MB0045A04

CUSTOMER_CODE SMUDE

DIVISION_CODE SMUDE

EVENT_CODE OCTOBER15

ASSESSMENT_CODE MB0045_OCTOBER15

QUESTION_TYPE DESCRIPTIVE_QUESTION

QUESTION_ID 9542

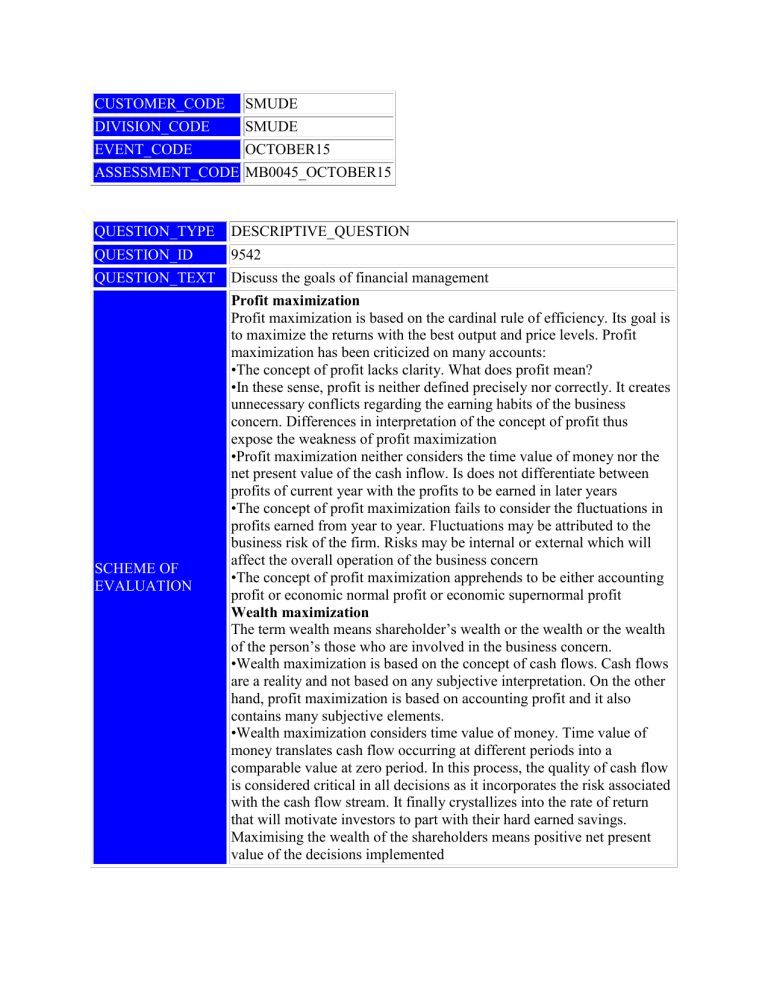

QUESTION_TEXT Discuss the goals of financial management

SCHEME OF

EVALUATION

Profit maximization

Profit maximization is based on the cardinal rule of efficiency. Its goal is to maximize the returns with the best output and price levels. Profit maximization has been criticized on many accounts:

•The concept of profit lacks clarity. What does profit mean?

•In these sense, profit is neither defined precisely nor correctly. It creates unnecessary conflicts regarding the earning habits of the business concern. Differences in interpretation of the concept of profit thus expose the weakness of profit maximization

•Profit maximization neither considers the time value of money nor the net present value of the cash inflow. Is does not differentiate between profits of current year with the profits to be earned in later years

•The concept of profit maximization fails to consider the fluctuations in profits earned from year to year. Fluctuations may be attributed to the business risk of the firm. Risks may be internal or external which will affect the overall operation of the business concern

•The concept of profit maximization apprehends to be either accounting profit or economic normal profit or economic supernormal profit

Wealth maximization

The term wealth means shareholder’s wealth or the wealth or the wealth of the person’s those who are involved in the business concern.

•Wealth maximization is based on the concept of cash flows. Cash flows are a reality and not based on any subjective interpretation. On the other hand, profit maximization is based on accounting profit and it also contains many subjective elements.

•Wealth maximization considers time value of money. Time value of money translates cash flow occurring at different periods into a comparable value at zero period. In this process, the quality of cash flow is considered critical in all decisions as it incorporates the risk associated with the cash flow stream. It finally crystallizes into the rate of return that will motivate investors to part with their hard earned savings.

