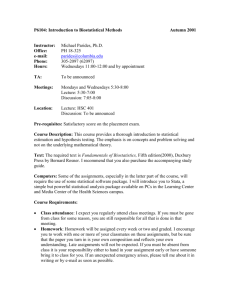

ACCT 3307/ACCT 5311 – Fall 2010 - John J. Masselli, Ph.D

advertisement

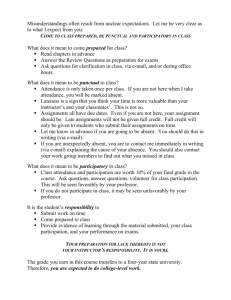

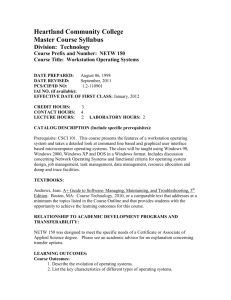

Texas Tech University – Area of Accounting ACCT 3307 / ACCT 5311: Income Tax Accounting – Summer 2- 2010 Dr. John J. Masselli, CPA Schedule: M-Th (4-6:50) The following course syllabus provides a general plan for the course; deviations may be necessary. Prerequisite - ACCT 2300-Elementary Accounting. Required Texts Jones, Sally, M, and S.Rhoades-Catanach: Principles of Taxation for Business and Investment Planning – 2010 Edition. McGraw-Hill Higher Education, New York, NY Smith, James E., Internal Revenue Code of 1986 & Treasury Regs: Annotated and Selected. 2009 edition or 2010 edition (Required), West Publishing 1. 2. Course Purpose/Objective This course is designed to introduce students to the Federal tax system while providing them with the skill sets necessary to apply the appropriate tax law concepts to various income and estate tax situations. In addition, students will understand the key concepts associated with business entity choice decisions. Bias aside, since all American citizens and residents of the U.S.A. are subjected to this tax system, the course will provide you with knowledge that will be relevant to you in your personal and/or business environments for the foreseeable future. In addition, from a professional perspective, careers in taxation are lucrative and plentiful. As such, this course serves also to expose students to some of the types of problems and issues that face tax professionals with the hope of enhancing interest in the tax profession. Educational Objectives / Outcomes This course is designed to introduce students to the Federal tax system while providing them with a skill set that will enable them to apply the appropriate tax law concepts to various income and estate tax situations. After completion of this course, students should maintain knowledge or skills related to: The Federal tax system including the different types of taxes and various tax compliance practices and procedures Tax research: including proper use and citation of the Internal Revenue Code and Regulations Individual taxation: including key concepts as gross income inclusions and exclusions, deductions for adjusted gross income, itemized deductions and the calculation of individual tax liabilities. Business taxation: including tax years, acceptable tax accounting methods, book/tax differences, depreciation/amortization methods, and self-employment income and taxation. Taxation of business and personal property transactions: including calculation of capital gains/losses, and calculation of business property transactions including those under sections 1231, 1244, 1245 and 1250 Entity choice including the different methods used to tax sole proprietorships, partnerships, limited liability companies (LLCs) , S corporations and C Corporations. Preparation of federal income tax forms for individuals including form 1040 and related schedules. Educational Assessments Several assessment vehicles are used to measure the student’s progress toward achieving the desired educational outcomes. These assessment tools include but are not limited to individual student examinations that are comprised of both essay and analytical program type questions, preparation of U.S. income tax forms to measure compliance outcome progress, as well as extensive cooperative and team learning activities Office, Hours and Communication Access My office is in BA 513 and I will have office hours on class days from 3-4:00 p.m. Feel free to also make an appointment to visit with me outside office hours. 1 Web page: http://jmasselli.ba.ttu.edu email: john.masselli@ttu.edu Phone Numbers: Office: 806 742 2392 / Home: 806 798 8582 / mobile: 806-283-1207 Please do not call the home or mobile numbers before 9:00a.m. or after 9p.m. Time Requirements For This Course For most of you, this course represents your first exposure to the Federal Tax System. As such, the time requirement to earn an above average in this course is extensive. Below is my estimation of the weekly time requirements typically needed for students to achieve a B or better in this class: In Class Time: Chapter Reading & Preparation of End of Chapter Questions/Assignments: Weekly Case Studies Other Homework and Semester Projects (spread throughout the semester) 6 Hours 6-8 Hours 2-4 Hours 4-8 Hours Weekly Estimate of Time for this Class: 18 – 26 hours per week – due to compressed nature 1. 2. 3. 4. Recommended Study Strategy Carefully read the chapter: Because the material is new to you and each chapter is quite complex, the time it takes to read the material such that comprehension takes place can be extensive. As such, rushing through the material will be ineffective. Prepare any assigned discussion questions/problems, application problems and issue recognition problems: These questions and problems are designed to help you comprehend the theories in each chapter. You should complete these after having read the chapter at least once. Prepare the case comprehensive case studies (when assigned): Each case has been created to integrate all the major issues in each chapter/group of chapters. Use the examples within the chapter to help you attack the issues in the case. Review: Once we have discussed a chapter, the related questions and the case studies in class, I advise you to go over any points you missed in your original preparation so that you feel more comfortable before we move on to the next area. Course Policies Attendance and Participation Students are expected to attend all class sections. As such, I