full year 2009 operating income

advertisement

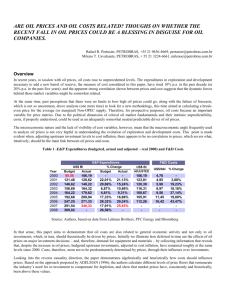

Company Update and Outlook for 2010 Almir Guilherme Barbassa Chief Financial Officer March 30, 2010 1 DISCLAIMER The presentation may contain forecasts about future events. Such forecasts merely reflect the expectations of the Company's management. Such terms as "anticipate", "believe", "expect", "forecast", "intend", "plan", "project", "seek", "should", along with similar or analogous expressions, are used to identify such forecasts. These predictions evidently involve risks and uncertainties, whether foreseen or not by the Company. Therefore, the future results of operations may differ from current expectations, and readers must not base their expectations exclusively on the information presented herein. The Company is not obliged to update the presentation/such forecasts in light of new information or future developments. CAUTIONARY STATEMENT FOR US INVESTORS The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this presentation, such as oil and gas resources, that the SEC’s guidelines strictly prohibit us from including in filings with the SEC. 2 CORPORATE ORGANIZATION AND KEY OPERATING RESULTS Exploration & Production Downstream (Supply) Gas & Energy Distribution International Biofuels Petrochemicals Summary Financials Operating Income* (US$ billion- USGAAP) (US$ billion- USGAAP) 18,9 20 Net Revenues EBITDA 2007 87.7 25.6 2008 118.3 31.1 2009 91.9 28.9 Net Income Capex Total Debt(1) Cash & Cash Equivalents Net Debt Total Equity Total Assets 13.1 21.0 21.9 7.0 14.9 65.2 129.7 18.9 29.9 27.1 6.5 20.6 61.9 125.7 15.5 35.1 57.1 16.2 40.9 94.1 200.3 15 10 5 0 -5 2007 Domestic E&P Distribution (1) * Includes capital leases Excludes Corporate and Elimination 15,5 13,1 2008 Downstream International 2009 Gas &Energy 2009 HIGHLIGHTS Accomplishments on the path to meeting long term vision ○ Installed 5 new production systems – 375 TBPD of new capacity ○ 6% Increase in national oil production ○ Initiated first Santos pre-salt production ○ Completed 3 new hydro-refining treatment units ○ Began distribution of S-50 diesel in major cities ○ Initiated LNG imports and neared completion of Nat. Gas infrastructure ○ Completed consolidation of the petrochemical sector ○ Raised US$ 35 billion of debt capital ○ Proposal of new Regulatory framework for the O&G sector in Brazil ○ Renewed participation in Dow Jones Sustainability Index STABLE FINANCIAL RESULTS DESPITE VOLATILE YEAR 4 2009 RESERVE REPLACEMENT: 17th consecutive year of fully replacing brazilian production ANP/SPE Criteria Billion boe International Reserves Brazil Reserves 14.093 14.169 2.124 2.113 0.992 0.495 0.203 RRI: 110% 11.969 2008 Oil & NGL 0.696 12.056 2009 Natural Gas 0.497 0.493 2008 Oil & NGL 2009 Natural Gas o 18 years of reserves to production in Brazil, 8 year reserves to production internationally o Pre-salt discoveries from Espirito Santo Basin contributed with 182 million boe. Estimated reserves in Santos Basin pre-salt are still under appraisal and therefore not included in proved reserves o Decrease in international reserves as constitutional changes in Bolivia eliminate reserve recognition 5 2009 PRODUCTION: PRODUÇÃO SEGUE TRAJETÓRIA SUSTENTADA Significant production increases in Brazil and internationally DE CRESCIMENTO Thous. boed Oil & Gas Average Total Production 2,400 2,526 Oil & Natural Gas Average Domestic Production 2,176 2,288 224 238 321 317 2,176 2,288 1,855 1,971 2008 National 