Maximising the wealth of the shareholders means positive net present value of the decisions implemented

QUESTION_TYPE DESCRIPTIVE_QUESTION

QUESTION_ID 9543

QUESTION_TEXT

Describe the factors affecting the determination of working capital in an organization

SCHEME OF

EVALUATION

Nature of business: Working capital requirements are basically influenced by the nature of business of the firm. Trading organization are forced to carry large stocks of finished goods, accounts receivables and accounts payables. Public utilities require lesser investment in working capital.

Size of business operation: Size of measured in terms of the scales of operations. Normally, a firm with large scale of operation requires more working capital than a firm with a low scale of operation

Manufacturing cycle: Capital intensive industries with longer manufacturing process will have higher requirements of working capital, because of the need of running their sophisticated and long production process.

Products policy: Production schedule of a firm influences the investments in inventories. A firm, exposed to seasonal changes in demand that follows a steady production policy, will have to face the costs and risks associated with inventory accumulation during the offseason periods. On the other hand, a firm with a variable production policy will be facing different dimensions of management of working capital. Such a firm has to effectively handle the problem of production planning and control associated with utilization of installed plant capacity, under conditions of varying volumes of production of products of seasonal demand.

Volume of sales: There is a positive direct correlation between the volume of scales and the size of working capital of a firm

Term of purchase and sales: A firm that allows liberal credit to its customers will need more working capital than a firm with strict credit policy. A firm, which enjoys liberal credit facilities from its suppliers requires lower amount of working capital when compared to a firm, which does not have such a facility

Operating efficiency: The firm with high efficiency in operation can bring down the total investment in working capital to lower levels. Here, effective utilization of resources helps the firm in bringing down the investment in working capital

Price level changes: Inflation affects the working capital levels in a firm. To maintain the operating efficiency under an inflationary set up, a firm should examine the maintenance of working capital position under constant price level. The financial capital maintenance demands a firm to maintain higher amount of working capital, keeping pace with rising price levels. Under inflationary conditions, the same levels of inventory will require increased investment. The ability of a firm to revise its products’ price with rising price levels will decide the additional

investment to be made to maintain the working capital intact.

Business cycle: During boom, sales rise as business expands. Depression is marked by a decline in sale. During boom, expansion of business can be achieved only by augmenting investment in various assets that constitute working capital of a firm. When there is a decline in business on account of depression in economy, the inventory glut forced a firm to maintain the working capital at a level far in excess of the requirements under normal conditions.

Processing technology: Longer the manufacturing cycle, larger is the investment in working capital. When raw material passes through several stages in the production, process inventory will increase correspondingly.

Fluctuations in the supply of raw materials: Companies which use raw materials available only from one or two sources are forced to maintain buffer stock of raw materials to meet the requirements of uncertainty in lead time. Such firms normally carry more inventory than it would have done, had the materials been available in normal market conditions

QUESTION_TYPE

QUESTION_ID

QUESTION_TEXT

SCHEME OF

EVALUATION

DESCRIPTIVE_QUESTION

125903

Explain the factors related to internal constraints in capital rationing.

(Each point carries 2 marks each) a. Private owned company b. Divisional constraints c. Human resource limitations d. Dilution e. Debt constraints

QUESTION_TYPE

QUESTION_ID

QUESTION_TEXT

DESCRIPTIVE_QUESTION

125904

Explain the concepts of working capital. a. Gross working capital (3 marks)

SCHEME OF EVALUATION b. Net working capital (3 marks) c. Permanent working capital (2 marks) d. Temporary working capital (2 marks)

QUESTION_TYPE DESCRIPTIVE_QUESTION

QUESTION_ID

QUESTION_TEXT

SCHEME OF

EVALUATION

125905

What is Receivable Management? Examine the costs of maintaining receivables.

Management of account receivable may be defined as the process of making decision related to the investment of funds in receivables for maximising the overall return on the investment of the firm. ( 2 Marks)

Costs of maintaining receivables: (Each point gets 2 marks along with explanation) a. Capital cost b. Administration cost c. Delinquency cost d. Bad-debt or default costs

QUESTION_TYPE DESCRIPTIVE_QUESTION

QUESTION_ID 125912

QUESTION_TEXT

What is Credit policy of a firm? Examine the variables of credit policy

SCHEME OF

EVALUATION

The credit policy of a firm can be termed as a trade-off between increased credit sales leading to increase in profit and the cost of having large amount of cash locked up in the form of receivables along with the loss due to the incidence of bad debts. ( 2 Marks)

Variables are: (Each point gets 2 marks along with explanation) a. Credit standards b. Credit period c. Cash discount d. Collection programme