Annexure 2: Performance by output - Department for International

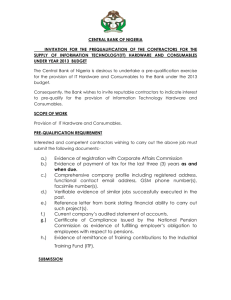

advertisement