2009 International 2008 2009 Oil & NGL Natural Gas o 6% increase in national oil production from ramp-ups of P-52, P-54 and P-53 and start-up of 5 new units; o 6% increase in international production from Akpo and Agbami fields in Nigeria; o Natural Gas production declined because of reduced demand in Brazil 6 PRODUÇÃO 2010 TARGET: 2010 PRODUCTION Growth from new systems and enhanced recovery 2ND QUARTER 1ST QUARTER 3RD QUARTER 4TH QUARTER Natural Gas EWT Tiro and Sidon 20 th bpd Uruguá Tambaú 10 million m3/d 35 th. bpd Mexilhão 15 million m3/d Cachalote e Baleia Franca 100 th. bpd 3.2 million m3/d TUPI Pilot 100 th. bpd 5 million m3/d Heavy oil Pre salt EWT Tupi Northeast 30 th. bpd EWT Guará 30 th. bpd 79 2,100 +- 2.5% 2,171 2,050 2009 Target 71 200 Difference 2009 Target– Production 2009 Difference Target 2010 – Target 2009 (BP 09-13) Target 2010 Ajusted (BP 09-13) Projects postponed NEW 2010 TARGET 7 2009 and 2010 PRE-SALT: Accelerating activities in the santos cluster o EWT currently producing 20 thous. bpd o 2 wells being drilled: Tupi O/A, North of Guará o 1 well being drilled for ANP in the North of Iara o 1 well being completed and evaluated in Guará and Tupi NE test finished with high productivity of 30 th. bpd o During 2010, 11 new wells expect to be drilled in the pre salt cluster o Bids in progress: Parati Iara (i) FPSO for Guará pilot IracemaTupi NE (ii) FPSO for the second pilot in the BM-S-11 (still being defined) Tupi O/A (iii) 8 hulls for the Santos cluster Tupi Jupiter Guará North Bem-te-vi Carioca Iguaçu Abaré Guará Tupi South Tupi 660 Tupi 646 Wells drilled Drilling for ANP Azulão Caramba Guarani Drilling Completing / testing EWT 8 DOWNSTREAM: Strong investments in fuel quality and expansion Downstream Investments in 2009 US$ 10.5 billion Oil Products output (th. bpd) 1,823 1,787 Fuel Quality 30% Complexity 153 159 255 243 135 142 34% 143 136 New projects* 2% 331 343 9% Logistics 74 65 25% Others 737 694 Construction in progress (US$ bn) 2008 2009 US$ 11.9 US$ 22.7 2008 Diesel Jet fuel 2009 Gasoline Nafta LPG Fuel Oil Others o 6.2% increase in diesel output and 5% reduction in fuel oil output yoy o 6 million barrel reduction in diesel imports ○ Acid and ultra-acid oils processing up 178% yoy ○ Comply with more strict environmental standards ○ Start up of Diesel S-50 production in 3 refineries (REDUC, REPLAN and REGAP) ○ 1new HDT unit and 2 new Propene units * Includes Northeast refinery, Comperj, Suape Petrochemical plant and Plangás 9 2009 PRICE IMPACT: Volatile international oil prices, stable domestic product prices Petrobras Oil Price (US$/bbl) 121 120.00 R$/bbl Brent (US$/bbl) ARP EUA: 130.06 100.58 89 US$/bbl 200 97 100.00 86.13 150 80.00 75 40.00 ARP Petrobras: 157.77 115 105.46 60.00 2009 average 250 64.42 76.75 68 59 55 47.95 75 70.24 64.00 2008 average 100 48.68 44 ARP EUA: 194.71 ARP Petrobras: 176.41 50 32.23 20.00 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 0 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 o Growing crude oil exports benefit from higher crude oil prices, improving quarterly earnings during the year. Lower discount between benchmark light and Petrobras oil also contributed o Following long term pricing policy, Petrobras average realization price (ARP) declined less than international prices, recovering shortfalls experienced in 2008 o Oil product pricing in Brazil continue to converge with international pricing o Pricing policy contributed to positive refining margins in 2009 (stable revenues, declining costs) 10 2009 CRUDE OIL AND PRODUCT SALES: Growth in domestic sales and higher export volumes Oil Products Thous.barrels/day 1,762 1,810 Natural Gas 1,849 434 492 489 211 222 212 364 327 366 753 769 782 4Q08 Diesel 3Q09 Gasoline 4Q09 LPG Others 311 4Q08 244 247 3Q09 4Q09 o Diesel sales increased with the Brazilian economy recovery (although imports decreased 43%) o Higher level of gasoline sales due to reduced competitiveness of ethanol o Reduced levels of natural gas sales due primarily to lower thermoelectric demand 11 NATURAL GAS AND ENERGY GENERATION: Creating a new industry in Brazil o Natural Gas logistic and Energy generation Infrastructure consolidation. Highlights: o Urucu-Coari-Manaus pipeline and Gasoduc III – 844 KM and 44.1 MMm3/d NG capacity o LNG Regasification Terminals: - Guanabara Bay and Pecém - 27 MMm3/d o Auctions and bi-lateral agreements to sell shortterm NG supply (average sales of 4.7 MMm3/d de NG in 9 auctions) o Portfolio diversification concluding first investment cycle 12 2009 CAPEX AND 2010 ESTIMATE: Substantially above the peer group to meet growth targets 50.000 45.000 40.000 35.000 US$ MM 30.000 25.000 2009 average without Petrobras 2010 average without Petrobras 20.000 15.000 10.000 5.000 2010 2009 2010 2009 2010 2009 2010 2009 * 2010 2009 2010 2009 2010 2009 2010 2009 2010 2009 2010 2009 2010 2009 0 Source: Evaluate Energy and Company Reports 2010 Petrobras CAPEX , of R$ 88.5 Bi, was converted using FX rate of 1,87 R$/US$ (2010 Petrobras premise). For 2009, preliminary results in USGAAP – Not audited 13 2009 CAPEX SPENDING: Reflects continued ramp-up of long-term plan Investments 2008 US$ 29.9 billion Investments 2009 US$ 35.1 billion 0,3 0,3 0,6 0,8 3,0 E&P 2,1 5,6 0,05 1,1 RTM 1,3 Gas & Power 5,1 4,2 14,3 3,8 16,5 6,1 7,2 10,1 International 24,7 Distribution 10,5 Others EBITDA (in US$ billions) 31 29 Stable cash generation supports Petrobras’s growing capital expenditures 2008 2009 14 2009 CASH FLOWS: Investments suported by cash flow and incremental debt Jan-Dec 2008 Jan-Dec 2009 4Q09 6,987 6,499 16,595 28,220 24,920 6,915 (29,466) (35,120) (9,598) Net cash from financing activities (2,778) (16,935) (2,311) Effect of exchange rate on cash (2,020) 2,935 (54) 6,499 16,169 16,169 97 62 75 1,84 2,00 1,74 US$ Million Cash at the beging of the period Net cash from operating activities Net cash used in investment activities Cash at the end of the period Brent (US$/bbl) FX Rate (R$/USD) o Stable operating cash flow, despite lower oil prices o Increase in investments was supported by additions to debt o Build-up in cash balances as of year end 2009 (despite advance payment of dividends), undrawn term loans and stable pricing, will support capex during 2010 15 2009 CAPITAL CONTRACTED: Successful efforts to raise debt capital from long term sources Market Capital Bond issuance 6.5 + Others Loans US$ 28.05 billions 6.75 1.5 Oct-30 (Maturity 2040) Yield: 7.00% 2.5 Oct-30 (Maturity 2020) Yield: 5.875% U S Eximbank (US$ bilion) BNDES Others 2 2.75 (*) 13.3 1.25 Jul-09 (Maturity 2019) Yield: 6.875% 10 China Development Bank 1.5 Brigde Loan Bond issue Feb-11 (Maturity 2019) Yield: 8.125% (*) R$ 25 billions converted by FX tax in 07.30.09 In 2009, US$ 34.8 billion were raised with an average life of 10.6 years 2009 CAPITAL STRUCTURE: Higher leverage due to growing capex 30% 25% 25% 21% 27% 27% 22% 19% 15% 12% 12/31/2008 Net Debt/Net Capt. 6/30/2009 US$ Billion 12/31/2009 12/31/2008 12/31/2007 Short