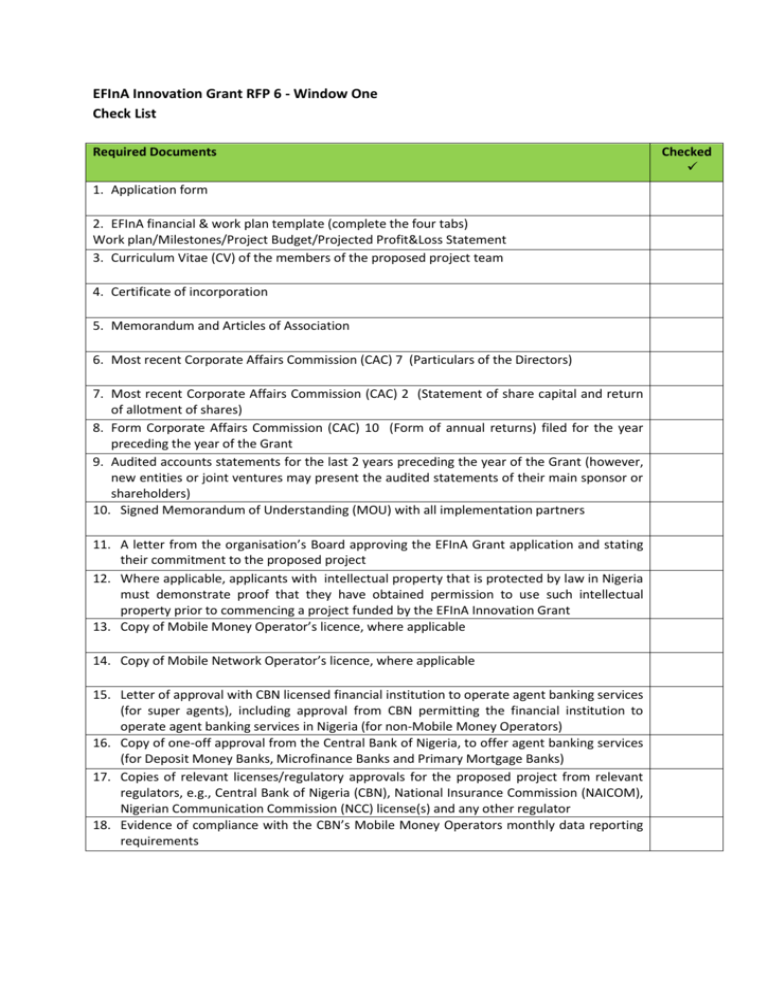

You can also the checklist here

advertisement

EFInA Innovation Grant RFP 6 - Window One Check List Required Documents 1. Application form 2. EFInA financial & work plan template (complete the four tabs) Work plan/Milestones/Project Budget/Projected Profit&Loss Statement 3. Curriculum Vitae (CV) of the members of the proposed project team 4. Certificate of incorporation 5. Memorandum and Articles of Association 6. Most recent Corporate Affairs Commission (CAC) 7 (Particulars of the Directors) 7. Most recent Corporate Affairs Commission (CAC) 2 (Statement of share capital and return of allotment of shares) 8. Form Corporate Affairs Commission (CAC) 10 (Form of annual returns) filed for the year preceding the year of the Grant 9. Audited accounts statements for the last 2 years preceding the year of the Grant (however, new entities or joint ventures may present the audited statements of their main sponsor or shareholders) 10. Signed Memorandum of Understanding (MOU) with all implementation partners 11. A letter from the organisation’s Board approving the EFInA Grant application and stating their commitment to the proposed project 12. Where applicable, applicants with intellectual property that is protected by law in Nigeria must demonstrate proof that they have obtained permission to use such intellectual property prior to commencing a project funded by the EFInA Innovation Grant 13. Copy of Mobile Money Operator’s licence, where applicable 14. Copy of Mobile Network Operator’s licence, where applicable 15. Letter of approval with CBN licensed financial institution to operate agent banking services (for super agents), including approval from CBN permitting the financial institution to operate agent banking services in Nigeria (for non-Mobile Money Operators) 16. Copy of one-off approval from the Central Bank of Nigeria, to offer agent banking services (for Deposit Money Banks, Microfinance Banks and Primary Mortgage Banks) 17. Copies of relevant licenses/regulatory approvals for the proposed project from relevant regulators, e.g., Central Bank of Nigeria (CBN), National Insurance Commission (NAICOM), Nigerian Communication Commission (NCC) license(s) and any other regulator 18. Evidence of compliance with the CBN’s Mobile Money Operators monthly data reporting requirements Checked