝑒𝑟

𝐶𝑖

𝑓𝑐𝑙

= 𝑅𝜙 − 𝜔𝐹𝐹𝑅 − 𝜔𝐹𝐹𝑅1 − 𝜃𝑖

𝑓𝑐𝑙−𝐴𝑆𝑢𝑝

− 𝜃𝑖

MCPC for proposed Future Ancillary Service

MCPC for a given AS is computed after the DAM optimization is complete. MCPCs are a linear

combination of Shadow Prices of constraints. In the current Nodal Market, the MCPCs are setup to be

the Shadow Price of a single constraint (procurement constraint of the respective AS).

1. In the current ERCOT market, all demand (load) is bought at the Load Zone (except for

Wholesale Load). Load Resources cannot submit Resource Specific (locational) demand bids (bid

to buy energy). Load Resources can only submit Resource specific Offers to sell Ancillary

Services.

2. Hence, the Load Resource Limit Constraints do not have an energy consumed portion between

their lower and upper limits.

3. Generation Resources, however, can submit Resource specific Offers to sell energy and Ancillary

Services.

4. Due to the above two features of our market design, in the DAM optimization:

a. For Generation Resources, the energy and AS co-optimization process allocates the

offered MW capacity (constrained between LSL and HSL) between energy and Ancillary

Services taking into account opportunity costs for energy and Ancillary Services. i.e. the

prices (LMP-energy and MCPC-AS) incorporate opportunity costs

b. For Load Resources, as there is no energy component (demand), the energy and AS cooptimization process only allocates the offered MW capacity considering only AS offer(s)

5. If AS offers from Load Resources were cleared against the AS requirement from Load Resources,

as there is no consideration of energy, then the corresponding AS MCPC will be determined

solely by the marginal AS Offer from Load Resources – there is no opportunity cost for energy

incorporated.

In the current ERCOT Nodal Market,

1. Load Resources are allowed to offer into any and all AS products.

2. AS Offers from Load Resources are cleared together with AS Offers from Generation Resources

and thus,

3. The resultant MCPC reflects any opportunity costs for energy and other Ancillary Services. This

decision was there even in the Zonal Market for RRS and seems to reflect a policy decision

made by the stakeholders.

4. The equivalency ratio between MW offered for AS from Load Resources and MW offered for the

same AS from Generation Resources is one (RAS = 1).

For the proposed future Ancillary Service product set, the same concepts (policy decisions) have been

carried forth based on discussion at the FAST meetings,

1. PFR and FFR procurement is governed primarily by the constraint that incorporates the

equivalency ratio R between PFR and FFR

a. This is similar to the way RRS is currently cleared if we consider R=1

b. Due to the equivalency ratio R, the MCPCRRS-LR for FFFR must reflect this ratio. Note: if in

the current RRS, if there was a decision to incorporate the ratio R (which comes from

reliability studies), then the MCPC for RRS from Load Resources must be R*MCPCRRS-Gen

2. Similarly for CR (CR1&CR2) and SR (SR1&SR2), the CR and SR Offers from Generation Resource

and Load Resource are cleared together to meet the total CR and SR requirement respectively.

This is done to allow for substitution between the AS offers from Generation and Load

Resources.

AS Product

PFR

MCPC

FFR1

𝑀𝑖𝑛𝑖𝑚𝑢𝑚 (𝑅 × 𝜙, 𝑉𝑂𝐿𝐿)

𝜙

FFR2

𝑀𝑖𝑛𝑖𝑚𝑢𝑚 (𝑅 × 𝜙, 𝑉𝑂𝐿𝐿)

CR1

𝛾 + 𝜔𝐶𝑅1

CR2

𝛾 + 𝜔𝐶𝑅1

SR1

𝛿 + 𝜔𝑆𝑅1

SR2

𝛿 + 𝜔𝑆𝑅1

RegUp

𝛼

FRRS-Up

RegDn

𝛼

𝛽

FRRS-Dn

𝛽

Comments

Shadow Price of the PFR+FFR1+FFR2

procurement constraint

R (equivalencing ratio of PFR to FFR) multiplied

by the Shadow price of the PFR_FFR1+FFR2

procurement constraint. This FFR2 MCPC is

capped at VOLL

R (equivalencing ratio of PFR to FFR) multiplied

by the Shadow price of the PFR+FFR1+FFR2

procurement constraint. This FFR1 MCPC is

capped at VOLL

Sum of the Shadow Prices of the CR (CR1+CR2)

procurement constraint (𝛾)and the CR1

minimum procurement constraint (𝜔𝐶𝑅1)

CR2 is valued the same as CR1. The Shadow Price

𝜔𝐶𝑅1 if non- zero encapsulates any opportunity

cost for energy and other Ancillary Service.

Sum of the Shadow Prices of the SR (SR1+SR2)

procurement constraint (𝛿) and the SR1

minimum procurement constraint (𝜔𝑆𝑅1 )

SR2 is valued the same as SR1. The Shadow Price

𝜔𝑆𝑅1 if non- zero encapsulates any opportunity

cost for energy and other Ancillary Service.

Shadow price of the RegUp procurement

(including FRRS-Up) constraint

FRRS-Up is valued the same as RegUp

Shadow price of the RegDn procurement

(including FRRS-Dn) constraint

FRRS-Down is valued the same as RegDn

![[Type text] Activities to try at home – Plant and try to grow some](http://s3.studylib.net/store/data/009766123_1-d8f5192933fbb7e47b9df92ea50807fc-300x300.png)