Course Outline

advertisement

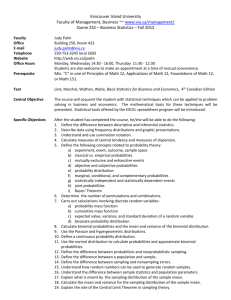

COURSE OUTLINE MBA 503 MANAGERIAL DECISION MAKING: FINANCIAL ANALYSIS Spring 2015 Professor/Instructor: Telephone: Office: Email: Office Hours: Classroom: Gordon Holyer 250.753.3245 local 2539 Bld’g 250 R. 426 gordon.holyer@viu.ca Monday & Wednesday, 14:00 – 16:00 Section S15N71 Tuesday 8:30 – 11:30 Building 250, Room 205 Section S15N72 Thursday 8:30 – 11:30 Building 250, Room 205 Vancouver Island University Department of MBA Programs Faculty of Management MBA 503 MANAGERIAL DECISION MAKING: FINANCIAL ANALYSIS Table of Contents Purpose of This Course Outline .......................................................................................................3 What Is a Learning Outcome? .........................................................................................................3 Course Description...........................................................................................................................3 Course Objectives ............................................................................................................................4 Learning Outcomes ..........................................................................................................................4 Knowledge and Understanding Skills and Objectives Reading List .....................................................................................................................................5 Grading Scheme ...............................................................................................................................5 Method of Evaluation ......................................................................................................................5 Assignment Mid-term test Final exam Standards and Academic Conduct ...................................................................................................6 Academic Misconduct .....................................................................................................................6 Referencing ......................................................................................................................................6 Schedule of Activities, Topics, Assignments and Readings ............................................................7 The Purpose of this Course Outline The purpose of this course outline is to give you information about lecture details, assignment details, contact details for teaching staff and information about learning resources. The objective is to provide sufficient information to enable you to study effectively and to assist you with planning the work involved in assignments so you have adequate time to complete them. One of the functions of this course outline is to help you plan your workload by giving you sufficient information at the start of your studies. It is important to realize that the course outline is just one mechanism to help you with your studies and that you need to utilize the full range of support that is available at Vancouver Island University. You need to read the Student Handbook as well. Your main lines of support are as follows: Course Professor/Instructor Director, MBA Programs Dean, Faculty of Management What is a Learning Outcome? You will note below that this course outline specifies “learning outcomes” for the course. A learning outcome characterizes what it is that you are expected to have learned at the end of the course, if you have successfully completed it. Learning outcomes are specified in terms of what knowledge/understanding and skills you will have acquired. This will then tell you beforehand what the course aims to teach you and what it is you need to learn in order to succeed. It is important to realize that the assignment for this course is designed to test your achievement of the stated learning outcomes. Course Description Managers for any organization from small to large, local to international require an understanding of financial and operational accounting techniques in order to make effective decisions. This course will examine financial reporting issues and operational accounting practices in the context of problem solving and decisionmaking in organizations. Course Objectives This course provides students with the knowledge of the financial reporting of an organization and an understanding that financial statements are only one source of information for managerial and investment decision making. Through case work and the use of accounting information the student will investigate alternative accounting methods, estimates and presentation to determine if the available accounting information gives the information required for quality decision making. Students will also understand the limitations of various accounting information in a decision making scenario. Learning Outcomes Knowledge and Understanding Successful students will have a knowledge and understanding of: • the uses and limitations of accounting information for both external and internal users including the effects of fraud and