Term Debt 8.5 5.9 1.5 Long Term Debt 48.6 20.6 19.6 Total Debt 57.1 27.1 21.8 Cash and Cash Equivalents 16.2 6.5 6.9 Net Debt 40.9 20.6 14.9 Net Debt/Ebitda 1.4X 0.7X 0.6X Average life 7.46 6.49 4.21 12/31/2009 Short Term Debt/Total Debt o Debt profile improved with new borrowings: longer tenor, competitive costs and diversified sources o Leverage sustained within the target range (25% to 35%) 17 CAPEX 2010 vs. 2009: Growth in capex, from additional upstream and downstream spending Investments 2009 R$ 70.8 billions Annual Business Plan 2010 R$ 88.5 billion 25% 0,6 0,9 3,8 2,6 E &P 6,2 6,8 D owns tream 8,1 G as & E nergy 31,6 10,5 36,7 International 17,4 34,0 D is tribuition Others 16.6 (0.7) (0.9) 88.5 5.1 (R$ billion) 70.8 (2.4) CAPEX 2009 E&P Downstream G&E International Distribution, CAPEX 2010 Biofuels and Corporate CAPEX FOR GROWTH: Expansion is responsible for increase in capex spending US$ MM 47,326 50.000 Others 45.000 40.000 35,134 Gas & Energy 35.000 30.000 Downstream 24,920 25.000 20.000 14,500 15.000 10.000 5.000 - OCF 2009 (1) (2) Capex 2009 (1) Capex 2010 (2) In USGAAP R$ 88.5 billion converted by FX rate of 1,87 R$/US$ (Petrobras forecast to 2010) Est. Maintenance Capex E&P BUSINESS PLAN 2010 – 2014: Commitment to a strong capital structure INVESTMENT 2010 – 2014 BETWEEN US$ 200 TO US$ 220 BILLIONS: MONITORING FINANCIAL RATIOS o Leverage between 25% and 35% o Net Debt/ EBITDA up to 2.5X o Investment revenue maintenance in the different segments RELEVANT ASSUMPTIONS FOR THE PROJECTIONS o Brent curve – upward trend o Capitalization – value and timing o Funding needs for the new Business Plan 2010-2014 20 FINANCIABILITY SIMULATION: Higher crude Long term oil price guarantee funding requirements ASSUMPTIONS Minority shareholders participation in the capitalization (US$ Bn) Investments (US$ bn) Average Brent Price (US$ bbl) 15 25 200 64 220 77 32% 2.2 27% 1.6 Financiability Simulation (Average 2010 - 2014) Leverage Net Debt/EBITDA 21 NEW REGULATORY MODEL Production Sharing Agreement Pre-salt and Strategic Areas Transfer of Rights with compensation Petrobras 100% Petrobras Operator Other companies through Bidding Process Other Areas Up to 5 billion boe Current Concession Model There will be no regulatory changes in the areas under concession, including the presalt area already granted 22 TRANSFER OF RIGHTS APPRAISAL Based on common variables standard throughout the industry Appraisal need to consider Production Curve Capex Production Costs Oil Volume Oil reservoir Future Oil prices Discount Rate Reserves development/ Knowledge Fiscal Environment (government participation) CAPITALIZATION UPDATE: Bills approved in lower house, now before senate Valuation of the barrels Size of capitalization Transparency and fairness Timing o Only completed after areas defined o One well drilling, another scheduled o Appraisal by at least 2 independent certification companies o Future revaluation to ensure fairness o STILL TO BE DETERMINED o Variables value of the barrels + funding needs + capital structure o Board Committee to represent minority and preferred shareholders o All shareholders will subscription rights o Full and Transparent disclosure of all relevant information o All Bills for capitalization and new regulatory regime now passed by Lower House o Senate has up to 45 days to approve, modify or reject the bill. If modified, must reconcile with lower house o Completion of Capitalization 60 to 90 days after bill becomes law have equal Results