Insurance 101 - Tulsa Partners, Inc.

advertisement

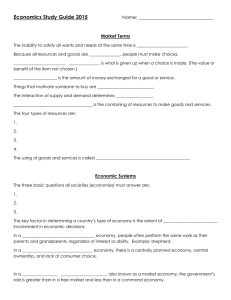

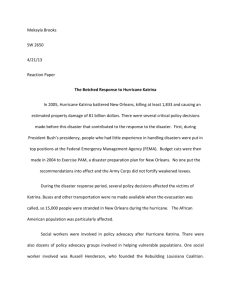

“Insurance 101” Small Business Insurance as one piece of your Business Contingency Plan Business Insurance 101 Key Objectives: Understanding your risks Protecting your assets You Don’t Have To Be A Statistic One of every Five businesses experiences a major disruption each year. Small business owners have a higher probability of being impacted by a disaster. Small business owners have fewer recovery resources and a lower tolerance for losses. (Compared to BIG Business) According to NAMIC 60% of Businesses do not fully recover after a Business Interruption of 3 months or more As many as 90% of small businesses do not have a business continuity plan in place. Business Interruption Claims from Hurricane Katrina cost Insurance Companies between $5 and $9 Billion Dollars* * Towers Watson 2005 Report Hurricane Katrina: Analysis of the Impact on the Insurance Industry Basic Property & Liability Exposures Damage to property (building, contents) Loss of revenue Loss of Income Extra Expense Theft (General, Employee) Liability arising from business operation (ex: customer slips/falls) Standard Business Owner’s Policy Section • • Property Loss of Income Section • • I II CGL Liability Medical Payments Business Owner’s Policy – Typical Built-ins Buildings – for owners. Contents – Furniture, equipment, supplies, inventory (Business equipment Includes permanently attached Personal Property) Tenant improvements and betterments – for Tenants Signs Loss of Income (Incredibly Important!) Liability Business Owner’s Policy – Other Options Money (on and off premises) Computer Property Temperature change Employee Dishonesty Increased Liability Limits Mechanical Breakdown Coverage Workers Compensation Coverage • Part A – Statutory limits • Part B – Employer’s liability • Rarely used • Must waive Part A Settlement and sue in court (BI by accident/by disease/policy limit) Premium • Estimated Payroll • Employees • Owners Annual Audit • Premium Adjustment Small Business Relationship Management Inland Marine Workers' Compensation Disability Business Policy Business Auto ENOL Business Continuity Planning Mutual Funds Bank Products Specialty Products Bonds Commercial Umbrella Business Life Retirement Plans Business Planning & Continuation Business Life Insurance • Key person Life Insurance • Group Life Insurance • Buy/sell agreements Business Retirement Plans Health Savings Account Long-Term Care Insurance Why Plan? • Business viewpoint • Insurance viewpoint • ◦ Protect assets and investment ◦ Remain competitive/preserve reputation ◦ Process Improvement ◦ ◦ ◦ ◦ Reduce property damage Reduce down time and expedite recovery Insurability Due diligence – obligation to inform/annual review Community viewpoint – Preserve jobs/contribute to tax base • It’s is outlined, encouraged and supported by Federal Legislation – Public Law 110-53 Title IX, Section 24 – Signed into law August 2007 – Section 524 encourages voluntary accreditation & Certification – PS Prep You Can Survive a Disaster Comments – Questions – Follow up David M. Hall, CPCU, ALCM Section Manager for Innovation and Small Business Solutions, State Farm Companies Disaster Resistant Business Council Chair Stephenson Disaster Management Institute Senior Fellow CPCU Interest Group Governor david.hall.cap5@statefarm.com