reserve the right to pursue, via the Dean’s office, involuntary withdrawal proceedings against any student that misses the equivalent of one week of course material unexcused. Furthermore, since it is my contention that students can learn just as much from their colleagues as from their professors, student participation is mandatory in this class. Absence due to Officially Approved Trips on behalf of Texas Tech University The Texas Tech University Catalog states that the person officially responsible for a student missing class due to a TTU sponsored trip should notify the instructor of the departure and return schedule in advance of the trip. The student may not be penalized but is responsible for the material missed. (p.49) Illness and Death Notification The Center for Campus Life is responsible for notifying the campus community of student illnesses, immediate family deaths and/or student death. Generally, in cases of student illness or immediate family deaths, the notification to the appropriate campus community members occur when a student is absent from class for four (4) consecutive days with appropriate verification. It is always the student’s responsibility for 2 missed class assignments and/or course work during their absence. The student is encouraged to contact the faculty member immediately regarding the absences and to provide verification afterwards. The notification from the Center for Campus Life does not excuse a student from class, assignments, and/or any other course requirements. The notification is provided as a courtesy. Observance of Religious Holy Days Absence due to religious observance - The Texas Tech University Catalog states that a student who is absent from classes for the observance of a religious holy day will be allowed to take an examination or complete an assignment scheduled for that day within a reasonable time after the absence (p.49). Notification must be made in writing and delivered in person no later than the 15th on which any University normal university class days are held (i.e. September 19, 2005 for the Fall semester). The student is responsible for all work and material covered during the absence. Civility in the Classroom Students are expected to assist in maintaining a classroom environment that is conducive to learning. In order to assure that all students have an opportunity to gain from time spent in class, unless otherwise approved by the instructor, students are prohibited from using cellular phones or beepers, making offensive remarks, eating (Note: drinking, unless in a computer laboratory, is allowed so long as you place empty containers in trash receptacles upon completion), reading newspapers, unauthorized internet or computer usage (e.g., using the wireless network to check email or browse the internet while using a laptop during class or using software programs not integral to the class discussion), sleeping, DIPPING tobacco, or engaging in any other form of distraction. Inappropriate behavior in the classroom shall result in, at a minimum, a request to leave class with more severe sanctions enacted if disruptive behavior persists. Cheating It is the aim of the faculty of Texas Tech University to foster a spirit of complete honesty and a high standard of integrity. The attempt of students to present as their own any work that they have not honestly performed is regarded as a serious offense and renders the offenders liable to serious consequences, possibly suspension. As such, please be advised that cheating in any form whether on exams, case studies, or tax return projects will, at a minimum, result in an automatic 0 for the assignment/test and likely subjected to more serious sanction referred to above. This included group assignments. For additional discussion of what constitutes cheating and plagiarism please refer to the Texas Tech University catalog (pg. 49 or thereabouts). Grading Students with Disabilities: Any student who because of a disability may require special arrangements in order to meet course requirements should contact the instructor as soon as possible to make any necessary accommodations. Student should present appropriate verification from AccessTECH. No requirement exists that accommodations be made prior to completion of this approved university procedure. Cross listed course issues: Owing to the cross listed nature of this course (i.e., there are MBA/MPFP students along with undergraduate accounting, finance, and PFP students in the course lectures) it is necessary to have differing course requirements based on whether you are receiving graduate or undergraduate credit for this course. To that end, if you are taking this course as ACCT 5311 there differences in requirements are as follows: 1) on each of the two major examinations, there will be additional requirements that must be completed, 2) there will be a comprehensive tax planning case that is required as part of your course requirements and 3) the grading standard for all graded assignments will reflect your graduate status. 