UNIT 3 - The Toppers Way

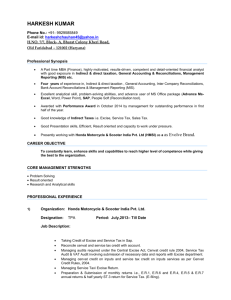

advertisement

Syllabus UNIT - III Direct&IndirectTaxes (MODVAT),(CENVAT),Competition Act 2002 & FEMA Acts ,Business Ethics, Corporate Governance, Philosophy and strategy of planning in India Taxation The act of levying taxes is called taxation. A tax is a compulsory charge or payment imposed by government on individuals or corporations. The persons who are taxed have to pay the taxes irrespective of any corresponding return from the goods or services by the government. The taxes may be imposed on the income and wealth of persons or corporations. The rate of taxes may vary. A tax "is not a voluntary payment or donation, but an enforced contribution, exacted pursuant to legislative authority” Canons of Taxation A good tax system should adhere to certain principles which become its characteristics. A good tax system is therefore based on some principles. Adam Smith has formulated four important principles of taxation. A few more have been suggested by various other economists. These principles which a good tax system should follow are called canons of taxation. Adam Smith’s four canons of taxation Canon of Equality Canon of Certainty Canon of Convenience Canon of Economy Canon of Equality This states that persons should be taxed according to their ability to pay taxes. That is why this principle is also known as the canon of ability. Equality does not mean equal amount of tax, but equality in tax burden. Canon of equality implies a progressive tax system. Canon of Certainty According to this canon, the tax which each individual is required to pay should be certain and not arbitrary. The time of payment, the manner of payment and the amount to be paid should be clear to every tax payer. The application of this principle is beneficial both to the government as well as to the tax payer. Canon of Convenience According to this canon, the mode and timings of tax payment should be convenient to the tax payer. It means that the taxes should be imposed in such a manner and at the time which is most convenient for the tax payer. For example, government of India collects the income tax at the time when they receive their salaries. So this principle is also known as ‘the pay as you earn method’. Canon of Economy Every tax has a cost of collection. The canon of economy implies that the cost of tax collection should be minimum. TYPES OF TAXES Taxes can be classified into various types on the basis of form,nature,aim and method of taxation. the most common and traditional classification is to classify into : • Direct Tax • Indirect tax Direct taxes A direct tax is that tax whose burden is borne by the same person on whom it is levied. The ultimate burden of taxation falls on the person on whom the tax is levied. It is based on the income and property of a person. Thus income tax, corporation tax on company’s profits, property tax, capital gains tax, wealth tax etc are examples of direct taxes. Indirect taxes An indirect tax is that tax which is initially paid by one individual, but the burden of which is passed over to some other individual who ultimately bears it. It is levied on the expenditure of a person. Excise duty, sales tax, custom duties etc are examples of indirect taxes. On the basis of degree of progression of tax, it may be classified into: • • • • Proportional tax Progressive tax Regressive tax Degressive tax Proportional tax A tax is called proportional when the rate of taxation remains constant as the income of the tax payer increases. In this system all incomes are taxed at a single uniform rate, irrespective of whether tax payer’s income is high or low. The tax liability increases in absolute terms, but the proportion of income taxed remains the same. Progressive tax When the rate of taxation increases as the tax payer’s income increases, it is called a progressive tax. In this system, the rate of tax goes on increasing with every increase in income. Regressive taxation A regressive tax is one in which the rate of taxation decreases as the tax payer’s income increases. Lower income is taxed at a higher rate, whereas higher income is taxed at a lower rate. However absolute tax liability may increase. Degressive taxation A tax is called degressive when the rate of progression in taxation does not increase in the same proportion as the increase in income. In this case, the rate of tax increases upto a certain limit, after that a uniform rate is charged. Thus degressive tax is a combination of progressive and proportional taxation. This type of taxation is often used in case of income tax. This is the case of income tax in India as well. DIRECT TAXES Income Tax: Income Tax Act, 1961 imposes tax on the income of the individuals or Hindu undivided families or firms or co-operative societies (other than companies) and trusts (identified as bodies of individuals associations of persons) or every artificial juridical person. The inclusion of a particular income in the total incomes of a person for income-tax in India is based on his residential status. There are three residential status, viz., (i) Resident & Ordinarily Residents (Residents) (ii) Resident but not Ordinarily Residents and (iii) Non Residents. There are several steps involved in determining the residential status of a person. All residents are taxable for all their income, including income outside India. Non residents are taxable only for the income received in India or Income accrued in India. Not ordinarily residents are taxable in relation to income received in India or income accrued in India and income from business or profession controlled from India. Corporation Tax: The companies and business organizations in India are taxed on the income from their worldwide transactions under the provision of Income Tax Act, 1961. A corporation is deemed to be resident in India if it is incorporated