PowerPoint Presentation for Contemporary Financial Management

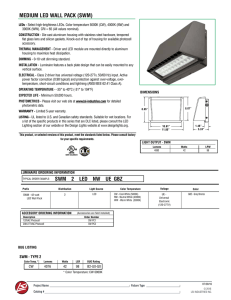

advertisement

Contemporary Financial Management 8th Edition by Moyer, McGuigan, and Kretlow Prepared by Tom Peacock University of Houston © 2001 South-Western College Publishing Chapter 1 The Role and Objective of Financial Management Questions Faced in Finance How is finance related to other fields of study? What are the goals and objectives of financial managers? How has the finance field evolved? How is the finance field changing today? 3 Principal Forms of Business Organizations Sole proprietorship Partnership Corporation 4 Sole Proprietorship Owned by one person Easy formation advantage Unlimited liability disadvantage Difficulty raising funds disadvantage Represent 75% of all businesses Account for < 6% of the $ volume 5 Partnership Owned by two or more persons Classified as general or limited Partnership dissolves when a general partner dies 6 Liability of Partners General Partner Has unlimited liability for all obligations of the business Limited Partner Liability limited to the partnership agreement 7 Corporation Limited liability Legal entity Permanency Have a board of Flexibility directors Owners are stockholders Easy marketability of shares of ownership Ability to raise of capital 8 Stockholders elect a board of directors Board of directors then hire management ( officers ) 9 Who Manages ? Board of directors deals with broad policy Management makes most of the decisions 10 Stockholder Rights Dividend Asset Voting Preemptive Corporate Securities in Order or Priority Bonds Preferred stock Common stock ( C/S ) ( highest) ( lowest ) 11 Optimal Form of Organization Influenced by Cost Raising capital Complexity Decision making Liability Tax considerations Continuity 12 Objective of Financial Management ( FM ) Objective of the financial manager Shareholder Wealth Maximization (SWM) NOT profit maximization Does not consider time value of money 13 SWM Considers the timing and risk of the benefits from stock ownership Determines that a good decision increases the price of the firm's common stock (c/s) Is an impersonal objective Is concerned for social responsibility 14 Social Responsibility Ethical issues will constantly confront financial managers as they achieve the goal of the firm ( SWM ). Managers Must Avoid personal conflicts Maintain confidentiality Be objective Act fairly 15 Agency Relationships / Problems Owners (shareholders) Problem created by separation of Management and Employees Management may maximize its own welfare instead of the owners wealth Job security 16 Job Security Management decisions based on retaining management rather than SWM Example–A decision to retain suppliers rather than selecting new suppliers providing higher quality or lower cost Why–If the transition is mishandled management will be scrutinized but if no change is made the issue will be ignored 17 Agency Costs Management incentives Monitor performance Owners protection Complex organization structures Recent Trends To flatten organization structures to cut costs 18 Problem created by separation of Owners Management Owners A similar problem Creditors Protective covenants in loan agreements 19 Examples of Protective Covenants Limitations of Common stock dividends Limitations on additional debts Not entering into sale and lease back arrangements 20 Shareholder Wealth Maximizing Is a Market Concept and Results in Maximizing PV of E(R) Measured by Market Value of C/S 21 3 Basic Factors Determine C/S Market Value 1) Amount of 2) Timing of Expected cash flows 3) Risk of 22 Conditions Affecting Market Value Economic environment factors Decisions under management control Conditions in financial markets Expected cash flows 23 Competitive Forces Influencing C/S Market Value New entrants Substitute products Bargaining power of buyers Bargaining power of suppliers Rivalry among current competitors 24 Cash Flow Concept Used for Financial analysis Planning Resource allocation CF does not equal accounting profit Cash Internal sources External sources 25 NPV of an Investment NPV = PV of future cash flows minus cash outlays The NPV of an investment represents the contributions of that investment to the value of the firm and passes on to SWM 26 Different Size Businesses Small Business Vs. Large Corporations Fundamental concepts are the same 27 Small Business Not the dominant firm in the industry Tend to grow more rapidly Limited access to financial market Lack management resources Have a high failure rate Stock is not publicly traded Poorly diversified Owner/manager frequently the same 28 Controller’s Activities Financial accounting Cost accounting Taxes Data processing 29 Treasurer’s Activities Management of cash and marketable securities Capital budgeting Financial planning Credit analysis Investors relations Pension fund management 30 Disciplines used in Finance Finance Economics Accounting Marketing Production Human Resources Quantitative Analysis 31 Professional Organizations Financial Executive Institute Institute of Charted Financial Analysis Financial Management Association Institute of Management Accounting 32 Exciting Career Opportunities in Finance VP of Finance Financial Analyst Director Account Executive Investor Relations Assistant Treasurer Tax Manager Security Broker Mortgage Analyst Banking 33