3 Grade Allocation: Group Work Exam 1 – 7/20/10 Quiz 1 – 7/27/10 Final Exam – 7/29/10 Comprehensive Tax Planning Project Total ACCT 3307 15% 30% 15% 40% 0 100% ACCT 5311 10% 25% 15% 30% 20% 100% Explanation of Grades: A, A-: 90-100%: Outstanding mastery of the material B+, B, B-: 80-89.9%: Above Average mastery of the material C+, C, C-: 70-79.9%: Average mastery of the material D+, D, D-: 60-69.9%: Below average but passing F: below 60%: Fail Please note that the exams and assignments are designed to provide evidence of your mastery of the material. While I encourage and respect student effort, it is important to realize that effort alone will not result in above average grades for the course. It is the knowledge and the ability to communicate that knowledge via exams, homework, and classroom participation that will result in an above average grade. Exams and quizzes: Exams and quizzes will be given on the dates shown on the attached course outline without exception. How each exam or quiz is weighted in your grade allocation is shown above. The exams will typically be comprised of both short answer and problem solving components. Prior to each exam, I will announce what resources, if any, may be used on the exams. Be aware that the last two exams will have an open book and closed book component to them. The exams are weighted as shown above. Homework Assignments: On the attached syllabus, homework is assigned for each class. The homework is classified as follows: 1. 2. Discussion Questions (DQ) and Application Problems (AP): The assigned questions are to be completed as noted on the syllabus for each chapter assigned. I will not collect these, however, during the class I will randomly select students to answer them. These questions are designed to help you comprehend the chapter readings and understand the theory in each section. In addition, these questions will be a tremendous study aid for the closed book portion of the exam. Group Case Studies: Throughout the course you will formally prepare, in groups, 3 comprehensive cases using a spreadsheet program as well as tax forms designed to examine a host of issues being addressed in each chapter. In addition, during class we will prepare several mini-cases. You are expected to participate in all of the case discussions. On the day the formal cases are due, you should bring the original and one copy of each case with you to class. At the beginning of the class I will collect the copy so I can review it for effort and accuracy. You are to keep the original and correct your errors as we go along. These cases can then be used to study for the exams. The collected duplicate will be graded. Note: The collected case studies comprise part of your group grade (see group discussion below). Course Structure and Format: In this course lecture, discussion of cases/questions, and substantial student interaction will be a part of every class session. My hope is to involve most if not all students in the class discussion each day. Please know that I make every attempt to make the students comfortable in class discussions to avoid any form of embarrassment. However, there is little I can do to minimize the effect of lack of preparation on your part. 4 Groups As you enter your professional careers you will quickly realize that the ability to function well as part of a group or committee is necessary if you are to be successful. Therefore, you will have several opportunities to function in a group as part of this course. Below I have described the anticipated group activities. Group Assignments and Grading Shortly after drop/ad is completed, I will make permanent group assignments. You will be members of this group for the entire semester. This group will various assignments and cases. Since the group is designed to function as a unified body, everyone in the group will receive the same grade for each project or exam. However, at the end of the semester, I will afford each group member the opportunity to grade the other members of the group including his/herself. This will give me an opportunity to adjust the grades of nonperforming group members. While I hope any group conflicts can be resolved within the group, if a major problem arises, please come talk to me so I might help mitigate the problem. Please note, collusion among groups for assignments will be construed as cheating. Human Policy Since I understand that there may be times when “life” gets out of control and you are unable to satisfactorily prepare for class, I encourage you to speak to me before class to minimize potential for embarrassment. ACCT 3307/ACCT 5311 – Fall 2010 DATE TOPIC 7/7/10 Module 1 – The Tax System (An overview) Course, Policies and Expectations Introduction to Taxation/Tax Research Read Ch. 1 / Chapter 5 7/8/10 7/12/10 ASSIGNMENT Due Today Tax Policy Issues In class demonstration case #1 Basic Maxims of Income Tax Planning Read Chapter 2 Tax Compliance Process Read Chapter 18 Demo Case 1 (Numbers 2,4,6) DQ – Chpt 2: 4,5,6,7,13,14 AP – Chpt 2: 3,4 DQ – Ch 4: 1,6,11,13, AP—Ch. 4: 2,17 DQ: Chpt: 18: 3,4,8,9,11 AP: Chpt 18: 3,10,14 Discussion Questions (Chpt 1,2,4, 18) Read Chapter 4 Module 2: Individual Tax Systems 7/13/10 7/14/10 Catch up Module 1 The Individual Taxation Model Read Chapters 14, 16, 17 Individual Tax Model (continued) In Class Demo Case #2 5 ACCT 3307/5311 DATE TOPIC ASSIGNMENT Due Today Module 3: Measurement and Taxation of Business Taxable Income 7/15/10 Individual Tax Model – Concluded Homework Assignment #1 Business Taxable Income Read Chapters 6 & 10 7/19/10 Exam 1: Module 1 & Individual Tax Model to date 7/20/10 Business Taxable Income Self Employment Tax Steps In Class Demonstration Case 3 Read Chapters 6 & 10 7/21/10 Property Acquisition / Cost Recovery In Class Demonstration Case 4 Read Chapter 7 7/22/10 Group Case 1 due today Property Transactions In Class Demonstration Case 5 7/26/10 Go Over Exam Group Case 2 Due The Corporate Taxpayer/Entity Choice Read Chapter 8 Read Chapters 10 (remainder), 11, 12 7/27/10 Quiz 1: Self Employment Tax / Property Transactions – last half of class The Corporate Taxpayer/Entity Choice Read Chapters 10 (remainder), 11, 12 In Demonstration Case 6 7/28/10 Go Over Quiz Group Case 3 – In class Wealth Transfer Taxes (time permitting) Read Chapter 16 (last Third) Graduate Planning Case Due Today Review for exam 7/29/10 Final Exam 6