of capitalization o Access to 5 billion barrels o Greater Financial strength o Participation of all shareholders in a larger company with more opportunities 24 BILL 5941/09 COURSE OF ACTION (CAPITALIZATION): Fast track procedure since arrival in the Senate 25 days Arrival in the Senate, appreciation of the bill and forward1 o Bill is sent to commissions and timeline is open for amendments 2 o After deadline for amendments the bill shall be voted and sent to plenary Presidential message requesting fast track procedure Art.64 F.C. Subject inclusion Voting process Up to 35 days 03/22/10 05/06/10 After 45 days, subject is ceased 05/17/10 Appreciation and amendment voting Up to 10 days Up to 15 business days Art 66 FC Returns to the Lower House Presidential approval 06/04/10 Approval with amendments Up to 15 business days Art 66 FC Approval 05/27/10 Rejected 1 Bills sent to commission 2 Amendments are presented in the CCJ Filled 25 2009 PRICE IMPACT: Volatile international oil prices, stable domestic product prices Petrobras Oil Price (US$/bbl) 121 120.00 R$/bbl Brent (US$/bbl) ARP EUA: 130.06 100.58 89 US$/bbl 200 97 100.00 86.13 150 80.00 75 40.00 ARP Petrobras: 157.77 115 105.46 60.00 2009 average 250 64.42 76.75 68 59 55 47.95 75 70.24 64.00 2008 average 100 48.68 44 ARP EUA: 194.71 ARP Petrobras: 176.41 50 32.23 20.00 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 0 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 o Growing crude oil exports benefit from higher crude oil prices, improving quarterly earnings during the year. Lower discount between benchmark light and Petrobras oil also contributed o Following long term pricing policy, Petrobras average realization price (ARP) declined less than international prices, recovering shortfalls experienced in 2008 o Oil product pricing in Brazil continue to converge with international pricing o Pricing policy contributed to positive refining margins in 2009 (stable revenues, declining costs) 26 Information: Investor Relations +55 11 3224-1510 petroinvest@petrobras.com.br 27 FULL YEAR 2009 OPERATING INCOME: Higher income with efficient cost controls (R$ MILLION) 45,950 2008 Operating Income (1) (32,408) Net Operating Revenue 32,586 COGS - Operating Expenses 46,128 2009 Operating Income (1) o Decrease in operating income due to lower oil prices (2008: R$ 149.80; 2009: R$ 104.88) and lower ARP of oil products (2008: R$ 176.41; 2009: R$ 157.77) o COGS decrease due to lower lifting cost with government participation and oil and oil products import price decrease o Operating expenses were flat despite Marlin Special Participation (R$ 2.065 bi) (1) Operating income before financial result, equity balance and taxes 28 FULL YEAR 2009 NET INCOME: Small decline, largely from exchange related variations (R$ MILLION) 32,988 178 5,985 (5,967) (4,992) 28,982 790 2008 Net Income Operating Income Financial Result Equity Income Taxes Minority Interest and Employees Part. 2009 Net Income o The deterioration in the financial results were due to: Real revaluation (2008: depreciated 32%; 2009: appreciated 26%) and increase in debt indexed to the exchange rate o Increase in equity income reflects better results from petrochemical sector (R$ 682 million) and international subsidiaries (R$ 127 million) o Decrease in taxes due to lower income, results increase in units abroad which present differentiated tax regimes and losses in some subsidiaries o Negative results in Minority Interest reflect FX gains in debt of