ppt - Moodle

advertisement

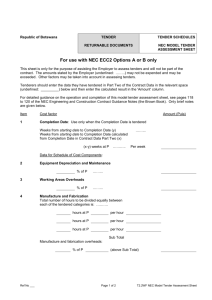

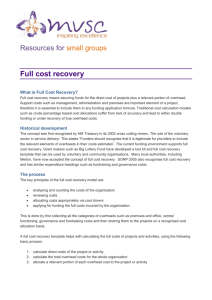

Estimation 1 S9 Lara Tookey o Final Stage – convert net cost estimate to a tender. o Must show full breakdown of costs for management team. o Must highlight issues which are: Cost significant; o Special / unusual contract conditions / risks; & o Alterations made to standard documents. o Estimators Report o Report consolidates all information which has influenced the preparation of the estimate. o Undertaken by estimator, construction planner and senior management. o Decision then made and final tender summary completed. Other issues to highlight Time for which tender is to remain open for acceptance; Conditions of contract; o Employer’s special conditions i.e. bonds / insurances; Escalation; Current work load; o Future prospects i.e. ‘follow-on’ work; Assessment of state of design & possible financial consequences thereof; Information regarding consultants that Management should know about; Details of other tenderers if known; Pertinent information regarding market & industrial conditions; Estimator’s report & appraisal of risks; Delays & site allowances; Unresolved technical & contractual problems; Major assumptions made in preparation of estimate; Any qualification of the tender; Capital required for project; Cash flow-calculations; Assessment of profitability of the project; Terms of quotations received from SC; Technical & managerial manpower requirements. NB: o Information relating to build-up of rates, assumptions and underlying decision must be available to final review team, and if successful, to the construction staff. Bid adjudication meeting – practice & procedures Internal Issues o Existing workload o Bids ‘in the market place’ o Resource issues o Finance considerations o Strategic direction of the company External Issues o The general economy o The ‘mood’ of the nation Other things to keep in mind o Deciding o o on the margin What is the basis for your margin allocation? How do you know what’s going on around you? o Commercial Considerations o Will this win the job? o What else can be considered? o What is your ‘commercial environment’? Review of estimators workings Decision on what margin to apply Bid submission details Submit your Tender Review of estimators workings Check work!!! o Pricing checks: o Mathematical checks; o Rates must apply to unit of measurement; o All items on each page have been priced or included elsewhere; o Major items needing costly resources should be reconciled with resource summary sheets. o Tender programme to be completed so the estimator can examine the resources estimated in time on the programme with those expressed in cash terms in the estimate. o Ie need to maintain excavator on site during groundwork operations. Planner allowed for 10 weeks but estimator only allowed for 6 weeks! Decision on what margin to apply o If tender appears to exceed the sum which would win the contract, there are two refinements which can be made: o o Re-examine suppliers’ and subcontractors’ quotations for any evidence that lower prices may be available; or Consider different profit margin for direct work and those for which subcontractors will be responsible. Pricing margins (Overhead & Profit) Tender = gross bill Mark Up (Profit) Adjudication Head Office Overheads Preliminaries i.e. Site Overheads PC & Provisional Cost + Own Subcontractors + Own Labour + Materials + Plant = net bill Request for bids Contract documents Quantity take-off Determination of Equipment cost Pricing of direct labour & material Determination of Project overheads (P&G) Taxes, bonds & insurance Subcontractor estimates Determination of Company overheads Contingency Addition of profit Bid Definition – Overhead Costs o Costs that support the production process in a Project but are not directly related to the production process (do not occur on site). o Relate to off-site costs which must be recovered to maintain the head office & local office facilities. Most certain & easiest to estimate of all the costs….. However, they causes more problems than any other cost!!! o Contractors often think that overhead costs can be reduced by reducing prices on jobs. o Very dangerous – overhead costs can only be reduced in the office. o Reducing the price bid for a