in India or if it’s control and management is situated entirely in India. In case of non resident corporations, tax is levied on the income which is earned from their business transactions in India or any other Indian sources depending on bilateral agreement of that country Property Tax: Property tax or 'house tax' is a local tax on buildings, along with appurtenant land, and imposed on owners. The tax power is vested in the states and it is delegated by law to the local bodies, specifying the valuation method, rate band, and collection procedures. The tax base is the annual ratable value (ARV) or area-based rating. Owner-occupied and other properties not producing rent are assessed on cost and then converted into ARV by applying a percentage of cost, usually six percent. Vacant land is generally exempted from the assessment. The properties lying under control of Central are exempted from the taxation. Instead a 'service charge' is permissible under executive order. Properties of foreign missions also enjoy tax exemption without an insistence for reciprocity. Inheritance (Estate) Tax: An inheritance tax (also known as an estate tax or death duty) is a tax which arises on the death of an individual. It is a tax on the estate, or total value of the money and property, of a person who has died. India enforced estate duty from 1953 to 1985. Estate Duty Act, 1953 came into existence w.e.f. 15th October, 1953. Estate Duty on agricultural land was discontinued under the Estate Duty (Amendment) Act, 1984. The levy of Estate Duty in respect of property (other than agricultural land) passing on death occurring on or after 16th March, 1985, has also been abolished under the Estate Duty (Amendment) Act, 1985. Gift Tax: Gift tax in India is regulated by the Gift Tax Act which was constituted on 1st April, 1958. It came into effect in all parts of the country except Jammu and Kashmir. As per the Gift Act 1958, all gifts in excess of Rs. 25,000, in the form of cash, draft, check or others , received from one who doesn't have blood relations with the recipient, were taxable. However, with effect from 1st October, 1998, gift tax got demolished and all the gifts made on or after the date were free from tax. But in 2004, the act was again revived partially. A new provision was introduced in the Income Tax Act 1961 under section 56 (2). According to it, the gifts received by any individual or Hindu Undivided Family (HUF) in excess of Rs. 50,000 in a year would be taxable. SERVICE TAX Service tax is a part of Central Excise in India. It is a tax levied on services provided in India, except the State of Jammu and Kashmir. The responsibility of collecting the tax lies with the Central Board of Excise and Customs(CBEC). Service Tax is a form of indirect tax imposed on specified services called "taxable services". Over the past few years, service tax been expanded to cover new services and recently list of negative services has been introduced. The objective behind levying service tax is to reduce the degree of intensity of taxation on manufacturing and trade without forcing the government to compromise on the revenue needs. For the purpose of levying service tax, the value of any taxable service should be the gross amount charged by the service provider for the service rendered by him. EXCISE Central Excise duty is an indirect tax which is levied and collected on the goods/commodities manufactured in India. The Central Excise Act, 1944 and other connected rules- which provide for levy, collection and connected procedures. It is mandatory to pay Central Excise duty payable on the goods manufactured, unless exempted eg., duty is not payable on the goods exported out of India. SALES TAX VAT “Value Added Tax” (VAT) is a tax on value addition and a multi point tax, which is levied at every stage of sale. It is collected at the stage of manufacture/resale and contemplates rebating of tax paid on inputs and purchases. It is a tax levied on a firm as a percentage of its value added, to avoid the multiplying effect of taxes as the product passes through different stages of production. The tax is based on the difference between the value of the output and the value of the inputs used to produce it. The aim is to tax a firm only for the value added by it to the inputs it is using for manufacturing its output. MODVAT Modified value added tax is a concept in central excise law introduced with effect from 1-3-1986. It has gained momentum with more and more industries beginning to avail this facility. Modified Value Added Tax, introduced in 1986, is a tax for allowing relief to final manufacturers on the excise duty borne by their suppliers for goods manufactured by them. It has now been replaced by the CENVAT scheme. Even though the term MODVAT is not defined in central exercise act 1944 or rules made there under. CENTRAL VALUE ADDED TAX DEFINITION The Modvat Scheme has been replaced by a new set of rules called CENVAT Credit Rules 2002. The definition of Capital Goods, Exempted Goods, Final products and the inputs has been provided in Rule 2 of CENVAT Credit Rules, 2002. It also included the list of items eligible for Capital Goods as well as for the inputs. DUTIES ELIGIBLE FOR CENVAT • A manufacturer or producer of final product is allowed to take CENVAT credit of duties specified in the Cenvat Credit Rules , 2002. CENVAT CREDIT RULES In order to remove the cascading effect of excise duty and • service tax, the Excise Duty paid on the inputs, capital goods and input services, which are used in or in • relation to the manufacture of final product or for providing output services is permissible to be set-off against the excise duty liability on the final products or paying service tax under the CENVAT Credit Rules, 2004. These rules have been notified to regulate the availment and • utilization of the CENVAT credit. WHEN AND HOW MUCH CREDIT CAN BE TAKEN