disclosure; • how the use of alternative acceptable accounting methods affects the statements and user decisions; • alternative methods of valuation, estimates and measurement and alternative ownership structures; • the audit process and an understanding of assurance products; • international financial reporting issues; • breakeven analysis and the relevant costs for decision-making with the view of maximizing value for the organization; • variable and absorption costing models; • budgeting systems. Skills and Objectives Successful students will be able to: • identify, interpret and analyze financial statement relationships; • research, analyze, evaluate and communicate relevant information to users in a professional manner; • demonstrate their awareness of financial reporting issues; • prepare budgets and then monitor and control expenditures against those budgets; • use appropriate decision-making techniques to formulate and solve cost based organizational problems; • assess methods of internal financial control with organizations. Reading List Required Reading: Accounting for Managers – Canadian Edition (2013) Paul M. Collier, Sandy M. Kizan Wiley Canadian Final Accounting Cases (2013) Camillo Lento, Jo-Anne Ryan Wiley Supplementary Articles (List to be supplied) Grading Scheme 90 – 100% 85 - 89% 80 – 84% A+ A A- B+ B B- 76 – 79% 72 – 75% 68 - 71% C+ C C- 64 - 67% 60 - 63% 55 - 59% D Referrals F <54 Failure Method of Evaluation Instrument & Weighting 1. 2. 3. 4. Essay & presentation - 25% Accounting Cases – 10% Mid-term test - 25% Final exam – 40% The essay is due the week of March 2, 2015 The mid-term test is scheduled for the week of February 16, 2015. The test will be 3 hours in length and you will be provided with a list of potential topics 1 week before the exam. The date of the final examination has not yet been determined. It will be in the examination period, April 16 – 27, 2015 Standards and Academic Conduct Exams must be written on the scheduled dates. Deferrals will only be granted on medical or compassionate grounds and will not be granted because of work or other commitments. Requests for a deferred exam date must be made in writing to the professor prior to the scheduled date. Medical certificates or other evidence must be attached and must contain information that justifies the extension sought. Students who miss an exam for any other reason will be given an F for the exam. Plagiarism refers to the practice of presenting the words of another author (it may be a text writer or another student) as your own. This is not permitted. At times you will be asked to learn about and discuss the views or theories of others. This should be done with appropriate acknowledgement of source materials. In other words, you must reference your work. Acknowledge your sources – both direct and indirect quotes – with in-text citations. Refer to the Referencing section contained in this course outline for further information. Academic Misconduct Academic misconduct will not be tolerated. Academic misconduct includes, but is not limited to: giving or receiving information during any quiz, test or exam; using unauthorized sources of information during any test or exam; and plagiarizing the work of another person. More details on this topic are set out in the Student Conduct Policy in the VIU online calendar. No electronic dictionaries will be allowed in exams / tests / quizzes. Only the approved calculators provided may be used in exams / tests / quizzes. No other materials will be allowed apart from a pen/pencil unless specifically approved by the faculty member. Referencing Faculty of Management (Business) requires the APA style of referencing for academic papers. Resources for using APA are available from the VIU Writing Centre (Library, Room 474). You can find access to online student resources (including tutorials and a printable Quick Guide) at: http://sites.viu.ca/writingcentre/. Schedule of Activities, Topics, Assignments and Readings The approximate lecture and reading scheduling are based on the text by Paul M. Collier and Sandy M. Kizan, (2012): Accounting for Managers – Canadian Edition. The readings are as follows: PART I FINANCIAL ACCOUNTING Chapter 1: Introduction to Accounting Chapter 2: Accounting and Its Relationship to Shareholder Value and Corporate Governance Chapter 3: Recording Financial Transactions and Accounting and Information Systems Chapter 4: Constructing Financial Reports: IFRS and the Framework of Accounting Chapter 5: Interpreting Financial Reports and Alternative Perspectives Chapter 6: Management Control Chapter 7: Inventory Management PART II OPERATIONAL ACCOUNTING Chapter 8: Marketing Decisions Chapter 9: Operating Decisions Chapter 10: Human Resource Decisions Chapter 11: Accounting Decisions Chapter 12: Strategic Investment Decisions Chapter 13: Performance Evaluation of Business Units Chapter 14: Budgeting Chapter 15: Budgetary Control Chapter 16: Strategic Management Accounting Articles and cases A variety of articles and cases will be assigned for reading, discussion, and submission during the course of the semester.