job cuts profit – not overheads. o Price cuts come off the top – out of profits – while overheads go on forever!!! Variable Nature Fixed Mixed Company Overheads Indirect (Project) Type General Nature of Overhead Costs o Relatively unaffected by outside influences - caused internally. o o o Variable costs Fixed costs Mixed costs Variable Costs costs are those costs that tend to vary with the volume of work COST o Variable REVENUES Fixed Costs costs are those costs that tend to be fixed over a specific range of revenue. COST o Fixed REVENUES Mixed Costs o Mixed costs are costs that contain both a variable component and a fixed cost component. o For example, if the company paid its estimators a base salary plus a bonus based on the volume of work won. Variable Nature Fixed Mixed Company Overheads Type Indirect (Project) General Indirect expenses (Project Overheads) o Vary with & are caused directly by individual jobs but are not directly chargeable against specific phase of work. o Welfare fund payments, apprentice training, social security, workmen’s compensation, unemployment taxes, miscellaneous payroll-related expenses, direct supervisions, building permits, temporary buildings, sales taxes etc. o Either added as percentage of estimated direct job costs o Suitable for contractors who perform same type of work all time, with stable work load. o Detailed o o o separately in tender. Cost identified and attributed directly to certain job (ie component of unit rate) Varying work loads, different type of jobs. % add-on simply adds another element of uncertainty…. General Overheads o Can’t job. o be charged directly to single Costs of maintaining office, rent, telephone, property taxes, interest, insurance, marketing material, office equipment; depreciation, salaries & cost of employment of directors & staff; Printing, stationery, postage & telephone; cars & other vehicle costs for office staff; advertising & entertainment; Finance costs & professional fees etc. o Normally expressed as overhead percentage of turnover. o Company policy to be clearly understood! o Affected o by market!!! Bad market conditions – scarce work, turnover drops o How do you reduce tender price to be competitive? How do you allocate General Overheads? o Necessary to distribute overheads against each project currently involved in, in an equitable manner. o Generally larger projects receive a larger percentage of overheads. o Once annual overheads have been recovered, you can reduce costs or even omit from new projects. Under recovery o Actual costs exceed budget costs &/or turnover fails to reach expected figure o Company could not continue for long without serious consequences. Over recovery o Actual costs fall short of budgeted costs due to unexpected fall in inflation &/or turnover higher than anticipated. o Extra profits earned. Question??? o Overheads are expected to increase from current level by 10% (297 250 to 326 975). o o o Can turnover be increase by corresponding % in order to keep pace or Must overhead % be increased? If neither feasible, must reduce overheads. o Business slack, some overhead costs may be reduced, other postponed i.e. o Repayment of loans, defer maintenance, advertising reduced, bank charges could be less. o Other o remain constant i.e. Staff salaries, rates, power, auditor’s fees. Method 1 - Turnover o Estimated o Expenses for 2011 $ 297 250 o Anticipated o Income for 2011 $ 3 375 000 o Charges evenly appropriated between projects o 297 250 / 3 375 000 x 100% = 8.81% o Assumes allowance of 8,81% levied against each project. o Work short supply – company unable to compete if it must include such a % in tender. o Not equitable – fraught with uncertainties o Unstable market conditions Method 2 – Duration of Contract o Determine annual off-site overheads (a). o Determine number of site working days (b). o Divide a by b = cost per day. o Distribute cost to each project equitably o Identify ratios. Base chart showing the daily overhead that has to be added to each tender No. Jobs per Est value Total value year (NPY) $m ($m) 1 4 16 $10 $4 $0.5 Turnover $10 $16 $8 29.41% 47.06% 23.53% $34 Office overheads Days Wked % cont'n to o/heads $ cont'n Daliy $ $735,294 $1,176,471 $588,235 $3,253.51 $5,205.62 $2,602.81 $2,500,000 $2,500,000 226 Daily rate / NPY $3,253.51 $1,301.41 $162.68 Chart showing the result when you win more projects – you can lower the daily rate OR if you have recovered your overheads for a period - you can tender with NO overheads. No. Jobs per Est value Total value % cont'n to year (NPY) $m ($m) o/heads 1 6 20 Turnover $10 $4 $0.5 Office overheads Days Worked $10 $24 $10 $44 22.73% 54.55% 22.73% $2,500,000 226 $ cont'n $568,182 $1,363,636 $568,182 $2,500,000 Daily $ $2,514.08 $6,033.79 $2,514.08 Daily rate / NPY $2,514.08 $1,005.63 $125.70 A situation where you are falling short in your job winning – need to increase daily overhead costs. No. Jobs per Est value Total value year (NPY) $m ($m) 1 $10 $10 2 $4 $8 12 $0.5 $6 Turnover $24 Office overheads Days Worked $2,500,000 226 % cont'n to o/heads 41.67% 33.33% 25.00% $ cont'n $1,041,667 $833,333 $625,000 $2,500,000 Daily rate / NPY $4,609.14 $4,609.14 $3,687.32 $1,843.66 $2,765.49 $230.46 Daily $ What other issues should be considered before a tender can be completed? o Desire o to win contract! Contract simply to increase current turnover or the first in a number of similar contracts? o Knowledge consultants. o of the client & Attitude & competence can have positive or negative impact on running of the project. o Local o market conditions. Consider the strength of competition for type of construction in area (often most important criterion when choosing winning profit margin). o Evaluation of previous bidding performance. o Knowledge gained of profit margins by examining results. o Contractor concerns: o o o o o o o may have other weather & its effects; work force; cash flow; future work & the flow of work; industrial relations; the public; paperwork, etc, etc. Pricing margins Profit o Seeking too low a price is not in the client’s best interest. oA contractor put in such a position is likely to spend much of its effort trying to increase the price or decrease costs. o Either way is likely to be to the detriment of quality!! o Contracting o The is not a bed of roses. contractor places its skill, knowledge & ability against an unknown but calculated risk in an attempt to make a fair profit. What is profit? o Simply o o o o It stated, it is payment for - Risks taken (contingencies) Capital invested Liability exposure is your right and responsibility to generate a net profit for your business. Why must profit be earned? o Shareholders investment; need return on o Company may wish to expand, increase turnover, diversify, take on extra staff; o Profits cushion effects of recession; o Profits maintain confidence levels; o External capital attracted to success. Remember o Cost of building ‘fixed’ according to plans & specifications, but amount for profit is not!! o rofit may represent difference between winning or loosing a contract. o o Too high a bid – will not secure project, abortive costs in preparing bid proposal. Too low a bid – may win a project, but increases risk of losing money. o Undertaken directors. o More by senior management / a hunch (gut feeling) than actual calculation. o Remember o Small profit margins require efficient use of resources & therefore efficient use of space on site, thus construction operations plan must be well developed! How do you allocate Profit (or margins)? Absorption Costing o Apply pre-determined percentage for overheads & profit respectively. o Ie Method 1 – Turnover calculations used in establishing % for Overheads Marginal Costing o Distinction between overheads & profit blurred. Point is to identify maximum bid that project likely to sustain. o Consider number of competitors, experience in type of work, level of costs, how desperate are they to win the contract. o Must question whether to take on work if mark-up insufficient to cover overheads let alone any profits. o Does project preempt another contract? Take on project but only if marginal revenue (contract sum) exceeds marginal costs (estimated project costs). o Even if overheads not fully covered, project does contribute to future relationship. o o When discussing your fees with Clients, Realtors and Lenders... Don’t call it Profit & Overhead But rather call it “Builder’s Margin” o Profit is not an accident, it is planned o Customers buy perceived value, not cost o Margin is not a One Size Fits All proposition o Carefully controlling costs will enhance profitability