consolidated SPE’s 29 FULL YEAR 2009 SEGMENT RESULTS - E&P: Lower average oil price reduces operating income (R$ MILLION) 57,232 (33,093) 5,689 Jan-Dec/08 Oper. Income Price Effect on Revenues Cost Effect on COGS 3,050 Volume Effect on Revenues (1,195) (1,711) Volume Effect on COGS Operational Expenses 29,972 Jan-Dec/09 Oper. Income o Revenue decline from 30% decrease in petroleum price and 44% decrease in gas transfer price o Higher sales volume due to 5% growth in domestic oil and gas production o 17% decrease in lifting cost, primarily a reduction in Royalties and Special Participation contributed to the decrease in COGS o Increase in operational expenses due to non-recurring charge for adjustment to Special Participation tax for Marlim field 30 FULL YEAR 2009 SEGMENT RESULTS – DOWNSTREAM: Stable prices and declining COGS lead to turnaround (R$ MILLION) 53,457 2,240 (2,203) 234 20,482 Operational Expenses Jan-Dec/09 Oper. Income (28,648) (4,598) Jan-Dec/08 Oper. Income Price Effect on Revenues Cost Effect on COGS Volume Effect on Revenues Volume Effect on COGS o Lower export prices and ARP in the domestic market contributed to revenue reduction o Decrease in downstream COGS reflected: strong reduction in domestic oil and international oil products acquisition cost as well as lower average inventory costs o 6% increase in diesel production therefore an import reduction amounting 6 million barrels o Margin in 2009 of 14%, versus -3% in 2009 31 FULL YEAR 2009 SEGMENT RESULTS - GAS AND POWER: Margins improve, offsetting reduction in demand (R$ MILLION) 3,388 (2,879) 546 1,541 Operational Expenses Jan-Dec/09 Oper. Income 2,497 (529) (1,482) Jan-Dec/08 Oper. Income Price Effect on Revenues Cost Effect on COGS Volume Effect on Revenues Volume Effect on COGS o Revenue decrease due to lower gas sales volume (19% decrease), gas price reduction (7% decrease) as well as reduced power dispatch o Higher gross margins (from 11% to 28%) due to lower acquisition costs for gas and electrical energy o Ongoing completion of gas infrastructure has led to avoided penalties and higher electricity sales 32 FULL YEAR 2009 SEGMENT RESULTS - DISTRIBUTION: Growing market share leading to higher sales increased earnings (R$ MILLION) 7,401 (6,786) (318) 1,833 (4,887) 4,792 Jan-Dec/08 Oper. Income Price Effect on Revenues Cost Effect on COGS 2,035 Volume Effect on Revenues Volume Effect on COGS Operational Expenses Jan-Dec/09 Oper. Income o Decrease in sales price more than offset by increase in sales volume (+13%) and higher market share following acquisiton of Alvo Distribuidora (2008: 34.9%; 2009: 38.6%) o Increase in operational expenses due to higher SG&A from increased sales activities 33 FULLY YEAR 2009 SEGMENT RESULTS - INTERNATIONAL: Production growth and better refining margins improve results (R$ MILLION) (1,025) 1,146 813 Operational Expenses Jan-Dec/09 Oper. Income 1,452 (1,294) (2,748) Jan-Dec/08 Oper. Income Price Effect on Revenues 3,282 Cost Effect on COGS Volume Effect on Revenues Volume Effect on COGS o Decrease in prices for crude and product sales (petroleum:-15%;gas:-26%) partially offset by production increase in Agbami ( Start up July 08) and Akpo (Start up March 09) o Lower acquisition prices and higher refining margins in US and Japan contributed to COGS decrease o Reduced losses from devaluation of inventories (-R$ 261mi) and improvement in the impairment account (2008:-330 mi; 2009:+7mi) explain lower expenses and gains in operating margin 34