The Cenvat Credit in respect of inputs may be taken immediately on receipt of the inputs. The Cenvat credit in respect of Capital Goods received in a factory at any point of time in a given financial year shall be taken only for an amount not exceeding fifty percent of the duty paid on such capital goods in the same financial year and the balance of Cenvat Credit may be taken in any subsequent financial year. The Cenvat credit shall be allowed even if any inputs or capital goods as such or after being partially processed are sent to a job worker for further processing, testing, repair etc. The salient features are as follows: “Capital goods” Input Input service Input service distributor Under the cenvat credit rules, 2004, the credit of following duties/tax is allowed The cenvat credit may be utilised for payment of — “CAPITAL GOODS” means The following goods, namely:— All goods falling under Chapter 82, Chapter 84, Chapter 85, Chapter 90, heading No. 68.02 and sub-heading No. 6801.10 of the First Schedule to the Excise Tariff Act; Pollution control equipment; Components, spares and accessories of the goods specified ad (i) and (ii) Moulds and dies, jigs and fixtures; Refractories and refractory materials; Tubes and pipes and fittings thereof; and Storage tank. “Input” means — All goods, except light diesel oil, high speed diesel oil and motor spirit, • commonly known as petrol, used in or in relation to the manufacture of final products whether directly or indirectly. And whether contained in the final product or not and includes lubricating, oils, • greases, cutting oils, coolants, accessories of the final products cleared along with the final product, goods used as paint, or as packing material, or as fuel, • For generation of electricity or steam used in or in relation to manufacture of final products or for any other purpose, within the factory of production. Definition of Input Service “Input service” means any service, — Used by a provider of taxable service for providing an output service; or Used by the manufacturer, whether directly or indirectly, in or in relation to the manufacture of final products and clearance of final products from the place of removal, INPUT SERVICE DISTRIBUTOR Meaning of Input Service Distributor “Input service distributor” means an office of the manufacturer or • producer of final products or provider of output service, which receives invoices issued under rule 4A of the Service Tax Rules, 1994 towards purchases of input services and issues invoice, bill or, as the case may be, challan for the purposes of distributing the credit of service tax paid on the said services to such manufacturer or producer or provider. UNDER THE CENVAT CREDIT RULES, 2004, THE CREDIT OF FOLLOWING DUTIES/TAX IS ALLOWED The duty of excise specified in the First Schedule to the Tariff Act, • leviable under the Act; The duty of excise specified in the Second Schedule to the Tariff Act, • leviable under the Act; The additional duty of excise leviable under section 3 of the • Additional Duties of Excise (Textile and Textile Articles) Act, 1978 (40 of 1978); The additional duty of excise leviable under section 3 of the • Additional Duties of Excise (Goods of Special Importance) Act, 1957 (58 of 1957); THE CENVAT CREDIT MAY BE UTILISED FOR PAYMENT OF — Any duty of excise on any final product; or • An amount equal to CENVAT credit taken on inputs if such inputs are • removed as such or after being partially processed; or An amount equal to the CENVAT credit taken on capital goods if such • capital goods are removed as such; or An amount under sub-rule (2) of rule 16 of the Central Excise Rules; 2002 • Service Tax on any output services: Provided that while paying duty, the • CENVAT credit shall be utilised only to the extent such credit is available on the last day of the month for payment of duty relating to the month. Duty Paying Documents against which CENVAT credit can be availed are:Invoice issued by A manufacture of inputs or capital goods. An importer An importer from his depot or premises of consignment agent, Provided the depot/ premises is registered with central excise A first/second stage dealer. A supplementary invoice A bill of entry. A certificate issued by appraiser of customs An invoice/bill/challan issued by providers of input service. A challan evidencing payment of service tax. Credit of duty is allowed only if all the conditions given below are met:The basic criteria for availment of credit of duty paid on inputs or capital goods is that the goods shall be used in manufacture of final products. The goods shall be accompanied with proper prescribed documents. `MODVAT' (Modified Value Added Tax) The modvat scheme is regulated by Rules 57A to 57U of the Central Excise Rules and the notifications issued there under (The Central Excise Rules, 2002 (Section 143 of the Finance Act, 2002). Modvat Scheme ensures the revenue of the same order and at same time the price of the final product could be lower. Apart from reducing the costs through elimination of cascade effect, and bringing in greater rationalization in tax structure and also bringing in certainty in the amount of tax leviable on the final product, this scheme will help the consumer to understand precisely the impact of taxation on the cost of any product. MODVAT and CENVAT Subsequently, MODVAT scheme was restructured into CENVAT( Central Value Added Tax) scheme. A new set of rules 57AA to 57AK , under The Cenvat Credit Rules, 2004, Were framed and whatever restrictions were there in MODVAT Scheme were put to an end and comparatively, a free hand was given to the assesses. Under the Cenvat Scheme, a manufacturer of final product or provider of taxable service shall be allowed to take credit of duty of excise as well as of service tax paid on any input received in the factory or any input service received by manufacturer of final product.